AusTender is the Australian Government’s procurement information system. Suppliers and other interested parties seeking information on Australian Government procurements can visit the AusTender website.

The Commonwealth Procurement Rules (CPRs) require non-corporate Commonwealth entities (NCEs) and prescribed corporate Commonwealth entities (CCEs) to publish a range of information on AusTender, including planned procurements, open requests for tender, standing offer arrangements and details of contracts that have been awarded. NCEs report details of contracts with a value of $10,000 or more, and prescribed CCEs report contracts with a value of $400,000 or more. Under the devolved procurement framework, individual entities are responsible for accurately reporting their procurements and contracts on AusTender.

The following data reflects contractual information reported on AusTender by entities during the relevant financial year in accordance with entities' procurement publishing obligations. Data is extracted from AusTender at the end of each financial year to prepare the aggregated information on this page. The figures for financial year 2023-24 were extracted from AusTender on 1 July 2024. Contract data can be amended, varied and updated by entities over time.

Note: To view current AusTender data, visit Information Made Easy (tenders.gov.au).

Total Procurement Contracts

The contract values on AusTender represent the total maximum value of each contract over its life, including where contracts span multiple years. AusTender data does not reflect annual expenditure.

In 2023-24 there were 83,453 contracts published with a combined value of $99.6 billion.

Total Value of Procurement Contracts by Financial Year - $million

Procurement Thresholds

In 2023-24:

Below is a summary of the number and value of contracts awarded at various thresholds.

| Threshold | Value $million | % of Total Value | Number of Contracts | % of Total Number |

|---|---|---|---|---|

| Below $80k | 1,371.9 | 1.38% | 43,320 | 51.91% |

| $80k and above | 98,269.2 | 98.62% | 40,133 | 48.09% |

| Total | 99,641.1 | 100% | 83,453 | 100% |

| Threshold breakdown | ||||

|---|---|---|---|---|

| $80k to <$200k | 1,806.8 | 1.81% | 13,783 | 16.52% |

| $200k to <$1m | 8,302.1 | 8.33% | 20,110 | 24.10% |

| $1m to <$4m | 8,211.6 | 8.24% | 4,195 | 5.03% |

| $4m to <$7.5m | 4,537.5 | 4.55% | 835 | 1.00% |

| $7.5m to <$20m | 8,556.1 | 8.59% | 712 | 0.85% |

| $20m and above | 66,855.1 | 67.10% | 498 | 0.60% |

Location of suppliers

94.1 per cent by volume and 77.0 per cent by value of the contracts in 2023-24 were awarded to businesses with an Australian address.

| Total | Overseas | |

|---|---|---|

| Value $million | 99,641.1 | 22,884.2 |

| % | 100.0% | 22.97% |

| Number | 83,453 | 4,946 |

| % | 100.0% | 5.93% |

Goods & Services

| Total | Goods | Services | ||

|---|---|---|---|---|

| 2023-24 | Value $million | 99,641.1 | 47,482.9 | 52,158.3 |

| % | 100% | 47.65% | 52.35% | |

| Number | 83,453 | 23,999 | 59,454 | |

| % | 100% | 28.76% | 71.24% | |

| 2022-23 | Value $million | 74,824.4 | 27,329.6 | 47,494.8 |

| % | 100% | 36.53% | 63.47% | |

| Number | 83,625 | 22,849 | 60,776 | |

| % | 100% | 27.32% | 72.68% | |

| 2021-22 | Value $million | 80,793.4 | 31,495.0 | 49,298.4 |

| % | 100% | 38.98% | 61.02% | |

| Number | 92,303 | 23,859 | 68,444 | |

| % | 100% | 25.85% | 74.15% | |

| 2020-21 | Value $million | 69,794.5 | 25,692.5 | 44,102.0 |

| % | 100% | 37% | 63% | |

| Number | 84,054 | 24,119 | 59,935 | |

| % | 100% | 29% | 71% | |

| 2019-20 | Value $million | 53,975.4 | 20,582.0 | 33,393.3 |

| % | 100% | 38% | 62% | |

| Number | 81,174 | 24,559 | 56,615 | |

| % | 100% | 30% | 70% | |

| 2018-19 | Value $million | 64,454.6 | 25,496.0 | 38,958.6 |

| % | 100% | 40% | 60% | |

| Number | 78,150 | 22,706 | 55,444 | |

| % | 100% | 29% | 71% | |

| 2017-18 | Value $million | 71,127.3 | 39,346.1 | 31,781.2 |

| % | 100% | 55% | 45% | |

| Number | 73,458 | 23,092 | 50,366 | |

| % | 100% | 31% | 69% | |

| 2016-17 | Value $million | 47,354.7 | 20,417.8 | 26,936.9 |

| % | 100% | 43% | 57% | |

| Number | 64,092 | 22,593 | 41,499 | |

| % | 100% | 35% | 65% | |

| 2015-16 | Value $million | 56,912.3 | 24,460.2 | 32,452.2 |

| % | 100% | 43% | 57% | |

| Number | 70,338 | 26,520 | 43,818 | |

| % | 100% | 38% | 62% |

| Category Titles | Value $million | % of Total Value |

|---|---|---|

| Military fixed wing aircraft | 9,207.4 | 9.24% |

| Building construction and support and maintenance and repair services | 6,533.3 | 6.56% |

| War vehicles | 5,302.8 | 5.32% |

| Computer services | 4,412.5 | 4.43% |

| Lease and rental of property or building | 4,314.0 | 4.33% |

| Military rotary wing aircraft | 4,056.6 | 4.07% |

| Real estate services | 3,738.8 | 3.75% |

| Aircraft | 3,569.3 | 3.58% |

| Missiles | 3,265.0 | 3.28% |

| Management support services | 3,000.8 | 3.01% |

| Components for information technology or broadcasting or telecommunications | 2,453.6 | 2.46% |

| Temporary personnel services | 2,321.9 | 2.33% |

| Professional engineering services | 2,320.6 | 2.33% |

| Property management services | 1,949.4 | 1.96% |

| Education and training services | 1,940.7 | 1.95% |

| Management advisory services | 1,820.1 | 1.83% |

| Marine craft systems and subassemblies | 1,670.1 | 1.68% |

| Aerospace systems and components and equipment | 1,619.2 | 1.63% |

| Software | 1,448.4 | 1.45% |

| Aircraft maintenance and repair services | 1,273.5 | 1.28% |

Note: Contracts reported on AusTender are categorised under the United Nations Standard Products and Services Code (UNSPSC).

Contracts by Commonwealth Entity

| RANK | ||||||

|---|---|---|---|---|---|---|

| Top Entity | Value $million | % of total Value | 2023-24 | 2022-23 | 2021-22 | 2020-21 |

| Department of Defence | 67,197.3 | 67.44% | 1 | 1 | 1 | 1 |

| Department of Health and Aged Care | 3,742.7 | 3.76% | 2 | 3 | 4 | 2 |

| Australian Taxation Office | 2,935.5 | 2.95% | 3 | 5 | 6 | 5 |

| Services Australia | 2,851.5 | 2.86% | 4 | 6 | 5 | 3 |

| Department of Home Affairs | 2,807.4 | 2.82% | 5 | 4 | 2 | 4 |

| Australian Federal Police | 2,011.2 | 2.02% | 6 | 14 | 12 | 8 |

| Department of Foreign Affairs and Trade - Australian Aid Program | 1,630.9 | 1.64% | 7 | 7 | 7 | 7 |

| Department of Foreign Affairs and Trade | 1,399.0 | 1.40% | 8 | 9 | 15 | 13 |

| Department of Climate Change, Energy, the Environment and Water* | 1,352.0 | 1.36% | 9 | 18 | 18* | 21* |

| Department of Agriculture, Fisheries and Forestry* | 1,263.9 | 1.27% | 10 | 10 | 10* | 11* |

*The formation of new entities following Machinery of Government changes means they can’t be compared to entities of previous financial years.

| Total Value $million | % of Total Value | |

|---|---|---|

| Total of top 10 entities | 87,191.5 | 87.51% |

| Total of other entities | 12,449.6 | 12.49% |

| Grand total of all entities | 99,641.1 | 100.00% |

Estimates of Small and Medium Enterprise (SME) Participation

Policy changes to support SMEs

The Commonwealth Procurement Framework is non-discriminatory and requires that all potential suppliers are treated equitably based on their commercial, legal, technical and financial abilities and that they are not discriminated against, for example, due to their size.

Thresholds:

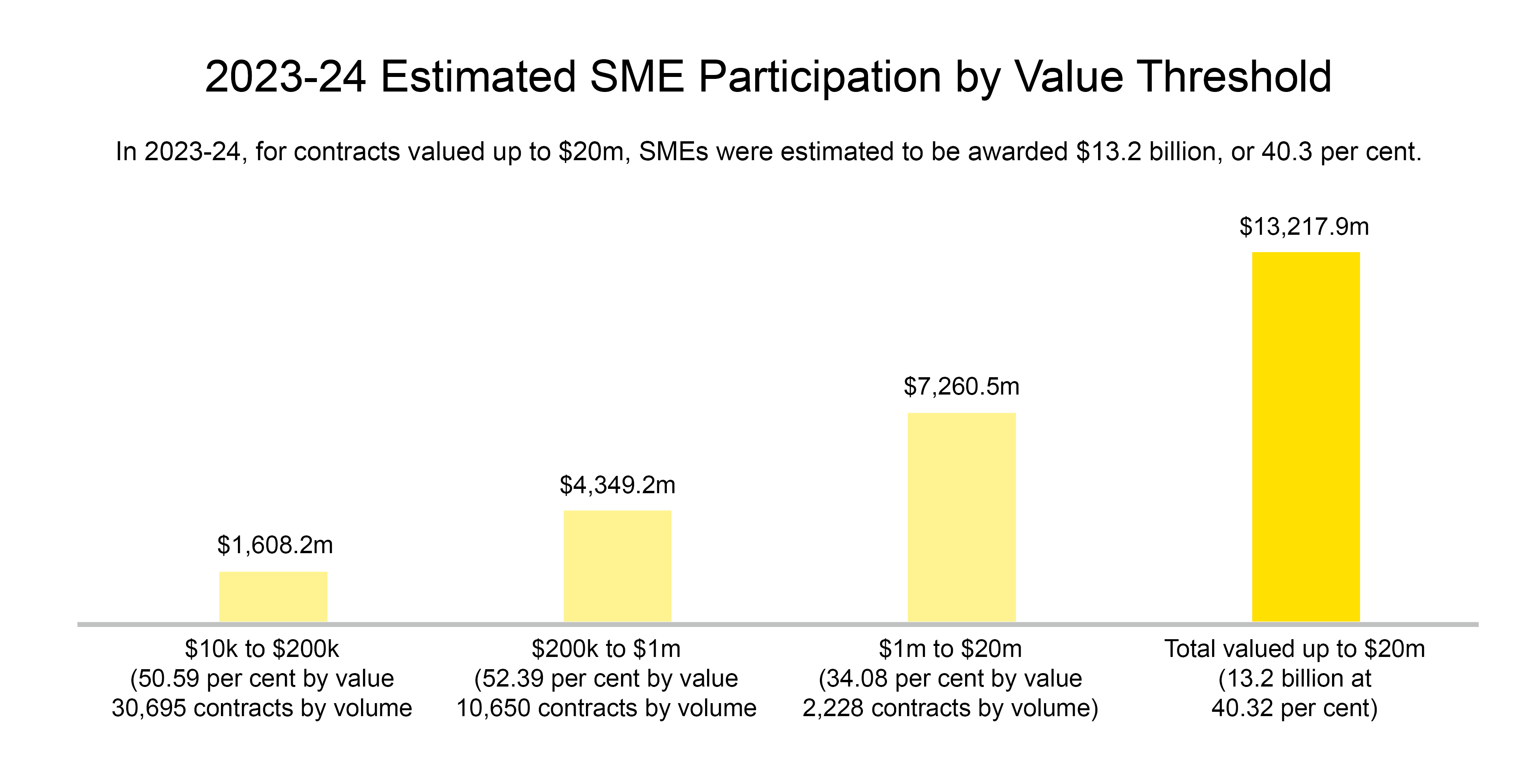

The Commonwealth has a commitment to supporting SME through two targets. In 2023-24 those targets were:

- Non-corporate Commonwealth entities procuring 20 per cent of contracts, by value from SMEs; and

- Non-corporate Commonwealth entities procuring 35 per cent of contracts, by value from SMEs, for contract with a value of up to $20 million.

On 1 July 2022 Target one was increased from 10 to 20 per cent. From 1 July 2024 this target increased to 25 per cent, for contracts up to $1 billion.

From 1 July 2024 Target two was increased from 35 to 40 per cent.

Definition:

For the period 2023-24 the definition of an SME was an Australian or New Zealand firm with fewer than 200 full-time equivalent employees. A small business is defined as a business with fewer than 20 full-time equivalent employees.

- From 1 July 2024, the Commonwealth has applied a new definition for Small and Medium sized enterprises. When assessing the number of employees a firm has, employees of any associated entity to the firm are included. Associated entities to a firm include a firm’s parent company, a firm’s subsidiaries, and any related bodies corporate to the firm.

This update will ensure that Commonwealth work that is intended for SMEs goes to organisations that are genuinely small or medium.

Economic Benefits:

The CPRs require the economic benefit to the Australian economy to be considered as part of the value for money assessment for procurements. In 2023-24, these captured procurements valued above $4 million for non-construction services and $7.5 million for construction services;

- On 1 July 2024 the non-construction services threshold was reduced to $1 million.

Appendix A Exemptions:

The Commonwealth Procurement Rules include an Appendix A exemption (17) which allows a limited tender approach for the procurement of goods and services from an SME. In 2023-24 this policy applied to procurements with a value of $200,000 or less, and $500,000 or less for procurement by the Department of Defence.

- On 1 July 2024 the exemption was amended to $500,000 or less for all Commonwealth entities.

The Commonwealth Procurement Rules include an Appendix A exemption (16) which allows a limited tender approach to procure goods and services from an SME with at least 50 per cent indigenous ownership.

Procurement Connected Policies:

The Indigenous Procurement Policy is a mandatory procurement-connected policy that includes specific targets for agencies to contract with indigenous businesses, most of which are SMEs.

Australian Industry Participation (AIP) is a mandatory procurement connected policy that encourages full, fair and reasonable opportunity for Australian businesses to compete for work in major public and private projects in Australia.

Finance Whole of Government Panel Policies:

The Department of Finance owns and manages the Management Advisory Services and People Panel arrangements. Concurrent with the changes to the CPRs both arrangements were updated to:

- Mandate that entities must include at least one SME in every approach to the panel; and

- Provides a new 5% flexibility allowance for entities to directly engage First Nations businesses that are not on the panel.

Statistical Approach:

The SME Statistics estimate the level of SME participation in Government procurement. The estimate is provided by the Australia Bureau of Statistics (ABS) based on AusTender data and the ABS Business Register.

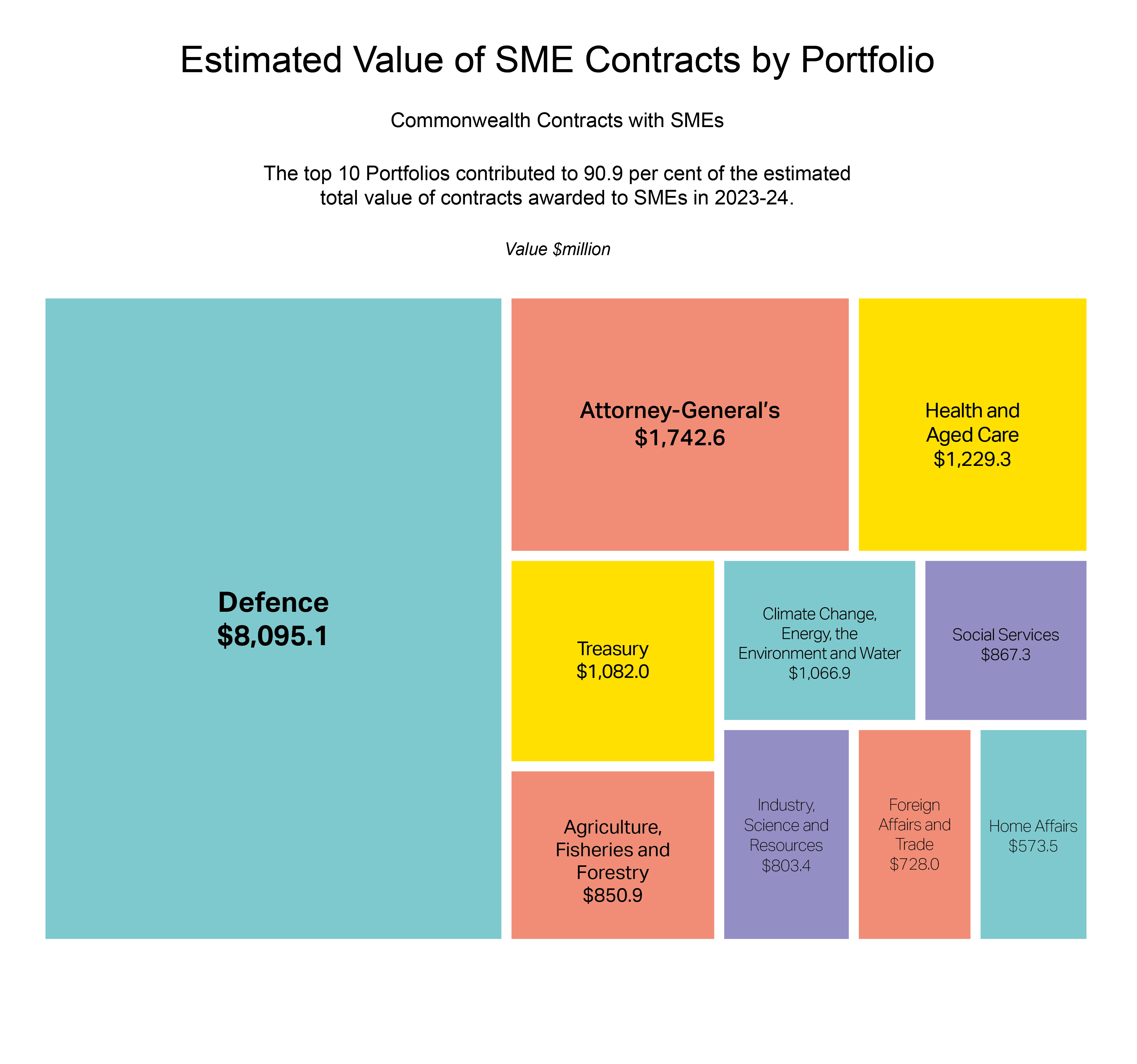

Statistical Estimate of SME Participation in 2023-24

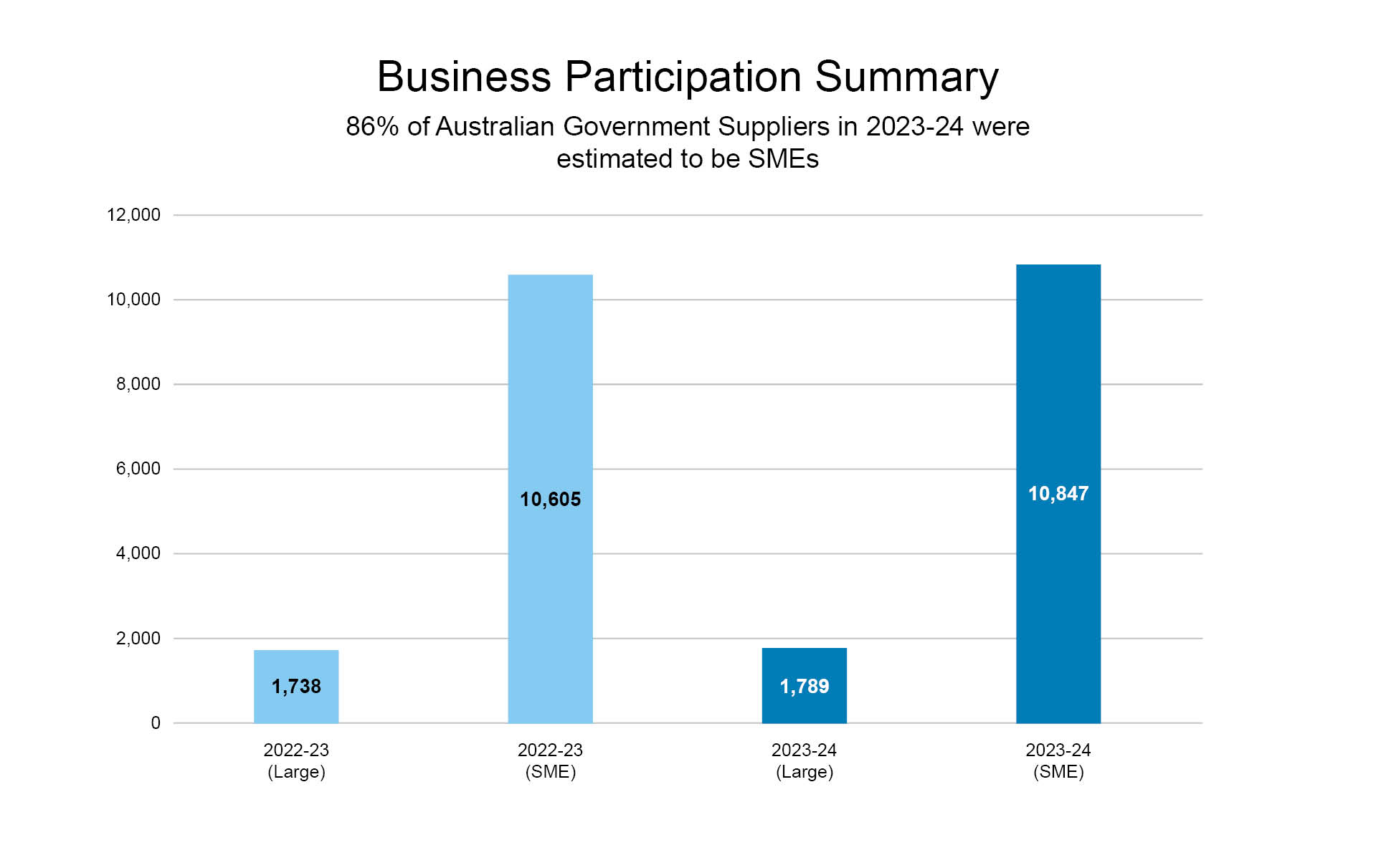

Business Participation Summary

Approximately 100 businesses classified as SMEs in 2022-23 were awarded contracts worth $2.3 billion in 2023-24 and re-classified as a large business. Since 1 July 2022, approximately 200 businesses previously classified as SMEs have grown to large businesses.

In 2023-24, the Commonwealth contracted with 242 more SMEs than the prior year and 1,384 more SMEs than in 2018-19.

Impact of High Procuring Activities

In 2023-24, the Commonwealth awarded $99.6 billion to all suppliers - the highest ever value reported on AusTender. This is primarily due to a significant increase in high value contracts (7) published by the Department of Defence between 1 July 2023 to 30 June 2024 for:

- Aircrafts

- Missiles

- War Vehicles and military fixed wing aircrafts.

This significant increase in Defence procurement activity has impacted the Commonwealth’s performance against the SME target Non-corporate entities procuring 20 per cent of contracts, by value from SMEs. In light of this, the SME target was amended from 1 July 2024 to remove the distorting effect of high value procurements.

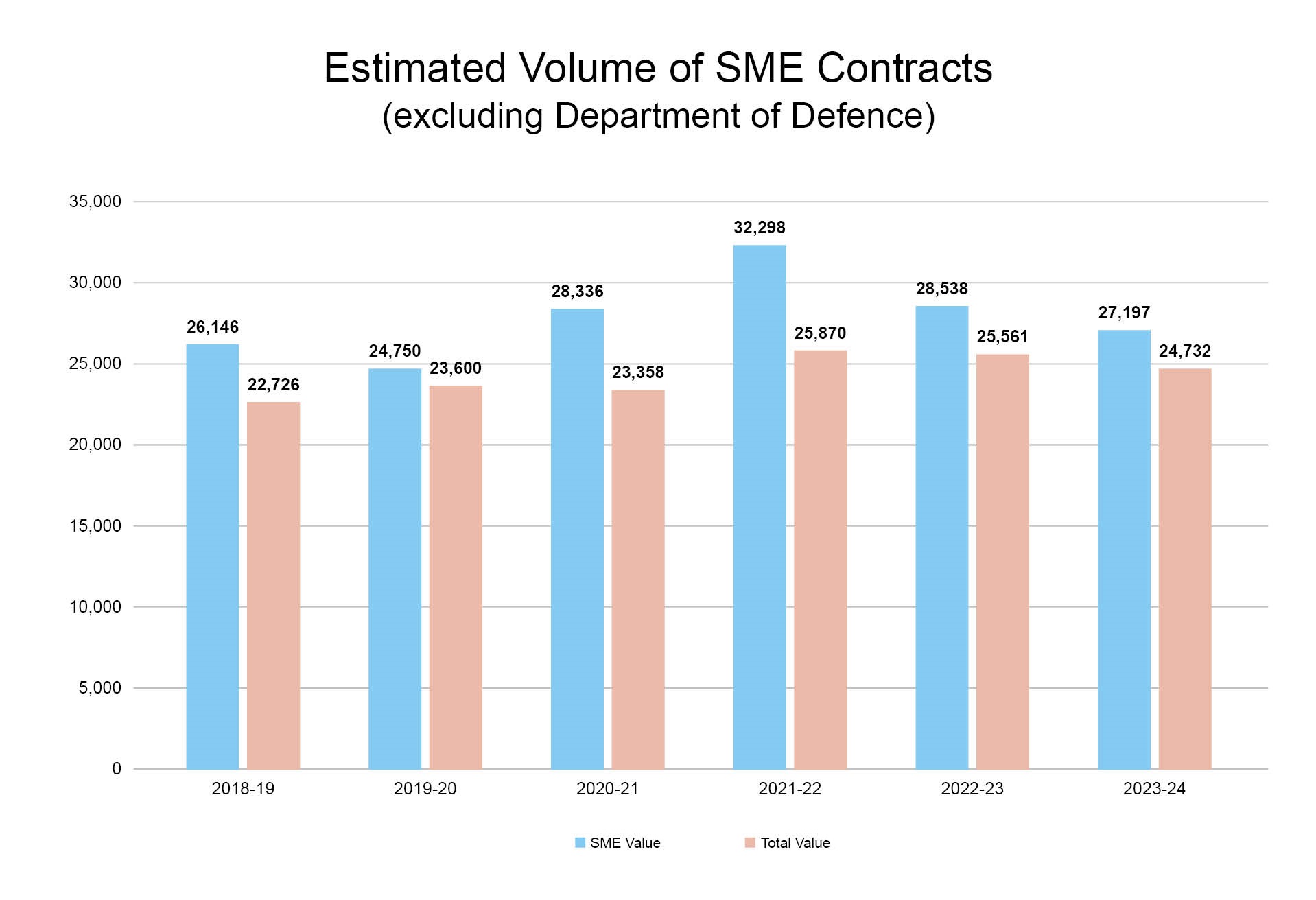

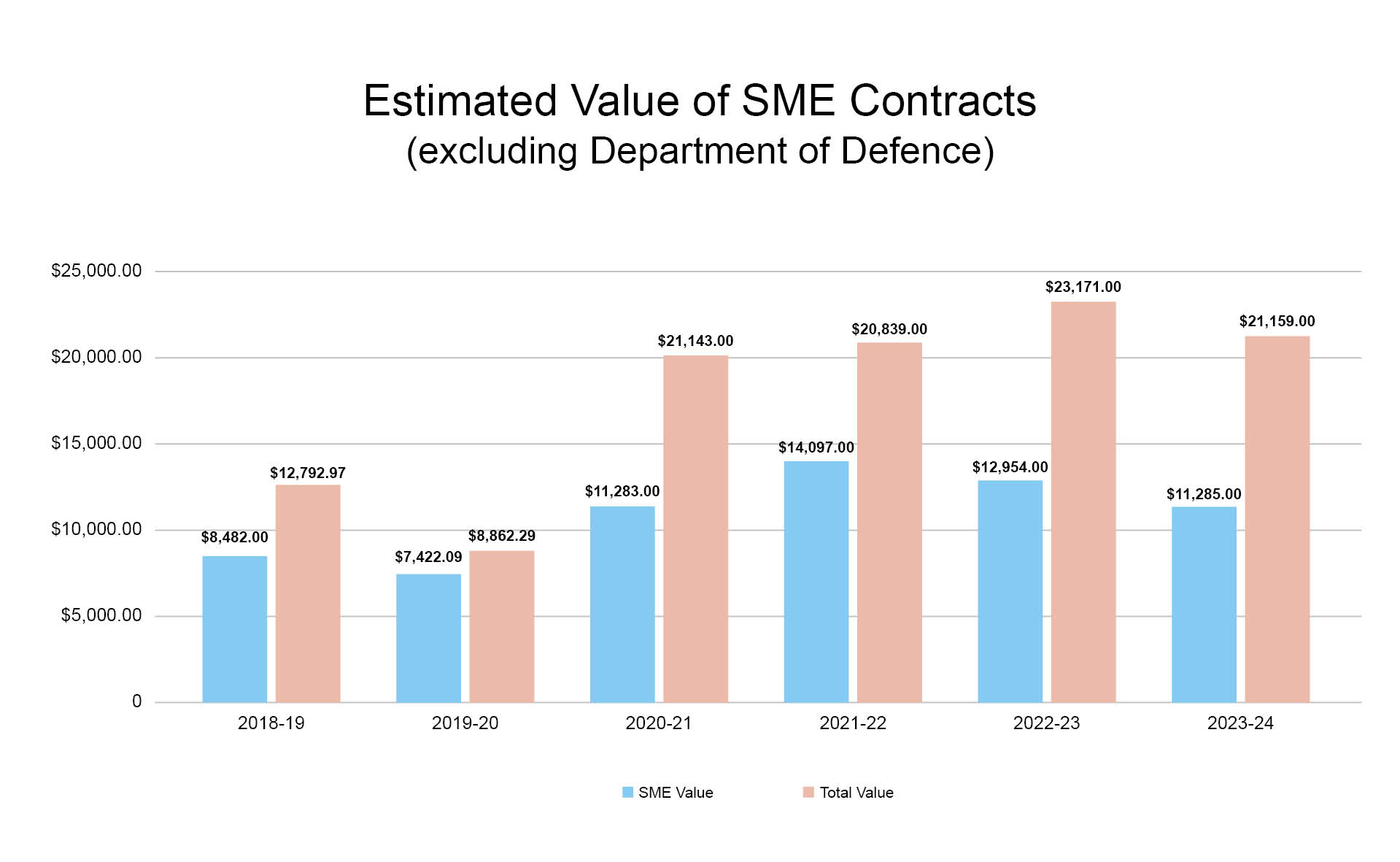

The procuring activity for the Department of Defence is high, complex, and frequently involves specialised goods and services that are unlikely to be able to be sourced from SMEs. These procurements include equipment and technology which require extensive resources and capabilities that may only be available through large companies. Additionally, some goods and services may be procured for use overseas. The following two charts exclude Department of Defence contracts to allow for comparability, removing the volatility of their procurement activity.

Impact of COVID-19 on procurement activity

In response to the CoVID-19 pandemic, the Australian Government undertook a range of targeted procurement activities in 2020-21 and 2021-22 with a large proportion of this activity being delivered through SMEs. Comparisons between 2023-24 and both 2020-21 and 2021-22 should be made carefully, mindful of this impact.

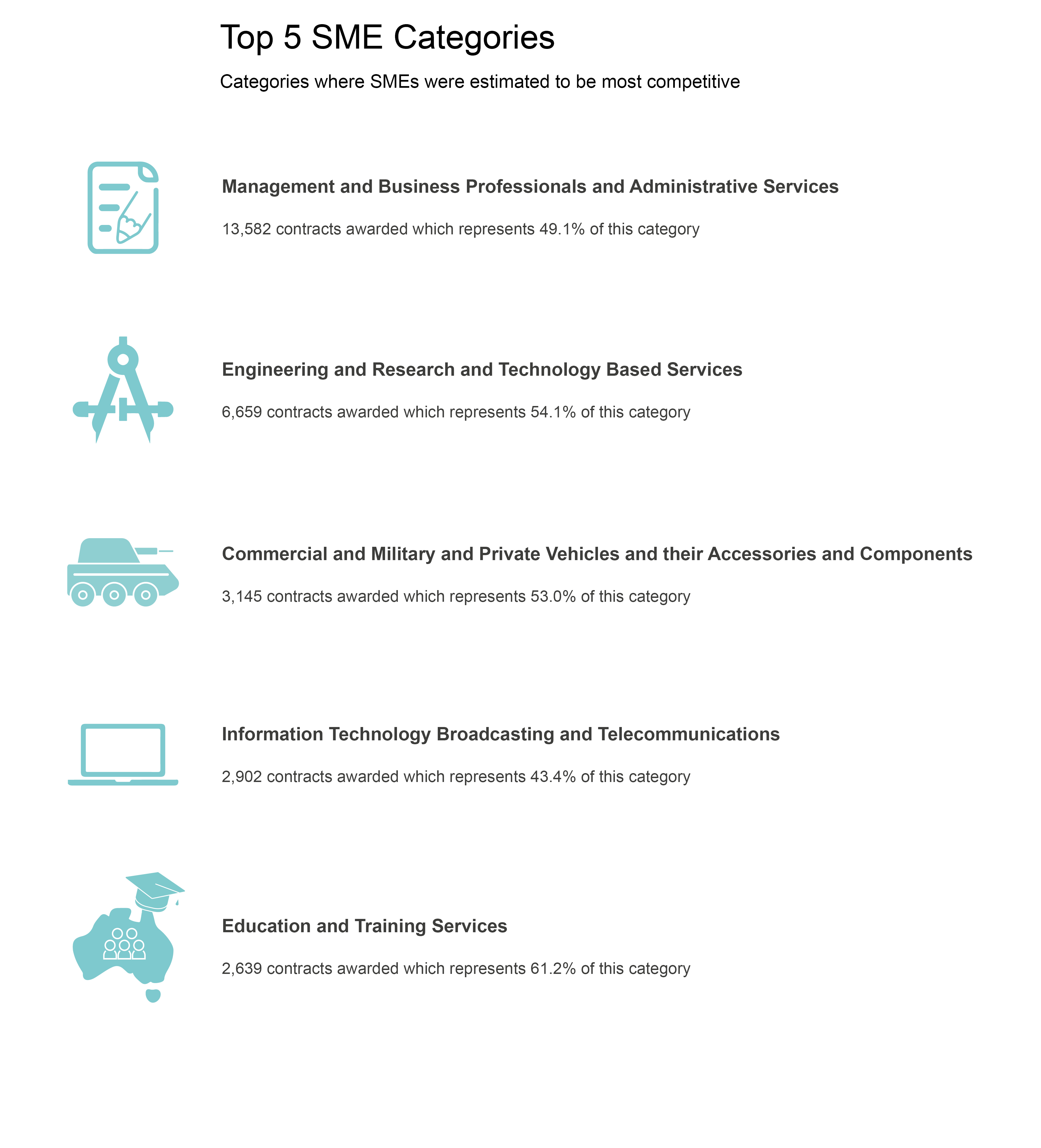

Estimated Volume of SME Contracts

(Excluding Department of Defence)

In 2023-24, 27,197 contracts were awarded to SMEs, representing 52 percent of all contracts, an increase of 1,051 contracts since 2018-19.

Estimated Value of SME Contracts

(Excluding Department of Defence)

In 2023-24, $11.3 billion in value was awarded to SMEs representing 35 percent of contract value. While the value in overall Commonwealth procurement increases, the proportion of value has remained consistent when compared to the total value awarded.

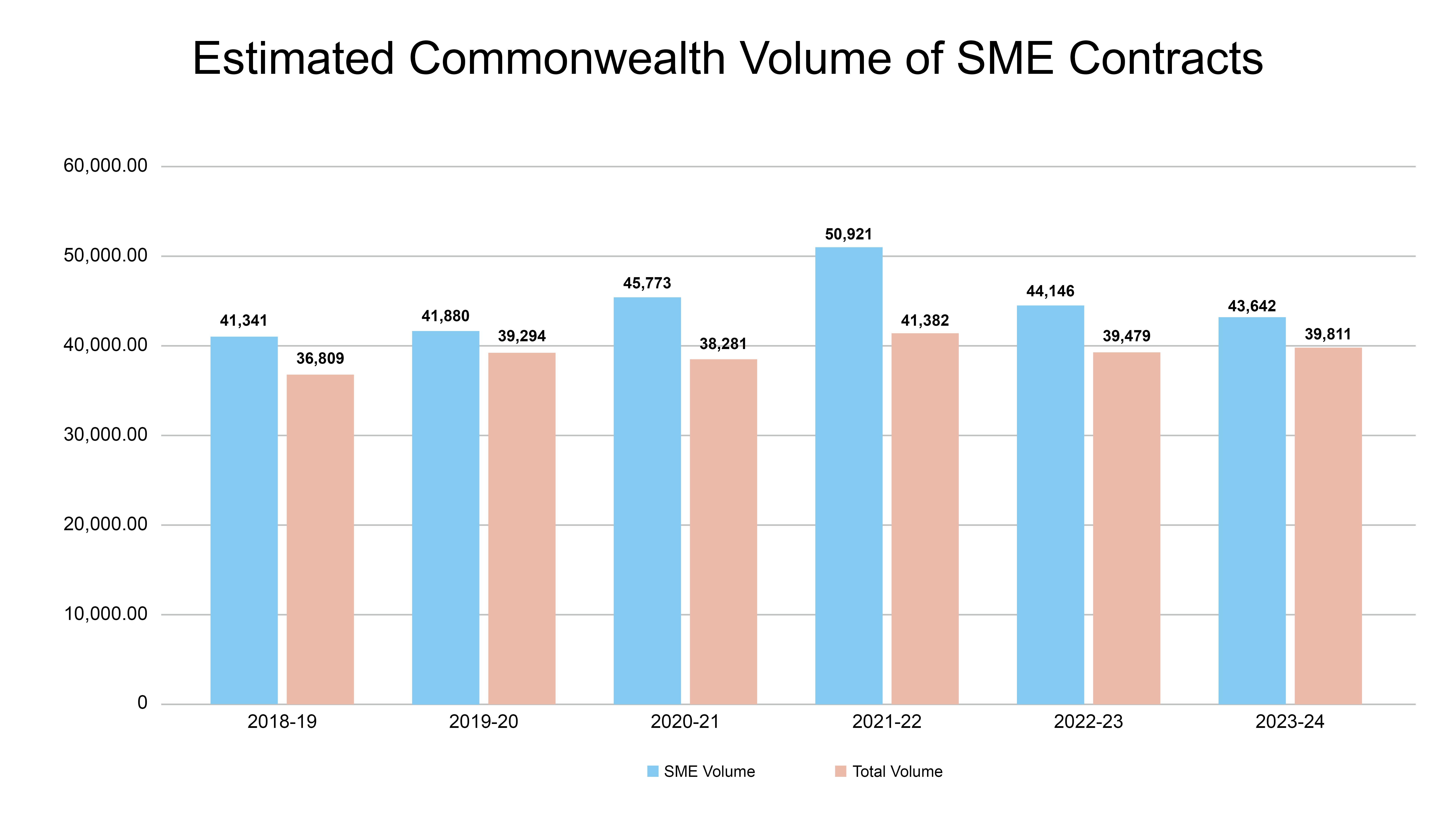

Estimated Commonwealth Volume of SME Contracts

The Commonwealth awarded 43,642 contracts to SMEs representing 52 percent of contract volume.

SMEs won 2,301 more contracts than compared to 2018-19.

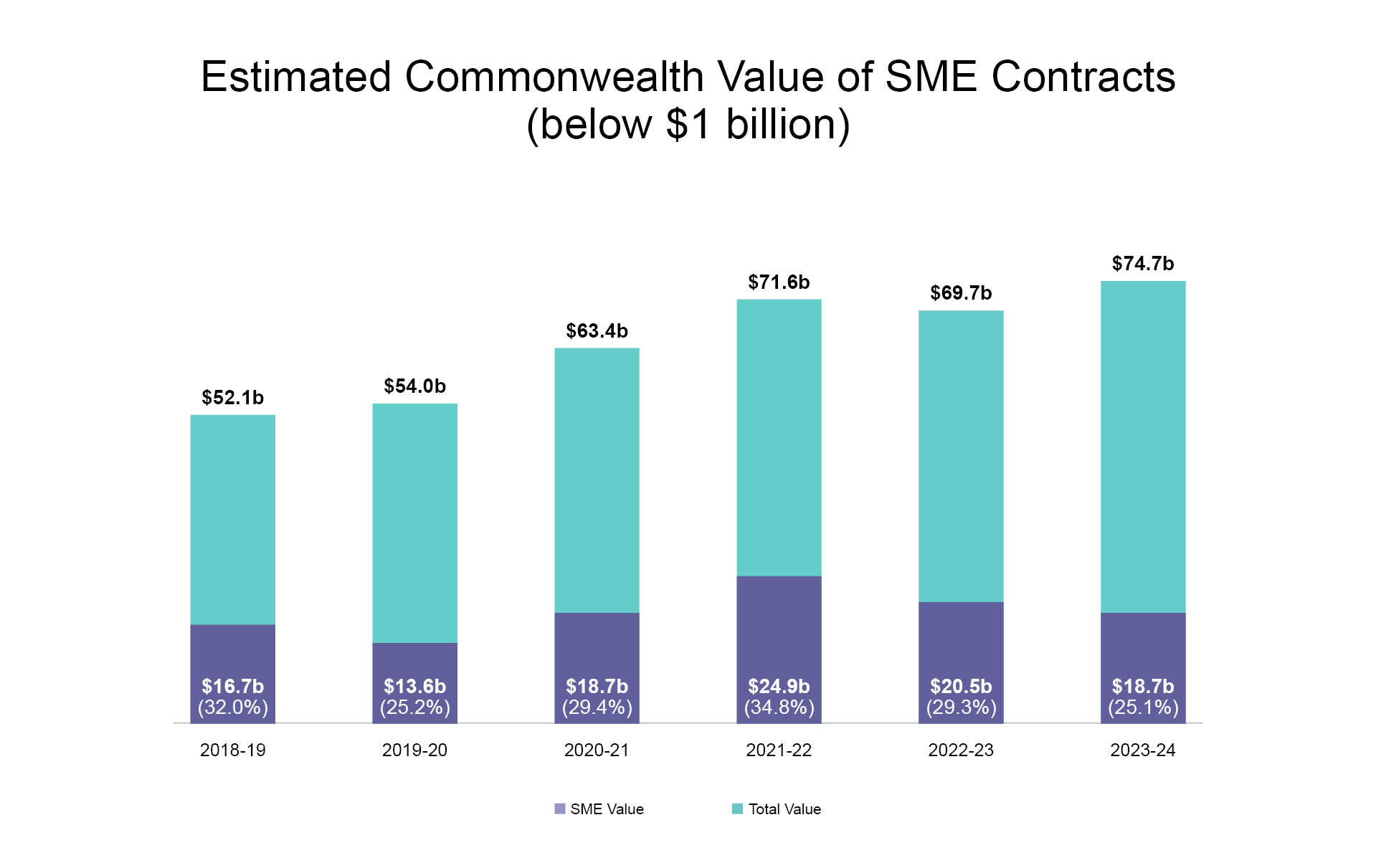

Estimated Commonwealth Value of SME Contracts

(Below $1 billion)

In 2023-24, 25.1 per cent of contracts by value were at or above $1 billion compared to 6.8 per cent in 2022-23. From 1 July 2024, the SME targets will exclude contracts valued at or above $1 billion, the removal of high value contracts will enable comparable SME figures and removes the volatility.

In 2023-24, 25.1% of contracts by value (below $1 billion) were awarded to SMEs with a combined value of $18.7 billion, increasing by $2 billion from 2018-19 and $5.1 billion from 2019-20.

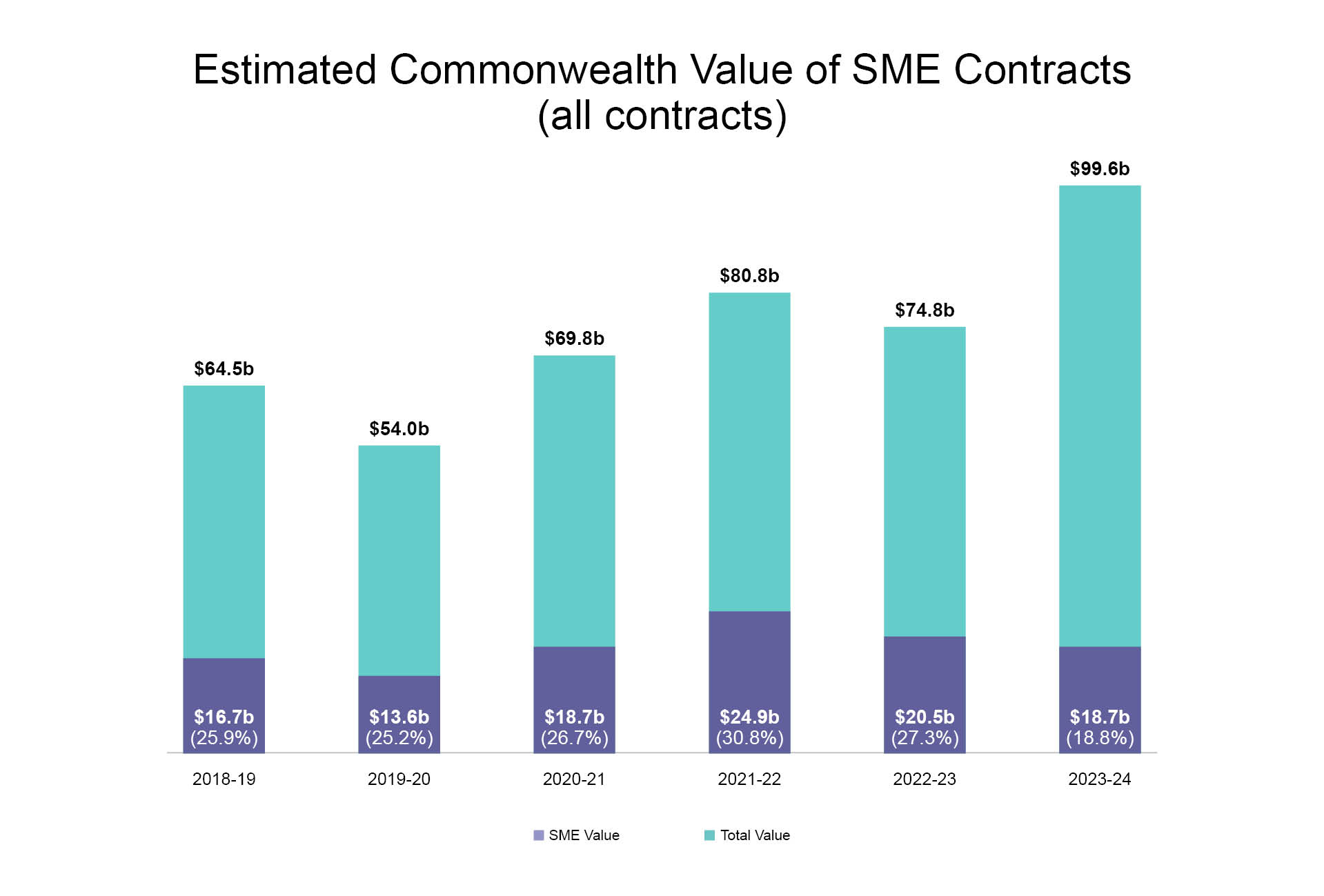

Estimated Commonwealth Value of SME Contracts

(All contracts)

The following chart sets out the estimated value of SME contracts including Department of Defence contracts.

| Total | SME | Other | |

|---|---|---|---|

| Value $million | 99,641.1 | 18,745.3 | 80,895.9 |

| % | 100.0% | 18.8% | 81.2% |

| Number | 83,453 | 43,642 | 39,811 |

| % | 100.0% | 52.3% | 47.7% |

| SME | Small Business | Total | ||||

|---|---|---|---|---|---|---|

| Financial Year | Value $million | Number of Contracts | Value $million | Number of Contracts | Value $million | Number of Contracts |

| 2023-24 | 18,745.3 | 43,642 | 8,166.0 | 23,312 | 99,641.1 | 83,453 |

| 2022-23 | 20,461.9 | 44,146 | 7,976.8 | 23,309 | 74,824.4 | 83,625 |

| 2021-22 | 24,914.8 | 50,921 | 8,536.7 | 26,352 | 80,793.4 | 92,303 |

| 2020-21 | 18,657.1 | 45,773 | 5,473.0 | 23,020 | 69,794.5 | 84,054 |

| 2019-20 | 13,601.0 | 41,880 | 5,362.8 | 21,256 | 53,975.4 | 81,174 |

| 2018-19 | 16,668.1 | 41,341 | 6,316.5 | 20,842 | 64,454.6 | 78,150 |

| 2017-18 | 12,911.6 | 38,739 | 4,017.0 | 21,135 | 71,127.3 | 73,458 |

| 2016-17 | 9,955.0 | 34,621 | 3,349.0 | 18,073 | 47,354.7 | 64,092 |