A corporate plan is designed to be a Commonwealth company's primary planning document. It provides Parliament, the public and stakeholders with an understanding of the purposes of the company, its objectives, functions or role. It sets out how the company undertakes its key activities and how it will measure performance in achieving its purposes.

The role of corporate plans in the Commonwealth Performance Framework

The corporate plan is published at the beginning of the reporting cycle and sets out a company's key activities and how performance will be measured and assessed.

For any companies that receive appropriation funding, the Portfolio Budget Statements set out the appropriation for the company and how the impact of that expenditure will be measured.

Unlike Commonwealth entities, Commonwealth companies are not required to prepare annual performance statements. However, Commonwealth companies' annual reports are required to report the results of the measurement and assessment of the company's performance for the period. This includes the results of the measurement and assessment of the company's performance against any performance measures and any targets included in the company's corporate plan and Portfolio Budget Statements where relevant.

Does my company need to publish a corporate plan?

Commonwealth companies are required, under section 95 of the PGPA Act, to publish a corporate plan on their website.

Commonwealth companies must prepare their corporate plans in accordance with the requirements of section 27A of the PGPA Rule. This refers to the preparation of a corporate plan under section 16E of the PGPA Rule, other than:

- Item 5 of section 16E(2) that refers to specified performance measures and targets, and

- Section 16EA that refers to performance measures for Commonwealth entities.

Government Business Enterprises (GBEs)

Section 5 of the PGPA Rule identifies those Commonwealth companies that are government business enterprises (GBEs) for the purposes of the PGPA Act.

Commonwealth companies who are GBEs are required to prepare corporate plans in accordance with the requirements set out in section 16E and 27A of the PGPA Rule, together with any additional requirements specified in RMG-126 Government Business Enterprise (the GBE Guidelines). This document can take the form of a complete corporate plan, a redacted corporate plan, or a statement of corporate intent. The plan must address the minimum requirements as prescribed by the PGPA Rule. In doing so it should include sufficient non-confidential or non-commercially sensitive information to inform how the GBE plans to deliver on its purposes.

For further information on the GBE Guidelines, please contact GBE Policy.

What is a reporting period?

A corporate plan must be prepared at least once each reporting period. For a Commonwealth company, a reporting period is a financial year. This means that the corporate plan will be prepared each financial year.

Period of the corporate plan

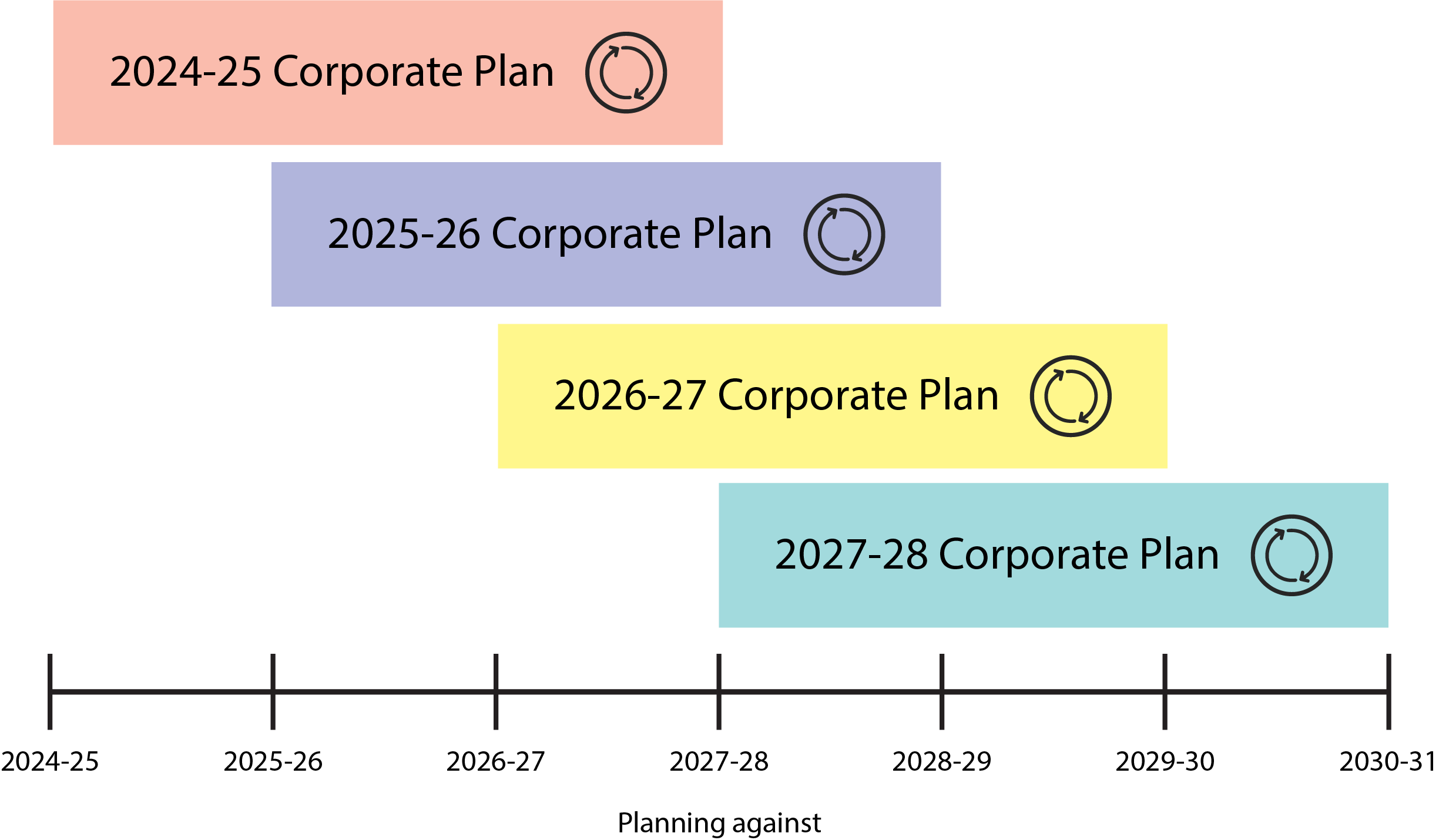

The corporate plan must cover at least 4 reporting periods, commencing from the reporting period for which the corporate plan is prepared. This does not prevent a company from producing a corporate plan that covers a longer period if that best addresses the company's specific requirements.

For example, a corporate plan prepared by a company for the 2024-25 financial year would be titled as that ‘company’s 2024-25 corporate plan’. That plan must cover at minimum 2024-25 to 2027-28.