Corporate governance

This section discusses our support services and governance structures, which provide a framework to ensure accountability and the overall effectiveness of the department.

Key corporate services

The Corporate Services and ICT divisions support the Department of Finance in delivering its programs and services by providing quality, timely services and being responsive to the department’s changing priorities and operational needs.

The divisions provide a broad range of corporate services, among them financial management, corporate planning, human resource services, knowledge management, information and communications technology, security and accommodation, communication and public affairs, in-house legal assurance, portfolio coordination and parliamentary liaison.

The governance framework

Finance’s governance framework promotes the principles of good governance and encourages all staff to be accountable for their actions, focus on performance, and ensure efficient, effective and ethical management of people and resources.

The framework consists of committees, business planning and reporting, performance management, risk management, audit and assurance activities, and awareness of ethical standards. It also supports the Secretary in discharging her duties under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Service Act 1999.

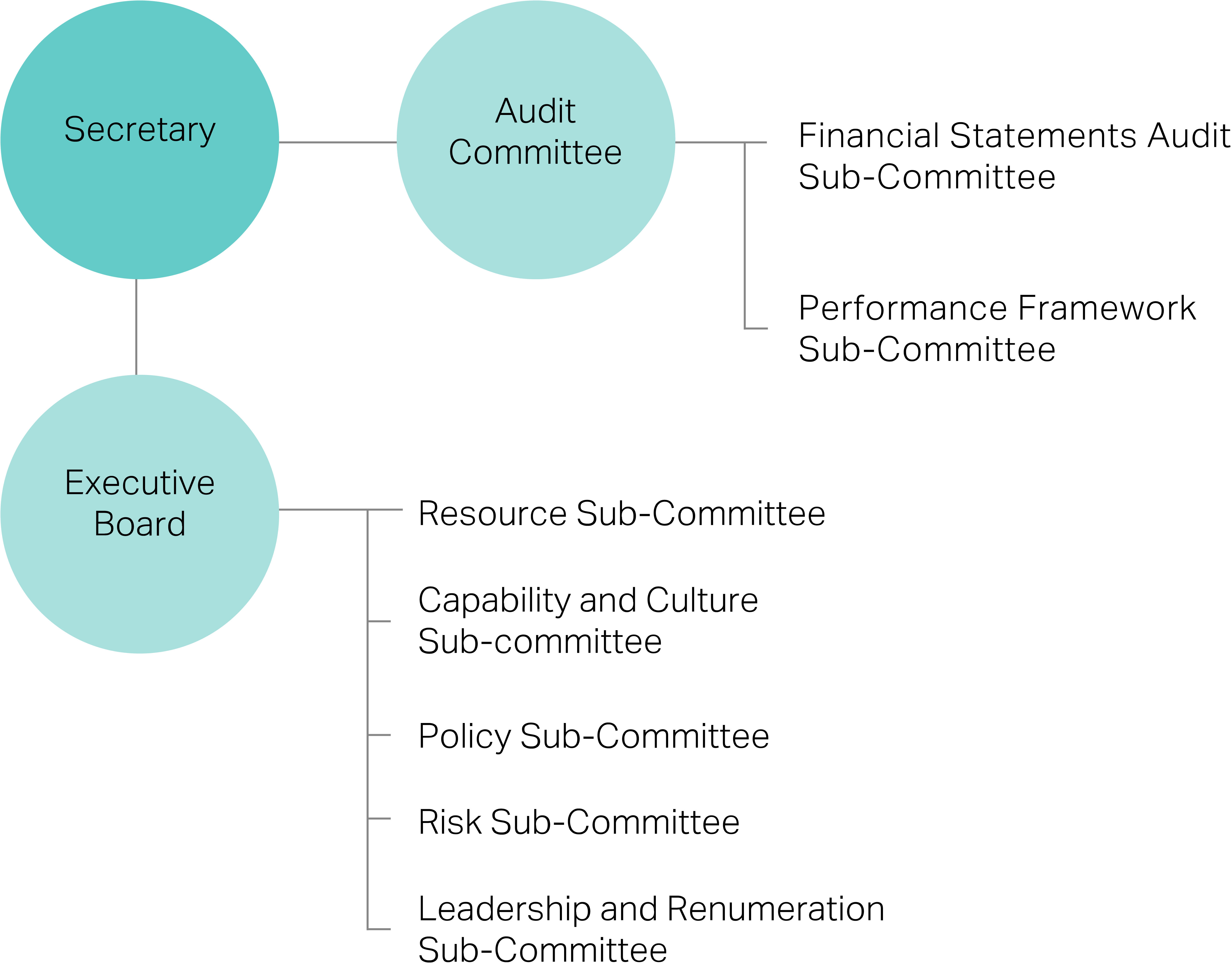

Figure 4 shows Finance’s governance structure in 2016–17; the structure is discussed in more detail in the paragraphs that follow.

Figure 4: Finance’s governance structure at 30 June 2017

New governance arrangements

Following an internal review, new governance arrangements for the department were implemented on 1 July 2016. The changes, which relate mainly to the Executive Board sub-committees, help us better prioritise our work—both specific projects and ongoing business—and facilitate collaboration between sub-committees.

Memberships, terms of reference and charters for the committees and sub-committees were updated to reflect the changes.

The Executive Board

The Executive Board is the chief advisory and decision-making body in the department and supports the Secretary in discharging her duties under the PGPA Act. It provides strategic leadership to ensure the department delivers its programs in keeping with the government’s policy objectives. It also monitors performance and maintains accountability.

In addition to its usual decision-making role, the board structures its business to ensure key strategic discussions are undertaken, emerging risks are considered and regular updates from the chairs of the sub-committees are received.

The Secretary is the chair of the Executive Board and the deputy secretaries are standing members. During 2016–17 additional members were the First Assistant Secretary of the Corporate Services Division, the Chief Information Officer and the Chief Financial Officer.

Staff are kept informed about key decisions of the Executive Board through communications which are published on the department’s intranet.

Executive Board sub-committees

The Executive Board has established the following sub-committees, comprising senior management officers, to assist it in discharging its duties and to allow detailed consideration of complex activities and other matters:

- The Resources Sub-Committee is responsible for providing assurance and advice to the Executive Board on departmental investment, to ensure appropriate alignment with and enablement of business priorities.

- The Capability and Culture Sub-Committee advises the Executive Board on the strategic direction for people management, leadership development and workforce capability within the department.

- The Policy Sub-Committee fosters a coherent policy framework for Finance and advises the Executive Board on the development and implementation of strategic policy priorities for the department.

- The Risk Sub-Committee ensures that the department has an effective (practical and adequate) risk management framework in place, along with the ability to effectively manage its risks.

- The Leadership and Remuneration Sub-Committee oversees and provides advice on the department’s remuneration policies, Senior Executive Service recruitment and people management matters.

The Audit Committee

The Audit Committee provides independent advice and assurance to the Secretary on the appropriateness of the department’s accountability and control framework—particularly those aspects concerning the system of risk oversight and management, the system of internal controls, performance reporting and financial reporting. It also provides assurance on the adequacy of the Australian Government’s Consolidated Financial Statements production and risk planning process.

In 2016–17 the committee was made up of four external members, one of them being the chair, and two departmental members. It met five times, and representatives from the Australian National Audit Office, the chair of the Risk Sub-Committee, the head of Internal Audit, the Chief Financial Officer and the department’s internal audit service providers attended as observers.

The Audit Committee has established two sub-committees, chaired by external members, to support it in performing its functions:

- The Financial Statements Audit Sub-Committee maintains an ongoing review of the process for preparing the department’s annual financial statements.

- The Performance Framework Sub-Committee assists the Audit Committee in meeting its responsibilities under the PGPA Act in relation to performance reporting.

The planning and performance reporting framework

The premise of the planning and performance reporting framework is that, where there is a shared understanding of the department’s purposes and priorities—and resources and activities are properly organised and aligned—we will achieve high standards of performance.

The operating model allows Finance to adjust its activities and resourcing to align with government priorities as expressed in the department’s corporate plan and measured through the annual performance statement. Figure 5 illustrates Finance’s approach to planning and reporting.

Figure 5: Finance’s approach to planning and reporting

Managing risk

The Risk Sub-Committee, reporting to the Executive Board, oversees the department’s risk management framework, which aligns with the principles of the PGPA Act and the Commonwealth Risk Management Policy.

The framework provides a sound foundation for ensuring a consistent approach to the identification, treatment and monitoring of risks by all staff on an ongoing basis. The Enterprise Risk Management Plan provides appropriate visibility of key risks to the Risk Sub-Committee and the Executive Board and assists with actively managing risks at all levels in the department.

During 2016–17 the department embedded its risk appetite and tolerance levels into the framework to help guide day-to-day decision making. Our risk appetite and tolerance levels reflect a flexible and proportionate approach to the way we identify and manage risk. This is informed by the likelihood of the risk occurring and the consequences if it does. Managing risk in a more considered way influences our business processes including:

- driving greater staff capability as staff have more authority to make decisions

- promoting a positive risk culture, accepting that sometimes things will go wrong and if they do—learning and responding in a thoughtful, measured way.

Business continuity management

Business continuity management is integral to the department’s risk management arrangements. It entails careful planning to enable the continuation or timely resumption of critical functions and eventual restoration to normal operations following a business interruption.

In the event of a business interruption, a central control team is convened by the Deputy Secretary of Business Enabling Services. The team serves as the central point of communications and coordination for the department’s response and recovery.

Internal audit arrangements

Primary responsibility for the department’s internal audit activities rests with the head of Internal Audit, who provides to the Secretary—through the Audit Committee—independent assurance that internal controls designed to manage organisational risks and achieve the department’s objectives are operating in an efficient, effective and ethical manner. The head of Internal Audit also implements the annual internal audit plan and manages liaison with the Australian National Audit Office.

Internal audits are either commissioned by the Audit Committee under the annual internal audit plan or initiated by management. A management-initiated review can be conducted in response to a newly identified risk or another matter on which management requires additional assurance. The department currently contracts KPMG to provide its internal audit services. During 2016–17 the internal audit program was delivered in line with the annual internal audit plan endorsed by the Audit Committee and approved by the Executive Board. In addition, internal audit services supported the transfer and establishment of the Service Delivery Office from the Department of Employment and the Department of Education and Training to Finance.

How we manage fraud

The department has a fraud control framework that aligns with the Commonwealth Fraud Control Framework. The department’s framework is overseen by the Risk Sub-Committee and establishes the systems and processes for prevention, detection, monitoring, evaluation and reporting of, and responses to, fraud within the organisation. We regularly review our fraud prevention and control measures, including our fraud risk assessment and fraud control plan.

There were five fraud matters reported for the 2016–17 financial year, with a total estimated loss of $4,650 and a proven loss of $2,500. Four of the matters were finalised because they were unable to be substantiated and one matter, relating to the theft of a defibrillator, was proven. Following consideration of the matter, no responsible party was identified.

Significant non-compliance with finance law

The department did not report any significant matters relating to non-compliance with finance law to the Finance Minister under section 19(1)(e) of the PGPA Act in 2016–17.