Audience

This guide is for officials with responsibility for managing receipts in:

- non-corporate Commonwealth entities (NCEs)

- corporate Commonwealth entities (CCEs), Commonwealth companies and private sector entities/persons that manage receipts for and on behalf of an NCE (ie as an agent of an NCE).

Key points

This guide:

- explains the legislation and rules that authorise NCEs to retain receipts by increasing certain existing appropriations

- provides guidance and examples on the kinds of receipts that may be retained

- explains how retained receipts collected by NCEs (or their agents) are managed.

This guide replaces Retainable receipts (RMG 307), released December 2017.

Introduction

- Money managed by NCEs is Commonwealth money and forms part of the Consolidated Revenue Fund (CRF). Many non-corporate Commonwealth entities (NCEs) receive money, in the course of business operations, from sources other than in annual appropriation Acts (eg payments for goods and services).

- Most money received by NCEs, particularly administered amounts, is treated as unappropriated general government revenue (ie administered receipts) and must be remitted to the primary central bank account of the Australian Government called the Official Public Account (OPA), which is part of set of bank accounts called the OPA Group.

- However, the Public Governance, Performance and Accountability Act 2013 (PGPA Act) includes provisions for NCEs to use certain kinds of amounts received to increase appropriations. Such amounts are known as ‘retainable receipts’.

1. Legislative framework for retainable receipts

- The PGPA Act includes provisions for NCEs to retain receipts by increasing the balance of an existing appropriation, by either part or the full amount collected. For an NCE to be able to retain and spend amounts received, it requires both:

- legislative authority in an Act, rule, instrument or other subordinate law

- policy authority from Cabinet or the Prime Minister.

- Under section 74(1)(a) of the PGPA Act, an NCE’s most recent annual departmental item appropriation may be increased by the kinds of amounts listed in section 27 of the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). These sections are not appropriations in themselves—they enable certain receipts to be retained by increasing appropriations enacted by parliament, by the amount received.

- If an amount is credited to an appropriation item as a retainable receipt under section 27 of the PGPA Rule, it cannot then be transferred to the balance of a special account.

- CCEs and Commonwealth companies are separately legal to the Commonwealth and can retain and spend monies in their own name. They do not require an appropriation to collect and retain receipts and are not limited by section 74 of the PGPA Act.

- Under sections 78 and 80 of the PGPA Act an amount received may be retained if it is consistent with the crediting provisions of one or more special accounts. A special account is a type of limited special appropriation that notionally sets an amount of money aside in the CRF for expenditure on defined purposes. For more information on special accounts, see Guide to Appropriations (RMG 100).

2. Departmental receipts that NCEs may retain

- Section 27(2) of the PGPA Rule specifies the amounts received by NCEs that may be retained, under section 74(1)(a) of the PGPA Act, by crediting the entity’s most recent departmental item in an appropriation Act, or another appropriation (i.e. special appropriation or special account) provided for by this PGPA Rule. Included at:

- subsection 27(2) of the PGPA Rule are the kinds of amounts (listed as items 1-9) that an NCE may retain

- subsection 27(3) of the PGPA Rule are the requirements for retaining receipts for a trust or similar arrangement

- subsections 27(4) – (5) of the PGPA Rule are the requirements for repayments

- subsections 27(6) – (8) of the PGPA Rule are the kinds of receipts that are not retainable.

Offset of costs related to an activity of the entity

- Item 1 of subsection 27(2) of the PGPA Rule enables amounts that offset departmental activity costs of the collecting NCE to be retained.

Examples - Item 1 retainable receipts

|

Item 1 includes amounts received for:

|

- This provision is not limited to a single financial year. An entity may collect prepayments in anticipation of future costs that they may offset, even if those costs occur in a different financial year, due to timing issues. Conversely, an entity may make payments and then collect the offsetting receipts in a different financial year, due to timing issues.

- Once a receipt is credited to the most recent departmental item, it forms part of the departmental appropriation item and therefore lapses after three years. Amounts in excess of costs cannot be retained and must either be remitted to the Official Public Account as general government revenue (administered receipt) or repaid to the client where appropriate. Also see Receipts in excess of costs.

Joint delivery of Commonwealth outcomes

- Section 17 of the PGPA Act requires accountable authorities to encourage officials to cooperate with other bodies to achieve common objectives.

- To achieve economies of scale in the delivery of Commonwealth outcomes, NCEs may agree to co-manage certain activities. Such arrangements are typically set out in a service agreement or memorandum of understanding (eg a shared services agreement). A key element of such arrangements is the division of funding and whether some NCEs will pay others for the delivery of some goods and services for the group’s benefit.

- The receiving NCE would use Item 1 of subsection 27(2) of the PGPA Rule to retain and pool the contributions from other NCEs.

- Entities can only retain costs of providing goods or services as agreed with client entities. NCEs need to demonstrate that they have reasonably considered the costs of delivering the activity (eg by referring to costings agreed with Finance, which inform the related government decisions that provided the policy authority to charge). Entities should not recover costs unrelated to the provision of agreed goods and services. Also see Receipts in excess of costs.

- For more information, contact Finance Special Appropriations Team.

Prepayments

- Prepayments are amounts received in advance of delivering a related good or service.

- Prepayments made to an NCE by another party that are departmental in nature, can be retained under Item 1 of subsection 27(2) of the PGPA Rule.

- Nevertheless, an NCE may only accept such a prepayment if the accountable authority (or delegate) decides that it is in the best interest of the Commonwealth (as a whole) to do so. Otherwise, receipts should only be received in the financial year in which the good or service was delivered by the NCE.

Sponsorships, subsidies, gifts, bequests or similar

- Item 2 of subsection 27(2) of the PGPA Rule enables NCEs to retain monetary sponsorships, subsidies, gifts, bequests or similar contributions (ie receipts that involve no reciprocity and no consideration on the part of the Commonwealth).

- Receipts cannot be retained under Item 2 if they were received:

- without an express purpose of contributing to the NCE’s departmental activities

- from another NCE (NCEs cannot provide each other with monetary sponsorships, gifts, bequests or similar contributions, or subsidies other than government subsidies offered to all Australian entities)

- for activities that have already been appropriated funding (see subsection 27(6) of the PGPA Rule.

Examples - Item 2 retainable receipts

|

Item 2 includes amounts received for:

|

- Sponsorships, gifts, bequests or similar contributions that are received without the express purpose of contributing to the NCE’s departmental activities, are regarded as being received for the Commonwealth as a whole. Such amounts should be remitted to the OPA as general government revenue (ie administered receipts).

- Provisions in section 74 of the PGPA Act and section 27 of the PGPA Rule prohibit an NCEs from providing such amounts to each other, particularly where they have already received an appropriation for the activities.

Monetary incentives or rebates

- Item 3 of subsection 27(2) of the PGPA Rule enables NCEs to retain monetary incentives or rebates in relation to procuring goods or services.

Examples - Item 3 retainable receipts

|

Item 3 includes amounts received for:

|

- Before accepting monetary incentives or rebates, NCEs must consider implications for receiving value for money in procurements and proper use of Commonwealth money.

Insurance payouts

- Item 4 of subsection 27(2) of the PGPA Rule enables the retaining of insurance payouts received in Australia or overseas.

Examples - Item 4 retainable receipts

|

Item 4 includes amounts received:

|

Damages and other compensation

- Item 5 of subsection 27(2) of the PGPA Rule enables retaining compensatory amounts awarded by a court or payable under contract, which relate to departmental activities.

Examples - Item 5 retainable receipts

Item 5 includes amounts received for:

|

- Item 5 does not include penalties or punitive amounts as these are not compensatory. Such amounts should be remitted to the OPA as general government revenue (ie administered receipts).

Employee leave

- Item 6 of subsection 27(2) of the PGPA Rule enables NCEs to retain receipts related to employee leave.

Examples - Item 6 retainable receipts

|

Item 6 includes amounts received for:

|

Sale of departmental assets

- Item 7 of subsection 27(2) of the PGPA Rule enables NCEs to retain receipts related to selling departmental assets.

Examples - Item 7 retainable receipts

|

Item 7 includes amounts received for:

|

- Amounts under Item 7 are limited by subsection 27(7) of the PGPA Rule to no more than 5 per cent of the total departmental items for the NCE for the financial year. Total departmental items is the sum of all departmental items contained in the annual appropriation Acts passed by parliament during the financial year (eg Appropriation Acts (Nos. 1, 3, 5 etc) and Appropriation Acts (No. 2, 4, 6 etc)).

Freedom of information requests

- Item 8 of subsection 27(2) of the PGPA Rule enables NCEs to retain receipts related to the processing of applications under the Freedom of Information Act 1982 (FOI Act). Fees charged must be consistent with the FOI Act.

Balance of a sunsetting special account

- Item 9 of subsection 27(2) of the PGPA Rule enables the retention of the balance of a sunsetting special account, subject to agreement from the Finance Minister. This item can be used to replace special accounts that supported departmental activities with annual departmental appropriation.

- If a sunsetting special account is used to manage an ongoing departmental activity, it may be appropriate to transfer the special account balance to an annual departmental appropriation and no longer use the special account. To do this, the portfolio minister must write to the Finance Minister to seek agreement under section 27 of the PGPA Rule.

- Entities are to seek Finance comments on draft ministerial correspondence at least two parliamentary sitting periods before the relevant special account is expected to sunset.

- For more information, see Guide to Appropriations (RMG 100) or contact Finance Special Appropriations Team.

Money held on trust

- Subsection 27(3) of the PGPA Rule allows an NCE to increase its most recent departmental item with amounts that relate to a trust or similar arrangement. If an NCE holds money on trust for a non-Commonwealth entity (such as an individual, company or non-government organisation), that money forms part of the CRF and an appropriation is required to spend the money, including repaying a trust benefactor.

- Legal trusts are established under state and territory laws and usually require money to be held ‘separately’. This separation can be met by an NCE maintaining a separate bank account to support the money held on trust as part of its annual departmental appropriation.

- For the purposes of section 8 of the PGPA Act, money held on trust is considered ‘relevant money’ and must be handled in accordance with the PGPA Act and section 18 of the PGPA Rule.

- Entities are discouraged from establishing a trust (under a trust deed or a trust instrument) or accepting trust-like responsibilities unless:

- it is expressly in the Commonwealth’s interest to do so

- legal and resourcing implications have been considered

- appropriate policy authority from Cabinet or the Prime Minister has been obtained under section 15 of the PGPA Act.

- Before entering into a trust or trust-like arrangement, it is important to understand the legal, financial and other implications for the Commonwealth. For further advice, particularly before entering into a trust relationship that obliges investment of money, contact Finance Governance Team.

- Where such an arrangement exists, and it obliges an NCE to invest a principal amount and earn returns or interest (including on bank accounts), the NCE must ensure it has the necessary delegations and approvals from the Finance Minister to invest money under section 58 of the PGPA Act and to accrue and spend bank account interest under banking policies.

- There are also specific financial reporting requirements for trust moneys. Additional transparency can be provided in the NCE’s annual report and on the NCE’s website.

- For more information on reporting and accounting for trust amounts, see the FRR and Commonwealth entities financial statements guide (RMG 125).

Repayments

- For various reasons, a payment made by the Commonwealth may be subsequently returned by one or more recipients.

Repayment to a limited appropriation

- Subsections 27(4) and (5) of the PGPA Rule provides for the retention of repayment receipts relating to a limited appropriation by re-crediting a limited appropriation, from which an original amount was paid, with some or all of a repayment amount.

- Appropriations that are limited in amount include:

- administered items or departmental items in schedules of annual Appropriation Acts

- special accounts, the limit being the balance of the special account

- special appropriations that have a dollar limit specified in the relevant Act.

Examples – When a repayment may be required

|

A repayment may be required where an NCE has:

|

- The appropriation to be increased is the one from which the original payment was made, but only if that original appropriation still remains in force. However:

- annual appropriation Acts cease after three years

- special accounts established by legislative instruments (determinations) cease after 10 years

- if the appropriation is increased, the amount cannot be spent without policy approval from government to adjust expenditure estimates.

- If an NCE has paid an amount:

- using its most recent departmental item, the repayment is to be credited to that departmental item

- using a departmental item in a previous appropriation Act, an administered item in an appropriation Act, a special appropriation limited in amount, or a special account, where the:

- original appropriation still remains in force, the repayment received may be credited to the appropriation used

- original appropriation has ceased, it cannot be increased and related repayments must be remitted to the OPA as administered receipts.

Repayment to an unlimited special appropriation

- If a payment is made from a special appropriation which is not limited in amount (ie an unlimited special appropriation) then all related repayment receipts are to be remitted to the OPA as administered receipts. There is no need for an unlimited special appropriation to retain repayments as its spending limits and expenditure estimates can be increased at any time (consistent with the appropriate policy approval processes).

- In accounting terms, not all receipts are extra revenue. In addition, depending on when the repayment is received (ie within the same financial year or in a subsequent year), the repayment may be accounted for differently.

- For more information on reporting and accounting for repayments, see Commonwealth entities financial statements guide (RMG 125).

3. Receipts that cannot be retained

- Under section 74 of the PGPA Act, amounts that are administered in nature are generally not retainable, with the exception of repayments (subsection 27(4) of the PGPA Rule). Subsection 27(6) of the PGPA Rule provides that the following amounts cannot be retained:

- receipts to offset expenditure the NCE is already appropriated for by parliament (paragraph 27(6(a))

- receipts collected under legislation, regulations, rules or other legislative instruments (paragraph 27(6)(b)).

Examples – Receipts that cannot be retained

|

Receipts that are not retainable include amounts:

|

- If a special account can be debited for payments, these must be made from and recorded as having been paid directly from the special account. No amounts may be transferred from the special account to a departmental annual appropriation item or an administered annual appropriation item.

- When an NCE collects receipts that cannot be retained, it must:

- remit the cash to the OPA

- record the amount in the NCE accounts and records to show these being remitted to the OPA

- record the amount in the Cash Management module of CBMS (using the receipt type ‘administered receipt’ and with an appropriate title describing the amount being remitted).

Receipts in excess of costs

- Amounts received that are surplus to costs cannot be retained. If an entity receives an amount surplus to costs incurred in delivering a specific good or activities, the surplus must be:

- remitted to the OPA as general government revenue and recorded as an administered receipt in the Cash Management module of CBMS, or

- repaid to the client, where appropriate.

- Entities are encouraged to undertake regular reconciliation processes with clients, to ensure that only amounts covering actual costs are retained.

Authority to charge

- NCEs are not authorised by either the PGPA Act or a special account to charge for goods and services, or to recover costs that a NCE has incurred. The legislative authority to retain certain receipts also does not authorise NCEs to charge for goods and services and/or to recover costs incurred.

- To charge non-Commonwealth entities (eg individuals, companies or non-government organisations) for goods and services, or to recover costs, an NCE requires:

- policy authority to charge from government (ie by a decision of Cabinet or the Prime Minister) and/or

- legislative authority to charge, such as in an Act related to the activity (eg levies on industry).

- How much to charge may be specified in legislation (an Act, rule, regulation or other instrument). If not in legislation, how much to charge must be decided by government, by a Minister responsible for the activity or by a delegated accountable authority, as defined in section 8 of the PGPA Act.

- Charging activities must be consistent with the Australian Government Charging Framework. If charging for an activity becomes regular (three years in a row) and/or material (over $1 million a year), the entity is advised to contact the relevant Finance AAU or Charging Policy Team to discuss reporting options.

4. Retained receipt – increasing an appropriation

- Cash received that represents retainable receipts must be transferred from an NCE’s bank account to the OPA in the Cash Management module of CBMS. This will increase the available amounts of cash against the relevant appropriation in CBMS.

- Under subsection 74(2) of the PGPA Act, an appropriation increase for retainable receipts takes effect at the time the NCE records the amounts in its internal accounts and records. When the NCE requires the cash to make payments, it submits a drawdown request in CBMS.

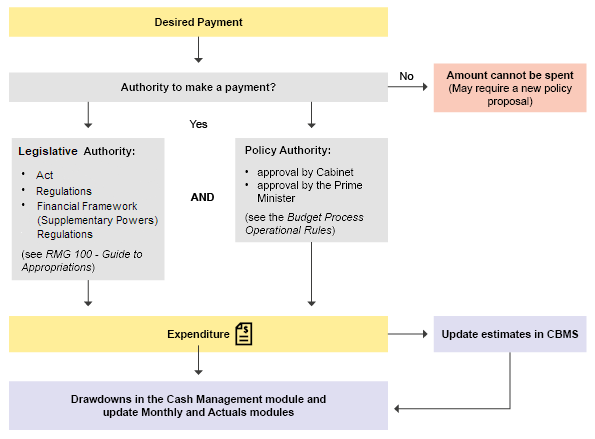

- Figure 1 shows the decision points and process for retaining a receipt by increasing an appropriation.

Figure 1: Retaining a receipt – decision tree

- Amounts received and credited to a special account are not retainable receipts and cannot be recorded as retainable receipts. Instead, these are recorded as increases to the balance of the special account.

- NCEs must ensure that the CBMS records are updated in a timely and accurate manner as CBMS data is used for whole-of-government budget balances and financial reporting.

- For more information on recording receipts in the CBMS Cash Management module, contact Finance OPA Admin Team.

Transferring cash collected

- Cash received that comprises retainable receipts must be transferred from the NCE’s bank account to the OPA.

- In the Cash Management module of CBMS, for:

- transactions related to retainable receipts—use ‘Appropriation Receipts (s74)’ as the identifier

- transactions related to repayments receipts—use ‘Appropriation Repayments’ as the identifier

- transactions related to subsequent expenditure of retainable receipts or repayment receipts—use ‘Drawdown’ as the identifier, reflecting an amount of cash being transferred from the OPA Group to one of the NCE’s bank accounts.

- Transactions in CBMS that reflect retainable receipts and repayment receipts increase the available cash amounts against the relevant appropriation balance. When an NCE requires cash to make payments, a drawdown request in CBMS is submitted to receive the money back from the OPA.

- For more information, contact Finance OPA Admin Team.

5. How retainable receipts can be spent

- Once an appropriation is increased with retainable receipts, the extra money can be spent on the purposes of that appropriation, but only if the government has agreed (ie given policy authority) to spend the extra amount. Spending an appropriation is authorised by government approval of estimates for revenue and expenditure and recorded in the ‘Estimates module’ of CBMS.

- When the NCE requires the cash to make payments, it submits a drawdown request in the Cash Management module of CBMS.

- For information on how and when receipts are recognised in an entity’s financial statements, please refer to the FRR and Commonwealth entities financial statements guide (RMG 125).

- Figure 2 shows the decision points and process for spending a retained receipt.

Spending a retained receipt - decision tree

- Expected drawdowns are to be reflected in the Estimates module and actual drawdowns are to be reflected in the Actuals module of CBMS. For more information, see Disclosure of retainable receipts.

- NCEs must ensure that the CBMS records are updated in a timely and accurate manner as the data in CBMS is used to calculate the whole-of-government budget balances and for whole-of-government financial reporting.

- For more information on monthly and annual actuals reporting, and variance explanations, contact Finance Monthly Reporting Team and Consolidated Financial Statements Team.

6. Disclosure for retainable receipts

- Retainable receipts are reported publicly in:

- Portfolio Budget Statements (PB Statements)—NCEs must include an estimate of expenses incurred in relation to receipts retained under section 74 of the PGPA Act (published as ‘s74 Retained revenue receipts’). CCEs must include an estimate of external revenue (see the latest Finance Guide to preparing the Portfolio Budget Statements)

- Budget Paper No. 4 – Agency Resourcing (BP4)—all Commonwealth entities and Commonwealth companies in the general government sector must report revenue in the ‘External Revenue’ column of the BP4 ‘Agency Resourcing Table’. In BP4:

- the figures in the External Revenue column are derived from NCE revenue estimates in the Estimates module of CBMS, in particular revenue accounts that have a cash flow impact

- reporting revenue rather than receipts, recognises that NCEs are not necessarily resourced with all receipts that they collect in a year

- financial statements—all Commonwealth entities must report receipts and revenue in annual financial statements, included in annual reports, consistent with the FRR and Commonwealth entities financial statements guide (RMG 125).

- Retainable receipts also form part of the figures published annually in the Final Budget Outcome (FBO) and the Consolidated Financial Statements (CFS).

- Entities must enter estimates of retainable receipts (as revenue or another appropriate classification) in the Estimates module of CBMS. As BP4, the FBO and CFS are prepared by Finance on an annual basis using data derived from CBMS, it is essential that all figures entered in CBMS are accurate.

- NCEs must review, and where necessary, revise revenue and expenditure estimates at each estimates update. For more information on the budget process and estimates updates, please contact the relevant AAU for your entity.

- For more information, see Guide to Appropriations (RMG 100) and The Budget process.

- For more information on monthly and annual actuals reporting, and variance explanations, contact Finance Monthly Reporting Team, Consolidated Financial Statements Team or the relevant AAU for your entity.

Agents of an NCE

- Section 29 of the PGPA Rule contains rules about the handling of ‘other CRF money’. Other CRF money arises where a person who is not an official, or minister, of an NCE uses or manages money, by receiving, having custody of or spending money for and on behalf of the Commonwealth, as the legal agent of the Commonwealth. The relationship between the Commonwealth and the entity/person is set out in a written agreement, such as a contract.

- Where another NCE or a CCE, Commonwealth company or other party acts as an agent and collects receipts on behalf of an NCE, the responsible entity NCE remains accountable for and is required to report the receipts as either:

- retainable receipts—if departmental in nature, or

- administered receipts—if administered in nature.

- The agent also needs to report amounts received and paid on behalf of the NCE.

- For more information, see:

- section 47 of the FRR—Disclosures by agent in relation to annual and special appropriations.

- Commonwealth entities financial statements guide (RMG 125)

- The banking of cash by Commonwealth entities (RMG 413)

- Quick Reference Guide – Budget Paper No. 4 (available in CBMS)

- CBMS Training.

Appendix 1 - Frequently asked questions

1. Can an NCE retain earnings generated from administered activities to cover costs?

No—administered receipts are general government revenue that NCEs do not have policy authority to retain. Such amounts must be remitted to the OPA.

If an NCE needs an additional administered appropriation, it must consult its AAU on whether a new policy proposal is required. If policy approval is given, funding would be provided in the next annual appropriation Act. For more information, see Receipts that cannot be retained.

2. Can an NCE retain earnings generated from an administered asset (such as land or a building) as retainable receipts?

Generally, no—most earnings generated from an administered asset are administered in nature so are not covered by section 27 of the PGPA Rule. However, in a small number of cases, such earnings may be regarded as departmental in nature.

The Finance Minister can approve the reclassification of amounts between administered and departmental but reclassifications cannot be made retrospectively. Any changes in funding would be reflected in the next appropriation Bills. NCEs are to contact their Finance AAU to discuss such issues.

3. Can an NCE expend a receipt it has retained, in anticipation of receiving policy authority to make the payment?

No—an NCE that has retained amounts in accordance with section 27 of the PGPA Act can only spend the amounts once relevant policy authority from government is received, even if policy authority is likely to be granted soon.

4. Can an NCE retain money left to the NCE in a will or by another type of contribution?

Yes—bequests can be retained if the will or other contribution, from persons other than the Commonwealth, specifies that the amount is to be applied towards:

- the departmental operations of the NCE

- activities not already funded.

Other contributions from persons other than the Commonwealth can be retained under Item 2 in subsection 27(2) of the PGPA Rule.

If a will, trust, deed, or other contribution specifies that money is to be applied towards the government in general or for an administered purpose, the NCE should endeavour to return the money to the payer. If this is not possible, then the money is considered general government revenue and must be remitted to the OPA as an administered receipt. For more information, see Sponsorships, subsidies, gifts, bequests or similar contributions.

5. Can an NCE retain a repayment related to an amount paid from an unlimited special appropriation?

No—if an NCE makes payments from an unlimited special appropriation (eg as part of a demand-driven entitlement program like social security benefits), then any repayment receipts are to be remitted to the OPA as administered receipts.

If this results in a need to expend more from the unlimited special appropriation at a later time, then the NCE needs to increase the:

- appropriation’s spending limits in the Cash Management module of CBMS

- expenditure estimates in the Estimates Module of CBMS, consistent with the appropriate policy authority and internal approvals processes, which may vary from appropriation to appropriation.

For more information, see Repayments.

6. Can an NCE retain a repayment related to an amount paid in a prior year?

Yes, in some cases. For:

- annual departmental or administered annual appropriations—yes, the relevant appropriation can be increased, if the appropriation is still in force at the time of receipt

| Example: An NCE made a payment against Appropriation Act (No. 1) 2019‑20 and receives a repayment in August 2020. As the original appropriation Act remains in force until 1 July 2022, the NCE may re-credit that appropriation. |

- special accounts—yes, the relevant special account can be increased, if the Act or determination that established it is still in force at the time of receipt

- limited special appropriations—yes, the relevant appropriation can be increased, if the appropriation is still in force at the time of receipt.

- unlimited special appropriations—no, repayment receipts are remitted to the OPA as administered receipts (also see Question 5).

For more information, see Repayments.

7. Can an NCE retain money collected in implementing the shared services program as retainable receipts?

Yes—if the receipts collected in implementing the shared services program are fees for providing goods and services (including prepayments). For more information, see Offset of costs related to an activity of the entity.

8. Can an NCE increase an annual administered appropriation with money contributed by another government (eg a state) for a joint activity?

No—the amount cannot increase an annual administered appropriation. Alternate options are to seek agreement from Cabinet or the Prime Minister to:

- be re-appropriated the amounts received, or

- use an existing special account (eg a special account for services for other entities or trust moneys) to retain the amounts received.

Entities wishing to use the latter approach, they should first contact Finance Special Appropriations Team.

9. Can an NCE increase a departmental appropriation with a reimbursement of costs from another NCE, for staff seconded to that other NCE?

Yes—for amounts that offset costs. For more information, see Offset of costs related to an activity of the entity.

10. If an NCE uses a departmental special account to hold employee provision balances for employees in positions funded by the special account, can the NCE debit the special account and credit a departmental appropriation for the leave provision transfer when an employee moves to a departmental appropriation funded position?

No—a special account determination may contain purpose clauses that allow payments of provision transfers between entities but the PGPA Act does not allow NCEs to credit a departmental appropriation item from a special account for an intra-departmental transfer.

11. Can an NCE use section 27 of the PGPA Rule to transfer amounts relating to non-financial assets to/from another NCE?

No—amounts appropriated to one NCE (entity A) to maintain its non-financial assets (eg departmental capital budget) cannot be paid to another NCE (entity B) to maintain entity B’s assets, as entity A would not receive a good or service in return for such a payment. If entity A wishes to contribute towards joint assets held by entity B, entity A should seek the Finance Minister’s approval to reduce its appropriations and increase entity B’s appropriations via the Budget process and next available appropriation Bills.

Under section 66 of the PGPA Act, in limited cases, non-financial assets themselves can be gifted away however appropriations can only be transferred between NCEs using the provisions of section 75 of the PGPA Act, or where the policy authority allows the reduction of the appropriations of one entity and the increase of another’s.

For more information, please contact your Finance AAU for a copy of advice on capital budgeting.

12. Can an NCE reclassify amounts retained as receipts as a departmental capital budget?

No—the receipts must continue to be reported as departmental revenue, and reported as an adjustment to the entity’s departmental appropriation in the appropriations note to the financial statements.

Entities can however spend the receipts retained on the departmental operations relating to the receipt, including capital expenditure. Entities should refer to the relevant capital budgeting policy.

For more information, see sections 37(a), 43(b) of the FRR and associated guidance on the Finance website.

Appendix 2 - Abbreviations used

|

AAU |

Agency Advice Unit (in Finance) |

|

BP4 |

|

|

CBMS |

Central Budget Management System |

|

CCE |

Corporate Commonwealth entity |

|

CFO |

Chief Financial Officer |

|

CFS |

Consolidated Financial Statements |

|

CRF |

Consolidated Revenue Fund |

|

FBO |

Final Budget Outcome |

|

Finance |

Department of Finance |

|

Finance Minister |

Minister for Finance |

|

FOI Act |

|

|

FRR |

Public Governance, Performance and Accountability (Financial Reporting) Rule 2015 |

|

NCE |

Non-corporate Commonwealth entity |

|

OPA |

Official Public Account |

|

PB Statements |

Portfolio Budget Statement |

|

PGPA Act |

|

|

PGPA Rule |

Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) |

|

RMG |

Resource Management Guide |

Resources

This guide is available on the Department of Finance (Finance) website.

Other relevant publications include:

- Guide to Appropriations (RMG 100)

- Commonwealth entities financial statements guide (RMG 125)

- Australian Government Charging Framework (RMG 302)

- Australian Government Cost Recovery Guidelines (RMG 304)

- The banking of cash by Commonwealth entities (RMG 413)

- Quick Reference Guide – Budget Paper No. 4 available on the Knowledge Management module of CBMS