Interest rate implicit in the lease

AASB 16 extract

For leases that commenced on or after on the AASB 16 Leases (AASB 16) transition date, that is, 1 July 2019, entities must adopt the interest rate implicit in the lease (IRI) to discount lease payments, where it is readily available.

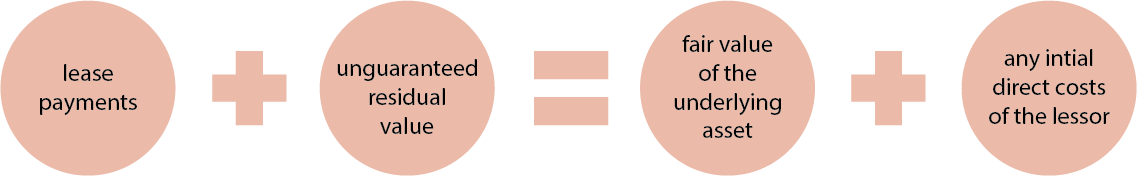

IRI, as defined at Appendix A of AASB 16, is the rate of interest that causes the present value of (a) the lease payments and (b) the unguaranteed residual value to equal the sum of (i) the fair value of the underlying asset and (ii) any initial direct costs of the lessor, as shown in the following diagram.

To determine the IRI, the lessee must know the lessor’s initial direct costs in establishing the lease and the unguaranteed residual value of the leased asset at the end of the lease. This information is often not available to the lessee.

Lessees should identify whether this information is included in the lease contract. If it is not, then lessees should apply their IBR in measuring the lease liability.

Note 12: Interest rate implicit in the lease

Incremental borrowing rate

A lessee’s IBR, as defined at Appendix A of AASB 16, is the rate of interest that a lessee would have to pay to borrow over a similar term, with a similar security, the funds necessary to obtain an asset of a similar value to the ROU asset in a similar economic environment.

Non-borrowing Commonwealth entities should use the Australian Government’s IBR, based on zero coupon bond parameters. These parameters are issued quarterly by Finance as the table of Leases - zero coupon discount rate. Entities should apply the quarterly parameters that precede the lease commencement date (for example, for leases commencing 1 October to 31 December 2019, use the 30 September 2019 quarter IBR parameters).

Commonwealth corporate entities who can borrow to fund their activities should identify their own IBR.

Note 13: Incremental borrowing rate

Non-borrowing Commonwealth entities must use the table of Leases - zero coupon discount rate to calculate their IBR. Commonwealth corporate entities who can borrow to fund their activities must identify their own IBR.

IBR Calculation

Non borrowing Commonwealth entity IBR’s should be calculated as the single discount rate that results in the same present value of future lease payments as that calculated using individual zero coupon bond rates. The IBR rate may be calculated using the Excel Goal Seek function, as outlined in the following example:

Table 1: Example IBR Calculation

| Year | Net Lease Payments (NLP) ($) | Zero-Coupon Yield | Present Value of NLP at Zero-Coupon Yield ($) | Present Value of NLP at IBR ($) |

|---|---|---|---|---|

| 1 | 280,000 | 1.5113% | 280,000 | 280,000 |

| 2 | 290,000 | 1.9339% | 284,498 | 283,220 |

| 3 | 300,000 | 2.0056% | 288,319 | 286,136 |

| 4 | 310,000 | 2.0690% | 291,528 | 288,761 |

| 5 | 320,000 | 2.1696% | 293,673 | 291,107 |

| 6 | 330,000 | 2.2820% | 294,794 | 293,185 |

| 7 | 340,000 | 2.3846% | 295,170 | 295,007 |

| 8 | 350,000 | 2.4714% | 295,019 | 296,584 |

| 9 | 360,000 | 2.5455% | 294,422 | 297,925 |

| 10 | 370,000 | 2.6053% | 293,545 | 299,042 |

| Total | 3,250,000 | 2,910,967 | 2,910,967 |

In this example, lease payments are assumed to be made annually in advance. The present value of net lease payments is $2,910,967, discounted using individual annual zero-coupon yields (sum of Year 1 $280,000/(1+.015113)^0, Year 2 $290,000/(1+.019339)^1, Year 3 $300,000/(1+.020056)^2….) . Applying this present value, the single IBR discount rate which results in the same NPV of $2,910,967 is derived at 2.3940% using the Excel Goal Seek function.

Changes in discount rate

Under paragraph 40 of AASB 16, lessees should only re-measure lease liabilities using a revised discount rate where there is a change in the estimated lease term or a re-assessment of an option to purchase the underlying asset.

Under paragraph 42 of AASB 16, lessees should re-measure lease liabilities using an unchanged discount rate where lease payments have changed due to:

- a change in the estimated residual value guarantee amount payable, or

- an index or a market review.

Worksheet D in Example lease journals illustrates accounting for a re-assessment of the lease term.

Note 14: Changes in discount rate

Lease liability interest expense

In accordance with section 15 of the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015 (FRR), entities cannot capitalise lease interest expense under AASB 123 Borrowing Costs (AASB 123).

Under AASB 123:

- borrowing costs may include AASB 16 lease liability interest expenses (see AASB 123, paragraph 6(d))

- not-for-profit public sector entities may elect to recognise borrowing costs as an expense when incurred (see AASB 123, paragraph Aus8.1).