This page provides details and guidance on the content requirements for an entity's annual report.

The accountable authority of a non-corporate Commonwealth entity must include the following content in the annual report as specified by the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule).

The drop-down menus below provide detail and guidance on the following annual report requirements:

- Letter of transmittal

- Aids to access

- Review by the accountable authority

- Overview of the entity

- Annual performance statements

- Financial reporting

- Including Report on financial performance and Annual financial statements.

- Management and accountability

- Including Corporate governance; Significant non-compliance issues with finance law; Audit committee; External scrutiny; Management of human resources; Managing and developing employees; Employee statistics; APS employee statistics; Workplace agreements; Performance pay, Executive remuneration; Assets management; Purchasing; Consultancy and non-consultancy contract expenditure reporting; Strategic Commissioning Framework; Australian National Audit Office access clauses; Exempt contracts; and Small business.

- Other mandatory information

- Including Advertising and market research; Grants; Disability reporting mechanism; Freedom of information; Remediation of information published in previous annual reports; and information required by other legislation.

In addition to the content in an annual report as specified by the PGPA Rule, the accountable authority of a non-corporate Commonwealth entity must consider reporting obligations as required by other legislation. This includes reporting obligations as detailed in the:

- Environment Protection and Biodiversity Conservation Act 1999

- This includes Emissions Reporting in line with the Government’s Net Zero in Government Operations Strategy.

- Work Health and Safety Act 2011

- Commonwealth Electoral Act 1918

- Carer Recognition Act 2010.

The table set out in Schedule 2 of the PGPA Rule shows the annual report content requirements, and is available in List of requirements - non-corporate Commonwealth entities under Tools and templates. This table must be included in entities’ annual reports as an aid of access.

The purpose of the letter of transmittal is to assure the responsible Minister that the accountable authority has prepared the annual report in accordance with all obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and other legislation (such as enabling legislation).

The letter must:

- state that the annual report has been prepared for the purposes of section 46 of the PGPA Act, which requires that an annual report be given to the entity’s responsible Minister for presentation to the Parliament

- outline any additional requirements in relation to the annual report that is specified in enabling legislation, including referencing that legislation.

The letter of transmittal must be signed and dated on the day the accountable authority approves the final text of the report for printing.

There is an expectation that Departments should, as a matter of best practice, include information on all Ministers that administered the Department for the reporting period in their annual report. This was consistent with recommendation 6 of the Report of the Inquiry into the Appointment of the Former Prime Minister to Administer Multiple Departments (the Bell Report), which the Government accepted.

Consistent with the 2022-23 and 2023-24 annual report, Departments should continue to include information on all Ministers that administered the Department for the reporting period in their annual report for 2024-25.

The annual report must include the following:

- a table of contents (in the print version only – a table of contents is not necessary in the digital version that is published on the Transparency Portal)

- an alphabetical index of the contents of the report, including any appendices (in the print version only)

- a glossary of any abbreviations and acronyms used in the report

- the list of requirements as set out in Schedule 2 of the PGPA Rule details (for example, the title, telephone number and email address) of the contact officer to whom enquires for further information may be addressed

- the address of the entity's website

- the direct address for the annual report on the entity's website and/or Transparency Portal.

The information presented in entities’ annual reports should be able to be easily accessed by the reader. The reader should be able to locate specific information of interest in a straightforward manner.

By ensuring a level of consistency between the minimum aids to access included in annual reports, the requirements detailed above will assist readers of multiple entities’ annual reports to find information of interest in each report.

The accountable authority has the discretion to include any additional structure to the annual report that might enhance the accessibility of the specific information included in the entity’s report.

Entities must include a list of requirements in a consistent format which is detailed in Schedule 2 of the PGPA Rule and in List of requirements - non-corporate Commonwealth entities under Tools and templates.

The list of requirements should be included as an appendix to the annual report. If an item specified in the checklist is not applicable to an entity, it should be reported as “Not Applicable” rather than omitted from the list. Entities must also provide details of the location of the information in the annual report that addresses each of the mandatory requirements specified by the PGPA Rule. In the hard copy and PDF versions, these should be page number references. In the digital version on the Transparency Portal, the relevant chapter or section should be hyperlinked.

The content of the annual report review is at the discretion of the accountable authority.

The review by the accountable authority may include a summary of significant issues for the entity, an overview of the entity’s performance and financial results and an outlook for the next reporting period.

If the entity is a Department of State that oversees a portfolio, the review may also include a summary of the significant issues and developments for the portfolio during the reporting period.

The associated data template can be found in Digital Reporting Tool data templates under Tools and templates:

- Subparagraphs 17AE(1)(aa)(i)-(iii) – Accountable Authority.

The overview of the entity must include the information detailed below, and is designed to give readers a high-level understanding of the organisation.

- a description of the entity, including the following:

- the role and functions of the entity

- an outline of the organisational structure of the entity

- the outcomes and programs administered by the entity during the period

- the purposes of the entity as included in the entity’s corporate plan for the period.

- information on the accountable authority, or each member of the accountable authority, during the period including:

- the name of the accountable authority or member

- the position title of the accountable authority or member

- the period as the accountable authority or member within the reporting period between 1 July 2024 to 30 June 2025.

- if the entity is a Department of State - an outline of the structure of the portfolio that includes the Department.

If the outcomes and programs administered by the entity during the period are not the same as the outcomes and programs included in any Portfolio Budget Statement, Portfolio Additional Estimates Statement or other portfolio estimates statement that was prepared for the entity for the period, the report must set out and explain the reasons for the differences.

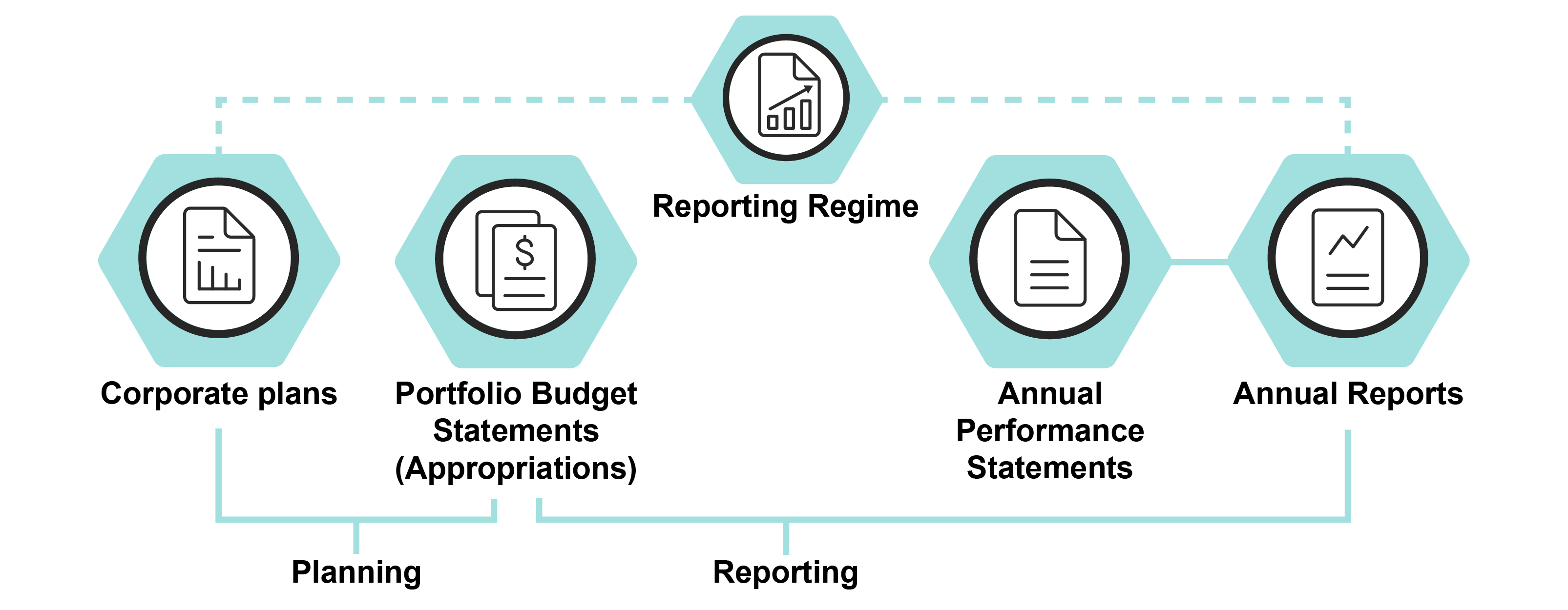

The annual report for a non-corporate Commonwealth entity must include the annual performance statements for the entity for the period.

The annual performance statements address the non-financial performance of an entity and must provide information about the entity's performance in achieving its purposes.

The annual performance statements are intended to complete the cycle of performance reporting that commenced at the start of the reporting period with the Portfolio Budget Statements (PBS) and corporate plan. An entity's annual performance statements should report the actual results achieved against the performance measures and targets set for the entity in its corporate plan and PBS.

RMG-134 Annual performance statements for Commonwealth entities provides additional guidance on the purpose and content requirements of the annual performance statements and is also available under Resource Management Guides.

Report on financial performance

The associated data template can be found under Tools and templates in Digital Reporting Tool data templates:

- Paragraph 17AF(1)(b) – Report on Financial Performance Summary.

- a discussion and analysis of the entity's financial performance during the period

- a table summarising the total resources of the entity, and the total payments made by the entity, during the period.

Entities should also provide an explanation for any significant changes in financial results. Including in relation to:

- the cause of any operating loss of the entity, how the entity has responded to the loss and the actions that have been taken in relation to the loss

- any matter or circumstance that the entity can anticipate having a significant impact on the entity's future operation or financial results.

Entity Resource Statement and expenses for outcomes, available under Tools and templates, sets out the preferred format of the table to be included in the annual report. The core content of the summary table is to show the total resources for the entity in comparison with the total payments made during the year. In addition, the table should also incorporate a series of summary tables showing the total resources for each outcome administered by the entity.

These tables should be consistent with the corresponding table in relevant PBS for the entity for the reporting period. It is suggested that the tables be included in an appendix to the annual report.

Annual financial statements

The associated data template can be found in Digital Reporting Tool data templates under Tools and templates:

- Financial Statements Subset Data Templates.

Annual reports must include a copy of the annual financial statements of the entity (and the Auditor-General’s report) for the period that the annual report is prepared.

Financial statements must be prepared in accordance with the Public Governance Performance and Accountability (Financial Reporting) Rule 2015.

RMG-125 Commonwealth Entities Financial Statements provides additional guidance on the preparation and presentation of annual financial statements.

The Digital Annual Reporting Tool (DART) requires a subset of financial statements information to be provided in the associated data templates. The data templates do not replace the entity’s existing reporting requirements under the PGPA Act or any other applicable requirement. The data templates can be found in Digital Reporting Tool data templates under Tools and templates, and are downloadable in Excel format from the DART.

The section provides guidance on the following management and accountability reporting requirements:

- Corporate governance

- Significant non-compliance issues with finance law

- Audit committee

- External scrutiny

- Management of human resources

- Managing and developing employees; Employee statistics; APS employee statistics; Workplace agreements; Performance pay, Executive remuneration

- Assets management

- Purchasing

- Consultancy and non-consultancy contract expenditure reporting

- Strategic Commissioning Framework

- Australian National Audit Office access clauses

- Exempt contracts

- Small business.

Annual reports must contain information on the management and accountability practices of the entity in the reporting period.

The requirements for these items are set out within:

![]()

Corporate Governance

Significant non-compliance issues with finance law

Audit Committee

External Scrutiny

Corporate governance

The annual report must include the following:

- information on compliance with section 10 of the PGPA Rule (which deals with preventing, detecting and responding to fraud and corruption) in relation to the entity during the period

- a certification by the accountable authority of the entity that

- fraud and corruption risk assessments have been conducted and fraud and corruption control plans have been prepared

- appropriate mechanisms for preventing, detecting incidents of, investigating or otherwise dealing with, and recording and reporting fraud and corruption, that meet the specific needs of the entity are in place for the entity

- all reasonable measures have been taken to deal appropriately with fraud and corruption relating to the entity.

The Commonwealth Fraud Control Framework 2024 provides further information on preventing, detecting and dealing with fraud.

Entities may wish to include the certification by the accountable authority as an element of the 'Letter of transmittal' from the accountable authority.

Annual reports must also include an outline of the structures and processes that the entity had in place during the reporting period to implement the principles and objectives of corporate governance, including probity. The content of this statement is at the discretion of the accountable authority; however, it is suggested that the review may include:

- the names of the senior executive and their responsibilities

- The responsibilities of the senior executive should be able to be reconciled with the entity’s organisational and outcome/program structures as set out under ‘Overview of the entity’.

- Entities may choose to locate this information in the ‘Overview of the entity’ section.

- senior management committees and their roles.

- corporate and operational plans and associated performance reporting and review, including contribution to specified outcomes

- Terminology in relation to entity plans may vary – it may, for example, involve strategic and business plans. The intent is to address longer term and annual plans.

- internal audit arrangements, including the approach adopted to identifying areas of significant operational or financial risk, and arrangements in place to manage those risks.

- the entity’s policy and practices on the establishment and maintenance of appropriate ethical standards; or

- The requirement in relation to the APS Values and Code of Conduct which applies to departments and executive agencies, and prescribed agencies staffed under the Public Service Act 1999. The Public Service Commissioner reports annually on these issues in the State of the Service report.

The requirements in the Australian Securities Exchange (ASX) Listing Rule 4.10.3 have been used as a guide for the above information. This rule requires disclosure in relation to the ASX Corporate Governance Council recommendations.

Significant non-compliance issues with finance law

The associated data template can be found in Digital Reporting Tool data templates under Tools and templates:

- Paragraphs 17AG(2)(d)-(e) – Significant non-compliance with the Finance Law.

The annual report must include the following:

- a statement of any significant issue reported to the responsible Minister that relates to non-compliance with the finance law

- if a statement is included, then an outline of the action that has been taken to remedy the non-compliance must also be included.

The PGPA Act (section 19) requires that accountable authorities of Commonwealth entities notify their responsible Minister when significant issues have been identified.

RMG-214 Notification of significant non-compliance with the finance law provides additional guidance and is also available under Resource Management Guides.

Consistent with the requirements in section 19 of the PGPA Act and paragraphs 17AG(2)(d)-(e) of the PGPA Rule, the annual report only reflects those significant issues reported to the responsible Minister during the reporting period. It is not the appropriate place to report significant issues in the first instance. Officials should ensure the responsible Minister was first notified of all significant issues proposed for inclusion in the statement for the annual report before the relevant section is finalised.

Audit committee

The associated data template can be found under in Digital Reporting Tool data templates under Tools and templates:

- Paragraphs 17AG(2A)(b)-(e) – Audit committee

- Paragraph 17AG(2A)(a) – Audit committee charter.

The annual report must include the following:

- a direct electronic address of the charter determining the functions of the audit committee for the entity

- We recommend entities utilise the table in the associated data template to cover these requirements:

- the name of each member of the audit committee during the period

- the qualifications, knowledge, skills or experience of those members

- information about each of those members; attendance at meetings of the audit committee during the period

- the remuneration of each of those members.

RMG-202 Audit committees provides additional guidance on the reporting requirements and is also available under Resource Management Guides.

External scrutiny

The annual report must include information on the most significant developments in external scrutiny of the entity, that has occurred within the reporting period and the entity's response to that scrutiny.

This must include:

- judicial decisions, or decisions of administrative tribunals or the Australian Information Commissioner, made during the period that have had, or may have, a significant effect on the operations of the entity; and

- any report on the operations of the entity given during the period by:

- the Auditor-General, other than a report under section 43 of the PGPA Act (which deals with the Auditor-General’s audit of the annual financial statements for Commonwealth entities); or

- a Committee of either or both Houses of the Parliament; or

- the Commonwealth Ombudsman.

- any capability reviews of the entity that were released during the period.

Management of human resources

Annual reports must include information about the entity’s effectiveness in managing and developing its employees, and certain statistics on the entity’s human resources, as set out below.

The requirements for these items are set out within:

Managing and developing employees

Employee statistics

APS employee statistics

Workplace agreements

Performance pay

Managing and developing employees

The annual report must include an assessment of the entity's effectiveness in managing and developing its employees to achieve its objectives.

The content of this assessment is at the discretion of the accountable authority; however, it is suggested that it may include:

- workforce planning and staff retention and turnover

- the main features of enterprise or collective agreements, individual flexibility arrangements, determinations made under the Public Service Act 1999 (subsection 24(1)), common law contracts, any remaining Australian Workplace Agreements, and developments regarding agreement making and the impact of making agreements

- the entity’s key training and development strategies, the outcomes of training and development, and an evaluation of effectiveness

- the entity’s work health and safety performance, noting specific information is also required pursuant to the Work Health and Safety Act 2011

- productivity gains.

Entities should take care to ensure that any information provided on individual terms and condition arrangements does not, or cannot be used to, identify individual employees. The Australian Bureau of Statistics have published a Data confidentiality guide that offers guidance on the Five Safes framework, confidentiality techniques and confidentialising your own data.

Employee statistics

The associated data template can be found under in Digital Reporting Tool data templates under Tools and templates:

- Paragraph 17AG(4)(aa) – Management of Human Resources.

Annual reports must include statistics on the number of employees of the entity (with reference to ongoing employees and non ongoing employees), at the end of the reporting period and the previous reporting period, in relation to each of the following:

- full-time employees, as identified by your entity’s employment arrangements. As a guide, the Fair Work Ombudsman provides general employment definitions.

- part-time employees as identified by your entity’s employment arrangements.

- gender, consistent with advice from the Attorney-General's Department, to describe gender in line with the Australian Bureau of Statistics' Standard for Sex, Gender, Variations of Sex Characteristics and Sexual Orientation Variables (2020). Categories are:

- Man/Male

- Woman/Female

- Non-binary

- Prefers not to answer

- Uses a different term.

location, based on the State or Territory of employment.

All human resources statistics are to be calculated and reported on an actual head count basis (number of employees) as at the end of each reporting period. Full-time equivalent statistics (for example, 1.5 FTE) are not to be reported.

If an entity believes the level of disaggregation of employee data could result in significant risk of unintentional identification and consequential harm to a specific employee, then the entity has the discretion to report that employee’s data at a higher level without further disaggregation. It is important when considering this, that the level of aggregation of information doesn’t make the reporting “meaningless” or be seen to complicate other details.

APS employee statistics

Associated data templates can be found in Digital Reporting Tool data templates under Tools and templates:

- Subparagraphs 17AG(4)(b)(i)-(iv) – Australian Public Sector (APS) Classification and Gender.

- Subparagraphs 17AG(4)(b)(i)-(iii) – Employment type by Full-time and Part-time Status.

- Subparagraph 17AG(4)(b)(v) – Employment type by Location.

- Subparagraph 17AG(4)(b)(vi) – Indigenous Employment.

In addition to the employee statistics for all ongoing and non-ongoing employees, the annual report must include statistics on the number of APS Act employees of the entity (including by reference to ongoing APS employees and non-ongoing APS employees) in relation to each of the following:

- each APS classification level of the entity

- full-time employees, as identified by your entity's employment arrangements. As a guide, the Fair Work Ombudsman's website provides a general employment definitions.

- part-time employees as identified by your entity's employment arrangements.

- gender, consistent with advice from the Attorney-General's Department, to describe gender in line with the Australian Bureau of Statistics' Standard for Sex, Gender, Variations of Sex Characteristics and Sexual Orientation Variables (2020). Categories are:

- Man/Male

- Woman/Female

- Non-binary

- Prefers not to answer

- Uses a different term

- location, based on the State or territory of employment.

- employee who identifies as Indigenous.

Workplace agreements

Associated data templates can be found in Digital Reporting Tool data templates under Tools and templates:

- Subparagraph 17AG(4)(c)(i) – Employment Arrangements of SES and Non SES employees

- Subparagraph 17AG(4)(c)(ii) – Salary Ranges by Classification level.

Annual reports must include information about the arrangements under which employees are employed in the entity. This may include information on any enterprise or collective agreements, individual flexibility agreements, determinations made under subsection 24(1) of the Public Service Act 1999, common law contracts or Australian Workplace Agreements. This information must include:

- the number of APS employees covered by enterprise or collective agreements, individual flexibility agreements, subsection 24(1) determinations, common law contracts and Australian Workplace Agreements by Senior Executive Service (SES) employees and non-SES employees

- the salary ranges available for APS employees by classification level (the range should reflect the full span of salaries available under an enterprise or collective agreement, individual flexibility agreement, subsection 24(1) determination, common law contract and/or Australian Workplace Agreement)

- a description of the range of non-salary benefits provided by the entity to employees.

For those entities subject to a determination made under subsection 24(3) of the Public Service Act 1999, it would be appropriate to include a discussion of the effect of that determination when responding to this requirement. This discussion should include the number of employees covered by the determination, any supplementary arrangements entered into via subsection 24(1) determinations or common law contracts, and progress towards replacement of the determination with an enterprise or collective agreement.

Performance pay

The associated data template can be found in Digital Reporting Tool data templates under Tools and templates:

- Subparagraphs 17AG(4)(d)(iii)-(iv) – Performance Pay by Classification level.

Annual reports must include information about performance pay, which can also be known as performance-linked bonuses, and usually taking the form of a one-off payment in recognition of performance. Note that this is a separate requirement to the reporting of bonuses as part of executive remuneration reporting.

In compiling the information about performance pay, entities should:

- include all eligible ongoing and non-ongoing APS staff

- include staff who left the entity during the reporting period, even if the performance payment was made after their departure

- include staff on leave of any kind at the end of the reporting period

- report the aggregate of actual payments, not payments before moderation. In the case of a small entity, or a small number of employees at a given classification level (e.g. 5 employees or fewer), a lesser disaggregation maybe necessary to ensure that individuals cannot be identified

- include each employee under one classification only. If an employee was promoted during the year and received performance pay at the lower classification only, include that employee in the report for the lower classification. If the promoted employee received performance pay at both classifications or at the higher level only, include the employee in the report for the higher level only and include the total payment in the aggregated payment report for that classification. Do not include the same employee in both classifications and do not break up the payment when aggregating the total payments for the various classifications

- not include performance-linked advancement (advancement to a higher pay point which then becomes the employee’s nominal salary). If an employee receives a performance bonus and a performance-linked advancement, only the bonus element should be reported;

- not include payments in the nature of retention payments, job loadings or skills and responsibilities loadings

- not include bonuses that accrued wholly in a previous reporting period, even if they were paid in the reporting period to which the report relates. For example, if a payment was made in the 2019–20 financial year for performance in respect of the period 1 July 2018 to 30 June 2019, it should not be included in the 2019-20 annual report. However, if a significant number of payments fall into this category, consideration should be given to correcting the information in the previous year’s annual report.

Entities that do not pay, or no longer pay, performance pay should include a statement to that effect in their annual report.

Executive remuneration

The associated data template can be found in Digital Reporting Tool data templates under Tools and templates:

- Subsection 17AD(da) – Executive Remuneration.

The annual report must include information about executive remuneration as required by Subdivision C of the PGPA Rule, which includes:

- the requirements for reporting remuneration details for:

- key management personnel (KMP)

- senior executives

- other highly paid staff (OHPS).

- the requirements for reporting the policies and practices of the entity regarding the remuneration of the above.

RMG-138 Commonwealth entities Executive Remuneration Reporting Guide for Annual Reports provides additional guidance and is also available under Resource Management Guides.

Assets management

Annual reports must include an assessment of the effectiveness of the entity’s asset management practices during the reporting period. This requirement is only necessary where asset management (including assets of which the day-to-day management has been outsourced) is a significant aspect of the strategic business of the entity.

Entities may wish to include a discussion of their asset management plans, particularly if a significant portion of their asset base has a life of 50 years or greater.

Purchasing

The annual report must include an assessment of the entity’s performance during the period against the Commonwealth Procurement Rules.

Consultancy and non-consultancy contract expenditure reporting

The associated data template can be found in Digital Reporting Tool data templates under Tools and templates:

- Subparagraphs 17AG(7)(a)(i)-(iv) – Reportable Consultancy Contracts

- Subparagraphs 17AG(7A)(a)(i)-(iv) – Reportable Non Consultancy Contracts

- Subsections 17AGA(2)-(3) – Additional information about organisations receiving amounts under reportable consultancy contracts or reportable non-consultancy contracts.

There are reporting requirements for any contract published on AusTender with respect to:

- the number of and expenditure on, new and ongoing reportable consultancy and non-consultancy contracts; and

- organisations receiving amounts under reportable consultancy contracts or reportable non-consultancy contracts during the reporting period.

- Where there are 5 or more organisations receiving amounts, entities must report both:

- those organisations who received the 5 largest shares of an entity’s total expenditure on such contracts and the total amounts received, and

- those organisations who received 5% or more of an entity’s total expenditure on such contracts, and the total amounts received.

- Where there are less than 5 organisations receiving amounts, entities must report:

- those organisations that received one or more amounts under one or more reportable consultancy or non-consultancy contracts and the total amounts received.

- Where there are 5 or more organisations receiving amounts, entities must report both:

Entities are required to report on contract expenditure in both the body of the annual report, and in the associated data templates. Please note, when preparing your annual report for publication on the Transparency Portal using DART, that the data templates require these amounts to be expressed as $000, and not in whole dollars. Please make sure you note this requirement when completing these data templates.

Further guidance, including definitions and example reporting tables, can be found in the Consultancy and Non-Consultancy Reporting Guidance under Tools and templates.

Strategic Commissioning Framework

Entities who employ staff under the Public Service Act 1999 are asked to summarise progress against their 2024-25 targets under the Strategic Commissioning Framework in their annual report. Details on what is expected can be found on the Australian Public Service Commission's website at Targets and reporting.

Australian National Audit Office access clauses

Entities must provide details of any contract entered into during the reporting period of $100,000 or more (inclusive of GST) that does not provide for the Auditor-General to have access to the contractor’s premises.

The annual report must include:

- the name of the contractor

- the purpose and value of the contract

- the reason why a clause allowing such access was not included in the contract.

The inclusion of standard access clauses provides the Australian National Audit Office with access to various types of information held by contractors and third party subcontractors for the purpose of audits, including access to records, information and assets directly relevant to the contract performance. The clauses do not enable access to information that is outside the scope of the specific contract.

Exempt contracts

The PGPA Rule requires that if any contract in excess of $10,000 (inclusive of GST) or a standing offer has been exempted by the accountable authority from being published on AusTender on the basis that it would disclose exempt matters under the Freedom of Information Act 1982 (FOI Act), the fact that the contract has been exempted and the value of the contract or standing offer must be reported, to the extent that doing so does not in itself disclose the exempt matters.

The exempt contracts provision addresses the requirement to document, in entities’ annual reports, any contracts entered into during the reporting period, where the contract details were not published in AusTender. This requirement also covers standing offers.

An accountable authority may direct in writing that contract details are not to be reported on AusTender if they would be subject to an exemption under the FOI Act and the accountable authority considers that the information is genuinely sensitive and harm is likely to be caused by its disclosure.

Small business

Procurement initiatives to support small business

The annual report must include the following statement:

"[Name of entity] supports small business participation in the Commonwealth Government procurement market. Small and Medium Enterprises (SME) and Small Enterprise participation statistics are available on the Department of Finance's website."

It must also include an outline of the ways in which the procurement practices of the entity support small and medium enterprises.

The Commonwealth Procurement Rules (Paragraphs 5.5 to 5.8) deal with the requirements for procurement practices of Commonwealth entities to support small and medium enterprises.

The Australian Government is committed to entities sourcing at least 20% of procurement by value from SMEs. The Commonwealth Procurement Rules state that, to ensure that SMEs can engage in fair competition for Australian Government business, officials should apply procurement practices that do not unfairly discriminate against SMEs and provide appropriate opportunities for SMEs to compete.

Annual reports must include a statement that refers readers to the statistics on SMEs’ participation in Commonwealth Government procurement available on the Statistics on Australian Government Procurement Contracts page.

This statement may include some of the following initiatives or practices:

- the Commonwealth Contracting Suite for low-risk procurements valued under $200,000

- Australian Industry Participation plans in whole-of-government procurement where applicable

- the Small Business Engagement Principles (outlined in the government’s Industry Innovation and Competitiveness Agenda), such as communicating in clear, simple language and presenting information in an accessible format

- electronic systems or other processes used to facilitate on-time payment performance, including the use of payment cards.

Material entities must include the following statement in the annual report:

"[Name of entity] recognises the importance of ensuring that small businesses are paid on time. The results of the Survey of Australian Government Payments to Small Business are available on the Treasury’s website.”

Entities that are considered material in nature, as characterised by the Department of Finance in the PGPA Flipchart must include a statement in their annual reports referring readers to the on-time payment performance results, which will be available on the website of the Department responsible for small business. This is currently the Department of the Treasury.

Advertising and market research

The annual report must include the following statement:

“During [reporting period], [name of entity] conducted the following advertising campaigns: [name of advertising campaigns undertaken]. Further information on those advertising campaigns is available at [address of entity’s website] and in the reports on Australian Government advertising prepared by the Department of Finance. Those reports are available on the Department of Finance’s website.”

or

- if the entity did not conduct any advertising campaigns during the period—a statement to that effect.

Entities should note that this requirement is in addition to the requirements in the Commonwealth Electoral Act 1918. For further information on those requirements, see Other legislative requirements section further below.

Entities are encouraged to clarify through an additional statement in their annual report that the report on Campaign Advertising by Australian Government Departments and Agencies, prepared by the Department of Finance, provides details of campaigns where expenditure was greater than $250,000 (excluding GST).

Grants

As GrantConnect now provides information about all grants made under the Commonwealth Grants Rules and Principles 2024, there is no need for entities to compile lists of grant recipients for their annual reports.

Instead, entities must include a statement in their annual reports:

"Information on grants awarded by [name of entity] during [reporting period] is available at [address of entity's website]."

Further information on grants administration is available from the Grants Policy Team, Department of Finance, at Grants.

Disability reporting mechanism

Annual reports must include an explicit reference to other disability reporting mechanisms, specifically noting where entity level information can be found. The annual report must include a reference to a website for further information.

A suggested form of words to satisfy this requirement is set out below:

Australia’s Disability Strategy 2021-2031 (the Strategy) is the overarching framework for inclusive policies, programs and infrastructure that will support people with disability to participate in all areas of Australian life. The Strategy sets out where practical changes will be made to improve the lives of people with disability in Australia. It acts to ensure the principles underpinning the United Nations Convention on the Rights of Persons with Disabilities are incorporated into Australia’s policies and programs that affect people with disability, their families and carers. All levels of government have committed to deliver more comprehensive and visible reporting under the Strategy. A range of reports on progress of the Strategy’s actions and outcome areas will be published and available at https://www.disabilitygateway.gov.au/ads.

Disability reporting is included the Australian Public Service Commission’s State of the Service reports and the APS Statistical Bulletin. These reports are available at http://www.apsc.gov.au.

Freedom of information

As part of the Information Publication Scheme (IPS), entities are required to publish, on a website, 10 categories of information, including information about the entity’s structure, functions and statutory appointments. The annual report must include a reference to the website where the entity’s IPS statement can be found.

To address the above requirement, annual reports should include a statement along the following lines:

[Name of entity]’s Information Publication Scheme statement, pursuant to Part II of the Freedom of Information Act 1982, is available at [link to statement on entity’s website].

Further information about the IPS is available at the Office of the Australian Information Commissioner website.

Remediation of information published in previous annual reports

If the previous annual report contains any significant statement on a matter of fact that has proved to be wrong in a material respect, the annual report must include information to correct the record.

Other legislative requirements

The operations that an entity reports on in its annual report can be affected by other legislation or legislative instruments. Such legislation can either be general in nature or specific enabling legislation of the entity.

Location of 'other legislative requirements' in annual reports:

Information required by other Acts or instruments to be included in the annual report must be included in one or more appendices to the report.

Below provides an overview of the other legislative requirements applicable to many entities. It is the responsibility of entities to consider whether the legislation applies to them.

Section 516A Reporting Guidelines helps entities decide which of their activities to report on. Sets of generic indicators have also been provided to assist entities with ongoing monitoring of their Ecologically Sustainable Development and environmental performance.

Questions about the application of these requirements should be directed to this online enquiry form.

Climate Action in Government Operations

Emissions Reporting

As part of the reporting requirements under section 516A of the Environment Protection and Biodiversity Conservation Act 1999, and in line with the Government’s Net Zero in Government Operations Strategy, all non-corporate Commonwealth entities, corporate Commonwealth entities and Commonwealth companies are required to publicly report on the emissions from their operations.

To ensure consistency across reporting, entities are required to use the emissions reporting tool provided by the Department of Finance to calculate their emissions.

- See Australian Government Emissions Reporting for further information on emissions reporting requirements and content to be included in annual reports.

- Contact Climate Action or call the reporting helpdesk at 02 6215 1999 for any queries regarding emissions reporting.

Commonwealth Climate Disclosure

Updated reporting requirement.

Commonwealth Climate Disclosure (CCD) is the Government's policy for all Commonwealth entities and Commonwealth companies to publicly report on their exposure to climate risks and opportunities, as well as their actions to manage them.

Implementation of CCD is phased over 4 years based on entity type, size and profile. Entities are allocated to ‘tranches’ based on this information.

Corporate Commonwealth entities in Tranche 1 are encouraged to include a climate disclosure in their 2024-25 annual reports.

- See Year 1 Commonwealth Climate Disclosure Requirements for full details of content to be included in 2024-25 annual reports.

- See Commonwealth Climate Disclosure Policy for information on tranche allocation.

Entities that are not in Tranche 1 can voluntarily opt-in to complete a disclosure this reporting period.

For any queries regarding CCD or for further information, please reach out to Climate Action .

For further information on the Work Health and Safety Act 2011, please see the Comcare website . If there are any questions, please contact general.enquiries@comcare.gov.au.

Reporting on advertising and market research is not restricted to electoral matters. See Types of advertising for further guidance.

The reporting threshold for each year is available from the Australian Electoral Commission.

In the case of an entity that is defined as a ‘public service care agency’, compliance with the entity’s obligations under the Carer Recognition Act 2010 is required.

A public service care agency is defined in section 4 of the Carer Recognition Act 2010 to mean an agency as defined in the Public Service Act 1999 that is responsible for the development, implementation, provision or evaluation of policies, programs or services directed to carers or the persons for whom they care.

Questions about the application of these requirements should be directed to carersupport@dss.gov.au.