The Commonwealth Resource Management Framework governs the use and management of public resources. It contains legislation, legislative instruments and policy including:

The PGPA Act is the cornerstone of the Commonwealth Resource Management Framework and covers three key areas that provide a strong foundation for a modern, streamlined and adaptable Commonwealth public sector:

|

For the purpose of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), ‘finance law’ (as defined in section 8 of the PGPA Act) means:

- the PGPA Act

- the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule)

- the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015 (Financial Reporting Rule)

- an Appropriation Act

- any instrument made under the PGPA Act, such as:

- the Commonwealth Procurement Rules

- the Commonwealth Grants Rules and Principles

- accountable authority instructions issued under section 20A of the PGPA Act

- determinations establishing special accounts under section 78 of the PGPA Act

- government policy orders issued under section 22 of the PGPA Act delegations

- instruments made under sections 107-110 of the PGPA Act.

What is a breach of finance law?

A breach of finance law occurs when individuals or entities fail to comply with legal obligations related to the management of public resources. Common examples include fraudulent activity, incorrect coding or misappropriation of funds or non-compliance with procurement or grants rules.

What happens if I breach finance law?

For APS officials, a breach of finance law may give rise to a breach of the APS Code of Conduct and lead to sanctions being imposed under the Public Service Act 1999 . For non-APS officials, a breach of finance law may lead to adverse consequences under their applicable employment framework. For all officials, serious breaches of finance law, such as those concerning fraud or corrupt conduct, may expose officials to a civil legal action or criminal prosecution.

A breach of finance law may damage an entity’s reputation and reduce public trust and confidence in the entity. Serious breaches of finance law may expose an entity to legal action, where the interests of other parties are adversely affected or the breach has caused loss or damage.

Generally, officials are people who are employees of, or are otherwise in, or form part of, a Commonwealth entity. Employees and members of the governing boards of Commonwealth companies are not officials for the purposes of the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

Each Commonwealth entity has officials. An official is an individual who is in, or forms part of, the entity (section 13(2) of the PGPA Act). These individuals can be officers, employees or members of the entity, or a person or member of a class of persons prescribed by the rules made under the PGPA Act to be an official.

Section 9 of the PGPA Rule helps to clarify which individuals are considered officials depending on whether the entity is a:

'non-listed entity' | 'listed entity' |

|---|---|

| departments of state, parliamentary departments and all corporate Commonwealth entities | all non-corporate Commonwealth entities (other than the departments of state and parliamentary departments) that are prescribed by an Act or the PGPA Rule to be a listed entity |

A person does not have to be employed on an ongoing basis to be an official. An employee engaged for a specified term or for the duration of a specified task, or for duties that are irregular or intermittent will be an official.

An official of a listed entity is a person who is prescribed by an Act or the PGPA Rule to be an official. Contracted individuals are not officials of a listed entity unless they are specifically prescribed to be officials of the entity in Schedule 1 to the PGPA Rule, the entity's enabling legislation, or section 9(1) of the PGPA Rule. For further information on prescribing people as officials, see RMG-212 Prescribing officials from non-corporate Commonwealth entities. This guide is available under Tools and templates.

Who is an accountable authority?

An individual who is, or is a member of, the accountable authority of the entity (for example, department secretaries, chief executives or members of a governing board) is also an official.

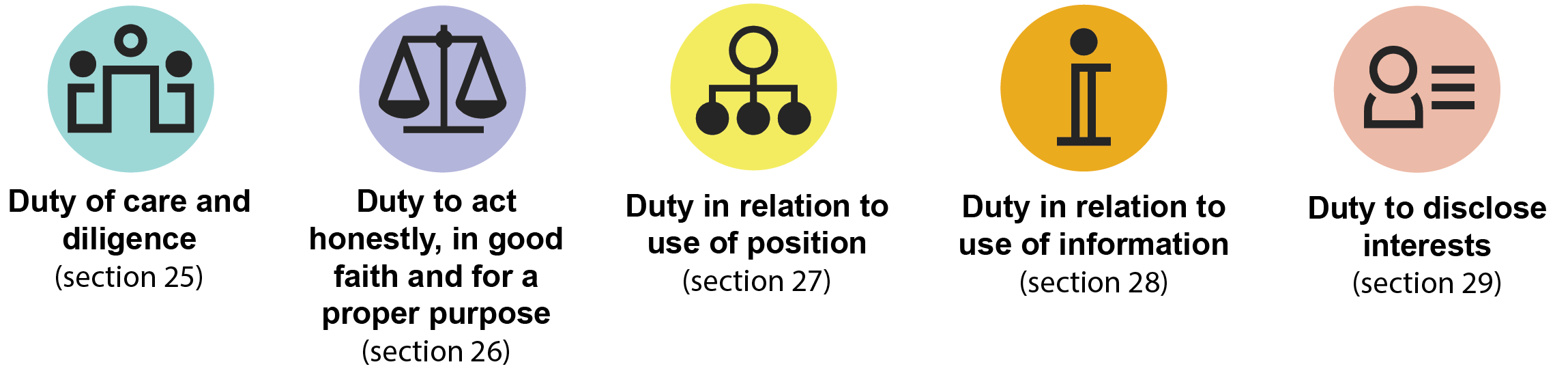

Accountable authorities are required to adhere to the general duties of officials set out in sections 25 to 29 of the PGPA Act, in addition to the duties that apply specifically to accountable authorities set out in sections 16 to 19. For more on the additional duties for accountable authorities, see RMG-200 Duties of accountable authorities. This guide is available under Tools and templates.