This Toolkit item relates to Part 1 – Investment Proposal and Business Case Development of the Commonwealth Investments Resource Management Guide.

What is a financial model?

A financial model explains the relationship between certain variables, decisions or events and the likely future economic and operating performance to predict the future financial results of the business case.

It is used to:

- understand the financial implications and viability of the business case

- support decision making by estimating the likely financial impacts before committing any funds

- analyse options and test the sensitivity of inputs and assumptions

- inform the appropriate investment instrument to finance the business case

- inform budget costing, and understand the accounting and impacts on key budget aggregates.

A financial model should be fit for purpose and flexible to account for changing model inputs and assumptions. Financial modelling expertise is required in the development and quality assurance of a financial model. A financial model’s value is only as good as the inputs and assumptions that feed into it.

Elements of a financial model

Where possible, financial modelling should be done in Microsoft Excel. There are many websites that prescribe Excel best practice. The number of assumptions and inputs will vary for each financial model.

Model Inputs

All model inputs and projections should be in nominal terms. When determining the returns of the proposal, discounting should be applied.

- Revenue projections: revenue should be modelled with consideration to the price and quantity of the good and/or service provided, market share, and industry analysis. When prepared by a private proponent, revenue projections should be informed by independent market modelling, which should inform revue sensitivity analysis. Private revenue projections are available for Commonwealth scrutiny of potential upside and downside risks

- Cost projections: costs should be modelled with consideration to cost estimation and the technical life of the asset, including major technical refreshes. Costs should account for both capital and operating expenses. Fixed and variable costs should be identified and modelled separately. Cash and non-cash expenses (for example, depreciation) should be separately identified

- Impact from operating activities: cash flows are typically recurring in nature and relate to revenue and cash operating expenses

- Impacts from investing activities: cash flows typically one-off in nature relating to the proposal such as purchase of new assets, sale of existing assets and interest income

- Impacts from financing activities: cash flows relating to the funding and financial returns of the proposal (both internal and external to the Commonwealth) includes interest expense, dividends and other capital returns

- Terminal value: included where the business case is likely to generate recurring revenues and costs beyond the financial model’s time horizon and, or where the proposal will be sold at the end of the financial model’s time horizon.

The model inputs derive cash flows that will be used to assess options, understand key assumptions and appraise the financial implications of the proposal to support the business case. Cash flows should separately identify Commonwealth and non-Commonwealth related receipts and payments.

From the model inputs, a full set of financial statements (income statement, balance sheet, cash flow statement and statement of changes in equity) should be derived and included in the model. The information in the financial statements should support the information presented from the model’s cash flows. Where differences occur, these should be highlighted and explained.

While the primary statement used to appraise the model’s financials is the cash flow statement, the other statements are needed to assess impact on budget aggregates, and to cross-check cash flow figures.

Assumptions

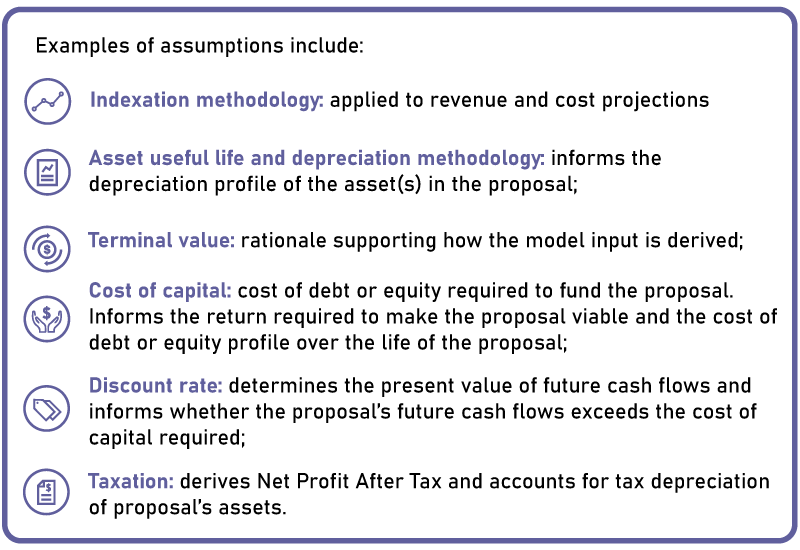

A list of assumptions underpinning the model’s inputs should be included in financial models. To further understand the impact of assumptions on model inputs, a sensitivity range (low, base, high) may be required.

Time horizons

Model inputs and financial statements should be presented annually for the life of the investment, in line with the business case. Where the investment does not have a finite life, a period of 30 years should be presented. Where the proposal life exceeds 30 years, the final year should include a terminal value achieved either through assumed sale, or through capitalising future cash flows.

If the proposal is for an extension of an existing business, actual financial statements for the last 3 years should be included alongside the projections. This provides a benchmark to assess the viability of the proposal.

Options

As part of the business case options analysis, the financial impacts for the base case and other options will require modelling. Modelling of options supports the assessment of business case viability, decision making of the business case, and informs the appropriateness of non-grant financing approaches.