Department of Finance

Download the Corporate Plan 2023–24

Covering reporting period 2023–24 to 2026–27

Message from the Secretary

The publication of the Finance Corporate Plan 2023–24 coincides with my first rewarding year as Secretary of Finance.

This year we have transformed our purpose statement and key activities to better reflect the breadth of activity Finance delivers. Further maturing and embedding our new performance framework, our approach to risk and embedding integrity will be a key focus for 2023–24.

Finance's purpose is to provide high quality advice, frameworks and services to achieve value in the management of public resources for the benefit of all Australians. This Corporate Plan – for the reporting period 2023–24 to 2026–27 – sets out how we will direct our efforts to achieve our purpose and deliver on the Government’s priorities.

In the year ahead we will maintain a strong focus on supporting the Government to safeguard Australia's economic prosperity and social outcomes, while our nation faces a range of ongoing economic, security and broader challenges that are affecting the lives of many Australians. Finance continues to play a leading role in supporting government to respond to these challenges, while implementing its priorities and supporting a modern public service. By providing advice on expenditure through the Budget processes we will support government to shape and deliver its fiscal and policy objectives.

The Department will continue to lead by example across the policies, frameworks and legislative commitments we hold stewardship responsibility for. Finance will work collaboratively with Commonwealth entities, the private sector and non-Government organisations to enhance the integrity and transparency of the Commonwealth's procurement and grant frameworks. Finance will continue to support a stronger APS through improved training on a range of core capabilities including procurement, contract management, grants management and financial management.

Finance will also deliver a wide range of the Government's priorities, including the Government's APS net zero commitments, supporting Australia's acquisition of nuclear-powered submarine capability, implementing the Government's commitment to a strengthened and expanded Digital ID system, working with the Digital Transformation Agency to support the implementation of the Data and Digital Government Strategy, and implementing improvements to Commonwealth parliamentary workplaces.

Investing in our capability – in our people, our systems and our practices – and empowering staff to be leaders and stewards of the APS are key to our performance. Sharing information with staff, supporting wellbeing, and enabling and promoting innovation including through greater use of data and digital technologies will ensure Finance can adapt and respond to emerging issues and contribute to the APS Reform agenda. At Finance, we have a strong commitment to integrity, investing heavily over recent years in strengthening our integrity culture and supporting all staff to share responsibility to foster accountability and ethical behaviour across the department.

I look forward to the challenging work of the next several years and am pleased to present our Corporate Plan.

As the accountable authority, I am pleased to present the Department of Finance Corporate Plan 2023–24 for the period 2023–24 to 2026–27, as required under section 35(1)(b) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

Jenny Wilkinson PSM

Secretary, Department of Finance

Introduction

Purpose

Finance provides high quality advice, frameworks and services to achieve value in the management of public resources for the benefit of all Australians.

Our key activities

For the period covered by our Corporate Plan, the key activities that we undertake in order to achieve our purpose are as follows:

- Provide policy advice on expenditure across all portfolios and deliver Budget updates, cash management and consolidated financial reporting (KA 1)

- Manage frameworks and policies, and provide advice to support the proper use and management of public resources (KA 2)

- Support the commercial interest of the Commonwealth (KA 3)

- Provide enabling services to the Commonwealth (KA 4)

- Support wider availability and use of Government data and promote digital transformation (KA 5)

- Deliver ministerial and parliamentary services (KA 6).

Our approach to performance

We are committed to strengthening the performance information provided to the parliament and the broader community. As custodians of the PGPA Act (2013), we strive to be exemplars in practice with integrity embedded across our operations.

In 2023–24, we have focused on transforming our purpose statement and identifying six key activities that better reflect the breadth of Finance's functions. Finance's performance framework provides substantial detail on how we measure progress in achieving our purpose by identifying:

- performance measures that reflect the outcomes our key activities are intended to achieve

- goals for each performance measure to assess achievements over time including performance targets where reasonably practicable, and

- methodologies and data sources to monitor results and track overall progress.

Integrated performance cycle

The Corporate Plan is our principal planning document and sets out how we manage our responsibilities and use of public resources. Finance's integrated performance cycle aligns with the Corporate Plan and encompasses regular budgeting processes, the Portfolio Budget Statements (PBS), and performance reporting in the Annual Report. Integrated business planning and governance processes direct individual and team activities to achieve our purpose and create a clear line of sight between Finance's strategic and operational business planning. Figure 2 illustrates how all aspects of Finance's Integrated Business Planning Framework integrate with our environment to support the efficient and effective delivery of our purpose.

Finance's operations and responsibilities are broad and varied. Our performance metrics provide a basis for measuring our impact over time. A range of initiatives, listed in the table below, showcase some of the high-profile work occurring under our key activities, providing further insight and context for how we deliver against our purpose.

| Key Activities | Priority Initiatives |

|---|---|

| KA 1. Provide policy advice on expenditure across all portfolios and deliver Budget updates, cash management and consolidated financial reporting | Support the delivery of the Budget and key economic updates In 2023–24, Finance will continue to support government priorities and decision-making through the delivery of key economic updates, consistent with the Charter of Budget Honesty Act 1998. Finance will deliver the 2022–23 Consolidated Financial Statements and the 2022–23 Final Budget Outcome. Our work will continue through the current financial year with the planning and delivery of the 2024–25 Budget. |

| KA 2. Manage frameworks and policies, and provide advice to support the proper use and management of public resources | Support the management and use of public resources In 2023–24, Finance will continue to support the management and use of public resources through our management of Commonwealth frameworks and policies, including:

|

| KA 3. Support the commercial interest of the Commonwealth | Support sound commercial decision making In 2023–24, Finance will support the Government and portfolio entities to develop commercial options, strategies and frameworks to meet Government objectives, including:

|

| KA 4. Provide enabling services to the Commonwealth | Delivery and facilitation of shared services, common ICT services, whole‑of‑government procurement arrangements, and insurance and risk management In 2023–24, Finance remains committed to continuing to deliver shared services to the APS. Areas of focus include:

|

KA 5. Support wider availability and use of Government data and promote digital transformation |

Lead development of the Data and Digital Government Strategy for the APS In 2023–24, Finance will continue to support the Government's data and digital transformation. |

| KA 6. Deliver ministerial and parliamentary services | Supporting parliamentarians and their staff and ensuring safe and respectful Commonwealth parliamentary workplaces In 2023–24, Finance will continue to provide quality and consistent client service and policy advice on HR matters, non-travel expenses and allowances under the Parliamentary Business Resources Act 2017 and the Members of Parliament (Staff) Act 1986 to Parliamentarians, office holders and their staff.

|

Figure 3 outlines the clear line of sight and relationship between Finance's different levels of business planning (our purpose statement, key activities, and priority initiatives) and how the approach we take is shaped by our leadership values and guiding principles.

Operating environment

Our operating environment shapes how we deliver on our purpose and key activities. This section outlines the environment in which Finance will operate for the period covered by this Corporate Plan.

A complex economic and fiscal outlook

Australia’s economic and fiscal outlook is presenting a number of challenges. Many of these are similar to those facing most advanced economies. Inflation appears to have peaked, and is easing, but remains high and cost of living pressures are being faced across society. Higher interest rates are expected to assist in reducing inflation over the period ahead but will lead to a period of lower growth. Unemployment remains low, which is creating opportunities to reconnect many individuals into the labour market, but the tight labour market continues to present challenges to business across the economy. There is considerable uncertainty about the path of the economy, domestically and globally over the next couple of years, and rising geo-political tensions which present additional risks.

From a fiscal perspective, the Government continues to repair the budget following the substantial level of support that was provided during the COVID pandemic, and ongoing high commodity prices are assisting in this task. Repairing fiscal buffers is important to ensure we are in a good place to respond to future shocks. However, expectations of government have been heightened over the past several years, and structural increases in spending across areas such as national security, aged care, health and disability services present medium term structural budget challenges.

Finance will continue to play a central role in advising government on how to balance competing priorities. A whole-of-system perspective will be critical to ensure Finance supports continuous improvements to performance, services and outcomes across the APS within targeted fiscal outcomes.

Trust and integrity

While citizens relied heavily on the Government during the pandemic, recent events, including the Robodebt Royal Commission and the issues surrounding breaches of confidentiality, have increased the focus of matters of integrity and trust. Australians have high expectations of government, particularly in relation to the integrity and effectiveness of government institutions, frameworks and decision-making processes, and it is important that these expectations are met.

Finance is responsible for a number of frameworks which support entities across the APS in their proper use and management of public resources. This includes ensuring that government procurement and contract management delivers value for money outcomes and that decisions are underpinned by ethical considerations.

The National Anticorruption Commission (NACC), which commenced on 1 July 2023, will provide additional transparency and oversight over the period ahead. The NACC will play an important role in educating both the public service and the public about corruption risks and prevention.

Advancing applications of data and digital technologies

The availability of data at scale, enhanced analytical capabilities and new technologies are creating significant opportunities across all sectors. For the public service, this includes improving the quality of policy advice we provide and improving service delivery to realise better outcomes for citizens. On the other hand, the potential application of data and digital advancements will need to be carefully considered to ensure the safety and security of our people, systems and data assets. Recent data and cyber security breaches have highlighted the risks and impacts that need to be carefully managed. Sophisticated layers of security, governance, protection and detection will be required to mitigate these risks and respond appropriately when they occur.

Finance, together with the Digital Transformation Agency, is central to advising government on data management and use, and supporting the Government develop and implement its data and digital strategy. A key initiative of the strategy is progressing the national Digital ID system, which will help citizens better manage where and how their key data is shared and stored, reducing their exposure to the risk of cyber attacks. This will be important as Australia’s national security environment will continue to be complex and challenging, with key threats including terrorism, espionage and foreign interference needing to be mitigated.

APS reform and capability

Activities are underway across the APS to build public sector capability by increasing the number of direct, permanent public sector jobs, and reducing the use of consultants and outsourcing. Ensuring the APS attracts, builds and retains the skills and capabilities to meet government priorities and future challenges is critical. This is a central focus of the Government’s APS reform agenda and will reshape the APS delivery environment. The Audit of Employment provided baseline information on agencies’ use of external employment and capability. Rebalancing the use of external contractors and consultants will take time and will require prioritisation of investment in employee capability. This will be central to ensuring models of delivery and competing community expectations of government can be met by the APS.

In a tight and competitive labour market, APS and entity workforce strategies will need to focus on having the right workforce composition and capabilities into the future. This will need to be underpinned by a modern employee experience and effective attraction and retention initiatives.

Risk oversight and management

This section outlines Finance's risk oversight and management systems, the key risks we will manage over the period of this plan and how these risks will be managed.

Risk management at Finance is about carefully considering risks and opportunities in our complex and changing environment. Finance continues to embed a positive risk culture and mature our risk management capability. Our Enterprise Risk Management Policy and Framework (Framework) aligns with the requirements of the Commonwealth Risk Management Policy and provides staff with a holistic approach to engage with risk and opportunities in line with our risk appetite and tolerance levels.

The Framework is supported by a range of tools that are designed to embed risk management in all elements of our day-to-day activities. Our risk champion network supports our risk management culture through information sharing, product development and networking with a focus on risk management capability.

Our business areas monitor, manage and report on risks and their controls through divisional risk registers which identify risk and control owners. Key risks are monitored by our Performance and Risk Committee on a quarterly basis, with advice provided to the Executive Board. The Audit Committee provides independent advice to our Secretary on risk oversight, management and systems of internal control.

We articulate our appetite for engaging with opportunity and risk through a risk appetite statement. Finance regularly considers our risk appetite statement through our internal governance committees, ensuring it remains contemporary, fit for purpose and reflective of our operating environment.

Following the update to our purpose statement and key activities to better reflect the breadth of activity Finance delivers, our focus in 2023-24 will turn to further refinement of our key risks and opportunities as part of our approach to continuous review and improvement.

The following table outlines our strategies to manage the key risks the department faces.

Our risk environment

| Risk description | Mitigation strategy |

|---|---|

| Relevant, timely and considered advice | To strengthen our partnerships, our governance structures are regularly reviewed to ensure our decision-making remains collaborative and focused on effectively managing shared risks. Our partnered and collaborative approach is all the more critical as the Department provides rapid advice in a highly uncertain environment. |

| Our stewardship role in modernising and transforming the public sector to achieve government fiscal and policy objectives. | Our cooperative partnerships with other government agencies remain a priority to identify shared risks, share lessons learned and jointly develop solutions with a focus on shared risk outcomes. |

| Effective governance frameworks for complex projects and program activities led by, or involving, Finance. | Our Major Projects Committee plays an important role in providing oversight, advice, and assurance over Finance's high-risk projects and investments. Finance's Audit committee provides independent advice to the Executive. |

Collaborate and operate as a connected organisation to provide excellence and value to stakeholders and government in a resource-constrained and dynamic environment. |

Finance's ICT strategy, renewed in 2022, continues to drive enhancements that enable staff to operate effectively in connected and engaged teams when working flexibly and from various locations across Australia. |

Transformation and cultural change to achieve our strategic purpose, priorities and drive innovation at the departmental and whole-of-government level. |

We continue to refine our approach to integrated business planning and governance, ensuring a clear line of sight between strategic and operational-level activities and decisions. |

| Effective governance and management of data. | Our Data Strategy and Action Plan sets out the key initiatives to support Finance in leveraging data as an enterprise. |

Finance's investment in capability, and management of, our people over the short-term and long‑term. Maximising productivity through staff engagement, particularly in relation to the management of staff wellbeing and capability, talent management and staff agility. |

Finance invests in people and culture through defined leadership behaviours and people management frameworks that focus on building capability and supporting mobilisation and flexibility in our working arrangements to ensure staff engagement at all levels. As part of our governance structure, the People and Culture Committee plays an important role in providing oversight, advice and assurance on the strategic direction for people management, leadership development and workforce capability within Finance. Our Health and Wellbeing Strategy brings a more holistic, long-term focus with clear measures focussing on supporting staff wellbeing. |

Capability and enablers

This section outlines the strategies and plans that Finance will implement to have the capability we need to undertake our key activities and achieve our purpose.

Governance and integrated business planning

Finance's governance framework promotes the principles of good governance and supports transparent performance in line with government and departmental priorities. Finance's governance framework is supported by a centralised secretariat function. This helps ensure decision-making on key issues is consistent across Finance, aligned with priorities and management of risk, and supports the Secretary in her discharge of duties under the PGPA Act and the Public Service Act 1999.

The Executive Board, supported by its subcommittees, sets departmental strategy and is informed by the integrated business planning approach to make decisions on departmental priorities and resourcing.

People

A professional and skilled workforce is critical to Finance's ability to undertake our key activities and achieve our purpose. Finance's strategic management of its workforce is underpinned by the Finance Workforce Strategy and Action Plan. The strategy is aligned to our 4 Bs framework of Bring, Build, Balance and Bind. The strategy is supported by a range of targeted Action Plans including:

- Diversity@Finance Strategy and Action Plan

- Health and Wellbeing Strategy and Action Plan

- Finance's Reconcilliation Action Plan

- Finance's Gender Equality Action Plan

These Action Plans work to position Finance as an employer of choice and support the department's employee value proposition. The Staff Consultative Group supports the operations and application of the Finance Enterprise Agreement. It provides a forum for staff feedback on employment matters and provides advice to management on workplace issues.

The People and Culture Committee plays an important role in championing HR policies and strategies, and provides oversight, advice and assurance on the strategic direction for people management, leadership development and workforce capability. Its remit includes receiving advice on work health and safety matters, workforce strategy, diversity and inclusion, and other priorities as directed by the Executive Board.

The management of our workforce is also supported by Finance's People Capability Framework, health and safety management system and Leadership Expectations.

Our annual Census results provide a benchmark on staff engagement, satisfaction and measurement of people strategies and workforce initiatives.

Integrity

Finance is committed to a culture of professional integrity. We expect, empower and support our people to act with honesty, transparency and accountability at all times and all levels.

Our Integrity Framework brings together key policies and procedures, as well as learning and development programs. It sets out key elements and expectations as they relate to integrity in the department.

Staff are supported with access to skills development and training which strengthens our culture of integrity and transparency, reinforces the importance of ethical leadership and behaviours, and provides a strong focus on the values of professionalism and a commitment to delivering quality work.

Business Optimisation

Finance's business optimisation function partners with all areas across the department to streamline business processes through a range of digital solutions including process re-design, digitisation, workflows, reporting and robotic automation. Digital solutions have released more than 34,000 hours back to business, releasing capacity for staff to focus on key value-add services. Over the period of this Corporate Plan, the business optimisation function will continue to use technology to drive the increase in digital solutions and the number of hours released back to business.

Data and information management

The Government's expectations of agencies under the Data and Digital Strategy includes greater data maturity, improved consistency in how we manage data holdings, and incorporation of appropriate data management and stewardship mechanisms.

Finance will build on the foundational activities developed under our inaugural Data Strategy, including establishing contemporary data governance to improve how Finance manages its data; lifting our analytical capabilities to maximise the value of our data for decision-making; and implementing best practices to ensure our data is safe and accessible.

We aim to leverage our information and data to enhance our advice to government and improve our service delivery. We do this by managing our information and data assets strategically in line with government requirements; making the most of the technologies implemented as part of the project to move Finance ICT platforms to the cloud environment; and investing in our capabilities.

Information and communications technology

Under Finance's 2022–25 ICT Strategy, Finance has implemented a hybrid cloud environment. This will facilitate the further adoption of cloud services by the department to access contemporary ICT services from a range of providers. It will also reduce data centre and ICT infrastructure costs and enable further digital transformation.

Over 2023–24, Finance will also work on optimising this environment with a focus on performance, reliability and security. The provision of new laptops and mobile devices will provide a streamlined user experience for staff.

Financial management

Finance has a total departmental expense budget of $787.7 million in 2023–24 including for functions delivered for whole-of-government purposes and supported through Special Accounts. Finance's departmental capital budget is $174.9 million, of which $98.7 million relates to projects in the Property Special Account.

Finance has a total administered expense budget of $13,071.2 million in 2023–24 and an administered capital budget of $14.7 million. Further information regarding Finance's budget estimates (departmental and administered), Average Staffing Levels, and financial statements for the reporting period is set out in Finance's Portfolio Budget Statements 2023–24.

Our regulatory reporting requirements

For 2023–24 Finance is reporting our responsibilities that fall under the Office of National Data Commissioner which are now subject to regulatory reporting requirements.

The National Data Commissioner, supported by their office, is the regulator of the DATA Scheme – a best practice Scheme for sharing data collected by the Australian Government. Established by the Data Availability and Transparency Act 2022, the Scheme is underpinned by strong safeguards and consistent, efficient processes.

We approach regulatory performance reporting in accordance with the Resource Management Guide – Regulator Performance (RMG 128). Key to this is operating effectively and efficiently as a regulator, in collaboration with other regulators. The National Data Commissioner's Statement of Intent sets out how we plan to operate in step with the Minister's Statement of Expectations and the principles of regulator best practice. These statements are available on our website.

Strategic partnerships and cooperation

This section outlines the organisations and bodies that Finance co-operates and collaborates with to help achieve our purpose.

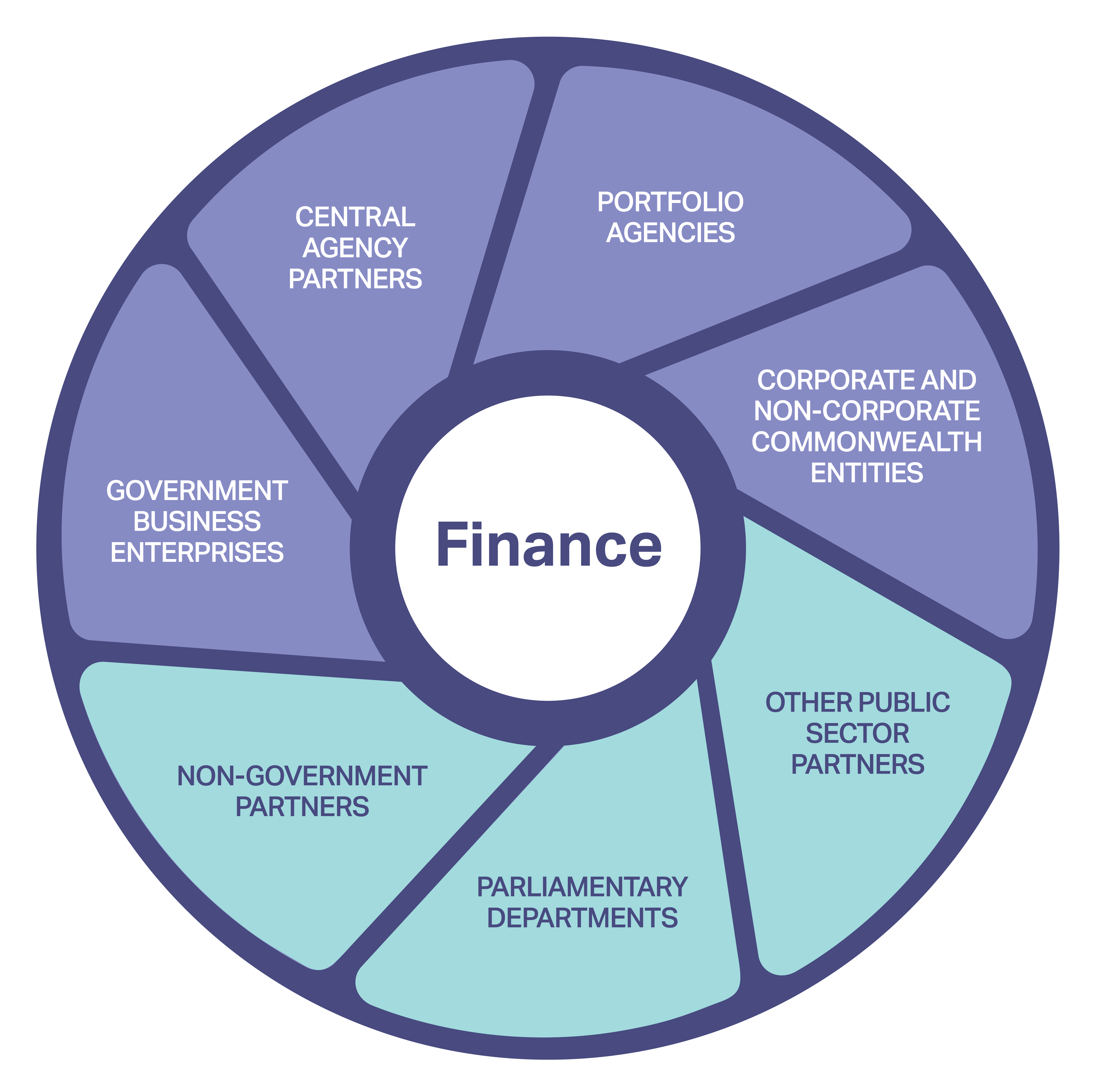

Key to Finance’s performance is the quality and strength of our relationships (Figure 7). Collaboration underpins the way we work and allows us to offer integrated services for clients and partners. Our proactive role in collaborating with other government agencies to support a more effective, efficient and agile public service, supports the achievement of better outcomes for government.

Figure 8 provides an overview of strategic partnerships and cooperative arrangements Finance uses at an entity level to achieve our purpose. As part of these arrangements, Finance works with:

- all Commonwealth public sector agencies including central agency partners, the Department of the Prime Minister and Cabinet and the Treasury, and with the Australian Public Service Commission to provide leadership in the APS and to deliver on APS Reform

- Corporate and Non-Corporate Commonwealth Entities to provide guidance and support on financial, regulatory, and policy advice/matters

- our portfolio agencies to achieve their objectives by working together to deliver shared outcomes in accordance with the PBS

- parliamentary departments to provide support, advice and services to Parliamentarians and their staff

- other public sector partners, including state and territory governments to develop appropriate responses to enterprise-wide issues (cross-jurisdictional and cross-APS) related to improving the Budget outcome for all Australians, and driving improvements to the regulatory environment

- non-government partners to challenge our thinking, test our ideas, and leverage industry expertise and better practice

- joint shareholder departments in supporting ministers and engaging with GBE Boards and senior executive team

- 23 partner countries in joining the Net Zero Government Initiative. The Net Zero Government Initiative commits governments around the world to lead by example and achieve net zero emissions across their own government operations.

Further details regarding the Department's cooperative arrangements with specific entities and sectors that support Finance’s key activities are presented in the performance sections.

Performance framework

The Corporate Plan 2023–24 is Finance's principal planning document. The performance reporting framework sets out what we intend to achieve over the 4 year period covered by this Corporate Plan from 2023–24 to 2026–27. Our performance measures and targets are aligned to our six identified key activities and reflect a range of qualitative and quantitative measures to demonstrate how we will deliver against our purpose.

Our performance measures

Key activity 1: Provide policy advice on expenditure across all portfolios and deliver Budget updates, cash management and consolidated financial reporting Coordinate, prepare and advise the Minister for Finance and the Expenditure Review Committee of Cabinet on expenditure and Budget updates to deliver the Government's fiscal strategy and policy objectives. Manage appropriations, cash and consolidated financial reporting to enable the functioning of Government. |

Target | |||

| 2023–24 | 2024–25 | 2025–26 | 2026–27 | |

|

Performance measure 1.1: Budget updates and appropriation bills Budget papers, related updates (e.g. the MYEFO) and appropriation bills are accurate, consistent with external reporting standards, delivered within required timeframes and meet the Government's fiscal and policy objectives and legislative obligations. |

||||

Why this matters? Finance is responsible for the effective estimation of expense projections. Expense estimates are a core function of Finance and this metric objectively assesses the accuracy and efficiency of Finance duties in estimating expenses. |

||||

| Type of measure: Effectiveness | ||||

| How will this performance measure be assessed? Finance is responsible for the effective estimation of expense projections. Expense estimates are a core function of Finance and this metric objectively assesses the accuracy and efficiency of Finance duties in estimating expenses. | ||||

| 1.1.1 Accuracy of Budget Estimates. | ||||

| Variances between estimated expenses and final outcome are within set parameters | ||||

|

< 2% |

< 2% |

< 2% |

< 2% |

|

<1.5% |

<1.5% |

<1.5% |

<1.5% |

|

< 1% |

< 1% |

< 1% |

< 1% |

|

<0.5% |

<0.5% |

<0.5% |

<0.5% |

|

Significant variances between estimated expenses and final outcome are explained. |

✓ | ✓ | ✓ | ✓ |

|

1.1.2 Timeliness of Budget Estimate Updates and Appropriation Bills. |

||||

|

✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ | ✓ |

|

1.1.3 External reporting standards and legislative requirements are met. |

✓ | ✓ | ✓ | ✓ |

|

Performance measure 1.2: Financial statements The Government's financial statements, including monthly statements, are complete, fairly presented and released publicly in timeframes agreed with the Government. |

||||

Why this matters? Linked to a key function of the department and ensures compliance with requirements including standards and frameworks. |

||||

| Type of measure: Effectiveness | ||||

| How will this performance measure be assessed? | ||||

| 1.2.1 Complete and fairly presented Financial Statements. | ||||

|

✓ | ✓ | ✓ | ✓ |

|

1.2.2 Timeliness of Financial Statements. |

||||

|

✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ | ✓ |

|

Performance measure 1.3: Daily disbursement of cash Commonwealth entities have access to cash, in near real-time, as required. |

||||

Why this matters? Entities are required to have access to near real-time funds to enable them to deliver on Government's policy objectives and services in required timeframes (e.g. income support payments). |

||||

| Type of measure: Effectiveness | ||||

| How will this performance measure be assessed? | ||||

|

1.3.1 Cash needs of all entities are met on a daily basis in near real-time. |

✓ | ✓ | ✓ | ✓ |

|

Methodology: 1.1 – Budget estimates take into account, to the fullest extent possible, all government decisions and other circumstances that may have a material effect. Significant differences between the estimated expenses and final outcome are reported annually, with explanations provided where variances are equivalent to, or greater than, the targets specified. The accuracy of estimates is measured by calculating the variance to actual between the measured estimated expenses and the FBO. Budget papers and related economic updates are produced in accordance with timeframes and requirements in the Charter of Budget Honesty Act 1998. Appropriation bills are introduced into parliament at times intended by government and in accordance with legislative requirements. Timeliness is demonstrated by tabling dates of budget papers, related economic updates and appropriation bills recorded in Hansard. Budget papers and related economic updates outline the external reporting standards used and identify any departure from that standard. For performance measure 1.1, which is a composite measure comprised of three sub-measures, weightings have been applied to determine the overall achievement. 1.1.1 accounts for 20%, 1.1.2 accounts for 40% and 1.1.3 accounts for 40%. End-of-year reporting thresholds are recorded as:

1.2 and 1.3 and their sub-measures (where applicable) are stand-alone measures and not weighted when considering the overall performance of each measure. All measures need to be fully achieved for the overall assessment of 1.2 and 1.3 to be fully achieved, otherwise the lower rating will apply. 1.2 – Measured monthly and reported annually. The Auditor-General issues an unmodified audit report on the Consolidated Financial Statements. Timeliness is demonstrated by date of correspondence to the Minister for Finance, providing monthly financial statements; and to the Auditor-General providing consolidated financial statements. 1.3 – CBMS and Reserve Bank intraday data transmission records show that payment requests have been completed each day with drawdowns available to entities. Measured daily and reported annually. Data sources: 1.1.1 – CBMS Annual Actuals and Annual Estimates data. Budget publications and related updates, including the Final Budget Outcome 1.1.2 – The Government's legislative obligations and budget timeframes are publicly available in the Charter of Budget Honesty Act 1998. 1.1.3 – Budget papers and related economic updates outline the external reporting standards and legislative requirements used and identify any departure from that standard. Requirements in the Charter of Budget Honesty Act 1998. 1.2. – The Budget documents, related updates including monthly financial statements and consolidated financial statements. 1.3 – CBMS records along with daily data transmissions to the Reserve Bank of Australia (RBA) input into the monthly reconciliations. |

||||

|

Explanation of changes since 2022–23 Corporate Plan for Key Activity 1: Numbering reflects the evolution of Finance's key activities from 11 in 2022–23 to 6 in 2023–24. Performance measures 1.1 and 1.2 are unchanged. Performance measure 1.3 previously appeared in Finance's Corporate Plan 2022–23 under key activity 2, as performance measure 2.1. The measure remains otherwise unchanged. Links with PBS Program: Measures 1.1, 1.2 and 1.3 link to program 1.1 - Budget and Financial Management (Outcome 1). |

||||

|

Key activity 2: Manage frameworks and policies, and provide advice to support the proper use and management of public resources Provide a policy and legislative framework to promote effective governance, advise on electoral matters, and support the Government to achieve value-for money procurements and grants. |

Target | |||

| 2023–24 | 2024–25 | 2025–26 | 2026–27 | |

Performance Measure 2.1: Governance, accountability and performance Finance's stewardship supports Commonwealth entities and companies to meet the requirements and policy intent of the Resource Management Framework. The Commonwealth performance framework provides for the scrutiny of the non-financial performance of Commonwealth entities and companies. The PGPA survey is used as a proxy to measure Commonwealth entity and company satisfaction with the support provided by Finance to assist them in meeting the requirements and policy intent of the Resource Management Framework. Monitoring Joint Committee of Public Accounts and Audit (JCPAA) Reports and Auditor-General Performance Audit Reports provide evidence of Parliament using the Commonwealth performance framework to scrutinise the non-financial performance of Commonwealth entities and companies. This is a proxy measure of performance. |

||||

Why this matters? By meeting the requirements and policy intent of the Resource Management Framework, Commonwealth entities and companies can demonstrate that public resources are managed and used properly. This means that public resources are managed and used in an efficient, effective, economical and ethical way. Reporting non-financial performance information, and the scrutiny of this by Parliament and other stakeholders, provides transparency and accountability in respect to how Commonwealth entities and companies are achieving their purposes and objectives. |

||||

| Type of measure: Effectiveness/Proxy | ||||

| How will this performance measure be assessed? | ||||

| 2.1.1 PGPA Entity Survey satisfaction results in respect to the support Finance provides to assist Commonwealth entities and companies to meet the requirements and policy intent of the Resource Management Framework achieves the target result of 85% or above. | ≥85% | ≥85% | ≥85% | ≥85% |

2.1.2 Joint Committee of Public Accounts and Audit (JCPAA) Reports and Auditor-General Performance Audit Reports provide evidence of Parliament using the key artifacts of the Commonwealth performance framework to scrutinise the non-financial performance of Commonwealth entities and companies. |

✓ | ✓ | ✓ | ✓ |

|

Performance Measure: 2.2 Stewardship over procurement systems and policies Finance works with external stakeholders to provide stewardship over systems and policies to support a fair, efficient, and transparent procurement framework and to implement and maintain Whole-of-Australian-Government (WoAG) procurement arrangements for non-ICT services (e.g. travel bookings and major office equipment) to generate price savings and operating efficiencies. |

||||

Why this matters? Finance is responsible for policy stewardship of the Commonwealth Procurement Framework, including the Commonwealth Procurement Rules, and ensuring that the Framework is fit-for-purpose and meeting the Government's priorities. In its stewardship role, Finance is committed to supporting the development of a positive procurement culture centred on fostering competition, efficiency, and accountability across the Commonwealth. |

||||

| Type of measure: Output / Proxy | ||||

| How will this performance measure be assessed? | ||||

|

2.2.1 Finance facilitates 30 outreach sessions per year and 99% of enquiries are responded to within three business days. |

||||

|

✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ | ✓ |

|

2.2.2 AusTender platform and data is available to users 99.5 per cent of the time |

✓ | ✓ | ✓ | ✓ |

|

2.2.3 All WoAG coordinated procurement arrangements which have been established for at least 12 months have a panel usage rate by NCEs of 75% or more during the financial year. |

✓ | ✓ | ✓ | ✓ |

Performance measure 2.3: Whole-of-government approach to regulatory policy, practice, performance, and regulatory reform Finance works with government agencies to deliver targeted reform projects and provides guidance on regulatory performance reporting. |

||||

Why this matters? Targeted digital innovation, policy and stewardship reform projects will promote better practice regulation and help modernise regulatory systems and complement the Government's APS reform and data and digital agendas. The Commonwealth regulatory performance framework provides for the scrutiny of Commonwealth regulators by parliament and other stakeholders. This measure provides evidence that this is occurring. |

||||

| Type of measure: Effectiveness | ||||

| How will this performance measure be assessed? | ||||

Targeted projects have been identified, approved and 75 per cent of milestones delivered on time and on budget and satisfy expected objectives and outcomes. |

✓ | ✓ | ✓ | ✓ |

|

Performance Measure 2.4: Australian Government Investment Funds Advice on the legislative framework for each investment fund facilitates the achievement of its policy objectives and includes setting investment mandates which specify the financial and risk objectives of each fund. |

||||

Why this matters? This measure corresponds with Finance's portfolio entity the Future Fund Management Agency and its measure. |

||||

| Type of measure: Output | ||||

| How will this performance measure be assessed? | ||||

| There are no material legislative impediments to the investment funds meeting their policy objectives and the Future Fund Portfolio quarterly updates show that funds are capable of meeting long-term investment mandate risk and return targets. | ✓ | ✓ | ✓ | ✓ |

Performance Measure 2.5: Civilian Superannuation Schemes Advice on the legislative framework for the Commonwealth Government's civilian superannuation schemes facilitates the schemes being administered in accordance with the applicable regulatory and legislative requirements. |

||||

Why this matters? This measure corresponds with Finance's portfolio entity Commonwealth Superannuation Corporation and its measure. |

||||

| Type of measure: Output | ||||

| How will this performance measure be assessed? | ||||

There are no material legislative impediments to the administration of the civilian superannuation schemes. |

✓ | ✓ | ✓ | ✓ |

|

Performance Measure 2.6: Administration of pension schemes for former parliamentarians, judges and governors-general Pension schemes are administered by the Department in accordance with the applicable regulatory and legislative requirements. |

||||

Why this matters? This measure corresponds with Finance's role to administer the superannuation entitlements of these groups. |

||||

| Type of measure: Effectiveness | ||||

| How will this performance measure be assessed? | ||||

| 2.6.1 The operations of the pension schemes administered by Finance comply with the regulatory and legislative requirements including the relevant schemes' legislation, payment requirements and superannuation scheme reporting obligations to the Australian Taxation Office. | ✓ | ✓ | ✓ | ✓ |

2.1, 2.2, 2.3, 2.4, 2.5, 2.6 and their sub-measures (where applicable) are stand-alone measures and not weighted when considering the overall performance of each measure. All measures need to be fully achieved for the overall assessment of 2.1, 2.2, 2.3, 2.4, 2.5, and 2.6 to be fully achieved, otherwise the lower rating will apply. Methodology: 2.1.1 – Assessed through an entity survey (satisfaction target derived from a specific survey question – the number reference of which may change from survey to survey). The survey is undertaken by a suitably accredited external research company. The design, methodology (sampling, collection, processing and analysis) of the survey is documented and available on the PGPA Communications Team SharePoint site. 2.1.2 – Measured through monitoring all JCPAA Reports and Auditor-General ANAO reports tabled in Parliament each reporting period and:

Commentary and recommendations are analysed to identify trends and emerging issues that may require engagement with entities, adjustments to guidance or the provision of clarification through the PGPA Newsletters. 2.2.1 – Measures through the number of outreach sessions, enquiries received through procurement advice inbox and AusTender helpdesk data. 2.2.2 – AusTender application, database and infrastructure performance and availability statistics. End of year reporting thresholds are recorded as:

2.2.3 – Number of NCEs that hold a contract under a WoAG coordinated procurement arrangement for the financial year divided by the number of NCEs identified in the ‘Flipchart of PGPA Act Commonwealth entities and companies' reference document. 2.3 – Targeted projects delivered as intended; Commonwealth regulators and regulatory functions are clearly identified via a ‘regulator stocktake', with links to current published Statements of Expectations and Intent. End of year reporting thresholds are recorded as:

2.4 – The adequacy of the legislative framework and the continued appropriateness of the investment mandate settings are considered in response to material policy changes and advice from the Future Fund Board of Guardians and the Future Fund Management Agency regarding the investment environment, to assist in achieving the policy, financial and risk objectives. Portfolio updates by the Future Fund Management Agency are considered at least quarterly in the context of long- term benchmark return targets that are specified in the investment mandate for each investment fund. 2.5 – The legislation establishing the civilian superannuation schemes is considered in response to material framework changes affecting the broader superannuation sector as well as advice from the Commonwealth Superannuation Corporation, Government, AGS and administering entities. 2.6 – Progress is measured continuously and reported on an annual basis by Finance, and subject to regular audits, based on pension scheme information in the Department's superannuation system. Data Sources: 2.1 – Survey results and analysis. JCPAA Reports and Auditor-General Performance Audit Reports. 2.2 – Department of Finance internal administrative data related to engagement activities, volume of enquiries and response rates. AusTender's Cloud and Performance Monitoring System. AusTender data and WoAG coordinated procurement arrangement reporting by entities and suppliers. List of NCEs on the ‘Flipchart of PGPA Act Commonwealth entities and companies' reference document. 2.3 – Ministerial Submissions/Briefings (PDMS), Cabinet, National Cabinet and Council on Federal, Financial Relations (CFFR) Meeting Outcomes (Minutes), SharePoint records of internal project documentation and presentations to other departments and communities of practice, Minutes from Interdepartmental committee (IDC) meetings and/or Regulator Leadership Cohort meetings, Corporate documents such as the Ministerial Statement of Expectations and Regulator Statement of Intent, Corporate Plans and Annual Reports of Commonwealth regulators and departments with regulatory functions. 2.4 – Submissions, including legislative proposals, demonstrated liaison with the Future Fund Management Agency and relevant policy departments; and Legal advice from AGS, where relevant. Risk and return data is obtained from the Future Funds' quarterly portfolio updates and Annual Reports with performance analysis against long term benchmark targets, as specified in the investment mandates, to be considered by the responsible Assistant Secretary(s) and documented (including in relevant briefings). 2.5 – Submissions, briefings and advice is prepared in a timely manner as needed with changes required or made to the legislation reported on legislation.gov.au the internet and/or Annual Report. 2.6 – Regular audits of Finance's pension scheme. |

||||

Explanation of changes since 2022–23 Corporate Plan for Key Activity 2: Numbering reflects the evolution of Finance's key activities from 11 in 2022–23 to 6 in 2023–24.

Link with PBS Program: Measure 2.2 is linked with program 2.5 Technology and Procurement (Outcome 2). Measures 2.1 and 2.3 are linked with program 2.1 Public Sector Governance (Outcome 2). Measure 2.4 is linked with program 2.9 Australian Government Investment Funds (Outcome 2). Measures 2.5 and 2.6 are linked with program 2.8 Public Sector Superannuation (Outcome 2). Linked Programs: Measures 2.5 and 2.6 are linked with the following programs:

|

||||

Key activity 3: Support the commercial interest of the Commonwealth Provide advice on Commonwealth commercial entities, Government Business Enterprises, Commonwealth property and superannuation schemes to deliver efficiency, financial sustainability, and appropriate governance arrangements. |

Target | |||

| 2023–24 | 2024–25 | 2025–26 | 2026–27 | |

Performance Measure 3.1: Commonwealth property initiatives are efficient and effective The management of Commonwealth property demonstrates improved outcomes in line with Commonwealth property policy in an evolving environment, including in relation to leasing and facilities management for non-corporate Commonwealth entities. |

||||

| Why this matters? Supports entities to achieve both monetary and non-monetary value for money across property and its related services. | ||||

| Type of measure: Proxy | ||||

| How will this performance measure be assessed? | ||||

| 3.1.1 Property efficiencies are delivered through the Whole-of-Australian Government Property Services Coordinated Procurement Arrangements through all Property Service Providers meeting the Property Operating Expenses saving target and the Commonwealth improving occupational density towards meeting the benchmark. | ✓ | ✓ | ✓ | ✓ |

| 3.1.2 Entity scoring in the Performance Survey Balanced Scorecard results show performance ratings at or above Meets Most Expectations for all Property Service Providers. | ✓ | ✓ | ✓ | ✓ |

Performance Measure 3.2: Promote efficient, financially sustainable and sound governance of commercial investments Continue to promote ongoing efficiency and financially sustainable commercial investments in significant Government owned businesses or initiatives, including:

|

| Why this matters? This performance measure matters to deliver Government's key infrastructure and national security priorities in an efficient, financially responsible and sustainable manner. | ||||

| Type of measure: Output | ||||

| How will this performance measure be assessed? | ||||

| Finance continues to proactively manage commercial investments in Government initiatives via entities such as GBEs and SIVs, and monitors progress through consistent engagement and regular reporting, including against corporate plan targets, quarterly performance reports and annual reports. | ✓ | ✓ | ✓ | ✓ |

Performance measure 3.3: Nuclear-powered submarine program advice The Department is supporting the initial steps in Australia's acquisition of conventionally-armed, nuclear-powered submarine capability. To achieve this, the Department, in cooperation with several Commonwealth agencies, seeks to influence, support and advise the Department of Defence, the Australian Submarine Agency and Government to ensure that program-related decisions are made in a timely and informed manner; and are consistent with legislative and regulatory requirements and meet policy objectives. |

| Why this matters? This performance measure matters to deliver Government's key infrastructure and national security priorities in an efficient, financially responsible and sustainable manner. | ||||

| Type of measure: Effectiveness | ||||

| How will this performance measure be assessed? | ||||

Provide timely, relevant and informed advice adhering to best practice, legislative and regulatory frameworks and requirements. Scope of control over decision-making is limited as ultimate decisions are made by Cabinet and finalised by the Australian Submarine Agency. Given the relative immaturity of the program and the multi-decadal program to follow, precise and exacting performance targets are difficult to define. |

Identification of Sovereign Submarine partners | TBD as program evolves | TBD as program evolves | TBD as program evolves |

Performance measure: 3.4: Promoting best practice risk management Comcover supports best practice risk management to improve risk maturity in the General Government Sector. |

| Why this matters? To reduce the pressure of risk and liability on the Commonwealth Budget and provide consistency and cohesiveness in the way risk and liability is managed across the Commonwealth. | ||||

| Type of measure: Effectiveness | ||||

| How will this performance measure be assessed? | ||||

| 3.4.1 Outcomes of the biennial (every two years) risk management benchmarking report shows sustained or positive improvement to best practice risk management across the General Government Sector. | ||||

|

✓ | ✓ | ✓ | ✓ |

| 3.4.2 Attain a high level of attendance of workshops and receive positive feedback on risk management education packages. | ||||

|

✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ | ✓ |

Performance measure: 3.5: Effective Administration of Comcover |

| Why this matters ? To reduce the pressure of risk and liability on the Commonwealth Budget and provide consistency and cohesiveness in the way risk and liability is managed across the Commonwealth. | ||||

| Type of measure: Effectiveness | ||||

| How will this performance measure be assessed? | ||||

| 3.5.1 The total premium pool set for the following financial year was in line with the actuarially assessed expense forecasts, and the actuarial assessment underpinning that forecast has taken account of claims history, Commonwealth risk profile, statistical trends, and anticipated volatility and uncertainty. | ✓ | ✓ | ✓ | ✓ |

| 3.5.2 At the time of reporting, Comcover's special account balance can cover three or more years of forecasted cash outflow, as actuarially assessed. | ✓ | ✓ | ✓ | ✓ |

Performance measure 3.6: Comcover Claims Management |

| Why this matters? To reduce the pressure of risk and liability on the Commonwealth Budget and provide consistency and cohesiveness in the way risk and liability is managed across the Commonwealth. | ||||

| Type of measure: Output | ||||

| How will this performance measure be assessed? | ||||

| There have been no formal allegations or self-identification of a breach of the model litigant obligation under the Legal Services Directions, which is confirmed by the Office of Legal Services Coordination recording zero breaches for the quarter. | ✓ | ✓ | ✓ | ✓ |

|

3.1, 3.2, 3.3, 3.4, 3.5, 3.6 and their sub-measures (where applicable) are stand-alone measures and not weighted when considering the overall performance of each measure. All measures need to be fully achieved for the overall assessment of 3.1, 3.2, 3.3, 3.4, 3.5, and 3.6 to be fully achieved, otherwise the lower rating will apply. Methodology: 3.1.1 – Occupational Density is measured and reported through the annual Australian Government Office Occupancy Report, the target is currently 14m2 per occupied work point.

3.1.2 – Performance of the Property Service Providers is measured through a balanced scorecard approach, informed by scoring and feedback provided through the bi-annual Performance Survey.

3.2 – Finance measures each GBE performance against key performance indicators, outlined in Corporate Plans. GBEs are required to report on and explain variances to corporate plan targets through quarterly reports and through quarterly and annual strategic reporting and meetings. Variance discussion and trend analysis reporting is provided to shareholder ministers. Dividends are paid consistent with Corporate Plan targets. GBEs advise of significant events consistent with expectations. Finance analyse GBE annual reports and provide advice to Ministers on full year outcomes. Finance is in the process of developing measures for SIV performance, noting the oversight function is new to Finance as at 2023–24. Initial performance will be measured against key performance indicators in corporate plans, Investment Mandates and accompanying Explanatory Statements. Further performance metrics will be developed as part of detailed SIV guidance during 2023–24. 3.3 – Scope of control over decision-making and measures of success is limited as ultimate decisions are made by Cabinet and finalised by the Australian Submarine Agency (ASA). Given the relative immaturity of the program, the multi-decadal program to follow, and the qualitative nature of this performance measure, specific methodology will be developed over 2023–24 in line with further clarification on Finance's role assisting the Department of Defence and ASA to provide a robust picture of the breadth and depth of the Department's contribution. 3.4 – Guidance material supporting the Commonwealth Risk Management Policy is reviewed and updated annually.

3.5.1 – The Department of Finance sets the future years premiums based on Actuarial advice.

Data Sources:

|

||||

|

Explanation of changes since 2022–23 Corporate Plan for Key Activity 3: Numbering reflects the evolution of Finance's key activities from 11 in 2022–23 to 6 in 2023–24.

Link with PBS Program: Measure 3.1 links to program 2.3 Property and Construction (Outcome 2). Measure 3.2 links to program 2.1 Public Sector Governance (Outcome 2). Measure 3.3 links to program 2.10 Nuclear Powered Submarine Guidance (Outcome 2). Measures 3.4, 3.5 and 3.6 link to program 2.4 Insurance and Risk management (Outcome 2). |

||||

Key activity 4: Provide enabling services to the Commonwealth |

Target | |||

| 2023–24 | 2024–25 | 2025–26 | 2026–27 | |

Performance measure 4.1: Shared services hub meets client needs As a shared service hub, the Service Delivery Office (SDO) provides quality and efficient services to client entities |

||||

| Why this matters? The Service Delivery Office focuses on delivering quality and valued corporate services to government entities in the areas of human resources, financial operations and Enterprise Resource Planning system support, to enable client agencies to focus on their core business. | ||||

| Type of measure: Efficiency | ||||

| How will this performance measure be assessed? | ||||

| 4.1.1 Service level agreements with client entities, including measurement of efficiency and effectiveness of services, are met. | ||||

|

100% | 100% | 100% | 100% |

|

100% | 100% | 100% | 100% |

|

100% | 100% | 100% | 100% |

|

100% | 100% | 100% | 100% |

|

<10 days | <10 days | <10 days | <10 days |

|

4.1.2 The benefits of shared, standard, and sustainable ERP technologies and business processes are realised. |

||||

|

≥15 | ≥15 | ≥15 | ≥15 |

|

≥66 | ≥6 | ≥6 | ≥6 |

|

≥2022–23 baseline | ✓ | ✓ | ✓ |

|

Performance measure: 4.2 GovTEAMS improves public sector collaboration Commonwealth entities and companies have access to GovTEAMS, a new generation platform to provide a single environment for both internal and external collaboration across government. |

||||

| Why this matters? Enabling collaboration is an integral part of the APS Reform agenda. For GovTEAMS to provide a truly effective collaboration service, it needs to be available whenever people need to use it, have a widespread active user base across the APS, and continue to provide value in new and relevant ways, resulting in increased usage across the service. | ||||

| Type of measure: Output | ||||

| How will this performance measure be assessed? | ||||

4.2.1. GovTEAMS platform is fully operational in accordance with set performance targets (Years 1 to 4, 99%) |

99% | 99% | 99% | 99% |

4.2.2. GovTEAMS active user count |

32,500 | 35,000 | 37,500 | 40,000 |

4.2.3 GovTEAMS usage – average number of interactions per active user per month |

29.29 | 29.49 | 29.65 | 30.00 |

|

Performance measure: 4.3 GovCMS effectively supports entities to create and manage digital services Commonwealth entities and companies have access to the GovCMS content management and website hosting platform. The platform provides the infrastructure, content management tools, and publishing workflow used by entities to deliver public-facing websites and digital services. Access is defined as entity personnel or their contracted third-party service providers being able to use the GovCMS platform to create, review, update, or delete content, application code or other digital assets. |

||||

| Why this matters? Providing whole-of-Government services that are stable and resilient and where staff are well-supported means the Commonwealth benefits from the economy of scale with greater influence over commercial arrangements. Entities benefit from shared approaches and common toolsets, enabling implementation of reusable design patterns and consistent deployment of supporting processes, such as security. In periods of peak workload, use of a common toolset enables entities to move and share resources with minimal training overhead. | ||||

| Type of measure: Output | ||||

| How will this performance measure be assessed? | ||||

4.3.1 The GovCMS platform is available to entities seeking to develop and maintain websites 99% of the time apart from scheduled outages. |

99% | 99% | 99% | 99% |

4.3.2 The GovCMS program continues to meet or exceed a customer satisfaction (CSAT) target of 80% |

85% | 85% | 85% | 85% |

4.1, 4.2, 4.3 and their sub-measures are stand-alone measures and not weighted when considering the overall performance of each measure. All measures need to be fully achieved for the overall assessment of 4.1, 4.2 and 4.2 to be fully achieved, otherwise the lower rating will apply. 4.1.1 – Progress is measured using the seven metrics in the SDO's Memoranda of Understanding, which are provided to clients on a quarterly basis (the seven metrics are Hire to Retire (payroll), Procure to Pay (accounts payable), Revenue to Bank (accounts receivable), Expense Management, Travel, and Integrated ERP (SDO HUB)). Resolution time is measured using the timeframe for closing a ticket. 4.1.1 – Volumetric data direct from the Enterprise Resource Management system (ERP) which provides clients volumetric data. |

||||

Explanation of changes since 2022–23 Corporate Plan for Key Activity 4: Numbering reflects the evolution of Finance's key activities from 11 in 2022–23 to 6 in 2023–24. Performance measures for 4.1 have been updated to reflect the implementation strategy moving forward. Performance measures for 4.3 have been updated to reflect the evolution and intended benefit of the GovTEAMS and GovCMS activities and availability of customer satisfaction data. Shared Services metrics previously appeared in Finance's Corporate Plan 2022–23 under key activity 9. GovTEAMS and GovCMS metrics previously appeared in Finance's Corporate Plan 2022–23 under key activity 10. Link with PBS Program: Measure 4.1 links to program 2.7 Service Delivery Office (Outcome 2). Measures 4.2 and 4.3 link to program 2.6 Delivery of Government Technology Services (Outcome 2). |

||||

Key activity 5: Support wider availability and use of Government data and promote digital transformation Implement arrangements to enable wider sharing and integration of Government data and support whole-of government data and digital priorities. |

Target | |||

| 2023–24 | 2024–25 | 2025–26 | 2026–27 | |

Performance measure: 5.1 Participation in Data Scheme Supporting safe sharing of data to deliver public benefit through requests in Dataplace that lead to data sharing. |

||||

| Why this matters? This performance measure provides a measure of data sharing activities that deliver public benefit in line with the objects of the Data Availability and Transparency Act 2022. | ||||

| Type of measure: Effectiveness | ||||

| How will this performance measure be assessed? | ||||

Provide 10 Dataplace case studies (request for data that leads to sharing) |

10 | TBC as 2023–24 baseline established | TBC as 2023–24 baseline established | TBC as 2023–24 baseline established |

Performance measure: 5.2 Support the Australian Government to continue developing Australia’s Digital ID System Output measures for the next stage of the Digital ID Program are progressed and reported on to established timelines. These include:

|

||||

| Why this matters? Combined, these performance measures demonstrate the success of implementing the next phase of the Digital ID Program by establishing sound policy and legislative settings and supporting effective public engagement about Digital ID. | ||||

| Type of measure: Output | ||||

| How will this performance measure be assessed? | ||||

| All planned Digital ID program activities completed to schedule. | ✓ | ✓ | ✓ | ✓ |

|

Methodology: 5.1 – Count of registrations of requests for data that leads to sharing (case study), across the 2023–24 FY.

5.2 – The Digital ID program and implementation schedule will be confirmed during Q1 2023–24 following the function's transfer to the Department of Finance on 1 July 2023.

Data Sources: 5.1 – Dataplace registrations. |

||||

|

Explanation of changes since 2022-23 Corporate Plan for Key Activity 5: Numbering reflects the evolution of Finance's key activities from 11 in 2022–23 to 6 in 2023–24. Performance measures have been updated to reflect the evolution of activity in the development of the Data Scheme, and the addition of Digital ID System responsibilities as part of the Finance portfolio in 2023–24. Performance measure 5.1 (Data Scheme) previously appeared in Finance's 2022–23 PBS. Neither of these metrics previously appeared in Finance’s Corporate Plan 2022–23. Link with PBS Program: Program 2.2 Transforming Government (Outcome 2). |

||||

Key activity 6: Deliver ministerial and parliamentary services Deliver a range of services to parliamentarians, their employees and others as determined by the Government to assist them in undertaking their duties.

|

Target | |||

| 2023–24 | 2024–25 | 2025–26 | 2026–27 | |

Performance measure 6.1: Services meet client needs Services meet the needs of parliamentarians, their employees and others as required by the Australian Government. |

||||

| Why this matters? Finance provides Parliamentarians and their staff employed under the MoP(S) Act with facilities and services to assist them in undertaking their duties. | ||||

| Type of measure: Output | ||||

| How will this performance measure be assessed? | ||||

| 6.1.1 | ||||

|

95% | 95% | 95% | 95% |

|

95% | 95% | 95% | 95% |

|

100% | 100% | 100% | 100% |

|

99% | 99% | 99% | 99% |

Performance Measure 6.2: Improve administration of parliamentary work expenses Sustained usage of PEMS by parliamentarians and their staff and successful processing of claims in PEMS |

||||

| Why this matters? PEMS (Parliamentary Expenses Management System) is a secure online portal for parliamentarians and MoP(S) Act employees to manage their office and travel expenses and to perform HR and payroll tasks. | ||||

| Type of measure: Output | ||||

| How will this performance measure be assessed? | ||||

6.2.1 Sustained usage of PEMS by parliamentarians and their staff. |

✓ | ✓ | ✓ | ✓ |

6.2.2 Successful processing of claims in PEMS |

90% | 90% | 90% | 90% |

6.2.3 Availability of public reporting on parliamentarian work expenses |

✓ | ✓ | ✓ | ✓ |

|

6.1 and 6.2 and their sub-measures are stand-alone measures and not weighted when considering the overall performance of each measure. All measures need to be fully achieved for the overall assessment of 6.1 and 6.2 to be fully achieved, otherwise the lower rating will apply. Methodology: 6.1.1 – Using established data sources, progress against targets is measured and reported regularly to Executive Board through the performance update progress report. Data is extracted from relevant system(s) or data sources for all measures. Additional calculations are made for the payments measure. Payments percentage is a calculation of expense payments plus payroll payments. Data extracted reflects point-in-time, year to date performance. Outcomes are reported annually in the Annual Performance Statements. 6.2 – Measured by the number of office expense claims processed through PEMS being at least 85% of the number of claims processed during the previous reporting period. This figure accounts for variability across reporting periods, noting that the nature of how claims are made are not directly comparable across periods. Successful processing of claims in PEMS is measured by the number of office expense claims being paid within agreed service levels. Outcomes are reported annually in the Annual Performance Statements. Availability of functionality within PEMS to produce reporting on parliamentarian work expenses at regular intervals. Data Sources: 6.1.1 – Vfire (call logging system) EMS, COMCAR Automated Resource System (CARS), Chris21, PEMS. 6.2 – Data sourced from PEMS and IPEA public reporting. |

||||

|

Explanation of changes since 2022–23 Corporate Plan for Key Activity 6: Performance measures have been updated to reflect the evolution of activity in the development of PEMS and identify interim and key outcomes. 6.2.3 is a new measure in 2023–24. Numbering reflects the evolution of Finance's key activities from 11 in 2022–23 to 6 in 2023–24. These metrics previously appeared under key activity 11 in 2022–23. Link with PBS Program: Program 3.1 Ministerial and Parliamentary Services (Outcome 3). |

||||

Appendices

Appendix A – Summary of changes to performance measures

In this Corporate Plan, Finance identifies 22 performance measures for the reporting period 2023–24 to 2026–27 with:

- 18 existing performance measures that are unchanged or only marginally changed to improve the clarity of the performance information, including where greater consistency is being supported across different aspects of the PGPA framework and where measure collection methodologies have been strengthened

- 4 new performance measures added to reflect a more robust indicator of performance

- 2 performance measures removed since 2022–23 (no longer applicable and/or oversight reassigned to an internal governance committee as an operational metric forming part of Finance’s cascading performance measures framework).

We continue to refine the presentation of our performance measures, including the relevant data sources and, where applicable, the weighting of targets to improve the clarity of where our performance information is sourced from and how overall results are calculated. Where weightings do not apply, these are explicitly stated in the methodology as stand-alone measures. The overall result is assessed by using the lower rating achieved across the relevant stand-alone measures.

Targets against individual performance measures are identified where practicable. For a small number, Finance uses a combination of qualitative performance information and proxy measures to assess and report on achievements against key activities, including where it is not practicable to set targets. We will continue to review these measures and set targets when possible. A tick presented in the 'year' columns in the performance tables indicates that the assessment approach will be used to measure performance for the given reporting period.

As part of our commitment to stewardship in the legislative policies and frameworks we hold responsibility for, Finance will continue to explore opportunities to further enhance performance measurement approaches over subsequent reporting cycles.

Appendix B – PGPA Act requirements table

| Requirement |

|---|

| Introduction |

| – Statement of preparation |

| – The reporting period for which the Plan is prepared |

| – The reporting periods covered by the Plan |

| Purpose |

| Key activities |

| Operating context |

| – Environment |

| – Capability |

| – Risk oversight and management |

| – Cooperation |

| – Subsidiaries (where applicable) N/A |

| Performance |

Acknowledgement of Country and Traditional Owners

The Department of Finance acknowledges the traditional owners and custodians of the lands on which we live and work. We extend that acknowledgment to their continuing connection to country, waters and community. We pay our respects to elders past and present, and extend that respect to all Aboriginal and Torres Strait Islander Peoples.

© Commonwealth of Australia 2023

ISSN 2206-7299 (online)

The content of this document is licensed under the Creative Commons - Attribution 4.0 International – CC BY 4.0 with the exception of:

- the Commonwealth Coat of Arms

- the Department of Finance logo

- Images

- content supplied by third parties, as identified.

Material used must be attributed to this department as:

© Commonwealth of Australia (Department of Finance) 2023.

Use of the Coat of Arms

The terms under which the Coat of Arms can be used are detailed on the 'It's an Honour' website.