Financial performance

This section highlights Finance’s financial performance during 2016–17 for both departmental and administered activities.

The department’s financial statements are presented in the Financial statements section of this report. The Australian National Audit Office issued an unqualified audit opinion for these statements on 5 September 2017.

Finance’s financial performance is summarised in Table 4. The department’s entity resource statement and tables showing expenses by outcome are presented in Appendix 3.

Departmental activities

Departmental resourcing includes assets, liabilities, revenues and expenses that Finance controls directly and uses to produce outcomes on behalf of the government.

For the 2016–17 financial year, the department recorded an operating surplus of $55.4 million. This is $51.0 million less than the revised surplus estimate of $106.4 million as published in the 2017–18 Portfolio Budget Statements and is due to higher insurance claims expense.

The operating surplus of $55.4 million in 2016–17 compares to an operating surplus of $113.5 million in 2015–16. Finance has budgeted for an operating surplus of $47.1 million in 2017–18.

Operating expenses were $51.2 million higher than 2015–16. This was primarily due to higher insurance claims expense, partially offset by lower centralised procurement expenditure

Write-down and impairment of assets decreased by $12.1 million, primarily due to a reduction in decrements for buildings and investment properties in 2016–17.

Table 4: Departmental financial performance

|

|

30 June 2017 |

30 June 2016 |

Variance |

|

|

($’000) |

($’000) |

($’000) |

|

Operating expenses |

674,534 |

623,292 |

51,242 |

|

Write-down and impairment of assets |

2,600 |

14,741 |

(12,141) |

|

Total expenses |

677,134 |

638,033 |

39,101 |

|

Own-source revenue |

417,432 |

440,445 |

(23,013) |

|

Gains |

36,760 |

43,591 |

(6,831) |

|

Net own-source income |

454,192 |

484,036 |

(29,844) |

|

Net cost of services |

222,942 |

153,997 |

68,945 |

|

Revenue from government |

278,357 |

271,315 |

7,042 |

|

Income tax equivalent |

– |

(3,843) |

3,843 |

|

Operating surplus (deficit) |

55,415 |

113,475 |

(58,060) |

|

Changes in asset revaluation surplus |

21,879 |

25,133 |

(3,254) |

|

Total comprehensive income (loss) |

77,294 |

138,608 |

(61,314) |

The decrease in own-source revenue of $23.0 million compared to 2015–16 was primarily due to decreased centralised procurement revenue resulting from changes to ICT procurement arrangements for some support and licensing arrangements, partially offset by increases in insurance premium revenue from Commonwealth entities. Figure 2 outlines the department’s financial performance over the past four years and the budget for 2017–18.

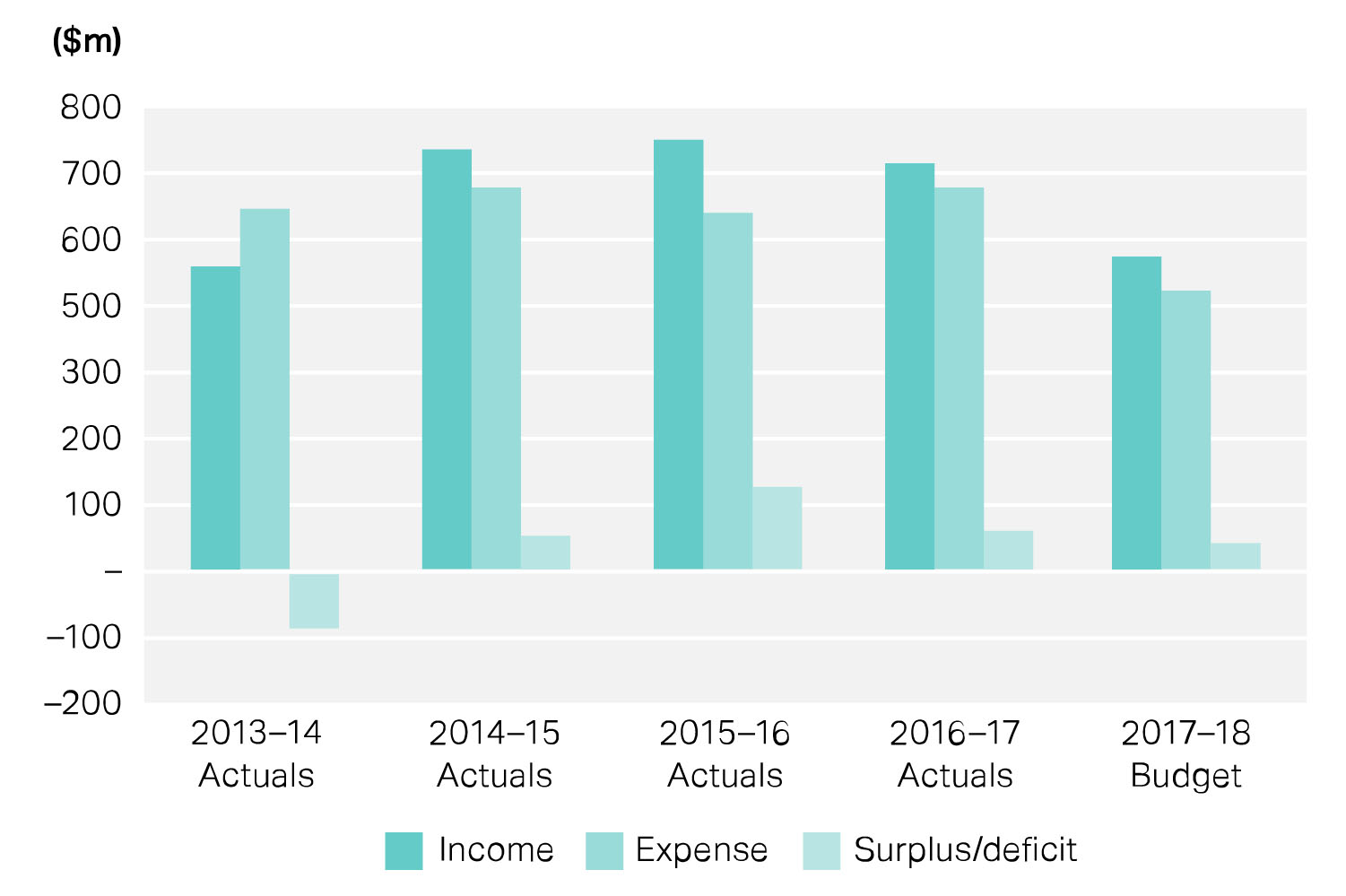

Figure 2: Departmental financial performance, 2013–14 to 2017–18.

Financial performance of administered activities

The financial performance of Finance’s administered activities for 2016–17 is summarised in Table 5. Administered items are assets, liabilities, revenues and expenses that are managed or overseen by Finance on behalf of the government. Finance incurred $9.5 billion of expenses, and recognised $1.9 billion of income on behalf of the government in 2016–17, with expenses and income similar to that of the previous year.

Table 5: Administered financial performance

|

|

30 June 2017 |

30 June 2016 |

Variance |

|

|

($’000) |

($’000) |

($’000) |

|

Expenses administered on behalf of the government |

9,480,184 |

9,509,540 |

(29,356) |

|

Income administered on behalf of the government |

1,895,086 |

1,906,567 |

(11,481) |

Figure 3 outlines the department’s financial performance in relation to administered activities over the past four years and the budget for 2017–18.

Figure 3: Administered activities 2013–14 to 2017–18 ($ million)

Financial summary and agency resource statement

Table 6: Financial Summary 2013–14 to 2016–17 ($ million)

|

Departmental summary of financial statements |

2013–14 |

2014–15 |

2015–16 |

2016–17 |

|

$ million |

$ million |

$ million |

$ million |

|

|

Expenses |

|

|

|

|

|

Employees |

168.08 |

161.22 |

170.36 |

168.62 |

|

Suppliers |

222.29 |

331.70 |

321.89 |

303.57 |

|

Write-down and impairment of assets |

118.92 |

57.69 |

14.75 |

2.60 |

|

Insurance claims |

108.39 |

76.46 |

94.30 |

163.99 |

|

Other |

34.89 |

48.08 |

36.73 |

38.36 |

|

Total expenses |

652.57 |

675.15 |

638.03 |

677.14 |

|

Own-source income |

|

|

||

|

Rendering of services |

143.02 |

152.82 |

230.94 |

201.35 |

|

Insurance premiums |

86.26 |

100.87 |

125.15 |

140.29 |

|

Reinsurance and other recoveries |

6.59 |

– |

1.50 |

1.82 |

|

Rental income |

48.18 |

76.48 |

72.12 |

67.68 |

|

Other revenues |

9.66 |

7.33 |

10.74 |

6.29 |

|

Total own-source revenue |

293.71 |

337.50 |

440.45 |

417.43 |

|

Gains |

5.97 |

4.61 |

43.59 |

36.76 |

|

Net cost of services |

352.89 |

333.04 |

153.99 |

222.95 |

|

Revenue from government |

261.69 |

395.37 |

271.32 |

278.36 |

|

Income tax equivalent expense |

5.86 |

5.91 |

3.84 |

– |

|

Net surplus (deficit) |

(97.06) |

56.42 |

113.49 |

55.41 |

|

Equity |

2,085.77 |

2,063.37 |

2,148.08 |

2,245.67 |

|

Net operating cash flowa |

47.89 |

64.20 |

53.57 |

209.28 |

|

Returns to government |

11.14 |

111.26 |

73.92 |

59.47 |

aA change in the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015 means departmental appropriation receivable relating to special accounts is no longer considered an operating cashflow. This change resulted in a restatement in 2015–16 net operating cashflow from $69.70 million to $53.57 million.

Table 7: Economic performance summary

|

Indicator |

2016–17 result |

|

Operating statement |

|

|

Total expenditure |

677,134 |

|

Total own-source income |

454,192 |

|

Total net cost of service |

222,942 |

|

Economic viability |

|

|

Total assets |

3,057,406 |

|

Total liabilities |

811,736 |