Arrangements not to be reported on AusTender (not considered a procurement)

Rule: Commonwealth Procurement Rules (CPRs) - Paragraph 2.9

Details what is not considered a procurement in the context of the CPRs.

Only contracts resulting from the ‘procurement’ of goods or services are to be reported on AusTender. RMG-411 Grants, Procurements and other financial arrangements provides detailed information on how to distinguish between grants, procurements and other financial arrangements.

Examples of arrangements NOT to be reported on AusTender can be found at paragraph 2.9 of the CPRs.

If a non-corporate Commonwealth entity (NCE) has acquired goods and services directly from another NCE without approaching other suppliers, this should be treated as ‘other’ financial arrangement and should not be reported as a procurement on AusTender:

If a relevant entity has undertaken a competitive process, in accordance with the CPRs, that results in the awarding of a contract to a Commonwealth entity, then it must be reported on AusTender.

| Type of entity to entity Engagement | Commonwealth entity engaged directly | Competitive process undertaken in accordance with the CPRs |

|---|---|---|

| You are a NCE who has contracted with another NCE | Do not report | Report |

| You are a NCE who has contracted with any other type of Commonwealth entity | Report | Report |

| You are a CCE who has contracted with any type of Commonwealth entity | Report | Report |

Reporting Standing Offer Arrangements

Rule: CPRs - Paragraph 7.20

All standing offers must be reported on AusTender within 42 days of the relevant entity entering into or amending such arrangements. Relevant details in the standing offer notice, such as supplier details and the names of other relevant entities participating in the arrangement, must be reported and kept current.

Where an entity has entered into a standing offer arrangement that is available for access by other entities, the entity that established the standing offer is the only entity that should report the standing offer arrangement on AusTender:

- Relevant entities responsible for the management of a standing offer are required to report amendments to standing offer arrangements, for example, when supplier details are amended or where an extension option is exercised.

Where multiple suppliers are on a standing offer arrangement, only one Standing Offer Notice (SON) is to be reported. A SON will not have a value reported against it.

Individual contracts under standing offer arrangements must be reported on AusTender, as outlined in the next section.

Reporting Contracts

Rules:

Relevant entities must report contracts on AusTender within 42 days of entering into a contract, when it is valued at or above the reporting threshold.

When conducting a limited tender above the relevant threshold, the relevant exemption or limited tender condition must be reported on AusTender.

Contract Notices (CNs) are managed by individual relevant entities. CNs reflect the information available at a point in time, and can be subject to amendments, variations, cancellation and machinery of government changes.

For the purposes of the CPRs, contracts include any arrangement described in section 23(2) of the PGPA Act that results from a procurement of goods and/or services. On this basis, a contract can include, but is not limited to, any of the following:

- a Commonwealth contract, including a verbal agreement, for the provision of goods and/or services

- an entity agreement (including for example, a memorandum of understanding with another jurisdiction or resulting from a procurement process)

- a deed of standing offer (with one or multiple suppliers), and

- a work order issued under a deed of standing offer.

The calculation of the 42 days applies from the date the contract is entered into, that is the execution date. Where an execution date is not provided, the 42 days applies from the start date, noting the start date cannot be prior to the execution date. The delivery of goods or services should not start until a contract is executed.

The reporting thresholds1, including GST, are:

- $10,000 for non-corporate Commonwealth entities

for corporate Commonwealth entities:

- $400,000 for procurements other than procurements of construction services

- $7.5 million for procurements of construction services.

- entity details

- supplier details

- identify if they are an Australian business or an SME2

- the reason that an Australian business or SME was not engaged for relevant procurements as per CPRs paragraphs 5.4 and 5.5.

- contract details:

- contract value

- description

- UNSPSC

- start and end dates

- execution date2

- number of suppliers invited3

- number of extension options and maximum end date if all options are executed2

- procurement method

- consultancy information, and

- confidentiality information.

2 This reporting functionality is scheduled to come online in late December 2025 and will be mandatory from 1 July 2026.

3 Only for limited tender contracts and/or contracts procured from a standing offer arrangement.

For each contract reported, the relevant entity must report the total value of the initial term of the contract (including GST where applicable). This does not take into account the value of any options, extensions, renewals, or other mechanisms that may be exercised at a future date to increase or decrease the value of the contract:

- options, extensions or renewals that increase or decrease the value of the contract by $10,000 or more should be reported as an amendment to the original CN at the time that they are entered into.

- the value of the CN should reflect the contract value. It should not reflect expenditure under the contract. Where a contract is completed and the value of the contract has not been fully expensed, relevant entities must not amend the value in AusTender unless the contract is also being amended to reflect the actual expenditure.

Individual credit card transactions, invoices and purchase orders valued at or above the relevant reporting threshold must be reported, but only if they have not been previously reported as part of an overarching contract.

Relevant entities should report the start date identified in the contract. If there is no start date identified, relevant entities should report the date that the contract was signed. If there is no written contract, the date of the first provision of goods or services under the contract should be reported.

For the purpose of reporting on AusTender, the end date is the date that performance of the contract is expected to be completed. It does not take into account any options, extensions, renewals, or other mechanisms that may be exercised at a future date to extend the period of the contract. The date does not take into account possible late performance or breach of contract.

In cases where the end date is not specified, relevant entities will need to estimate the expected date of receipt of the final instalment of goods or services.

Where an open tender ATM has been undertaken, the ATM ID must be referenced against all reportable contracts that are subsequently awarded.

Where a multi-stage open tender ATM has been undertaken, the ATM ID for the initial open ATM must be referenced against all reportable contracts that are subsequently awarded.

CNs on AusTender should not disclose information that would contravene legislative requirements, such as those set out in the Privacy Act 1988 or information that may pose a risk to national security.

Standing offer arrangements are reported as SONs on AusTender.

Contract Notice Descriptions on AusTender

Contract descriptions should be clear, relevant to the contract, and where appropriate, provide additional information to the category. Meaningful contract descriptions provide useful information to understand the purpose of the procurement, and what it is expected to deliver. This assists with transparency which is a key principle of the CPRs.

Where a procurement has been undertaken through a whole-of-Australian Government arrangement, the panel name should not be used as a description of the procurement as it does not provide any detail about the contract.

Contract notices on AusTender should not disclose information that would contravene legislative requirements, such as those set out in the Privacy Act 1988 or information that may pose a risk to national security.

An entity procures actuarial consultancy services from the Management Advisory Services. The contract description entered may be entered as ‘Longitudinal Study of the usage and effectiveness of assistive technology’. This description provides a useful description of the purpose of the contract.

Contracts entered into under Standing Offer Arrangements

Contracts that result from a standing offer arrangement and that are valued at or above the reporting threshold must be reported through a CN on AusTender.

The CN must reflect the procurement method used to establish the standing offer and reference the relevant SON ID.

An entity undertakes an open tender to establish a panel for the purchase of office furniture, with 4 tenderers evaluated as providing value for money.

The entity will report one SON (SON1234) that lists the 4 successful tenderers that were evaluated as providing value for money. The SON will not have a reported value, as subsequent purchases from the panel will be reported individually as CNs.

As entities procure from the panel, if a resultant contract is valued at or above the reporting threshold, the entity must report the individual contract (or work order) on AusTender through a new CN, which must include the relevant SON identifier.

Additionally, irrespective of the number of suppliers on the panel that were approached to quote, the CN must reflect the procurement method listed on the SON (in this case, open tender).

Coordinated procurement contracts

Each whole-of-Australian Government coordinated arrangement has its own reporting requirements. Relevant entities should follow the process that is stipulated by the arrangement. Any questions on reporting requirements should be directed to the panel manager of the relevant arrangement.

Cooperative procurement contracts

Cooperative procurement is where more than one entity approaches the market together (clustering) or where an entity accesses another entity’s established contract or standing offer (panel) arrangement (piggybacking). Cooperative procurement can enable relevant entities to reduce expenditure by sharing administration costs and utilising their combined economies of scale.

Reporting a cooperative procurement should be based on the contractual arrangement. Where more than one relevant entity is a signatory to a contract, each relevant entity should separately report only its commitment under the contract.

Where an entity has approached the market and entered into a contract which includes the needs of other entities (that is purchasing on behalf of those entities) the lead entity is responsible for reporting the entire value of the contract on AusTender, with participating entities not reporting their contributions separately.

Four entities decide to approach the market together for a common good or service. The total estimated value of the procurement is $1,600,000. It is anticipated that the cost will be split equally across the 4 relevant entities.

One entity is identified as the ‘lead entity’ and will be responsible for publishing the ATM on AusTender. The approach to the market results in 4 separate contracts (1 per entity).

Each entity is required to report the resultant contract (where valued at or above the reporting threshold) on AusTender as a separate CN. Each CN reported would reference the ATM ID used to approach the market, and the value reported would be specific to the contract of the entity (in this instance, $400,000 each).

Note: If the value of one entity’s commitment did not meet the relevant reporting threshold (for example it is valued under $10,000), there would be no requirement for that entity to report their portion of the contract.

Limited tenders at or above the procurement thresholds

Rules:

The CPRs do not apply to the extent that an official applies measures determined by their accountable authority (or an official to whom the accountable authority delegates the power to determine such measures) to be necessary for the maintenance or restoration of international peace and security, to protect human health, for the protection of essential security interests, or to protect national treasures of artistic, historic or archaeological value.

A relevant entity must only conduct a procurement at or above the relevant procurement threshold through limited tender in certain circumstances.

Appendix A: Exemptions from Division 2 of the CPRs

Certain kinds of goods and services are exempt from the rules of Division 2 in the CPRs, and from paragraphs 4.7, 4.8, 7.27 and 7.28 of Division 1.

In addition to the internal record keeping required under the CPRs, when a relevant entity undertakes a limited tender (that is not an open tender) valued at or above the relevant threshold, the justification for the limited tender must also be reported on the AusTender CN. The selections available are:

- limited tender condition – refer paragraph 10.3 of the CPRs

- exemptions from Division 2 – refer Appendix A: Exemptions from Division 2 of the CPRs

- when the estimated value of the procurement (determined prior to selecting the procurement method) was below the threshold, however the resulting contract was valued at or above the threshold

- if paragraph 2.6 of the CPRs was applied in some part, or

- the procurement is for construction services valued at or above $125,000 but below the construction threshold of $7.5 million.

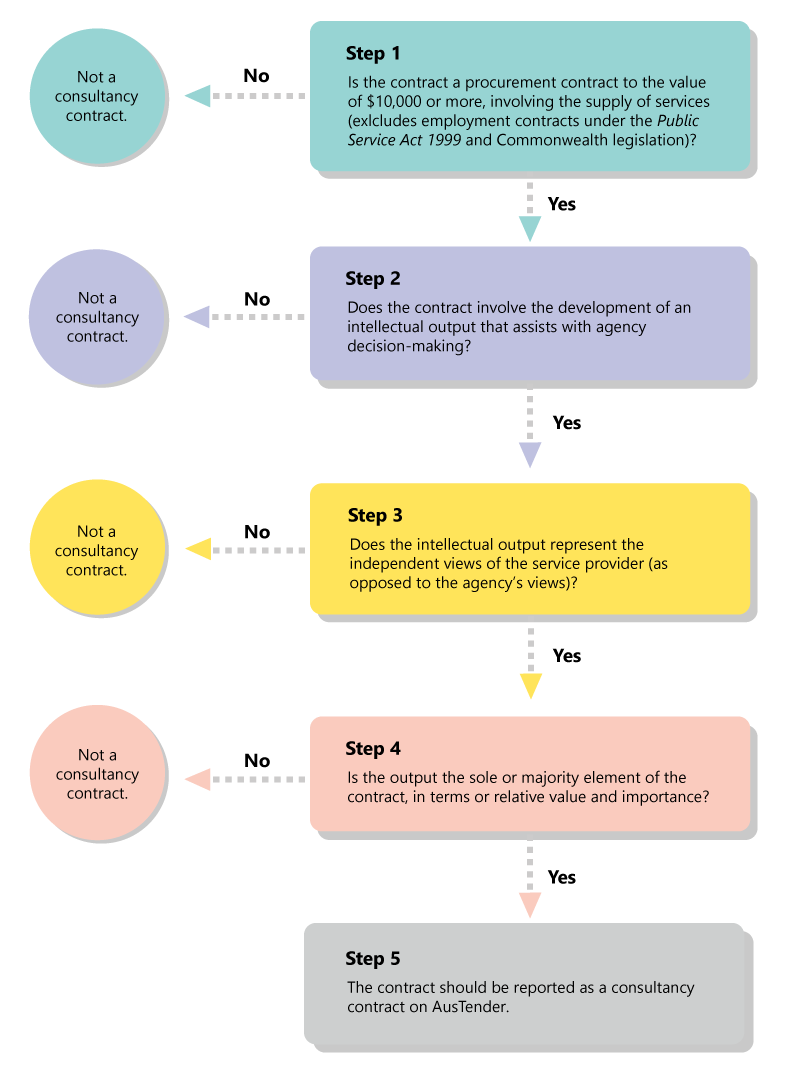

Consultancies

Procurement of consultancy services must be identified when publishing the contract on AusTender.

A consultancy is defined as the engagement of services that:

- involves the development of an intellectual output that assists with decision making, and

- the intellectual output represents the independent view of the service provider.

Note: If a contract does not meet the above requirements, the contract should not be identified as a consultancy on AusTender.

Procurement of consultancy services typically involve the supplier working independently and substantially retaining direction and control over the work that is performed to develop the independent intellectual output. Key features can include:

- the consultant retaining discretion regarding the performance and delivery of the services

- development of independent output occurs without the entity’s direct supervision or direction, and

- the output is expected to reflect the independent views or findings of the individual or organisation delivering the services.

While they are not definitive, refer to Characteristics of consultancy contracts and common examples as it may assist entities to determine if a contract is a consultancy.

Where an entity has determined that the primary purpose of the procurement is a procurement of consultancy services, the reason for the consultancy must be reported in the CN on AusTender. The potential reasons for using a consultancy are:

- need for independent research or assessment

- need for specialised or professional skills, or

- skills currently unavailable within entity.

Only one reason as to why a contract is a consultancy can be selected. If there are multiple reasons, the most appropriate (or significant) reason should be selected.

An entity has engaged a supplier to deliver 2 outcomes within one procurement.

The first is to undertake a review of internal business functions and develop a report with recommendations on how to transform the entity’s service delivery using process automation. The second outcome is to provide additional short term support to deliver the agreed transformation initiatives, under direction from the entity’s senior management.

As the first outcome of the contract will lead to the development of an intellectual output that will represent the views of the contracted provider and assist with the entity’s decision-making, this outcome meets the definition of a consultancy. The second outcome will lead to the delivery of services under direction, and does not meet the definition of a consultancy.

As the entity determines that the first outcome is the most significant outcome of the contract and will represent the majority of the costs, the contract should be flagged as a consultancy contract on AusTender.

Note: It is important to remember that just because the supplier describes itself as a consultancy firm, it does not necessarily mean that the procurement meets the definition of a consultancy.

Confidentiality

Rule: CPRs - Paragraph 7.22

In order for a supplier’s commercial information to be considered confidential, it must meet all of the 4 criteria of the ‘Confidentiality Test’.

- Criterion 1: The information to be protected is specifically identified.

- Criterion 2: The information is commercially ‘sensitive’.

- Criterion 3: Disclosure would cause unreasonable detriment to the owner of the information or another party.

- Criterion 4: The information was provided under an understanding that it would remain confidential.

Further guidance on the criteria is available on Additional Reporting on Confidentiality.

Confidentiality Test

This table details the appropriate options for how confidentiality should be reported on AusTender

| AusTender “Contract”: Protecting information contained in the contract | AusTender “Outputs”: Protecting information obtained or generated in performing the contract | |

|---|---|---|

| Where there are general confidentiality provision/s only | Report “No” | Report “No” |

| Where there are specific provision/s protecting information in the contract and information obtained or generated in performing the contract | Report “Yes” | Report “Yes” |

| Where there are specific provision/s protecting information in the contract only | Report “Yes” | Report “No” |

| Where there are specific provision/s protecting information obtained or generated in performing the contract only | Report “No” | Report “Yes” |

| Reasons available where a contract is reported as “yes” |

|

|

Note: if a supplier’s commercial information does not meet the confidentiality test, there is no requirement to report ‘confidentiality’ as part of the CN on AusTender.

Relevant entities must identify on AusTender whether a contract includes confidentiality provisions. Relevant entities must separately identify whether the requirements are to maintain the confidentiality of:

- contract clauses or other information contained in the contract, such as a description of the methodology to be used by a contractor which reveals confidential intellectual property

- information obtained or generated as a result of performance of the contract, such as a consultancy report which contains information that is protected as its disclosure would be contrary to the public interest.

Relevant entities must report requirements to maintain the confidentiality of information obtained or generated as a result of performance of the contract only where a contractual clause has sought to protect specific information.

In assessing the need for confidentiality in procurement and in contracts, relevant entities should balance the need to keep information transparent to meet reporting and disclosure requirements, with the need to protect the confidentiality of information that might genuinely damage the Australian Government’s interests or the commercial interests of suppliers.

Genuine reasons for confidentiality include the protection of the public interest, intellectual property and other commercial confidentiality.

The Australian Government cannot provide an absolute guarantee of confidentiality within a contract.

- Department of Q entered into a contract for the provision of internal audit services that contained a clause saying that the contractor could not, except in certain circumstances, disclose any confidential information without prior approval. There was no specific information listed as confidential and no requirement to maintain the confidentiality of any of the contract’s provisions.

- The confidentiality clause in this contract would be regarded as a general confidentiality clause described within the overarching statement in AusTender that most contracts contain general confidentiality provisions. Accordingly, this contract would be reported as not containing provisions protecting information contained in the contract (on AusTender Contract = No) and not containing confidentiality provisions in relation to “information obtained or generated in performing the contract” (on AusTender Outputs = No). This clause was not considered sufficient to enable the contract to be listed as "protecting" information obtained or generated in performing the contract” because the information to be protected was not specifically identified, but was only defined in general terms.

- Department of Z is preparing to report a contract that contains a clause that requires the parties to keep confidential the information listed in the schedule and other information that the parties ought to know is confidential.

- Several clauses of the contract are listed in the schedule. These clauses contain details of the supplier’s original business methodology and the price of certain individual items. There is no other information listed in the schedule.

- This contract would be reported in AusTender as a contract containing clauses protecting specific information contained in the contract (on AusTender Contract = Yes) specifying “intellectual property” and “internal costing/profit information” as the reasons. The contract would be reported as not protecting specific information obtained or generated in performing the contract (on AusTender Outputs = No). The other general confidentiality obligations imposed by the clause would be covered by the overarching statement provided in AusTender.

- Department of J is preparing to report a consultancy contract that contains a clause that requires the parties to keep confidential the information listed in the schedule and other information that the parties ought to know is confidential.

- The schedule lists the consultant’s final report as information to be kept confidential. The report is expected to make recommendations on a number of sensitive issues and the entity has determined that releasing the report would disclose matters contrary to the public interest. There is no other information listed in the schedule.

- This contract would be reported in AusTender as a contract not containing clauses protecting specific information contained in the contract (on AusTender Contract = No). It would, however be reported as protecting “information obtained or generated in performing the contract” since it identifies specific information generated in performing the contract (on AusTender Outputs = Yes). The reason would be reported as “public interest”. The clause also imposes general confidentiality obligations as outlined in the overarching statement provided in AusTender.

Amendments to contracts

Rule: CPRs - Paragraph 7.19

Relevant entities must report amendments on AusTender within 42 days where:

a. a previously unreported contract is amended to be valued at or above the relevant reporting threshold; or

b. an amendment increases or decreases the reported contract value by $10,000 or more; or

c. accumulated unreported amendments will vary the reported contract value by $10,000 or more.

Relevant entities must report amendments on AusTender within 42 days of amending a contract, if the amendment(s) meet the requirements of paragraph 7.19 a, b, or c. The reporting thresholds are stated at paragraph 7.18.

Amendments may include options that have been exercised, contract extensions or renewals.

Relevant entities are not required to report amendments to the contract term, although they may choose to. This includes instances where the term of a contract is amended with no impact to the contract value.

A CCE enters into a contract valued at $500,000, which is reported on AusTender. Over the next year, it makes 3 amendments valued at $4,000 each. Whilst the CPRs do not require each individual amendment to be reported on AusTender, the CCE is required to report the amendments once the cumulative value adds up to $10,000 or more.

An NCE enters into a contract valued at $1,000,000, which is reported on AusTender. Over the next year, the scope of work is reduced (for example) and the contractual arrangement is varied by $50,000 to decrease the total contract value to $950,000. The NCE is required to report the negative amendment on AusTender within 42 days of amending the contract.

Third-party procurement

Rule: CPRs - Paragraph 4.17

Procurement by third parties on behalf of a relevant entity can be a valid way to procure goods and services, provided it achieves value for money.

Relevant entities must not use third-party arrangements to avoid the rules in the CPRs when procuring goods and services.

In meeting AusTender reporting requirements for third party procurements, the overriding principle is ensuring transparency and accountability of entity procurement practices. The 42-day reporting requirement applies to all third party procurements.

Where a supplier has subcontracted all or part of the responsibilities under a contract, that arrangement is not considered a third party procurement. Subcontracting arrangements are not reportable on AusTender.

Where a Commonwealth entity has procured on behalf of a third party

When a relevant entity procures on behalf of a third party which results in a commitment from the Commonwealth, the entity must report the total value of the Commonwealth’s commitment only. The total value of the third party’s commitment should be included in the CN description:

- Where there is no commitment from the Commonwealth, the entity is not required to report the contract on AusTender.

An entity conducts a non-construction services procurement on behalf of a third party (for example, a state government entity) with a total contract value of $1 million, $400,000 of which is the responsibility of the relevant entity. The relevant entity would report, as a CN on AusTender, a contract value of $400,000. The entity would include, in the description of the CN, the total value of the third party’s commitment (in this case, $600,000).

Where a third party has procured on behalf of a Commonwealth entity

When a third party procures on behalf of a relevant entity, the third party may procure in one of two ways, either:

- the relevant entity will contract directly with the preferred supplier; or

- the third party will enter into a contract with the preferred supplier on behalf of the relevant entity.

Where the contracts are valued at or above the relevant reporting threshold, the relevant entity must report, on AusTender, a separate CN for:

- any fees payable to the third party; and

- any contracts entered into with the preferred supplier (regardless of whether the third party entered into them directly or on behalf of a Commonwealth entity).

A third party approaches the market and enters into a contract with the preferred supplier on behalf of the entity

An entity engages a software developer to manage the delivery of a new ICT project build, including any necessary testing to deliver the final product. The developer is responsible for approaching the market and entering into an agreement with a testing service provider on behalf of the entity. The testing service provider invoices the software developer, who pays the testing service provider. The software developer in turn invoices the entity to be reimbursed for the cost of paying the testing service provider.

The entity reports the fees payable to the software developer for their management services as a separate CN on AusTender. Where the value of the contract with the software developer is valued at or above the reporting threshold, a separate CN is published on AusTender. The supplier details published on AusTender for all CNs are the software developer’s name, address and ABN.

A third party approaches the market and the entity contracts directly with the preferred supplier

An entity engages a software developer to manage the delivery of a new ICT project build, including any necessary testing to deliver the final product. The software developer is responsible for approaching the market, however the entity enters into a contract directly with the testing service provider.

In this circumstance there would be 2 CNs published on AusTender. One for the engagement of the software developer for their management services and one for the testing service provider. The supplier details for the testing service provider’s CN is the testing services provider’s name, address and ABN.