RMG-133 has been updated. There are no policy changes. The updates include:

- clearer guidance on publishing requirements and new guidance on seeking extensions to publishing deadlines (on How to publish your corporate plan)

- additional examples as to what constitutes ‘better practice’ (on What to include in a corporate plan)

- enhanced guidance on publishing a varied corporate plan (on Variations to a corporate plan)

- updated Better practice examples, and

- updated reporting years to reflect current 2025–26 reporting period

For any questions, please contact PGPA@finance.gov.au.

RMGs are guidance documents. The purpose of an RMG is to support PGPA Act entities and companies in meeting the requirements of the PGPA framework. As guides, RMGs explain the legislation and policy requirements in plain English. RMGs support accountable authorities and officials to apply the intent of the framework. It is an official’s responsibility to ensure that Finance guidance is monitored regularly for updates, including changes in policy/requirements.

Audience

This guide is relevant to officers of Commonwealth companies who assist the directors with preparing their corporate plan.

Key points

This guide outlines:

- the content requirements for preparing a corporate plan

- the presentation and publication requirements

- how to vary a corporate plan.

- better practice examples

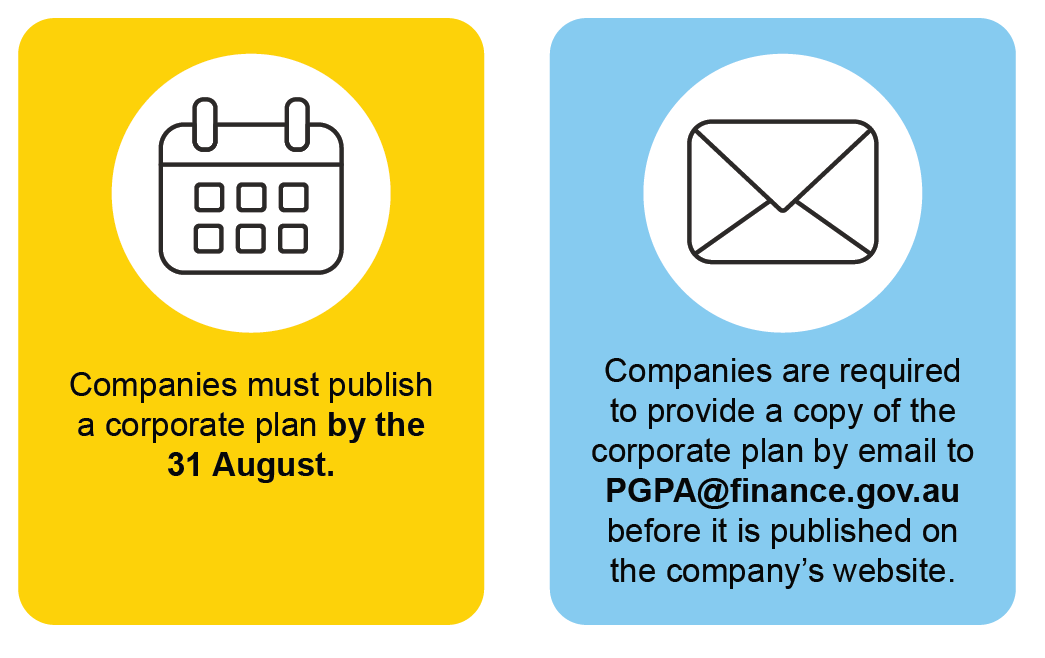

The directors of a Commonwealth company must prepare a corporate plan for public release at least once each reporting period. The corporate plan must be published on the company’s website by the last day of the second month of the reporting period for which the plan is prepared (31 August each year).

A copy of the company's corporate plan must be given to the responsible Minister and the Finance Minister as soon as practicable after it is prepared and before it is published on the company's website. To meet the requirement to give the corporate plan to the Finance Minister, a copy of the corporate plan should be sent to the Department of Finance at PGPA@finance.gov.au. Companies do not need to send a copy of the corporate plan to the Office of the Finance Minister directly.

Finance is responsible for publishing the company’s corporate plan on the Transparency Portal after the plan has been sent to PGPA@finance.gov.au and the plan has been published on the company’s website.

Resources

Related resources including links to related guidance, glossary terms, publications, PGPA Act and Rule and relevant legislation are located in the right-hand menu.

Corporate plan requirements for Commonwealth entities is covered by RMG-132 Corporate plan for Commonwealth entities.