Key points

There are a variety of circumstances where a valuation may be required.

Examples include, but are not limited to:

- agreeing a purchase price for an acquisition or disposal

- to determine the value of an asset that was acquired or disposed of for no or nominal consideration

- supporting components of compensation claims

In the context of compulsory acquisitions of interests in land under the Lands Acquisition Act 1989 (LAA), valuations are required to determine the ‘market value’ of the interest. For the purpose of Division 2 of the LAA, ‘market value’ is defined as ‘the amount that would have been paid for the interest if it had been sold at that time by a willing but not anxious seller to a willing but not anxious buyer’ (see section 56 of the LAA).

In the context of a compulsory acquisition under the LAA, section 55 also requires a number of other factors to be assessed in determining the amount to be paid for the interest being compulsorily acquired.

Accordingly, the objectives of any such procurement are to ensure that valuation advice is balanced, appropriately considers any circumstances specific to the asset being valued and is provided by an independent expert with appropriate qualifications and experience.

It is the responsibility of the entity undertaking the acquisition or disposal to ensure that other due diligence activities are conducted as appropriate to the particular acquisition. For example, these could include constitutional, legal, environmental, heritage, native title or contamination considerations.

Valuation principles

To ensure that valuations support accountable and transparent decision making for Commonwealth land acquisitions and disposals, the following principles should be considered when obtaining a valuation:

Valuation instructions

Should clearly state the purpose for which the valuation will be used (including referencing LAA as the relevant legislation), and include due diligence to provide assurance that all important factors have been considered.

Fit for purpose

The methodology used for the valuation should be fit for purpose with regard to all the factors of the acquisition or disposal and any assumptions made by the valuer must be appropriate in the circumstances.

Engaging a valuer

Must reflect appropriate management of public resources and comply with the CPRs.

Transparency

Valuations must be conducted in a transparent manner with an appropriate level of probity given the nature, value and complexity of an acquisition or disposal. Officials must not enter into informal discussions or meetings with valuers or a non-government party concerning valuation advice.

Confidentiality

Valuation advice should generally be treated as confidential and should not be disclosed to a third party unless authorised or required by law to do so (for example, by the Parliament, a court or tribunal).

The purpose of the valuation should be clear, noting that at times it may be appropriate to share the valuation (or relevant parts) to support reaching agreement on mutual terms.

Validity

The valuation relied upon should reflect an appropriate period of validity and be as close to the transaction as possible.

Valuation methodology

The valuation methodology must be proportionate to the scale, scope and risk of the acquisition (or disposal). A preference should be given to a method that includes physical inspections of the site as appropriate to the particular circumstance. The methodology adopted for a valuation can vary depending on the purpose of the valuation.

Types of valuations

In general terms, there are 4 broad types of valuations:

Desktop valuations

Based on available documentation without physically sighting or inspecting the asset. Generally this type of valuation is most appropriate for residential properties in circumstances where it is easy to identify comparable properties to help assess the value of the property.

Restricted assessment

Based on available documentation with limited physical inspection of the assets (that is, an external inspection from outside the property only). Again, this type of valuation is generally more appropriate for residential properties and generally not appropriate for commercial property valuations.

Physical inspection

Based on a physical inspection of the asset and limited enquiries. This type of inspection will typically involve a more detailed inspection than a restricted assessment, but will not reach the level of detail used for a full valuation.

Full valuation

Based on detailed physical inspection and all relevant enquiries. This will include the most detailed information on the property and include a comprehensive physical inspection of the property. This will generally be the most expensive option, but will often be the most appropriate in circumstances where there are limited comparable properties or other factors which make the property unique.

Choosing the appropriate methodology

The appropriate methodology for conducting the valuation will depend on many factors including:

As a general principle, the highest level of valuation that is appropriate to the type of property, the policy intent and other relevant factors should be sought.

Where a valuation other than a full valuation is given, the reasons and justifications should be clearly documented and the limitations of the valuation methodology and any associated risks should be clearly identified in briefing and advice to decision makers.

It may be prudent to seek more than one valuation if the interest in land is of high value or subject to commercial or other sensitivities.

Joint valuations

There may be very exceptional circumstances where a joint valuation might be appropriate (such as between levels of government on equal terms), in which case the scope and terms of the valuation must be clearly documented as well as the rationale for conducting a joint valuation.

Precautions should also be taken to ensure that both parties are copied into any instructions that are issued to the valuer. Where a joint valuation has been obtained to establish a purchase price, it may be prudent to also obtain separate valuation advice to make an informed decision, depending on the nature of the valuation.

Generally, valuations have a short period of currency, so it is important that they occur as close as possible to the proposed date of the transaction.

Valuation instructions

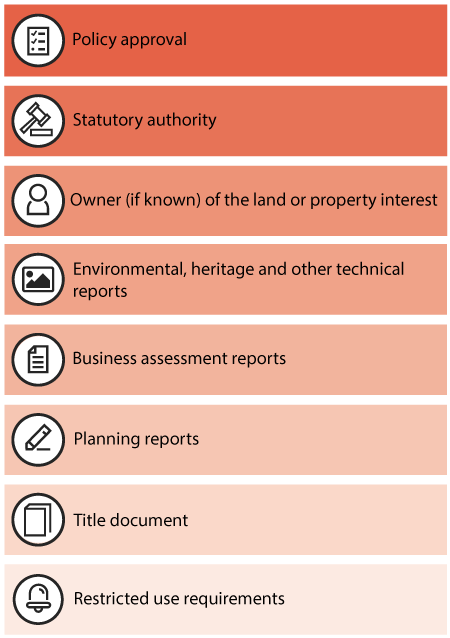

When providing valuation instructions all relevant information should be included with as much detail as possible. This may include, but is not limited to information regarding the land or property interest, including:

Developing instructions

The instructions provided to the valuer must:

| specify the type of the valuation |

| specify the purpose of the valuation and how it will be used |

| identify any legislation that is relevant or applicable to the valuation. For example, for compulsory acquisitions there is a definition of market value to use in the LAA |

provide all available information on the interest in land

|

instruct the valuer to undertake the valuation adopting the methodology appropriate for the relevant purpose and land interest

|

| specify that the valuation report may be provided to other parties for the purposes of determining the price to be paid for the land. |

Choosing a valuer

The process to engage a valuer is considered a procurement and NCEs and prescribed CCEs must follow the CPRs (and relevant Accountable Authority Instructions). Irrespective of the scale, scope and risk of the procurement, entities must seek to achieve value for money in accordance with the CPRs.

In addition to selecting a valuer that represents the best value for money, entities must also ensure the following matters are considered as part of their decision:

- independence – potential valuers should be required to disclose any actual, potential or perceived conflicts of interest;

- qualifications – a valuer must have the appropriate qualifications and accreditations; and

- experience – valuers should be able to demonstrate relevant knowledge and experience in the valuation of the type of asset being valued and the purpose for which the valuation will be used.

Procurement considerations

Wherever possible, entities should approach more than one supplier within a panel for a quote to support and demonstrate value for money. Where only one supplier is approached, officials should provide the decision maker with reasons on how value for money will be achieved in the procurement.

The Commonwealth should encourage landholders to engage their own independent valuer to support a transparent approach to claims associated with land acquisition. Officials can direct landholders to ‘the Guide to Acquisitions under the LAA’ and ‘Australian Government Solicitor Factsheet 3 – LAA’, for more information.

Valuers should confirm in writing they have no conflict of interest in performing the valuation. Where a conflict is declared, the entity should consider the declared conflict and seek probity advice where required. It may be necessary to arrange confidentiality agreements where the valuation is sensitive.

Probity considerations

Entities should also consider obtaining probity advice on the procurement process for valuation services and the valuation scope if:

- the valuation is likely to be complex or sensitive;

- the land interest value is likely to be significant;

- stakeholder or other interest in the land, or in the acquisition or disposal itself, is likely to raise sensitivities or contentious issues;

- potential valuers raise conflict of interest issues, including any commercial sensitivities or confidentiality requirements; or

- modifications to, or conditions around, the scope of the valuation are proposed.

Valuers’ conference

Prior to conducting a valuation conference it may be beneficial for the parties to narrow down the areas of dispute as much as possible. Alternative dispute resolution such as pre-conference discussions between the relevant parties may be an effective tool to support this.

While either party may request a valuers’ conference, the Commonwealth may wish to consider offering a conference to the landholder as a proactive alternative to dispute resolution.

It is the Commonwealth’s responsibility to keep negotiations progressing effectively and to use appropriate valuations to inform offers as part of the negotiation or claims process.

Valuation report

A high-quality valuation report is an important tool to provide evidence to support decisions that are made in accordance with the LAA.

As a minimum, valuation reports should include:

- a description of the asset(s) being valued

- the effective date of the valuation

- the details, qualifications and professional memberships of the valuer

- the scope and approach of the valuation and a statement as to whether the valuation meets the requirements of the International Valuations Standards and/or the Australian Accounting Standards (where relevant)

- an explanation of the key assumptions, methods and considerations used in the valuation (including relevant legislation)

- limitations, caveats and consideration of restrictions in the valuation

- details of comparisons used to determine valuations where relevant and supporting evidence

- any matters known to the valuer that may affect or change the valuation

- the term over which the valuation will be valid

- the recommended value, including a valuation range where relevant

- any other matters relevant to the valuation

Other considerations

Any condition in a valuation report that restricts the ability of the Commonwealth to use or share the valuation report should, generally, not be agreed to.

While every endeavour should be made to treat a report confidentially, it is preferable that the Commonwealth is not under any obligation to do so.

Where a valuation report is being used to support a decision to purchase an asset, a summary of the key assumptions, limitations, calculations and risks should be provided to the decision maker.

Any other valuations of the asset which the entity knows of should also be provided to the decision maker, including an explanation of any methodological differences that may have contributed to material differences in valuations.

-- Explore more of RMG-501 --

Go to Lands Acquisition Framework (RMG 501)

Go to Introduction

Go to Acquisition

Valuation

Go to Compensation and other payments

Go to Disposals

Go to Reporting