Department of Finance

Corporate Plan 2021–22

Covering reporting period 2021–22 to 2024–25

Message from the Secretary

The 2021–22 Corporate Plan of the Department of Finance is released at a time when the effects of COVID-19 are being felt across the country and remain a major contributing factor in shaping the context in which the public service operates. Finance has played, and continues to play, a leading role in supporting the Government’s response to, and the community’s recovery from, the pandemic which has had such a dramatic effect on the lives and livelihoods of many Australians.

The role of Finance in advising on government expenditure and providing effective governance and stewardship of public sector resourcing and reporting has been a key enabler of the Government response to COVID-19. Finance staff have delivered a sustained effort across an extended budget cycle, working with agencies to develop and assess a significant number of policy proposals, while continuing to advance the full range of portfolio priorities. Looking back over the year, staff have quickly adapted to new ways of working, leveraging digital collaboration platforms and strengthening partnerships to achieve shared results.

Finance continues to strongly support the Government response to COVID-19, including by seconding appropriately skilled staff to other Australian Public Service (APS) agencies such as Services Australia to support delivery of front line services. We have enabled COVID-19 related payments throughout the pandemic, supporting the establishment of legislative authority and through Advance to the Finance Minister allocations for urgent and unforeseen expenditure.

The lessons learned over the past year are informing Finance’s policy thinking going forward. Significant initiatives over the period of this Corporate Plan highlight our focus on supporting and embedding both departmental and whole-of-government approaches. We continue to improve our data analytics capabilities to better inform government decision-making and are actively collaborating with others to ensure the quality and timeliness of payments data in an increasingly uncertain strategic environment. We are developing a web-based evaluation toolkit of practical guidance and supporting resources to help embed evaluation in everyday APS practice.

Modernising service delivery channels across our operations remains a priority, supported by current and future ICT strategies and commitment to innovative practices right across the business. We continue to play a leadership role in shared services transformation for the public sector, bringing together the capabilities required to support corporate service functions through the GovERP technology platform, and working closely with Services Australia in progressing this significant reform. We will continue to modernise services to assist parliamentarians and their staff through digital enhancements and additional online offerings as well as improving facilities in parliamentary offices to support parliamentarians and the effective operation of government.

Significant initiatives over the period of this Corporate Plan will focus on enhancing policy and practice to build safe and respectful workplaces. Finance will support the Independent Review into Commonwealth Parliamentary Workplaces, the Government’s response to the Review’s recommendations and the implementation of interim measures. We will provide additional education and training opportunities to parliamentarians and their staff, enhanced case management support and more tailored guidance and toolkits.

Finance’s people – and the capabilities they bring – are the key asset in delivering on our purpose. Consistent with the Delivering for Tomorrow: the APS Workforce Strategy 2025, Finance will refresh and implement our Workforce Strategy to attract, build and retain skills, expertise and talent for the future; embrace data, technology and flexible and responsive workforce models; and strengthen integrity and purposeful leadership, at all levels.

Finance has a strong culture of professionalism and commitment to delivering quality work. In 2021–22, our focus on integrity will continue, with improvements in procurement practices and embedding shared values and behaviours in the way we work. These changes demonstrate our commitment to continuous improvement and serve as a reminder that we all have a part to play in achieving assurance and integrity.

This 2021–22 Corporate Plan outlines Finance’s priorities for the reporting period and builds on the steps we have taken to mature our performance framework and commitment to integrated business planning. Collectively, the priorities enunciated in this Plan ensure we are working to achieve our purpose, actively managing our key outputs in a changing operating environment. This is illustrated by our recent focus on the delivery of quarantine facilities to support ongoing efforts to increase the number of Australians returning home and provide capacity for the gradual reopening of Australia’s international border.

It is a privilege to lead a department that has been able to adapt to new challenges and which continues to demonstrate the values of the public service, including through its willingness to collaborate and adopt innovative practices in a complex and changing landscape.

I am pleased to present the Department of Finance 2021–22 Corporate Plan.

Rosemary Huxtable PSM

Secretary, Department of Finance

Introduction

I, Rosemary Huxtable, as the Accountable Authority of the Department of Finance, present the Department of Finance 2021–22 Corporate Plan for the period 2021–22 to 2024–25, as required under section 35(1) (b) of the Public Governance, Performance and Accountability Act 2013.

Purpose

Finance assists the Australian Government to achieve its fiscal and policy objectives by advising on expenditure, managing sustainable public sector resourcing, driving public sector transformation and delivering efficient, cost-effective services to, and for, government.

Integrated performance cycle

Finance’s integrated performance cycle aligns to the Corporate Plan. The Corporate Plan is our principle planning document and sets out how Finance manages its responsibilities and use of public resources. Performance planning occurs through regular budgeting processes, the Portfolio Budget Statements (PBS), and performance reporting in the Annual Report. Integrated business planning and governance processes direct individual and team activities to achieve our purpose and create a clear line of sight between the Department’s strategic and operational business planning. Figure 1 illustrates the relationship between this performance cycle and operating environment.

Our approach

As a central agency, Finance has a unique opportunity to influence transformation in the public sector and the adoption of innovative, digitally-driven solutions in our approach to service delivery. Finance takes a proactive role in collaborating with other government agencies to deliver a more effective, efficient and agile public service, achieving better outcomes for government. We will continue to modernise service delivery channels to meet client expectations, including enhancing support to parliamentarians and their staff to help build safe and respectful workplaces.

Through our role in the Budget process, setting public sector resource management frameworks, managing the Commonwealth’s commercial interests and delivering enabling services, including to parliamentarians and their staff, there is significant opportunity to shape and support best overall value for money for the Australian community. Our ongoing advice and analysis is an important input to the Government’s efforts to ensure a sustainable recovery for Australia and our community in response to the challenges of COVID-19.

Finance is committed to continuing to improve our data analytic capabilities. These capabilities will improve our capacity to analyse government spending and provide greater insights on key expenditure programs, better informing government decision-making. With this insight, we will continue to embed discipline, rigour and contestability in policy and budget development processes, and engage proactively and collaboratively with partners to improve the quality and use of data on expenditure and outcomes.

In the 2021–22 Budget, the Government renewed its commitment to the transformation of Commonwealth entities through shared services. As one of the hubs delivering shared services to the public sector, Finance’s Service Delivery Office (SDO) directly supports public sector productivity by providing standard and sustainable technologies. Finance retains the strategic policy responsibility and core governance functions to drive shared services transformation across the APS.

Operating Context

Finance maintains a strong focus on stewardship and collaboration in supporting entities across the APS achieve their objectives. We actively partner with entities in key policy areas to improve outcomes for the Government and the Australian community.

In an environment of increasing complexity, uncertainty and change, Finance and the broader APS need to quickly and effectively respond to challenging circumstances as they arise. To support this, Finance encourages the adoption of digitally-driven solutions and innovation in the way we work. We continually review our practices, processes and procedures to ensure our operating model focusses on automating the more routine aspects of our work, releasing capacity for our staff to apply their expertise in ways that add the most value.

We will continue to review our operating model, with a focus on maturing how we mobilise resources to priorities, ensure strong alignment of programs, outcomes and operations and embed departmental and whole-of-government approaches to operating. This includes strategic and cooperative partnerships with the:

- Department of the Prime Minister and Cabinet to deliver improved services for parliamentarians and their staff, including through enhanced case management support and an expanded focus on education and training

- Department of the Treasury to deliver the annual Budget and associated economic updates as set out in the Charter of Budget Honesty Act 1998

- Secretaries Digital Committee to ensure effective APS digital governance, digital capabilities and whole-of-government solutions , including improved support for agencies through the Grants Hubs and Shared Service Hubs

- Chief Operating Officers Committee to embed an enterprise-wide approach to APS operations and management, and

- Australian Public Service Commission (APSC) and cross-government partners on entry-level recruitment to build APS leaders of tomorrow.

We will focus on enhancing advice to government and modernising service delivery for clients. This includes:

- implementing recent budget measures to strengthen capacity to assess Commonwealth expenditure monitoring and scrutiny of new and existing programs that respond to government priorities

- supporting the transition to modernised digital service delivery (for example, Parliamentary Expense Management System, PEMS, and COMCAR Automated Resource System, CARS) for clients

- evolving the Commonwealth Investment Framework to achieve more widespread use of commercial investment and procurement models in delivering policy outcomes

- exploring business optimisation and functional-based working innovations, and

- further developing shared services, including client on-boarding to the SDO and adoption of the new GovERP technology Platform.

Central to Finance’s performance is the effective delivery of a wide range of enabling functions. These relate to people, data and information management, financial management, information and communications technology, and business optimisation.

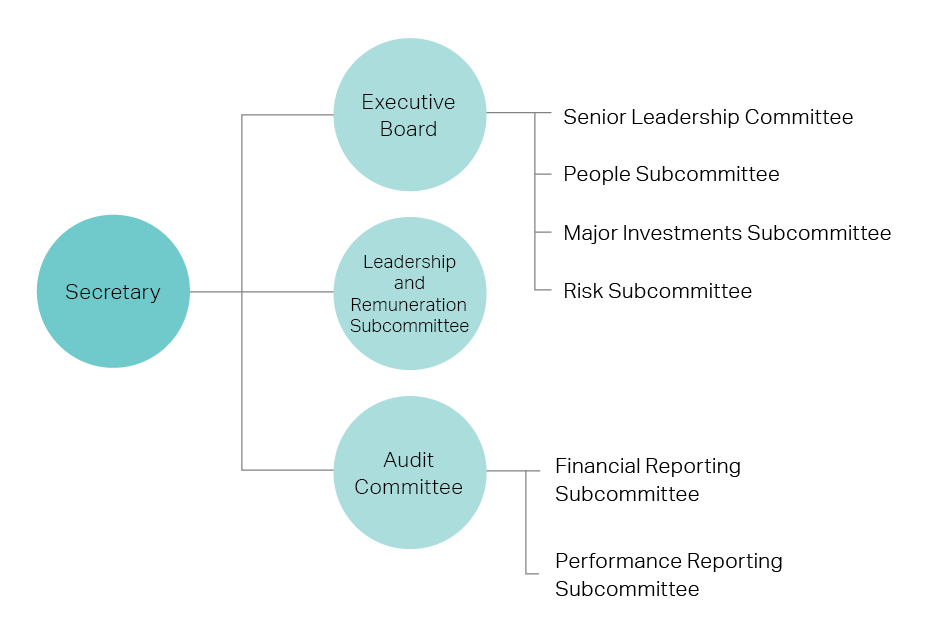

Our governance framework, led by an Executive Board, facilitates sound, transparent and timely decision-making, giving us the ability to confidently respond quickly to emerging challenges and opportunities. Finance’s integrated business planning cycle and our governance committees support active consideration of priorities and resourcing, with a managed approach to risk.Environment

Over the period of this Plan, Finance will apply the lessons from recent challenges to improve the way we deliver on our transformation commitments and encourage innovation, while managing the risks of rapid change. Table 1 sets out the environmental factors that may affect Finance’s ability to achieve its purpose across our three performance themes.

Finance strives to be an exemplar in promoting outcomes that are efficient, effective, economical and ethical. We will focus on delivering services to and for government, the public sector, and parliamentarians in efficient and effective ways that encourage trust in our service delivery, and meet community expectations in an environment of fiscal pressure. Building capability in decision-making, ethical behaviour, digital literacy, data analytics and financial and policy analysis will position Finance to meet expectations now and into the future.

The strong relationships we have formed with Commonwealth entities and counterparts in other jurisdictions and overseas support our approach to improving whole-of-government services, through stronger delivery relationships and advances in data, digitisation and automation.

We will continue to proactively identify and respond to emerging opportunities and risks through regular environmental scanning undertaken by our governance committees.

Table 1: Environmental factors 2021–22 to 2024–25

| Areas of focus | Environmental factors and controls |

|---|---|

| Advising on expenditure |

|

| Public sector resourcing and transformation |

|

| Delivering effective services to, and for, government |

|

Risk oversight and management

Embracing change and innovation is crucial to deliver our purpose and to promote the effective and efficient management of public resources. By proactively engaging with risk and providing a continuous learning culture, management of risk continues to develop and improve.

Finance’s Enterprise Risk Management Plan (ERMP) documents our key strategic, program and operational risks, including shared risks. The ERMP is reviewed regularly by the Risk Subcommittee to ensure that:

- changes in our operating environment are reflected

- controls and treatment strategies remain effective, and

- communication between the Risk Subcommittee, other committees including the Executive Board, and individual risk owners is ongoing and effective.

Finance actively considers risk in its prioritisation and allocation of resources. This enables a clear understanding of opportunity and consequence. Risk-based discussions ensure evidence-based decision-making to strengthen strategic and cooperative partnerships, transform processes and deliver services.

Finance’s positive risk culture is underpinned by an Integrity Framework. Finance staff are encouraged to question assumptions and use their expertise to put forward ideas. Our positive risk culture enables:

- early identification of opportunities to improve the way we work, designed and implemented in a collaborative and connected way across the Department

- lessons learned to be shared and embedded

- an agile and responsive workforce that champions our commitment to continuous improvement, and

- ongoing refinement and strengthening of our frameworks and approach to risk.

Operationally, we are focused on ensuring a workforce that understands risk, is able to identify and engage with risk across all levels, and aligns risk management with business strategy.

Our approach to managing risk

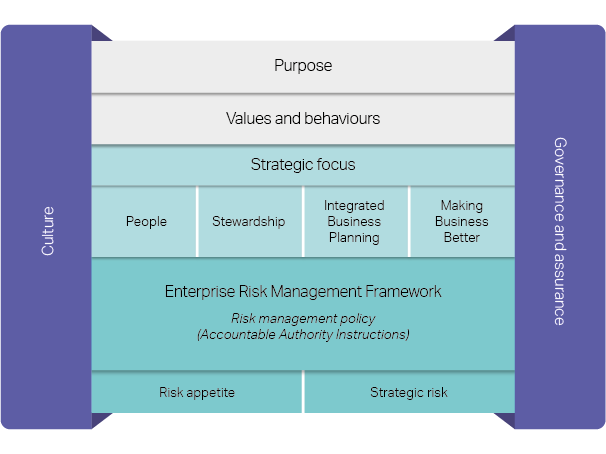

Finance manages opportunity and risk in accordance with the Commonwealth Risk Management Policy and Finance’s Enterprise Risk Management Framework (the Framework). The Framework sets out our policy and governance arrangements for the identification, management and communication of risk.

Finance’s Executive Board, chaired by the Secretary, has overarching responsibility for the Framework. The Chief Risk Officer, a central risk oversight team, the Risk Subcommittee, and the Audit Committee support the Executive Board in reviewing and assuring the appropriateness of Finance’s systems of risk oversight and management.

Finance also supports the Minister for Finance in his responsibility for oversight of whole-of-government risks, including those notified through corporate planning, advised by GBEs under section 19 of the PGPA Act, or arising in relation to the management of insurance risks.

Individual senior executives are responsible for key strategic, program and operational risks and report to the Executive Board against the delivery of relevant outcomes. Central oversight of risk management, through the ERMP, extends to project and program-level risks, including those shared with external stakeholders. This ensures a clear line of sight between day-to-day risk management and Finance’s key strategic, program and operational risks.

Finance’s risk governance in 2021–22 will continue to support this clear line of sight. In addition to the ongoing governance role of the Risk Subcommittee, the membership and Terms of Reference of the Risk Engagement Group will be refreshed to support enhanced risk capability in our people, drive ‘local’ risk engagement and ensure the ‘tone from the top’ is complemented by active risk management in practice across the Department.

Risk appetite

Finance articulates its appetite for engaging with opportunity and risk through a risk appetite statement.

“To meet the Australian Government’s fiscal and policy objectives, the Department of Finance carefully considers risks and opportunities in our complex and changing operating environment.

Finance recognises it cannot, and should not, eliminate all risk in delivering on our purpose. Considering opportunities to innovate, as well as managing risk, allows us to drive transformative change within our own department and across the public sector. Our appetite for engaging with opportunity and risk extends to the management of shared risks with other entities to deliver on the Government’s objectives.

Finance’s risk appetite informs and guides our decision-making and plays a central role in shaping a culture that embraces change and innovation while promoting the effective and efficient management of public resources.”

This statement authorises staff to make risk-based decisions that take into account the benefits of innovation and consider ‘what could go wrong?’. Risk appetite levels of ‘Enhanced’, ‘Balanced’ and ‘Limited’ complement the statement at an operational level. These levels guide whether the Department will accept a risk, leading to more informed and consistent decision-making. Risks that exceed Finance’s appetite are escalated in line with the Department’s committee governance and program assurance framework for further consideration, including treatment of the risk.

Table 2: Our levels of risk appetite

| Risk appetite | Description | Treatment |

|---|---|---|

| Enhanced |

Risk management is less constrained by process to encourage innovation. Staff are empowered to embrace opportunities and develop new ways of working that enhance our public sector stewardship, improve our organisational efficiency and connectedness and promote a more collaborative culture. |

Greater risk is accepted to support new ways of doing things. |

| Balanced |

Risk management is balanced to pursue opportunities to innovate. Staff are empowered to consider risk while exploring new ways of delivering services, engaging with stakeholders, and allocating resources to ensure our service levels, stakeholder relationships and staff wellbeing are optimised. |

Measured risk is accepted to grow the business. |

| Limited |

Risk management involves active mitigation against additional risk exposure. Staff are empowered to recognise and escalate matters that risk our organisational reputation and integrity and compliance with legislative obligations and better practice policy. |

Risk is reduced to the lowest acceptable level. |

Key strategic risks

Finance has identified nine key strategic risks that, were they to eventuate, may affect our ability to achieve Finance’s purpose. Our approach to mitigating these risks reflects the current operating environment and how we engage with our strategic and cooperative partners. Strategic risks and mitigation strategies are mapped against Finance’s transformation areas of focus (Stewardship, Integrated Business Planning, People, and Making Business Better) and annual commitments. Our transformation areas of focus serve as guiding principles in how we manage and direct our work. This relationship is explained further in the performance chapters and in Figure 7: Integration of Finance’s Purpose, PBS and Performance commitments across operations.

In 2021–22, Finance will review its ERMP, key strategic risks and mitigation strategies to ensure they continue to reflect emerging opportunities and risks in our operating environment, advances in the Commonwealth Risk Management Policy and examples of better practice.

Supporting risk management tools and the role of the Risk Sub‑Committee will be considered as part of Finance’s commitment to strengthening governance, and better integrating the proactive management of, and engagement with risk as part of day to day operations.

Table 3: Key strategic risks and mitigation strategies

|

Strategic focus |

Strategic risk |

Risk mitigation strategy |

|---|---|---|

| Stewardship |

|

Finance’s central agency role involves strategic and cooperative partnerships with clients and stakeholders. To strengthen these partnerships, Finance is defining and implementing governance structures to collaborate, share knowledge and develop solutions with a focus on shared risk outcomes. Finance’s partnered and collaborative approach is all the more critical as the Department provides rapid advice, responds to uncertainty and drives transformation in a changing environment. As part of Finance’s ongoing commitment to strengthening governance, lessons learned will be applied to enhance the operation of the Department’s project assurance frameworks, committees and secretariat structures. In 2021, Finance established a People Committee and a Major Investments Committee to provide additional support as part of a refreshed committee governance framework. These committees play an important role in connecting operations across the Department and enabling timely, evidence-based decision-making. |

|

||

|

||

|

||

| Integrated Business Planning | ||

|

Finance collaborates internally and operates as a connected organisation. We are systematically prioritising work and allocating resources through integrated processes that consider Finance’s operating model and risk profile as part of a long-term investment approach. |

|

| People |

|

Finance’s ability to drive productivity, efficiency and innovation is dependent on people and culture. Finance recognises the importance of staff wellbeing, development and engagement as the operating environment continues to evolve. Finance invests in people and culture through defined leadership behaviours and people management frameworks that focus on building capability and supporting mobilisation and flexibility in Finance’s working arrangements to ensure staff engagement at all levels. The Finance People Committee further supports this focus. Finance’s Staff Consultative Committee is our primary consultation mechanism. Finance’s leadership expectations and values incorporate a commitment to act with integrity and in a manner consistent with the Integrity Framework. Finance’s Integrity Framework is linked with the Enterprise Risk Management Framework. In 2021, Finance will develop a workforce strategy, ensuring the capability, capacity and composition of the Department’s workforce remains fit for purpose. |

|

||

| Making Business Better |

|

Finance optimises opportunities to deliver better programs, services and to enable outcomes that are fit for purpose. The Department values forward planning that anticipates the needs of our people, and stakeholders – including shared risks with other entities to deliver on the Government’s objectives - and the Australian community. Finance is strengthening its ability to govern and manage data by embedding new systems and practices that support evidence-based decision-making and improve public sector policy advice and program delivery through enhanced data analytics and data management. In 2021 as part of Finance’s commitment to strengthening governance, Finance will look for opportunities to refine the role of the Risk Subcommittee to better integrate proactive management of, and engagement with, risk as part of our day to day operations. This will accompany Finance’s newly established People Committee and Major Investments Committee. |

|

Capability and enablers

The quality of Finance’s capabilities will influence how well we deliver on our purpose over the period of this Corporate Plan. This includes our people, and how we deliver on our Integrity Framework, data and information management commitments, information and communications technology platforms, business optimisation investments, and financial management responsibilities.

People

A refreshed Workforce Strategy will identify critical workforce risks and set out the key priorities for action in the next 12 months. The drivers shaping the broader APS workforce as defined in the Delivering for Tomorrow: the APS Workforce Strategy 2025, will inform the strategy, and be tailored to our operational context. This will ensure that we continue to build on and apply the lessons learned under COVID-19, and remain agile and skilled in responding to changing and emerging demands in delivering on government priorities.

Finance remains committed to a flexible, inclusive and positive workforce culture, and values the diversity of our people. Finance continues to apply flexible work practices to support the health and well-being of our people. The implementation of Finance’s fifth Reconciliation Action Plan, together with a revised diversity and inclusion strategy aligned with APS-wide diversity plans, will provide a strong platform to develop and strengthen practices to attract, recruit, develop and retain a diverse workforce.

Entry Level Programs remain a key element of Finance’s Workforce Strategy, ensuring we are equipped to meet and deliver on the current and evolving needs of the Australian public and government priorities. Finance will continue to drive a whole-of-government approach and lead the delivery of APS entry-level recruitment through the expansion of the Australian Government Graduate Recruitment process and Career Starter program in partnership with other APS agencies.

The Finance People Capability Framework outlines the core capabilities for staff across all classifications. It is supported by learning and development programs targeted at the continued uplift of core capabilities through the education, experience and exposure model of learning. Finance also supports its workforce to engage with the APS Professional Streams and, in doing so, strengthens their skills, knowledge and networks. Over the period of this Plan, Finance will explore opportunities to leverage digitally driven solutions to innovate our learning approaches. Embedding capabilities in financial and policy analysis, data analytics and digital literacy will be a departmental focus.

Finance has established a set of leadership expectations and values considered essential to all roles in Finance. Delivering on leadership expectations is the responsibility of all staff and forms part of our integrated performance framework.

Integrity framework

Finance is committed to a culture of professional integrity. We expect, empower and support our people to act with honesty, transparency and accountability at all times and all levels.

Finance launched its Integrity Framework in 2021 bringing together key policies, procedures and learning and development programs. It sets integrity expectations for awareness, capability and transparency. Staff are supported to access skills development and training to strengthen a culture of integrity and transparency and ensure a strong focus on the values of professionalism and a commitment to the delivery of quality work.

Finance’s Integrity Framework is embedded in our Department leadership expectations and values, and supported by the:

- Enterprise Risk Management Framework, which sets out the arrangements for designing, implementing, monitoring, reviewing and continually improving risk management in Finance

- Fraud Control Framework (including the Fraud Control Plan), which presents the arrangements for fraud prevention, detection, investigation and reporting strategies in Finance

- Conflict of Interest Policy, which sets out the requirements for the disclosure of interests and management of conflicts of interest

- Managing and Addressing Inappropriate Workplace Behaviour Policy, which sets out how Finance addresses, manages and supports staff in relation to inappropriate behaviour.

Data and information management

Finance is committed to improving its data and information management practices to enhance policy outcomes and support evidence-based decision-making at all levels. Finance has taken an incremental approach to growing our analytical capability, prioritising improvements in the management and governance of data. This approach builds a solid foundation for ongoing improvement in future years. This is in line with whole-of-government guidance (including that of the Office of the National Data Commissioner) to maximise the value of government data to drive efficiencies.

Finance has implemented an Information and Data Governance Policy to provide direction and guidance on best practice use of our data assets. Our decision-making committees remain focused on improving data governance, working to enhance information and data capabilities across Finance, and ensuring legislative compliance.

Finance undertook an assessment of its data capability in 2020 against key dimensions of data maturity: people, tools, governance, practice and leverage. In 2021, Finance collected and analysed key data assets and data teams to develop a comprehensive understanding of the data produced and used in Finance, and opportunities and challenges. Over the period of this Plan, Finance will formalise and implement a fit-for-purpose data strategy to guide investment and promote better management of data assets and capabilities.

Information and communications technology

All Finance staff have access to a consistent and highly functional IT platform as a result of the ‘One Desktop’ project. Use of common devices has made for a more agile environment and supported the successful transition to remote working arrangements, including in response to COVID-19. Finance’s GovTEAMS platform and videoconferencing functionality, enables staff, and the APS more broadly, to continue to work effectively in connected and engaged teams when working from various locations across Australia.

Finance’s current ICT strategy entered its third phase on 1 July 2021. During this phase, Finance will increasingly use the digital workplace environment to further business objectives and deliver additional value. A major activity will be implementing the Finance Advanced Cloud Environment Transformation (FACET) project, which will move the Finance ICT environment to the cloud to provide:

- technology, skills and support that enable further digital transformation

- cross-department collaboration and knowledge sharing

- robust, secure, resilient and agile technologies that are easier to consume, and

- access to innovations from a broad range of commercial providers.

Finance will look to refresh our ICT Strategy in coming years to ensure investment in IT platforms and collaboration tools remains fit for purpose for the future.

Business optimisation agenda

Finance’s Business Optimisation function partners with business areas to assess business processes and identify opportunities to reduce effort, build resilience, reduce risk and improve process maturity through automation, digitisation and process re-engineering. This is delivered through:

- defining, documenting and redesigning business processes to create efficiencies and redirect staff effort

- standardising and transforming time-consuming transactional, manual and paper-based tasks into reusable digital solutions, and

- removing manual effort from everyday tasks by deploying ‘digital workers’ – software designed to carry out business processes like any employee.

Partnering with ICT, the business optimisation function uses the latest available technology to provide fit-for-purpose digital solutions to all business areas, releasing capacity for staff to focus on key value-add services such as data analysis, policy implementation and the provision of support and advice.

Digital workers and business process improvement build resilience by maturing Finance’s service delivery to continuously meet the evolving challenges of the public sector. Over the period of this Plan, the business optimisation function will continue to drive the increase in digital workers and the number of hours released back to business. Finance will look to expand existing capability and capacity for business optimisation through technical training, certification and cross-skilling with other agencies and private sector partners.

Financial management

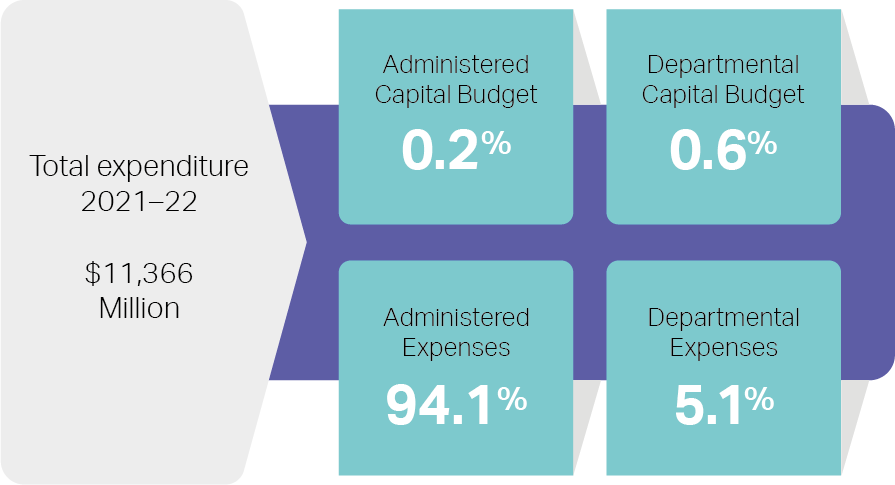

Finance has a total departmental expense budget of $579.8 million in 2021–22 including for functions delivered for whole-of-government purposes and supported through Special Accounts. Finance’s departmental capital budget is $64.4 million, of which $55.2 million relates to projects in the Property Special Account.

Finance has a total administered expense budget of $10,703.1 million in 2021–22 and an administered capital budget of $18.9 million.

Further information regarding Finance’s budget estimates (departmental and administered), Average Staffing Levels, and financial statements for the reporting period is set out in the Finance PBS 2021–22.

Figure 4: Total expenditure 2021–22

Integrated business planning and governance

Finance operates a regular integrated business planning mechanism. The Executive Board uses this process to set departmental strategy and make decisions on departmental priorities and resourcing, aligned with Finance’s approach to managing risk. This includes creating investment capacity to build capability and support the Government and APS more broadly.

Finance’s governance framework promotes the principles of good governance and supports transparent performance in line with government and departmental priorities. Finance’s governance framework incorporates integrated business planning and is supported by a centralised secretariat function. This helps ensure decision-making on resourcing is consistent across Finance, aligned with priorities and management of risk and supports the Secretary in discharging her duties under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Service Act 1999. Finance refreshed its governance framework (Figure 5) in 2021.

Throughout the financial year the Executive Board, supported by its Subcommittees, regularly reviews:

- immediate and future priorities, associated investment (including in major ICT projects and property capital works) and resourcing implications, and opportunities/risks

- opportunities for improvement, optimisation, deregulation/streamlining and greater alignment within and across business areas to enhance delivery of advice and services, and

- people management, leadership development and workforce capability.

Strategic partnerships and coorperation

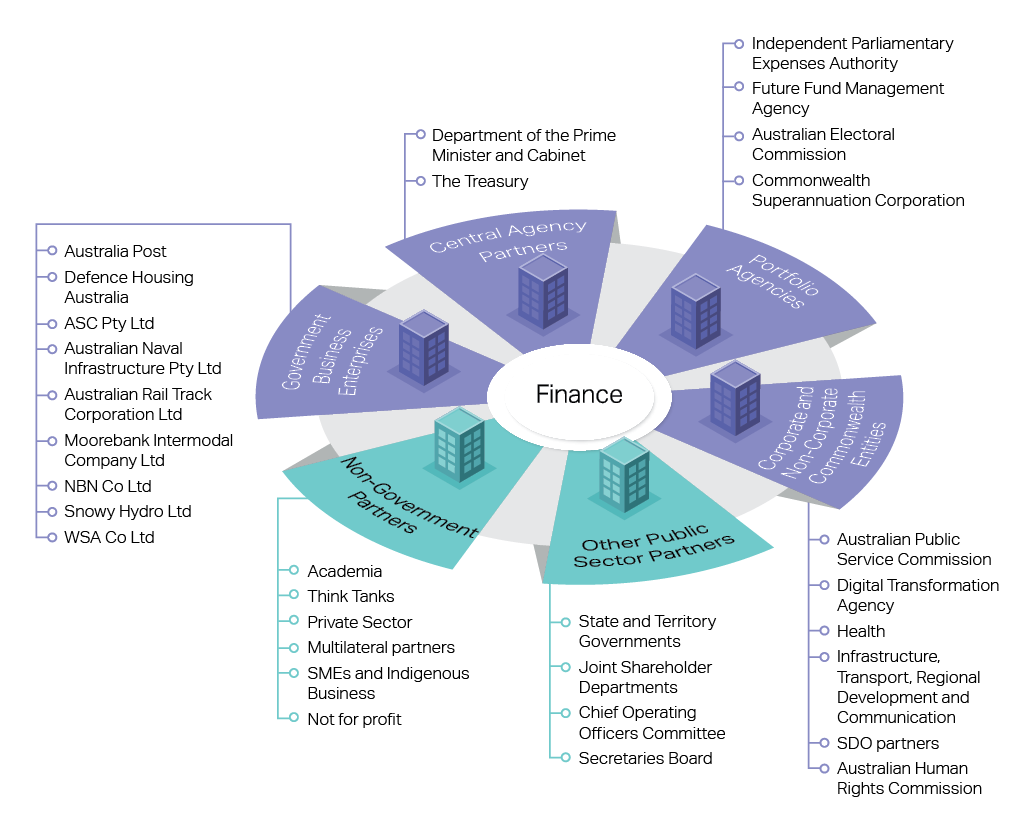

Underpinning Finance’s contribution over the period of this Plan is the quality and strength of our relationships (Figure 6). Finance’s focus on stewardship and collaboration with all entities to support the achievement of their objectives ensures the Department delivers:

- more appropriate, practical and timely advice from a whole-of-government perspective, supported by robust data and analytics

- sound policy able to respond to contemporary challenges

- better services supported by engaging more successfully with our clients and stakeholders, and

- leadership in enabling and driving productivity in the APS.

Figure 6 provides an overview of some of the strategic partnerships and cooperative arrangements Finance uses at an entity level to achieve its purpose. As part of these arrangements, Finance:

- works with partners across the public sector including central agency partners, the Department of the Prime Minister and Cabinet and the Treasury, and with the Australian Public Service Commission to provide leadership in the APS

- provides whole-of-government guidance and support on financial and policy advice, budget estimates and the Commonwealth’s finances

- advises other government agencies on a wide range of investment and resource management decisions

- collaborates across government to develop robust and fit-for-purpose polices and legislation around public governance, performance, accountability and risk management

- supports its portfolio agencies to achieve their objectives by working together to deliver shared outcomes in accordance with the PBS. Finance collaborates on policy development and learns from their ‘on the ground’ experiences to continue refining frameworks for the future

- collaborates with other public sector partners, including state and territory governments to develop appropriate responses to enterprise-wide issues (cross-jurisdictional and cross APS) related to the Budget and emergency response

- works with non-government partners to challenge our thinking and test our ideas, and leverages industry expertise and better practice, thus helping us to understand the Department’s operating environment and develop policies and advice that support a fit-for-the-future public service

- works closely with joint shareholder departments in supporting ministers and engaging with Government Business Enterprise Boards and senior executive teams.

Further detail regarding the Department’s cooperative arrangements with specific entities and sectors that support Finance’s key activities is presented in the performance chapters.

Performance

Finance continues to strengthen the performance information we provide to the Parliament and the broader community. The 2021–22 Corporate Plan features updates to the explanation of Finance’s performance framework that more clearly links Finance’s purpose, functions and priority activities in the forward period.

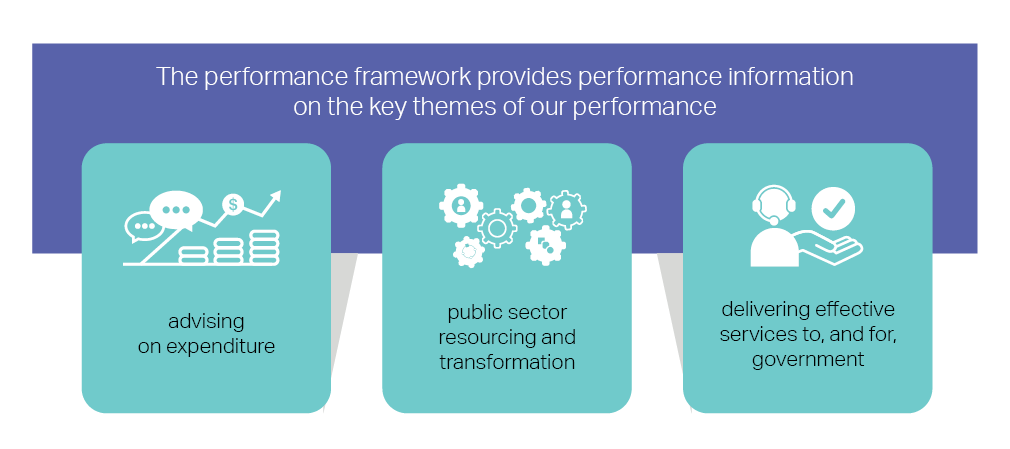

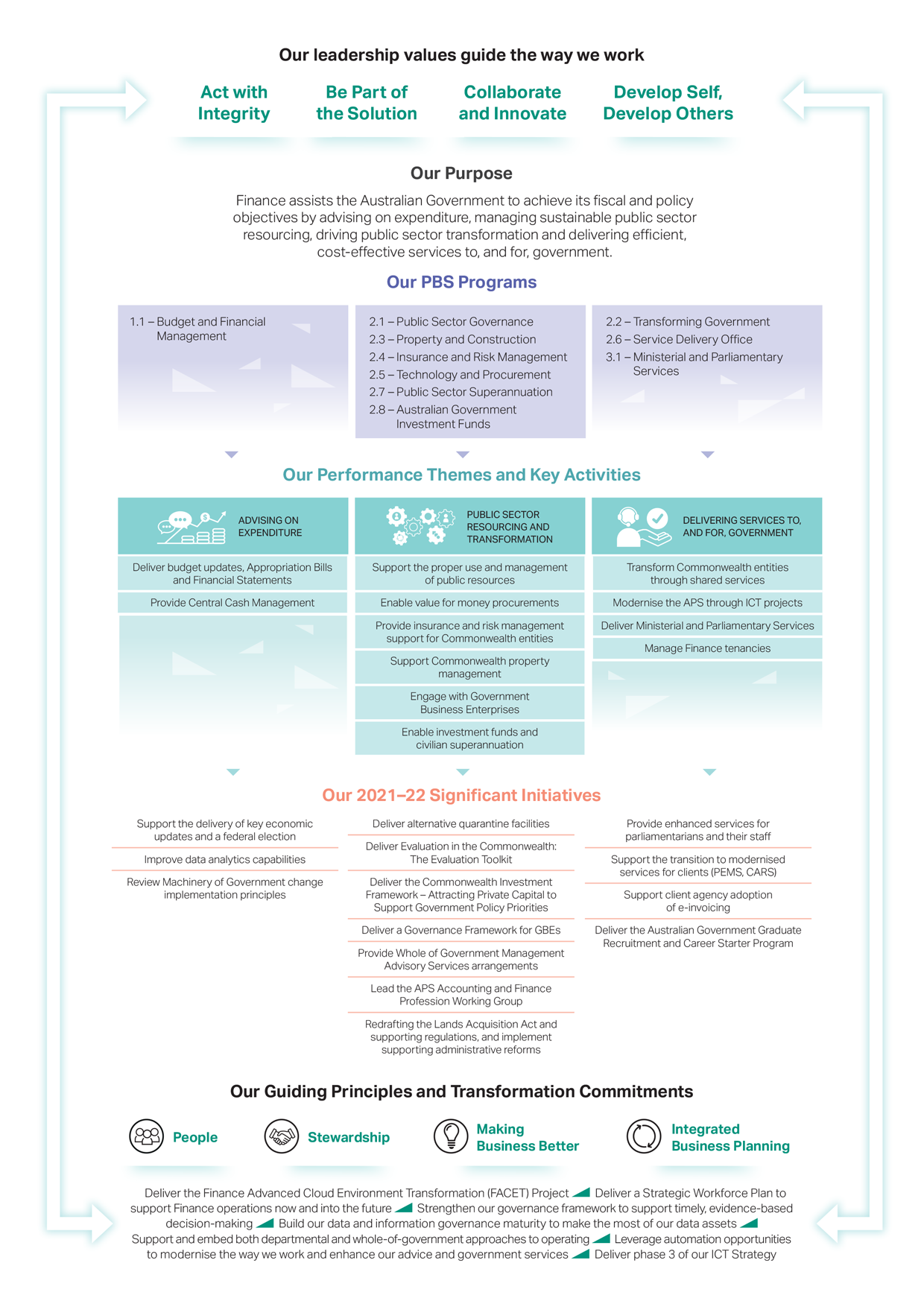

Performance themes and framework

Performance themes

Finance’s responsibilities under each performance theme are not mutually exclusive. Collaboration across functions remains a key feature of the way we work and allows us to offer integrated services for clients and partners. Collectively, Finance’s performance themes ensure all activities contribute to achieving our purpose.

Finance’s performance framework provides substantial detail on how we measure progress in achieving our purpose by identifying:

- key activities under each of the three performance themes

- performance measures that reflect the outcomes these activities are intended to achieve

- goals for each performance measure to assess achievements over time including performance targets where reasonably practicable, and

- methodologies to monitor results and track overall progress.

Figure 7 outlines the relationship between Finance’s different levels of business planning (the purpose statement, key activities, and significant initiatives) and how the approach we take is shaped by our values, guiding principles and transformation commitments. This provides a clear line of sight and informs internal business planning, resourcing and investment decisions.

Updates to support continuous improvement

Finance updated the presentation of key activities and performance measures to improve the clarity of our performance information and better allow for a clear read across reporting documents and cycles. Short- and long-form descriptions of key activities and performance measures are included with clear reference to Finance’s other performance reporting documents (PBS and Annual Report). A summary of changes is included at Appendix A. The corresponding performance tables explain any substantive changes to individual performance measures.

Targets against individual performance measures are identified where practicable. For a small number, Finance uses a combination of qualitative performance information and proxy measures to assess and report on achievements against key activities, including where it is not practicable to set targets. Finance will continue to review these measures, and targets will be set when possible. A tick presented in the ‘year’ columns in the performance tables indicates that the assessment approach will be used to measure performance for the given reporting period/s.

Finance will explore opportunities to further enhance performance measurement approaches over subsequent reporting cycles. Consideration will be given to refining measures that assess the effectiveness of activities in delivering Finance’s purpose, along with consideration to government targets for deploying e-invoicing technology, occupational density and Commonwealth property footprint.

Recognising the contextual nature of performance and the scale of domestic and global change expected over the period of this Plan, Finance will remain flexible in managing performance. Finance’s capacity to build lessons learned into its performance framework will be critical to achieving results in the current operating environment and to remaining accountable to our Minister, the Parliament and the broader community.Advising on expenditure

A significant aspect of Finance’s purpose relates to providing advice on whole-of-government expenditure, budget trends and policy issues. Finance’s work and advice continues to support the Government’s response to the challenges of the pandemic, and the Budget focus on sustaining Australia’s economic recovery highlights the importance of this work into the future.

The Government’s response to the COVID-19 pandemic includes significant expenditure directed to health and economic support for the Australian community. While the 2021–22 Budget position improved compared to forecast, Finance’s ongoing advice and analysis is an important input to the Government’s efforts to ensure a sustainable recovery, including by stabilising government expenditure.

To support the achievement of government outcomes, Finance will continue to embed discipline, rigour and contestability into policy and budget development processes, seeking to balance fiscal and policy objectives, and taking into account inter-generational issues that affect Australia’s social, economic and demographic environment.

A summary of the key activities that Finance will manage under this performance theme are set out below and in the performance tables, with further information on all activities available on our website.

Deliver budget updates, appropriation bills, and financial statements

Along with the Treasury, Finance prepares the annual Budget and associated economic updates as set out in the Charter of Budget Honesty Act 1998. Finance has a key role in developing the Government’s Economic and Fiscal Strategy and budget rules and providing policy and costings advice on expenditure to the Minister and the Expenditure Review Committee of Cabinet. Finance also has responsibility for all non-taxation revenue, which broadly includes charging, dividends, interest and investments.

To support the delivery of Budget and related economic updates, Finance regularly reviews budget estimates in collaboration with entities, updating budget estimates to take account of the best available information and to maximise their reliability and accuracy. Finance ensures that budget frameworks, policies and systems are in place so that budget papers and related economic updates are delivered in required timeframes and budget estimates are accurate.

Finance is responsible for using whole-of-government budget estimates information to prepare the annual appropriation bills, which, if passed by parliament, create the legal authority to spend money from the Consolidated Revenue Fund for Commonwealth purposes. To support ongoing financial management and compliance with the Government’s financial reporting responsibilities, Finance also prepares monthly financial statements and consolidated financial statements.

In the 2021–22 year the annual Appropriation Acts continue to allow an extraordinary amount for Advances to the Finance Minister and there are continued risks for calls on this contingency fund due to the health and economic impacts of the COVID-19 pandemic. Finance is taking an active approach to monitoring emerging pressures, acting swiftly on requests and providing policy advice to the Minister for Finance on alternate approaches to managing appropriations.

Provide central cash management

Finance has undertaken significant work to transform the way Commonwealth entities access their appropriations and automate the daily whole-of-government payment run, receipting and reconciliation processes. The benefits of this work include:

- enabling Commonwealth departments to access their appropriations on a near real-time basis

- increasing government efficiency and reducing business continuity risk for Commonwealth cash management

- reducing risk to the Commonwealth by decreasing the amount of funds sitting outside of the Official Public Account, and

- contributing to the Australian Public Service innovation and transformation agenda by adopting new technology.

As part of its stewardship role, Finance also facilitates a cash management community of practice. This initiative will support continuous improvement in Commonwealth cash management practices and enable better collaboration between Commonwealth entities on existing and emerging technologies, and transformation programs such as the Near Real-Time Funds Project.

Over the period of this Plan, significant initiatives we will manage to help achieve our purpose include the following:

- Support the delivery of key economic updates and a federal election

- Improve data analytics capabilities

- Review machinery-of-government change implementation principles.

Support the delivery of key economic updates, and a federal election

In 2021–22, Finance will continue to support government decision-making processes and the preparation of the 2020–21 Final Budget Outcome, the 2021–22 Mid-Year Economic and Fiscal Outlook and the 2022–23 Budget. In this financial year, Finance also expects to contribute to the delivery of a Pre-election Economic and Fiscal Outlook ahead of the next federal election.

Improve Data Analytics Capabilities

Finance continues to improve its data analytics capabilities, enabling us to better inform government decision-making. These data capabilities aim to improve Finance’s analysis on government spending and provide greater insights on key expenditure programs. Finance will continue to work with partner entities to improve funding data quality and to place data analysis in the context of emerging pressures in an increasingly complex, challenging and uncertain strategic environment.

Review machinery-of-government change implementation principles

In 2021–22, Finance will undertake a review of machinery-of-government (MoG) Principles, in collaboration with the Department of the Prime Minister and Cabinet and the Australian Public Service Commission. The Review will focus on the efficient and effective implementation of MoG changes. The Review will include a series of workshops with entity representatives and will produce an updated set of MoG Principles, updates to the current MoG guide and ensure guidance materials remain fit for purpose.

| Advising on expenditure – key activities and performance measures | ||||

|---|---|---|---|---|

| Key activity 1: Deliver Budget updates, appropriation bills and financial statements Coordinate, prepare and advise the Minister for Finance and the Expenditure Review Committee of Cabinet on the delivery of the Budget and related economic updates, including appropriations legislation and the Government’s financial statements, to contribute to promoting the Government’s fiscal strategy and policy objectives. |

Target | |||

| 2021–22 | 2022–23 | 2023–24 | 2024–25 | |

| Performance measure 1.1:Budget updates and appropriation bills Budget papers, related updates (e.g. the Mid-Year Economic and Fiscal Outlook – MYEFO) and appropriation bills are accurate, consistent with external reporting standards, delivered within required timeframes and meet the Government’s fiscal and policy objectives and legislative obligations. | ||||

| How will this performance measure be assessed? | ||||

| 1.1.1 Accuracy of Budget Estimates. | ||||

| Variances between estimated expenses and final outcome are within set parameters. | ||||

|

< 2% |

< 2% |

< 2% |

< 2% |

|

<1.5% |

<1.5% |

<1.5% |

<1.5% |

|

< 1% |

< 1% |

< 1% |

< 1% |

|

<0.5% |

<0.5% |

<0.5% |

<0.5% |

|

Significant variances between estimated expenses and final outcome are explained. |

✓ | ✓ | ✓ | ✓ |

|

1.1.2 Timeliness of Budget Estimate Updates and Appropriation Bills. |

||||

|

✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ | ✓ |

|

1.1.3 External reporting standards and legislative requirements are met. |

✓ | ✓ | ✓ | ✓ |

|

Methodology: Budget estimates take into account, to the fullest extent possible, all government decisions and other circumstances that may have a material effect. Significant differences between the estimated expenses and final outcome are reported annually, with explanations provided where variances are equivalent to, or greater than, the targets specified. Budget papers and related economic updates are produced in accordance with timeframes and requirements in the Charter of Budget Honesty Act 1998. Appropriation bills are introduced into parliament at times intended by government and in accordance with legislative requirements. Timeliness is demonstrated by tabling dates of budget papers, related economic updates and appropriation bills recorded in Hansard. Budget papers and related economic updates outline the external reporting standards used and identify any departure from that standard. |

||||

|

Performance measure 1.2: Financial statements |

||||

| How will this performance measure be assessed? | ||||

| 1.2.1 Complete and fairly presented Financial Statements. | ||||

|

✓ | ✓ | ✓ | ✓ |

|

1.2.2 Timeliness of Financial Statements. |

||||

|

✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ | ✓ |

|

Methodology: Measured monthly & reported annually. The Auditor-General issues an unmodified audit report on the consolidated financial statements. Timeliness is demonstrated by date of correspondence to: the Minister for Finance, providing monthly financial statements; and to the Auditor-General providing consolidated financial statements. |

||||

|

Explanation of changes since 2020–21 Corporate Plan: Performance measures are unchanged. Links with PBS: Program 1.1 Budget and Financial Management (Outcome 1). |

||||

| Key activity 2: Provide central cash management Intra-day disbursements through the central cash management system so that entities have access to near real-time funds to deliver on the policy objectives of the Government in necessary timeframes. | Target | |||

| 2021–22 | 2022–23 | 2023–24 | 2024–25 | |

| Performance measure 2.1: Daily disbursement of cash Commonwealth entities have access to cash, in near real-time, as required. |

||||

| How will this performance measure be assessed? | ||||

| 2.1.1 Cash needs of all entities are met in near real-time, each and every day (including outside business hours), for each financial year. | ✓ | ✓ | ✓ | ✓ |

| Methodology: CBMS and Reserve Bank intra-day data transmission records show that payment requests have been completed each day with drawdowns available to entities. Measured daily and reported annually. | ||||

|

Explanation of changes since 2020–21 Corporate Plan: Performance measures are unchanged. Links with PBS: Program 1.1 Budget and Financial Management (Outcome 1). |

||||

Public sector resourcing and transformation

We are committed to reforming business processes, process automation, and enabling public servants to focus on the Government’s strategic priorities and delivery of services to Australians.

Finance’s stewardship role in leading, facilitating and implementing whole-of-government public sector reforms and transformation initiatives is critically important.

To achieve our purpose and continue to support the Government and the public sector in its responses to COVID-19 and other emerging issues, Finance is committed to ensuring that its key activities:

- are supported by robust whole-of-government policy frameworks, which have stood up well to the demands of a global crisis and will be continually monitored and reviewed to ensure they remain fit for purpose and afford operational flexibility in an evolving environment

- continue to ensure that the principles of accountability and transparency underpin Finance’s advice to the Australian Government and Commonwealth entities on appropriate response, recovery and reform initiatives

- continue to leverage and promulgate innovation across the public sector, while effectively managing risks and harnessing lessons learned

- build on the quality and strength of Finance’s relationships with strategic and cooperative partners to identify and embed rapidly evolving technologies and business practices, where these contribute to a more effective and efficient approach to public resource management.

A summary of the key activities that Finance will manage under this performance theme are below and in the performance tables, with further information on all activities available on our website.

Support the proper use of public resources

Finance is responsible for the Commonwealth’s resource management framework including governance, performance and accountability arrangements for using and managing public resources. We administer the Public Governance, Performance and Accountability Act 2013 (PGPA Act) which guides the duties of officials, planning and budgeting, grants and procurement, charging and cost-recovery, engaging with risk, reporting on financial and non-financial performance and managing appropriations, assets and liabilities.

Finance also supports the operations of the public sector through policy frameworks that guide electoral matters, campaign advertising, and productivity and business improvement initiatives.

Support Commonwealth procurement, property and risk management

Finance administers frameworks and policies that support Commonwealth procurement, property and risk management.

The Commonwealth Procurement Framework, including relevant legislation and policies, governs the way Commonwealth officials procure goods and services. In addition, Finance manages whole-of-government coordinated procurement arrangements for commonly used non-ICT goods and services, such as travel, accommodation, property services, and consultancies to maximise market benefits and deliver efficiencies.

The Commonwealth Property Management Framework, including relevant legislation and policy, governs the management of property that is leased or owned by the Commonwealth, including acquisition, disposal and management of property interests. Finance manages the delivery of major capital works projects including the national purpose-built quarantine facilities. Finance also administers the Lands Acquisition Act 1989 and the Public Works Committee Act 1969 and considers Commonwealth leases that exceed certain thresholds.

The Commonwealth Risk Management Policy seeks to strengthen the risk management practices of Commonwealth entities by encouraging engagement with risk in a positive and transparent way. Finance is also responsible for Comcover, the Australian Government’s self-managed general insurance fund, which encourages entities to manage insurable risk effectively.

Engage with Government Business Enterprises and joint shareholder departments

Finance manages the policy frameworks applicable to the Commonwealth's investment and Government Business Enterprises (GBEs). We provide advice to the Australian Government relating to commercial investments and GBEs – ASC Pty Ltd, Australian Naval Infrastructure Pty Ltd, Australian Postal Corporation, Australian Rail Track Corporation Limited, Defence Housing Australia, Moorebank Intermodal Company Limited, NBN Co Limited, Snowy Hydro Limited and WSA Co Limited.

We provide advice on accountability and governance arrangements, board appointments and GBE performance and financial sustainability. Finance works closely with partner shareholder departments in supporting ministers and engaging with GBE Boards and senior executive teams.

Enable investment funds and civilian superannuation schemes

Finance manages the policy and legislation of the Commonwealth Investment Funds – the Future Fund, the Disability Care Australia Fund, the Nation-building funds, the Medical Research Future Fund, the Aboriginal and Torres Strait Islander Land and Sea Future Fund and the Future Drought Fund.

Finance is also responsible for policy and legislation governing the Australian Government superannuation schemes for civilian employees and office holders, parliamentarians, governors-general and federal judges and administer the pension schemes for relevant parliamentarians, governors-general and federal judges. This includes monitoring cost drivers and considering strategies for management of long-term costs (including legacy costs) and adaptation of schemes to reflect changes in industry practices and community standards.Over the period of this Plan, significant initiatives we will manage to help achieve Finance’s purpose include:

- Deliver alternative quarantine facilities

- Deliver Evaluation in the Commonwealth: The Evaluation Toolkit

- Enhance the Commonwealth Investment Framework

- Enhance the Governance Framework for GBEs

- Deliver Whole-of-Government Management Advisory Services arrangements

- Lead the APS Accounting and Finance Profession Working Group

- Redrafting the Lands Acquisition Act and supporting regulations, and implement supporting administrative reforms.

Deliver alternative quarantine facilities

Finance is leading the delivery of national purpose-built quarantine facilities on behalf of the Australian Government. The national quarantine facilities will enable an increased number of Australians to return home and provide additional quarantine capacity for the gradual reopening of Australia’s international border.

Finance has leveraged our project management, property, procurement and commercial capability and expertise, and assembled expertise from a range of Commonwealth agencies to expedite the early delivery of the Government’s commitment to stand-alone quarantine facilities that meet the Government’s Key Assessment Criteria.

In collaboration with state governments and private delivery partners, Finance is leading planning, including site feasibility studies, relevant agreements with state governments, project management and overall delivery of Centres for National Resilience. The centres will provide a long-term option for quarantine, and the Australian Government will retain the centres for future alternative uses. Design, planning and incentives are geared to support the earliest possible handover of facilities to state government operators.

Deliver Evaluation in the Commonwealth: The Evaluation Toolkit

Finance plays a central role in driving continuous improvement across the public sector, with a focus on achieving greater efficiency, accountability and capability.

The Government expects the Australian Public Service (APS) to deliver for all Australians by setting clear goals and measuring progress towards their achievement. The Government tasked Finance with supporting the APS to do this by building evaluation capacity, expertise and practices across the APS.

Leveraging the evaluation expertise present in many APS entities, Finance is developing a web-based evaluation toolkit of practical guidance and supporting resources to embed evaluation in everyday APS practice, while ensuring the systematic evaluation of programs and policies in line with the Commonwealth Performance Framework. The Department is also working with key stakeholders to embed evaluation planning in new policy proposals and Regulation Impact Statements.

The evaluation toolkit will be launched in 2021–22 and is intended to provide staff new to evaluation with an overview of evaluation concepts and approaches so they can:

- build their capability to evaluate government programs and activities

- understand more about measuring the effects and impacts of a program or activity

- use data and robust evidence to drive continuous improvement

- help deliver successful policies and programs

- meet their obligations under relevant Commonwealth legislation and policy

- improve the quality of performance reporting, and

- help build an evaluative culture across the Commonwealth.

The collaborative process used to develop the evaluation toolkit goes to enhancing the way the Department supports and engages with entities, including through self-service, to promote the objectives of the Public Governance, Performance and Accountability Act 2013 and the Commonwealth Performance Framework. The evaluation toolkit will be hosted on the Department’s website and administered in-house and will be regularly reviewed to maintain up-to-date content and usability.

Enhance the Commonwealth Investment Framework

The Commonwealth Investment Framework (CIF) supports the Australian Government to realise the benefit of investments that utilise the Commonwealth balance sheet for Australian citizens, businesses and communities.

The CIF supports the successful long-term implementation and management of investment decisions from a whole-of-life investment perspective. It achieves this by providing decision makers with the best evidence to support consideration of investment proposals and by ensuring that Commonwealth entities have the necessary tools and access to relevant expertise to support Commonwealth investment. The CIF includes a Resource Management Guide (RMG) and a Toolkit of practical, user-focused content, providing a ‘how-to’ for Commonwealth agencies.

Since the launch of the CIF, capital markets and the Government’s fiscal position have significantly changed due to the impacts of, and response to, COVID-19. The Government’s short- and medium-term fiscal position has deteriorated with the Underlying Cash Balance projected to be in deficit through the medium term and net debt expected to increase to approximately $980 billion in 2024–25 (40 per cent of GDP), reflecting the Government’s increased borrowing requirements from the response to, and impacts of, the COVID-19 pandemic.

Following the Government’s decision in the 2020–21 Budget, Finance was tasked with enhancing the Government’s commercial focus to achieve more widespread use of commercial investment and procurement models in delivering policy outcomes. Finance is supporting agencies to consider the benefits of commercial financing and procurement and to create opportunities for partnership with the private sector in delivering government priorities. This will be achieved by:

- developing and piloting an expanded set of commercial options and approaches to secure private capital and capability; and

- working with key stakeholders to further support strategic engagement with the investment community.

These work streams focus on opportunities to leverage private sector capital, investment, innovation, risk appetite, and capability to maximise the efficiency and effectiveness of major government investments.

Enhance the Governance Framework for GBEs

The Commonwealth Government Business Enterprises – Governance and Oversight Guidelines (GBE Guidelines) are the primary policy document which outlines the Australian Government’s expectations of GBEs.

These apply to Corporate Commonwealth entities or wholly-owned Commonwealth companies. They supplement those provisions of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) which apply to GBEs.

In response to a number of developments in contemporary corporate governance practices relevant to GBEs, Finance will undertake a review of the GBE Guidelines in consultation with relevant stakeholders including shareholder Ministers.

The review will seek to ensure the GBE Guidelines continue to represent a framework which is appropriate, fit for purpose, aligns with domestic expectations and international best practice guidance, and can be easily adapted to address future changes. The review will incorporate relevant recommendations and findings from recent reviews and investigations relevant to accountability and transparency, governance, proper use of public resources, and effective management of risk.

Deliver Whole of Government Management Advisory Services arrangements

The Whole of Australian Government Management Advisory Services Panel (the Panel) has been established to improve quality, consistency and efficiency in the procurement of Management Advisory Services by Commonwealth entities.

The Panel is being established in three phases, with each phase conducted via a separate open approach to market. Phase 1, Financial Management Advisory Services, commenced on 12 July 2021. Tender evaluation of Phase 2, Corporate Management Advisory Services, is currently underway, with services expected to commence in the first quarter of 2022. Services under Phase 3, Commercial Management Advisory Services, are expected to commence in the second quarter of 2022. The Panel will replace around 20 existing APS panels and provides a range of benefits, including:

- improved quality, consistency and efficiency for Management Advisory Services, with standard terms and conditions and a Performance Management Framework

- cost savings and efficiencies for Service Providers by reducing administration and tendering efforts

- reduced time and effort for entities and for Service Providers to establish contracts, and

- standardised rate structures for entities, noting that currently Service Providers’ rates can vary significantly across existing panels for the same types of services.

Lead the APS Accounting and Finance Profession Working Group

An APS Accounting and Finance Profession Working Group was established by the Department of Finance in early 2021 to create and implement a strong foundation for ongoing collaboration, support and development of Accounting and Finance Professionals within the APS. The priorities of the Working Group are to grow capacity and capability, support diversity and nurture development, and align with the APS Workforce Strategy 2025. Working Group membership comprises representation from a range of APS entities.

Redrafting the Lands Acquisition Act and supporting regulations, and implement supporting administrative reforms

Finance is implementing reforms to land acquisitions that were announced by the Australian Government on 17 August 2021. The reforms will enhance the responsiveness and timeliness of acquisition processes, provide more support and greater certainty for landholders and improve outcomes for all parties.

Targeted legislative and regulatory amendments will modernise the Lands Acquisition Act 1989, provide process clarity, encourage more timely resolution of compensation negotiations and apply greater rigour to acquisitions by agreements.

A new case management model will better support landholders throughout the acquisition process and new guidance will support best practice in Commonwealth land acquisitions. Guidance will provide advice around valuations, the conduct of acquisitions and determining an appropriate price.

| Public sector resourcing and transformation – key activities and performance measures | ||||

|---|---|---|---|---|

| Key activity 3: Support the proper use and management of public resources Support the proper use of public resources by Commonwealth entities and companies under the Commonwealth Resource Management Framework. |

Target | |||

| 2021–22 | 2022–23 | 2023–24 | 2024–25 | |

| Performance measure 3.1: Governance and accountability Finance ensures the Resource Management Framework is maintained as a fit-for-purpose framework for the proper use of public resources, and supports Commonwealth entities and companies to meet high standards of governance, performance and accountability through effective engagement and the provision of guidance. |

||||

| How will this performance measure be assessed? | ||||

| 3.1.1 Effectiveness of Finance’s stewardship, policy advice, engagement and guidance on governance and accountability arrangements. | ✓ | ✓ | ✓ | ✓ |

| 3.1.2 Parliamentary and independent audit report findings related to the PGPA framework and the effectiveness of Finance’s support services and guidance are applied to maintain a fit-for-purpose framework. | ✓ | ✓ | ✓ | ✓ |

|

Methodology: Assessed through a combination of qualitative case studies, entity correspondence, and an annual entity survey. Survey methodology is undertaken in a manner consistent with accepted market research practices. Parliamentary and independent audit perspectives measured through monitoring all ANAO and JCPAA reports published each financial year, and assessing findings that relate to the PGPA framework. Report findings that identify issues and opportunities for improvement are applied as part of ongoing work to maintain and strengthen the efficiency and application of the Resource Management Framework, legislation, associated guidance and Finance’s support services. |

||||

| Performance measure 3.2: Confidence in the quality and accessibility of performance reporting across the Commonwealth Parliament and independent auditors have confidence in the quality and accessibility of performance information produced under the Commonwealth Performance Framework and available to the Parliament and the public. Entities and companies understand their obligations under the Commonwealth Performance Framework, and are equipped and supported to meet them. |

||||

|

How will this performance measure be assessed? |

||||

| 3.2.1 Effectiveness of Finance’s stewardship, policy advice, engagement and guidance on the Commonwealth Performance Framework, including a measure of entity satisfaction with the level of support provided by Finance. | 80% | 80% | 80% | 80% |

| 3.2.2 Parliamentary and independent audit report findings related to the Commonwealth Performance Framework and the effectiveness of Finance’s support services and guidance are applied to maintain a fit-for-purpose framework. | ✓ | ✓ | ✓ | ✓ |

|

Methodology: Assessed through a combination of qualitative case studies, entity correspondence, and an annual entity survey (satisfaction target derived from a specific survey question). Survey methodology is undertaken in a manner consistent with accepted market research practices. Parliamentary and independent audit perspectives measured through monitoring all ANAO reports tabled in parliament each financial year, JCPAA reports and other parliamentary committees, and assessing findings that relate to the quality of performance reporting under the Commonwealth Performance Framework. Measured continuously and reported annually. Report findings that identify issues and opportunities for improvement are applied as part of ongoing work to maintain and strengthen the performance framework, legislation, associated guidance and Finance’s support services. |

||||

|

Explanation of changes since 2020–21 Corporate Plan: Performance measures are unchanged. |

||||

| Key activity 4: Enable value for money procurements Leverage experience and support the Australian Government to achieve value for money procurements. |

Target | |||

| 2021–22 | 2022–23 | 2023–24 | 2024–25 | |

| Performance measure 4.1: Stewardship over procurement systems and policies Finance works with external stakeholders to provide stewardship over systems and policies to support a fair, efficient, and transparent procurement framework, and to implement and maintain Whole-of-Australian-Government (WoAG) procurement arrangements for non-ICT services (e.g. travel bookings and major office equipment) to generate price savings and operating efficiencies. |

||||

| How will this performance measure be assessed? | ||||

| 4.1.1 Effectiveness of Finance’s stewardship, policy advice, engagement and guidance on procurement systems and policies. | ✓ | ✓ | ✓ | ✓ |

| 4.1.2 AusTender platform and data is available to users 99.5 per cent of the time. | ✓ | ✓ | ✓ | ✓ |

| 4.1.3 Engagement with domestic and international stakeholders supports information exchange on advances in procurement policy. | ✓ | ✓ | ✓ | ✓ |

| 4.1.4 Savings and efficiencies from WoAG arrangements are compared, where possible, against similar arrangements, previous arrangements or markets. | ✓ | ✓ | ✓ | ✓ |

| Methodology: Measured and reported annually via data and feedback collected from various sources such as: AusTender helpdesk, agency procurement forums and agency advice enquiries. Savings and efficiencies for WoAG arrangements are considered when they are created, extended or refreshed. | ||||

|

Explanation of changes since 2020–21 Corporate Plan: Performance measures are unchanged. Links with PBS: Program 2.5 Technology and Procurement (Outcome 2). |

||||

| Key activity 5: Insurance and risk management support for Commonwealth entities Provision of a self-managed insurance fund (Comcover) to protect Commonwealth entities against insurable losses and support them to manage risk. |

Year | |||

| 2021–22 | 2022–23 | 2023–24 | 2024–25 | |

| Performance measure 5.1: Treatment of insurable risks and claims management Comcover is effectively managed to ensure the fund is financially sustainable, there is a consistent, WoAG approach to the management of claims and Comcover supports the improvement of risk maturity in General Government Sector entities over time. |

||||

| How will this performance measure be assessed? | ||||

| 5.1.1 An appropriate level of net assets is maintained to meet outstanding claims liabilities. | ✓ | ✓ | ✓ | ✓ |

| 5.1.2 Litigation is undertaken honestly and fairly as a model litigant. | ✓ | ✓ | ✓ | ✓ |

| 5.1.3 Effectiveness of Comcover’s stewardship, policy advice, engagement and guidance on risk management. | ✓ | ✓ | ✓ | ✓ |

| Methodology: Finance maintains adequate Comcover reserves to meet its outstanding claims liability. Comcover claims are managed in accordance with the Commonwealth’s Legal Services Directions. Strong attendance at Comcover education services and aggregate feedback from attendees indicates an increasing level of understanding and knowledge. The biennial benchmarking report indicating an aggregate improvement in risk maturity over time. | ||||

|

Explanation of changes since 2020–21 Corporate Plan: Performance measures are unchanged Links with PBS: Program 2.4 Insurance and Risk Management (Outcome 2). |

||||

| Key activity 6: Support Commonwealth property management Deliver an efficient and commercial approach to the management of Commonwealth property through the Commonwealth Property Management Framework. |

Target | |||

| 2021–22 | 2022–23 | 2023–24 | 2024–25 | |

| Performance measure 6.1: Commonwealth property initiatives are efficient and effective The management of Commonwealth property demonstrates best practice effectiveness in an evolving environment, and delivers efficiencies in relation to leasing and facilities management for non-corporate Commonwealth entities. |

||||

| How will this performance measure be assessed? | ||||

| 6.1.1 Property efficiencies are delivered through the whole-of-Australian Government property services coordinated procurement arrangements for leasing and facilities management. | ✓ | ✓ | ✓ | ✓ |

| 6.1.2 Effectiveness of Finance’s stewardship, policy advice, engagement and guidance on Commonwealth property management. | ✓ | ✓ | ✓ | ✓ |

| Methodology: Measured and reported through the annual Australian Government Office Occupancy Report, property services coordinated procurement arrangements for leasing and facilities management and agency forums, entity correspondence and qualitative case studies. | ||||

|

Explanation of changes since 2020–21 Corporate Plan: Performance measures are unchanged. Links with PBS: Program 2.3 Property and Construction (Outcome 2). |

||||

| Key activity 7: Engage with Government Business Enterprises