Tips on how to enter remuneration information

Modifying reporting tables: Executive remuneration disclosures must be in accordance with the tables at Schedule 3: Information about executive remuneration (PGPA Rule).

DART data templates are prepopulated with the current reporting period threshold bands, and are to be used exactly as set in the reporting platform. Table columns should not be deleted, even when there is no information to report.

For example, many entities do not pay bonuses or termination benefits, but to assist with the consistency of reporting, the bonuses and termination benefits columns should be included in the tables reported in the annual report.

When reporting in body of annual report, entities may use a copy of the DART data templates or customise it to improve presentation. For example, if there are remuneration bands that do not contain remuneration details of officials, that row may be removed from the respective tables.

For example, an entity may not have any senior executives in the $250,001 - $270,000 remuneration band and therefore may remove this band row from the senior executives table.

No changes to remuneration bands: Total remuneration bands must not be varied or combined even when there is a small number of employees in a particular band.

When to exclude the entire table: If an entity pays no remuneration to one of the 2 categories of officials (senior executives and other highly paid staff, entities always report KMP), the relevant table(s) should not be included in the remuneration disclosures in the body of the annual report. A note should be included to explain the reason why there is no disclosure of the relevant table(s). However, all tables need to be completed in the DART data templates, even if an entity pays no remuneration in that category.

Value for each cell: Where there is no data to report enter ‘0’ for each cell (Excel based table allows for a convenient drag and fill).

Use whole dollar format: When entering the figures, use whole dollar formatting for thousands, for example report $235,673 with no spaces between numbers.

Providing footnotes:

No footnotes to be reported in the DART data templates.

Footnotes may be used in the body of annual report to provide additional information and explanation to assist the reader to understand what has been included in the tables.

No previous reporting periods required: For the purpose of the executive remuneration disclosures, comparative information from previous reporting periods is not required to be reported in an entity’s annual report.

Key Management Personnel remuneration reporting example

The following is an example of how the KMP note would be presented. During the reporting period ended 30 June 20X1, Entity X had 4 executives who meet the definition of key management personnel. Their names and the length of term as KMP are summarised below:

| Name | Position | Term as KMP |

| Rachael [Surname] | Secretary/Chief Executive Officer (CEO) | Full year |

| Suraj [Surname] | Deputy Secretary/CEO | Full year |

| Greg [Surname] | Chief Financial Officer (CFO) | Full year – Terminated on 30 June 20X1 |

| Dave [Surname] | Chief Operating Officer (COO)1 | Part-year – Appointed 1/03/20X1 |

1 The COO was a newly created position during the year with a single occupant of this role.

In the notes to the financial statements for the period ending 30 June 20X1, Entity X disclosed the following KMP expenses:

| Note X: Key management personnel remuneration for the reporting period | 20X1 |

| Short-term benefits: | |

| Base Salary | 1,233,000 |

| Bonus | 113,000 |

| Other benefits and allowances 2 | 20,000 |

| Total short-term benefits | 1,366,000 |

| Superannuation | 70,597 |

| Total post-employment benefits | 70,597 |

| Other long-term benefits: | |

| Long service leave | 20,680 |

| Total other long-term benefits | 20,680 |

| Termination benefits | 50,000 |

| Total key management personnel remuneration | 1,507,277 |

2 Includes $20,000 for car parking.

In accordance with the PGPA Rule, this information now needs to be further disaggregated. The below table shows how this information would be presented in the body of the annual report:

Senior Executives remuneration reporting example

The following examples (examples 1 to 3) demonstrate how the underlying data for senior executives was prepared under this guidance.

The underlying data used should not be disclosed with the remuneration disclosures.

Please also note that for illustrative purposes the revaluation of long service balances required under AASB 119 is not included in the below examples but should be calculated and reflected in the disclosure. Each example builds on the previous example, adding an additional person with circumstances commonly found by entities completing this disclosure. The examples reference the underlying data used to compile the table, which is not a requirement of the disclosure. For example, see notes (a) and (b) in the table below.

Example 1

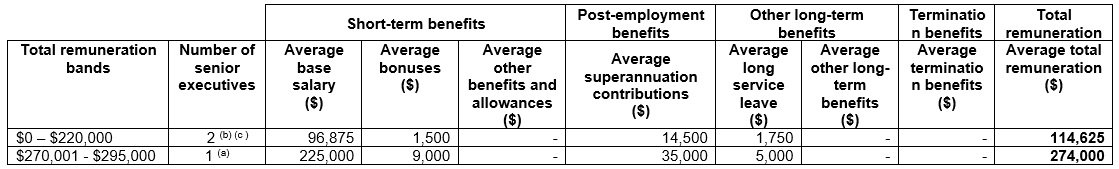

During the reporting period ended 30 June 20X1, Entity X had 2 senior executives, Mary and Bob.

- Mary worked full time for the entire financial year. Her annual salary is $245,000. In the reporting period Mary took 5 weeks annual leave ($24,000) and a period of long service leave ($15,000). She accrued 4 weeks annual leave (of $19,000) and a period of long service leave (of $5,000)2. Mary’s reportable base salary during the reporting period is $225,000, which comprises: ($206,000 salary while working plus $24,000 of annual leave taken plus the net movement in the annual leave provision (4 weeks accrual of $19,000 less leave paid of $24,000). Mary also earned a bonus of $9,000 for 20X1 and her employer superannuation contribution was $35,000. Mary’s total remuneration for the purpose of the senior executive remuneration table is $274,000 ($225,000 (base salary) plus $9,000 (bonus) plus $35,000 (superannuation) plus $5,000 (long service leave)3) putting her in the $270,001 - $295,000 remuneration band.

- Bob is part-time (0.7 full time equivalent) and worked for the entire reporting period. His part-time annual salary is $133,000 based on a

full-time annual salary of $190,000. Like Mary, Bob accrued 4 weeks annual leave ($10,000) and accrued a period of long service leave ($2,500). During the year Bob took 1 week’s annual leave ($7,500). Bob’s reportable base salary is $135,500 for the reporting period, which comprises: $125,500 salary while working plus annual leave taken ($7,500) and the net movement in the annual leave provision ($10,000 less $7,500). Bob also earned a bonus of $3,000 for 20X1 and his employer superannuation contribution was $21,000. Bob’s total remuneration for the purpose of the senior executive remuneration table is $162,000 ($135,500 (base salary) plus $3,000 (bonus) plus $21,000 (superannuation) plus $2,500 (long service leave)) putting him in the $0 - $220,000 remuneration band.

2 The amount of $5000 is a notional amount based on Mary’s entitlement as per the accrual methodology outlined in AASB 119.

3 The $5,000 included in Mary’s total remuneration (disclosed in the ‘Average long service leave’ column under the ‘Other Long-term benefits’ heading) equals the long service leave taken of $15,000 plus the negative movement in the long service leave provision of $10,000.

Entity X would present the following senior executive table in the body of its annual report for 20X0/20X1 in accordance with the PGPA Rule.

Example 2

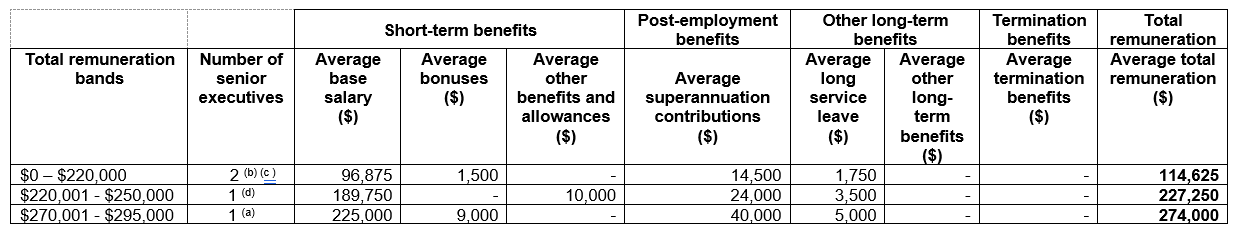

In this example, Entity X had 3 senior executives during the reporting period ended 30 June 20X1. This example builds on Example 1 and includes Vijay, who was acting as a senior executive during the reporting period. Please note that for illustrative purposes the revaluation of long service balances required under AASB 119 is not included but should be calculated and reflected in the disclosure.

- Vijay acted as a senior executive from 1 August 20X0 to 31 October 20X0 while his manager was seconded to another role. Vijay’s annual salary while acting was $215,000, which meant he was paid $53,750 while acting in a senior executive role. Vijay didn’t take any leave while acting and in this period accrued annual leave of $4,500 and long service of $1,000. Vijay’s reportable base salary for the reporting period is $58,250 which comprises: $53,250 salary while working plus $4,500 being the net movement in the annual leave provision. His employer superannuation contribution for the period of acting was $8,000. Vijay’s total remuneration for the purpose of the senior executive table while acting as a senior executive is therefore $67,250 ($58,250 (base salary) plus $8,000 (superannuation) plus $1,000 (long service leave)) putting him in the $0 - $220,000 remuneration band.

The average amounts for the relevant category are based on the number of senior executives within the relevant band, not the full time equivalent. As such, while Bob was part time and Vijay was acting for a period within the year, the average is calculated based on the 2 staff members. The following shows how the average base salary for Bob and Vijay, whose total remuneration was within the $0 - $220,000 remuneration band, is calculated:

| Senior Executives | Base Salary ($) | Bonus ($) | Other Benefits and Allowances ($) | Superannuation Contributions ($) | Long Service Leave ($) | Total ($) |

| Bob | 135,500 | 3,000 | - | 21,000 | 2,500 | 162,000 |

| Vijay | 58,250 | - | - | 8,000 | 1,000 | 67,250 |

| Total | 193,750 | 3,000 | - | 29,000 | 3,500 | 229,250 |

| Average based on number of staff | 96,875 | 1,500 | - | 14,500 | 1,750 | 114,625 |

Entity X would present the following senior executive table in the body of its annual report for 20X0/20X1 in accordance with the PGPA Rule.

Example 3

In this example, Entity X had 4 senior executives during the reporting period ended 30 June 20X1. This example builds on Example 2 and includes an additional senior executive, Chi, who spent a period of time as a KMP. Please note that for illustrative purposes the revaluation of long service balances required under AASB 119 is not included but should be calculated and reflected in the disclosure.

- Chi was in the role of a senior executive for the first 7 months of the year, until she moved into a KMP role for the remainder of the reporting year. She was paid $315,000 for the full reporting year, of which $183,750 was paid before she moved into the KMP role. Chi was paid $10,000 for annual leave taken before changing roles. Chi accrued 4 weeks annual leave and 1 week long service leave consistent with the other senior executives, pro-rated for her time as a senior executive, which equates to $16,000 for annual leave and $3,500 for long service. She also received employer superannuation contributions of $24,000. As part of Chi’s package, she also received a housing benefit of $10,000. Chi’s reportable base salary for the reporting period is $189,750 which comprises: $173,750 she received in salary while working plus $10,000 for the annual leave taken, plus $6,000 being the net movement in the annual leave provision ($16,000 less $10,000). Chi’s total remuneration for the purpose of the senior executive table while in the senior executive role is $227,250 ($189,750 (base salary) plus $10,000 (housing benefit) plus $24,000 (superannuation) plus $3,500 (long service leave)) putting Chi in the $220,001 - $245,000 remuneration band.

As Chi is included in the KMP table for the 5 month period that she qualified for that classification, her remuneration for the period as a KMP is excluded from the senior executive table.

Entity X would present the following senior executive table in the body of its annual report for 20X0/20X1 in accordance with the PGPA Rule.

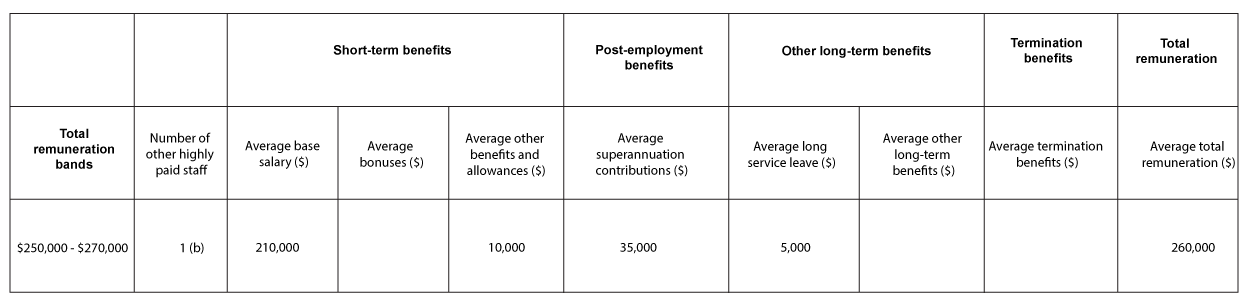

Other Highly Paid Staff remuneration reporting example

The following example demonstrates how the underlying data for other highly paid staff was prepared under this guidance. The examples include the underlying data (notes a) to c)) used to compile the table. It is not a requirement to disclose the underlying data in the annual report. Please also note that for illustrative purposes the revaluation of long service balances required under AASB 119 is not included but should be calculated and reflected in the disclosure.

Example

During the reporting period ended 30 June 2024 Entity X had 2 other highly paid staff – Tom and Davina.

- Tom is full time and worked for the entire reporting period. His annual salary was $190,000. He accrued 4 weeks annual leave ($15,000) and a period of long service leave ($4,000). Tom was paid $5,000 for annual leave taken. Tom’s reportable base salary is $200,000 which comprises: $185,000 he received while working plus $5,000 annual leave taken during the year plus the net movement in the annual leave provision ($15,000 in accrued annual leave less $5,000 annual leave taken). Tom’s employer superannuation contributions were $30,000. Tom’s total remuneration for the purpose of the other highly paid staff table is $234,000 ($200,000 (base salary) plus $30,000 (superannuation) plus $4,000 (long service leave)) putting Tom under the reporting threshold band of $250,000.

- Davina is full time and worked for the entire reporting period. Her annual salary was $215,000. She accrued 4 weeks annual leave ($17,000) and a period of long service leave ($5,000). Davina was paid $22,000 for annual leave taken. Davina was also provided with a housing benefit of $10,000 and employer superannuation contributions of $35,000. Davina’s reportable base salary is $210,000 which comprises: $193,000 she received while working plus $22,000 leave taken during the year plus the movement in the annual leave provision ($17,000 accrued annual leave less $22,000 in annual leave taken). Davina’s total remuneration for the purpose of the other highly paid staff table is $260,000 ($210,000 (base salary) plus $35,000 (superannuation) plus $10,000 (housing benefit) plus $5,000 (long service leave)) putting her in the $250,000 - $270,000 reporting band.

The average amounts for the relevant category are based on the number of other highly paid staff within the relevant band. The following shows how Davina’s total remuneration is reported in the $250,000 - $270,000 band.

Entity X would present the following other highly paid staff table in its annual report for 2023–2024 in accordance with the PGPA Rule.

Note that the first total remuneration band in the table below ($250,000 - $270,000) reflects the updated threshold remuneration amount for the 2023–24 reporting period.

Separate reporting of Overseas Housing Benefits and Allowances Example

The following table demonstrates how overseas housing benefits and allowances can be disclosed as a separate component of ‘Other benefits and allowances’ and as a separate component of Total remuneration in the body of the annual report.

Entities should only adopt this additional disclosure where the reporting of total remuneration is distorted in view of the quantum and/or nature of these particular benefits and allowances.

[Name of entity] provides accommodation for staff and their families while posted overseas. While staff benefit from these arrangements, they do not receive direct remuneration for rental costs and the value of the accommodation allowances is determined by the location of each posting rather than the work or personal circumstances of individual staff. The value of housing allowances reported in the table above generally reflects the high property costs in many of the overseas locations where staff are posted. In these circumstances the total value of an individual staff member’s total remuneration is impacted by the value of the overseas housing benefits and allowances paid on behalf of the staff member and the table above is reported to enable a fuller understanding of the extent of this impact while still reporting the total remuneration of each relevant staff member as required by the disclosure requirements of the PGPA Rule.