Introduction

This guide outlines the present requirements for Commonwealth programs that should be followed by General Government Sector (GGS) entities when determining if new programs, or changes to existing programs are required.

What are Commonwealth Programs?

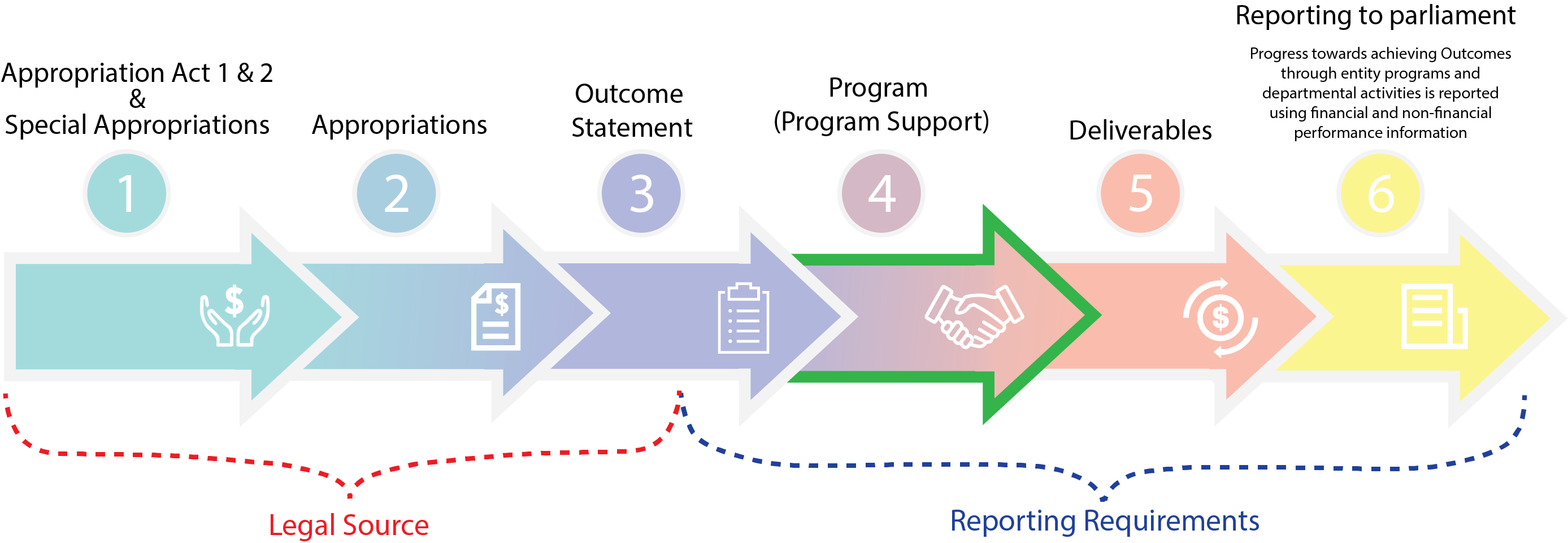

Commonwealth programs deliver benefits, services or transfer payments to individuals, industry/business or the community as a whole and are the primary vehicles for Commonwealth entities to achieve the intended results of their outcome statements.

Commencing from the 2009‐10 Budget entities were required to report to parliament by program. This is the minimum level of reporting required for budget documentation, and is recorded in the Central Budget Management System (CBMS) and reported in Portfolio Budget Statements (PB Statements). CBMS is maintained by the Department of Finance (Finance) in conjunction with entities and is used for whole‐of‐government reporting, most notably in Budget Paper No.1.

Characteristics of a Commonwealth Program

The characteristics of Commonwealth programs are included in the hierarchy below (generally these points should apply from one to four, with point five being an exception):

Difference between Program and Measure

Entities should note that Budget measures (appearing in Budget Paper No. 2 and in the Mid Year Economic and Fiscal Outlook) rarely constitute new programs.

Funding Sources of Programs

As noted above, a Commonwealth program represents activities or groups of activities that contribute to an intended result of Government. As such there are no strict rules governing the composition of funding sources for a Commonwealth program. A program may by funded through one or more of a number of appropriation items (including Bill 1, Bill 2, special appropriations and special accounts) which may be administered, departmental, or a combination of the two.

Public Reporting of Commonwealth Programs

Entities are required to report against the approved list of programs for which they are responsible in PB Statements, Portfolio Additional Estimates Statements and in Annual Reports from 2009‐10.

Reporting Below the Program Level

There may be a requirement or desire for entities to provide more detailed information on key aspects of program activities if public interest would dictate this additional level of reporting. The areas of reporting may be described as components, but in essence represent significant areas of activity and/or public interest within programs that warrant reporting to parliament.

Reporting at the program component level provides additional transparency when reporting to parliament but is not required to be separately disclosed in CBMS.

Program Support

Program support refers to the departmental activities and resources that can be attributed to the policy development, delivery and associated costs of administering a Commonwealth program. It covers the costs of the area of the entity responsible for the program’s administration, and a relevant portion of the costs of the corporate areas that support the operation of the entity.

As program support is funded from the entity’s departmental appropriations, it is notional and can be redirected by the accountable authority of the entity to meet emerging priorities. It does, however, signal the expected resource requirements associated with the development and delivery of programs.

Program support is distinguishable from particular Commonwealth programs because it is attributable to the delivery and/or development of a specific program and is not a service or function in its own right.

Changing the Commonwealth Program List

Approval of additions or changes to Commonwealth Programs

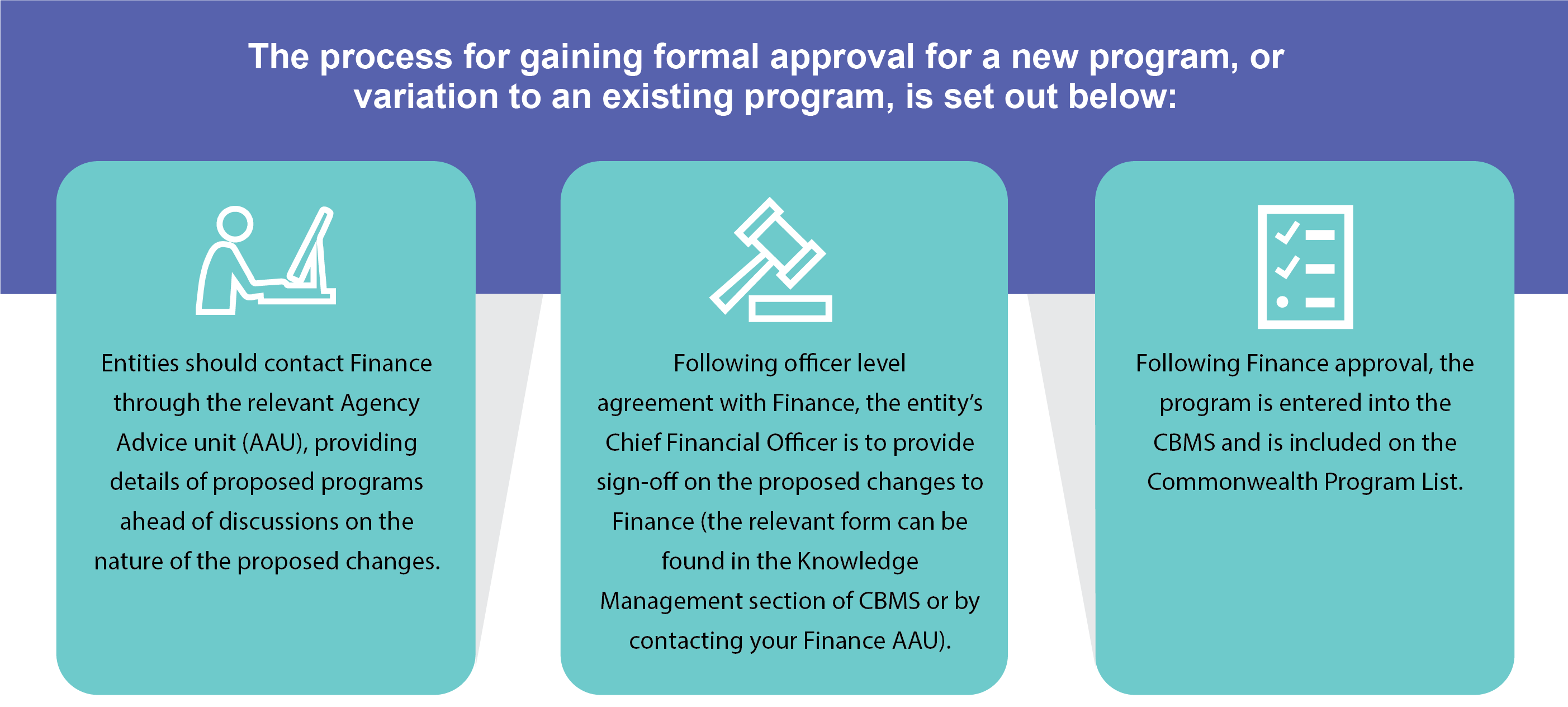

The Commonwealth Program List contains all GGS entity programs, and is managed by Finance to ensure that the correct level of information is disclosed about material and significant areas of government spending.

Finance must approve proposals to change the Commonwealth Program List to ensure the usefulness and consistency of program reporting information over time.

Recording of Commonwealth Programs in CBMS and the PB Statements

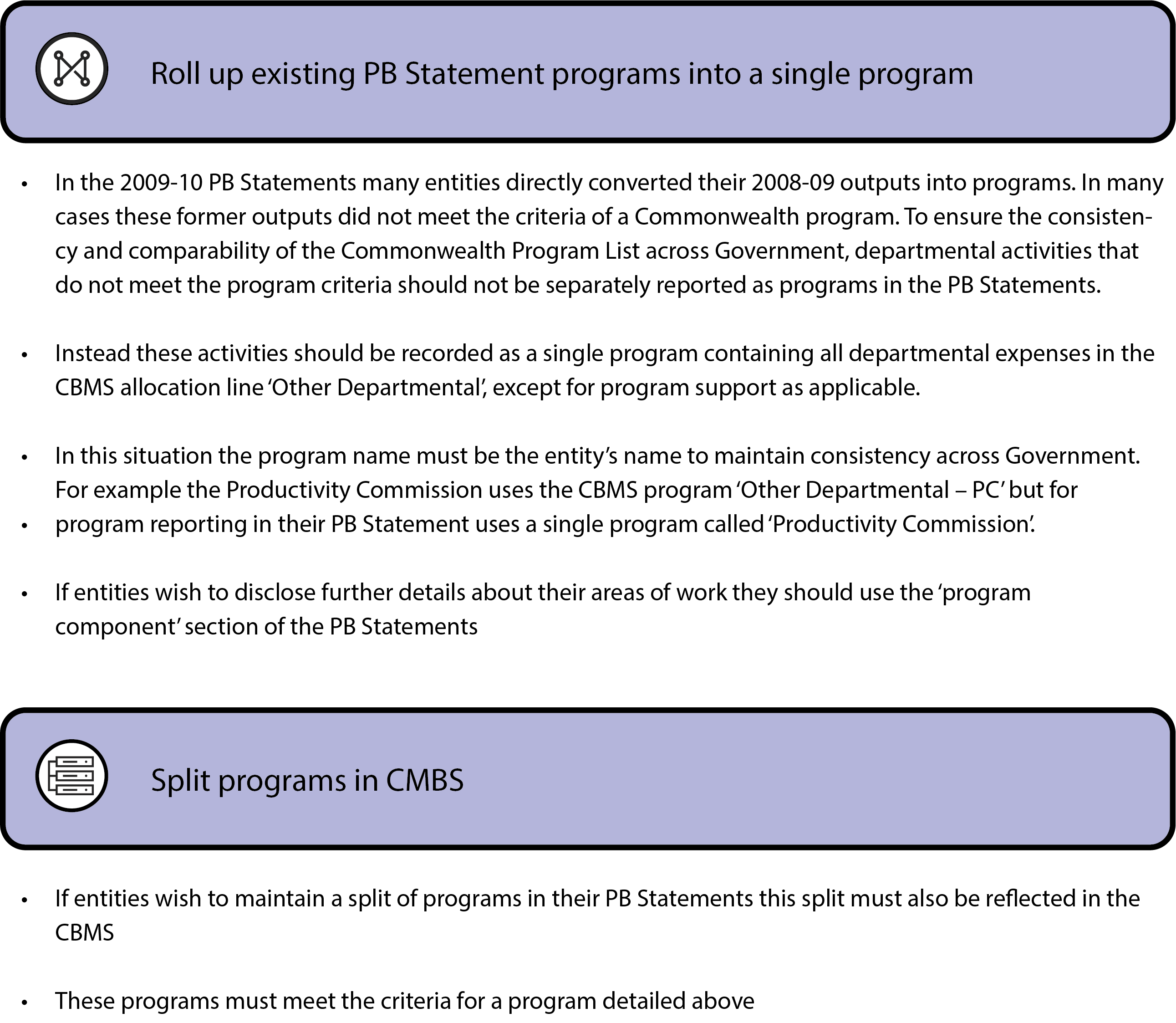

The programs reported in PB Statements must match the programs listed in CBMS, except in a limited number of cases which are detailed below. Any exceptions must be agreed with Finance prior to their inclusion or exclusion in PB Statements.

“Other” is not a Commonwealth program

Entities are not to use the program titles “Other Administered” or “Other Departmental” in the PB Statement under any circumstances. While these categories are available in CBMS for financial allocation purposes they are not to be used for public reporting.

Entities should only use the “Other Administered” program allocation line in CBMS where absolutely necessary. This includes:

- where it is too late to create a new program in CBMS prior to the close of a whole of Government estimates update (when new funding has been agreed and no existing program is appropriate). In this situation a new program for the PB Statements must be agreed in‐principle with Finance before publication with the program to be entered into CBMS at the next available opportunity; or

- where Portfolio Departments make payments within their portfolio to corporate Commonwealth entities as defined by the Public Governance, Performance and Accountability Act 2013.

Departmental Funding

Entities must not use ‘Other Departmental’ as a program in their PB Statements. ‘Other Departmental’ is generally used to record entity running costs in CBMS. In the PB Statements these costs are allocated to programs as program support.

Where departmental funding is not classed as program support, but is recorded in CBMS against ‘Other Departmental’, there are two options for entities for reporting in the PB Statements:

Public reporting needs differ from the requirements of CBMS

There are a limited number of circumstances where the requirements of CBMS differ from the agreed Commonwealth Program List. This can occur where, for instance, a program is split over more than one sub‐function.

An example of this situation is the Finance “Public Sector Superannuation” program which is recorded as two programs in CBMS to correctly allocate data between the ‘Nominal superannuation interest’ and ‘Government superannuation benefits’ sub‐functions.

In these circumstances entities must show all lines from CBMS in their PB Statements program expenses table to enable the figures to be directly translated back to CBMS.

Commonwealth programs funded through both administered and departmental appropriations

When reporting in CBMS a program must be explicitly classified as either administered or departmental because of the flow on consequences to the Appropriation Bills. This means that where a Commonwealth program reported in the PB Statements contains both administered and departmental funding (other than program support) it must be represented by two programs on CBMS. This can be done in CBMS by adding (Administered) or (Departmental) after the program name.

Guidance on classifying items as administered or departmental can be found in the Knowledge Management section of CBMS.