Lands Acquisition Framework

This Lands Acquisition Framework supports entities to meet obligations under the Lands Acquisition Act 1989 (LAA) and encourages informed decision-making for property acquisitions and disposals under the LAA.

Requirements that must be complied with are denoted by the term ‘must’. The term ‘should’ indicates good practice.

The Framework supports acquisitions and disposals of interests in land under sections 40, 41, 119 and 125 of the LAA. That is, those matters most likely to arise for entities in day-to-day activities.

The Framework provides overarching, first principles guidance on the LAA and its requirements. It is not intended to be a comprehensive or prescriptive guide on the requirement for compliance.

While the Framework provides guidance on legislative, policy and due diligence requirements that entities may need to consider when conducting acquisitions and disposals, entities will need to satisfy themselves that a sufficient assessment has been carried out to support the acquisition or disposal. This may include undertaking activities beyond the scope of the Framework.

If you're unsure of whether the Framework applies to your acquisition or disposal, please contact us at LAA@finance.gov.au.

Application

The LAA is the key piece of legislation that provides the Commonwealth with powers to acquire land for public purposes, such as national security and major infrastructure, while safeguarding the rights of Australians. ‘Interest in land’ is defined broadly in the LAA. This means that the LAA applies to the acquisition and disposal of a wide range of rights and estates in land, including freehold interests in land and lesser rights and interests such as leases, easements or licences.

For clarity, the acquisition and disposal of land, leasing of office space or land, licences and easements are subject to the LAA unless otherwise exempt.

For example, sections 21 and 117 of the LAA provide for circumstances in which an acquisition or disposal (respectively) of an interest in land can occur outside of the requirements of the LAA. This includes where the LAA regulations provide that the LAA does not apply to acquisitions and disposals in specified circumstances, and where acquisitions and disposals are appropriately authorised by another Commonwealth law.

The Framework applies to all interests in land which are authorised under the LAA. It covers interest in land in Australia, external territories (excluding those territories that are outlined in Section 5 of the LAA) and overseas. The Framework does not apply to transactions to which the LAA does not apply.

The Framework promotes informed decision-making and value for money outcomes, demonstrated by ensuring:

- affected landholders are treated fairly and acquisitions represent ‘just terms’ outcomes

- responsiveness to stakeholder expectations

- a foundation for achieving value for money and promoting the efficient, effective, economical, and ethical use of Commonwealth resources in relation to the acquisition or disposal of interests in land

- accountability for all entities on the use of acquisition powers

- compliance with relevant legislation and Commonwealth policies, including with respect to the environment, heritage, native title, and use of public resources.

NCEs and officials must establish and maintain appropriate systems and internal controls for the oversight and management of risk as required by the Commonwealth Risk Management Policy. Delegates are expected to manage their responsibilities under a risk-based framework in proportion to the level of risk posed by the relevant property dealing to the Commonwealth's interests. Delegates of the Finance Minister will also be expected to comply with any directions concerning their delegated LAA authority.

Legislative and policy environment

Within that broad context, the Resource Management Framework consists of the legislation and policy governing the management of the Commonwealth’s resources, including the acquisition and disposal of interests in land.

Non-compliance with the requirements of the Resource Management Framework, including in relation to acquisitions and disposals of interests in land, may attract a range of criminal, civil or administrative remedies including under the Public Service Act 1999 and the Crimes Act 1914.

Related property management legislation includes:

- The Constitution

- Auditor-General Act 1997

- Public Service Act 1999

- Crimes Act 1914

- Public Governance, Performance and Accountability Act 2013

- Lands Acquisition Act 1989

- Lands Acquisition Act 1955 (for preserved mining provisions)

- Lands Acquisition Regulations 2017

- Lands Acquisition 1989 Delegation Instrument

Public Governance, Performance and Accountability Act 2013 (PGPA Act)

Acquisitions under the LAA are procurements, and as such they need to comply with the Commonwealth Procurement Rules and the broader Resource Management Framework in the PGPA Act. In particular, the PGPA Act requires that taxpayers’ money is spent in a proper manner, which means that it is spent in a way that is efficient, effective, economical and ethical. In Commonwealth procurement, this requirement is defined as achieving value for money.

- Section 8 - Public resources be used or managed in an efficient, effective, economical and ethical manner.

- Section 15 - Accountable authorities of Commonwealth entities have an obligation to promote the proper use and management of the public resources for which the accountable authority is responsible.

- Section 16 - An Accountable Authority's duty to establish appropriate internal control systems for their relevant entity. Accountable Authorities should draw on this Framework to establish Accountable Authority Instructions (AAIs) and operational requirements in relation to acquisitions and disposals of interest in land.

The Commonwealth Resource Management Framework governs how officials in the Commonwealth public sector use and manage public resources. The framework is an important feature of an accountable and transparent public sector and informs the Australian people of the daily work of Commonwealth entities and their employees. The cornerstone of the framework is the PGPA Act and also includes the Public Governance, Performance and Accountability Rule 2014 and the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015.

The Commonwealth Procurement Rules (CPRs) govern how entities buy goods and services, and are designed to ensure the Government and taxpayers get value for money. Finance looks after the Commonwealth Procurement Framework, and assists both Government and business through advice, support and services. NCEs and prescribed CCEs must comply with the CPRs when undertaking procurements, including acquisitions of interests in land under the LAA.

For clarity, procurement of goods and services includes every type of right, interest or thing which is legally capable of being owned. This includes, but is not restricted to, physical goods and real property as well as intangibles such as contract options and goodwill.

- RMG-500 Commonwealth Property Management Framework

- RMG-501 Lands Acquisition Framework

- Commonwealth Property Disposal Policy

- Property Service Coordinated Procurement (PSCP) Arrangements

- Commonwealth Leasing Strategy

- Other Property Guidance

- RMG-206 Accountable Authority Instructions (AAIs)

Delegation

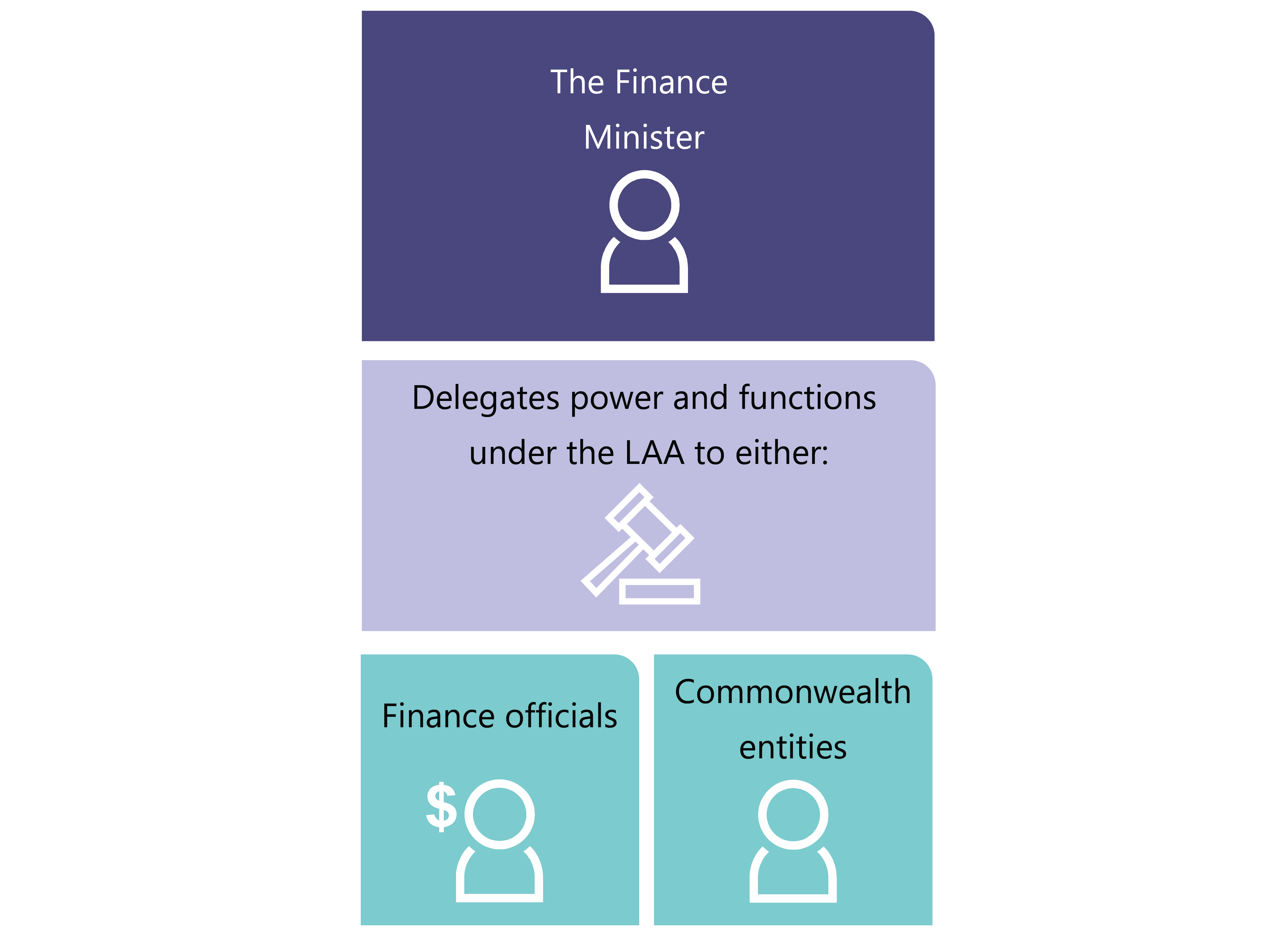

An acquisition or disposal of an interest in land must be authorised under the LAA, either by the Finance Minister or a delegated official.

The Finance Minister has portfolio responsibility for the LAA, and has delegated a number of functions and powers under the LAA to officers within Finance and other Commonwealth entities. Delegation allows entities to best manage the range of interests in land that fall within their administrative responsibilities.

Some acquisitions or disposals can only be authorised by the Finance Minister or, in some cases, a Finance delegate.

Delegation Instrument

Section 8 of the delegation instrument states that the Finance Minister has directed that entities must keep a register detailing the LAA delegations exercised by their officers. The entity must make this register available to Finance or the Finance Minister upon request.

In addition, the Finance Minister’s directions also require entities to consider the PGPA Act, Commonwealth Property Management Framework (CPMF), Commonwealth Property Disposal Policy (CPDP) and other legislation and policies relevant to decisions.

The current delegations to officers can be found here.

Please contact LAA@finance.gov.au regarding delegations under the LAA.

Entities should notify us by email of any changes in positions that may impact on LAA delegations in force for inclusion in future updates to the delegations.

Obligations when interacting with external parties

Entities engaging with parties that are external to government, such as landholders, valuers, and claimants, must act in accordance with the highest standards of probity and ethics, their entity’s AAIs and any requirements of the approved acquisition strategy for the transaction.

See Stakeholder engagement for more information.

At a minimum, the principles driving engagement with external parties would be expected to include requirements that:

ensure that accurate records are kept throughout the acquisition and negotiation processes, including notes on all discussions and meetings.

declare all real or perceived conflicts of interest and follow probity instructions in relation to declared conflict/s of interest.

have at least 2 officials present at meetings, with face-to-face meetings held at appropriate venues, taking into consideration the content planned to be discussed at the meeting.

« Explore more of RMG-501 »

Go to Lands Acquisition Framework (RMG 501)

Introduction

Go to Acquisition

Go to Valuation

Go to Compensation and other payments

Go to Stakeholder engagement

Go to Disposal

Go to Reporting