This section discusses the performance information reported by Commonwealth entities that produce Portfolio Additional Estimate Statements (PAES).

Purpose of PAES

PAES provide information to Parliament and other users on updated entity revenue and expenditure estimates for the Budget year and reflect changes since the Budget. PAES should be considered as a supplement to the Portfolio Budget Statements (PBS), explaining subsequent changes to Budget estimates as they appear in the Additional Estimates Appropriation Bills No. 3 and/or 4 or Appropriation (Parliamentary Departments) Bill (No. 2).

Not all entities prepare a PAES. Only those entities which receive an appropriation through Appropriation Bill 3 and/or 4 or Appropriation (Parliamentary Departments) Bill (No. 2) are required to prepare a PAES.

For further information and guides to preparing PAES, refer to Portfolio Budget Statements.

Performance information reportable in PAES

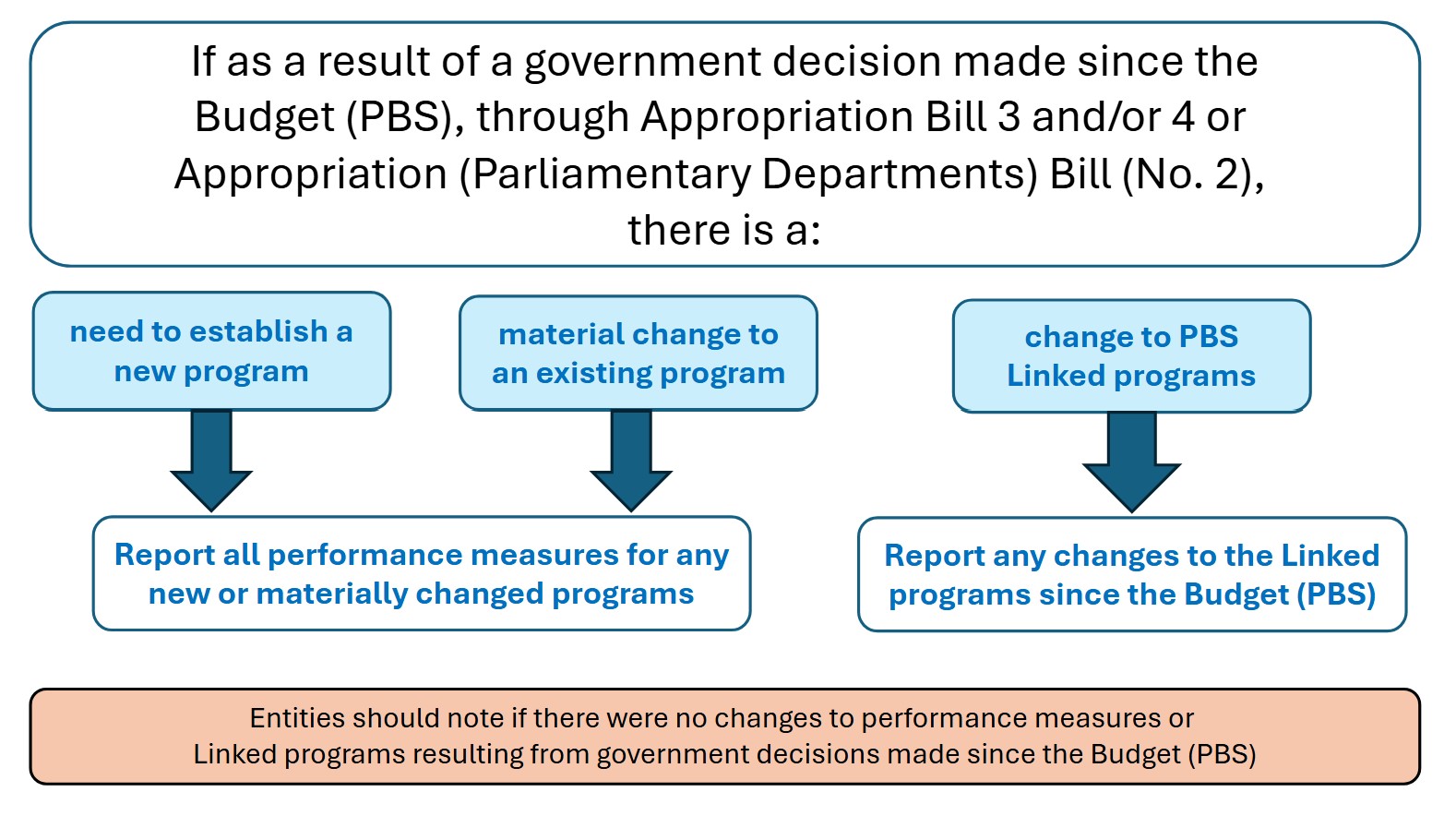

If your entity is required to prepare a PAES, performance information should only be provided in PAES where government decisions made since the Budget (PBS) results in a:

- need to establish a new program

- material change to an existing program

- change to PBS Linked programs.

Reporting new or materially changed programs

In the context of PAES, Direction 3 requires an entity to report all performance information for any new or materially changed programs resulting from government decisions made since the Budget (PBS).

The provision of performance information in PAES should follow the relevant requirements of the Finance Secretary Direction. It is Finance’s preference that the PAES performance reporting table available under Tools and templates is used for reporting performance information in PAES so that performance information is provided to Parliament in a consistent and comparable manner to the PBS. Please note, the PAES performance reporting template typically only includes the planned performance results as the expected performance results will have been reported in the corresponding (earlier) PBS.

For information on how to report new programs and determine if a material change has been made to an existing program, refer to Direction 3: New or materially changed programs and the Guide to preparing the PAES (available under Tools and templates).

For information on preparing annual performance statements in the context of reporting on performance measures in Budget Statements, including the PBS and PAES, refer to RMG-134 Annual performance statements for Commonwealth entities.

If there were no changes to performance measures resulting from government decisions made since the Budget (PBS), entities should note this in line with wording in the example below.

Source: 2024–25 Australian Skills Quality Authority PAES (page 67).

Varying existing performance information

PAES should not be used to change existing performance information or introduce new performance information for existing programs. This should be done in the following PBS and corporate plan.

There is capacity provided by section 16E(5) of the PGPA Rule to vary the current corporate plan if the accountable authority of an entity considers the variation to be significant. For further information on varying a corporate plan see RMG-132 Corporate plans for Commonwealth entities.

Please email PGPA@finance.gov.au for advice if you are considering a variation to your corporate plan.

Linked programs in PAES

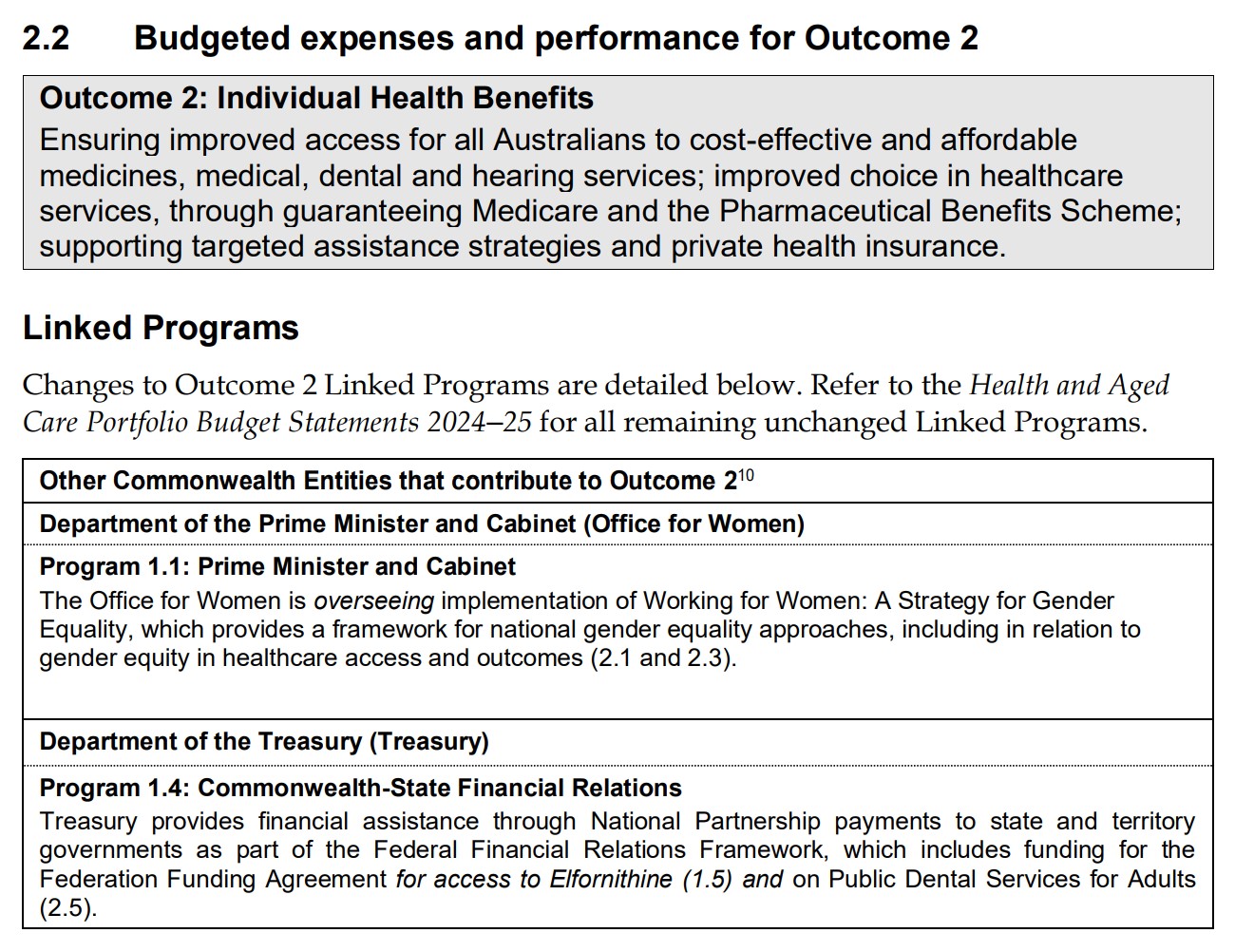

Entities are only required to publish changes to their Linked programs, under each Outcome, if the Linked programs changed as a result of government decisions made since the Budget (PBS).

If any changes to Linked programs occurred as a result of government decisions made since the Budget (PBS), entities should note:

- the changes to the Linked programs detailed below are a result of government decisions made since the Budget (PBS)

- refer to their entity's 2025–26 PBS for all remaining unchanged Linked programs.

Source: 2024–25 Department of Health and Aged Care PAES (page 49)

If no changes to Linked programs occurred as a result of government decisions made since the Budget (PBS), entities should note this in line with the wording in the example below.

Source: 2024–25 Australian Communications and Media Authority PAES (page 83)

For more information on Linked programs, refer to Direction 5: Linked programs and the Guide to preparing the PAES (available under Tools and templates).