Introduction

- The Australian Government seeks to achieve benefits for the Australian community primarily through programs that:

- deliver benefits, services or transfer payments to individuals, organisations or the community as a whole, and/or policy advice to inform government decisions

- are defined by a Commonwealth entity and company in annual appropriation Acts and portfolio budget statements (PB statements)

- are comprised of activities or groups of activities

- are delivered by government entities.

- Outcome statements articulate the intended results, activities and target group of an Australian Government entity.

Outcome statements within the Budget process

- Entities receive resources either directly or via portfolio departments, through:

- annual appropriations Acts

- special appropriations (including standing appropriations and special accounts)

- revenue from other sources.

- Outcomes are the results, impacts or consequences of a purpose or activity as defined in the annual appropriation Acts and the portfolio budget statements (PB statements), by a Commonwealth entity and company. Outcome statements articulate the intended results, activities and target group of an Australian Government entity.

- Within the Budget process, outcome statements:

- provide the basis for the appropriation of Commonwealth money to an entity

- articulate the intended results, activities and target group of the entity

- provide the basis for assessing and reporting on the performance of the entity and the programs it delivers.

- All entities within the general government sector (GGS) must have at least one outcome statement to allow them to receive appropriations and report their performance. This excludes Commonwealth entities classified in Government Financial Statistics as public finance corporations or public non-financial corporations – these are not part of the GGS.

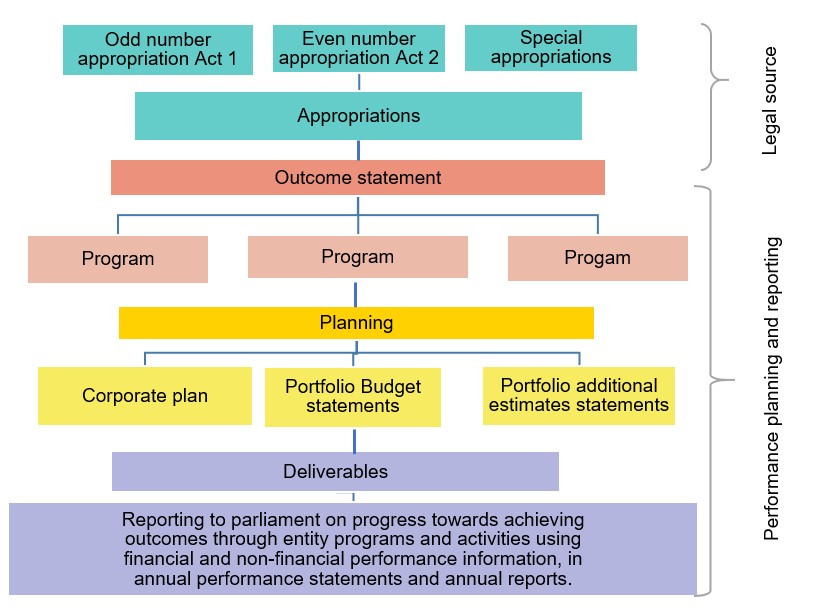

- For a diagram of the connection between outcome statements in the Budget process, resource management and performance frameworks, see Figure 1.

Outcome statements in the portfolio budget statements

- Under section 12 of the Charter of Budget Honesty Act 1998, entities within the GGS are part of the Commonwealth general government sector fiscal estimates and are required to produce PB statements which:

- are tabled in parliament on Budget night (as budget-related papers) as part of the suite of information the government provides to describe Budget appropriations

- inform parliamentarians and the public of the proposed allocation of resources to government outcomes

- assist Senate standing committees with their examination of the government's Budget.

- PB statements show linked programs and include information about each program that is intended to contribute to achieving the result specified in the outcome statement.

- Within the PB statements, outcome statements form part of a broader reporting framework to inform those outside of the entities with an interest in government performance, such as:

- ministers

- parliamentarians

- external accountability bodies (eg the Auditor-General)

- the public.

- For more information on the development of PB statements, see Guide to preparing the Portfolio Budget statements.

Outcomes statements and resource management

- The use and management of public resources by officials in the Commonwealth public sector is governed by the Commonwealth resource management framework – see Managing Commonwealth Resources.

- Entities apply resources (eg funding, human resources, capital equipment) to actions and processes that generate products and services. These resources include:

- the funds appropriated to entities through the annual Budget

- revenue from other sources, such as receipts for services delivered, sales, levies and industry contributions.

- In the resource management framework, outcome statements:

- explain and control the purposes of annual appropriations

- provide a basis for annual budgeting

- provide a basis for reporting on the financial performance of entities – against the use of appropriated funds.

Outcomes statements in the performance framework

- PB statements, entity-based corporate plans and annual performance statements are the three key components of the Commonwealth performance framework.

- Annual performance statements are included within entity annual reports to acquit actual performance against the planned performance (as described in the entity's corporate plan and PB statements).

- Performance information described in PB statements should:

- easily relate to the expectation created by the relevant outcome statement

- provide readers with a sense of the information that is likely to be useful in assessing whether a specific outcome is delivered satisfactorily

- provide a basis for measuring, assessing and reporting on the non-financial performance of entities or programs, in contributing to government policy objectives.

Figure 1: Outcome statements in Budget processes and the performance framework

Creating or changing outcome statements

- Changes to an existing outcome statement, or a new outcome statement, may be required when:

- an entity undertakes a new program, or has programs transferred to it, and that program is not adequately described in the entity's existing outcome statements

- policy objectives, strategies or intended results for entity actions are refined or need to be clarified

- a new entity is established

- an existing function is transferred from one entity to another entity, through a machinery of government (MoG) change, and the program description is no longer required.

- Once appropriations bills are passed by the parliament, there are no administrative mechanisms to amend outcome statements (except where a MoG change occurs).

- As a general principle, entities should only amend outcome statements or structure at the start of each new financial year to:

- avoid having dual outcomes statements or structures in the same financial year

- minimise the risk of an entity drawing down funds without a valid appropriation, which would be a breach of section 83 of the Constitution.

- Where an entity chooses to amend its outcome statements or structure part way through the year, the entity must take care to ensure appropriate records are maintained and any funds drawn down were used for the purposes of the relevant outcome.

- Importantly, where an entity does get agreement to amend its outcome statements the change will not take effect until new appropriation bills reflecting the amendments have received royal assent.

How to write an outcome statement

- Outcome statements are usually a single and relatively short sentence or statement that:

- provides an immediate impression of what success looks like and that articulates:

- what the government wants to achieve (i.e. outcomes)

- the activities that the government plans to undertake to achieve the outcome (i.e. programs and activities)

- how the government plans to monitor its progress towards achieving the outcome, for performance reporting.

- clearly states the purpose of the appropriation (i.e. specific, focused and precise)

- is succinct and easy to understand.

- provides an immediate impression of what success looks like and that articulates:

- Each outcome statement must include wording that:

- identifies the intended result(s) of the entity – the intended result(s) must:

- have identified performance objectives against which the intended results are capable of being measured

- be distilled from the government's international and domestic policy goals, objectives for the department or entity, and the government's expectations of what the entity is to achieve

- specifies the target group(s) where the group is narrower than ‘Australia' or ‘Australians' – however, the target group(s):

- does not need to be specified if it is implied that the outcome benefits Australians generally

- should only be defined by the entity where it is clear that the results will only relate to that group and no others

- specifies the activities to be undertaken by the entity that will contribute to the achievement of the intended result(s) – these:

- are the broad activities the government or entity will undertake to bring about the intended result

- describe the major actions, policy processes, events or business processes undertaken to bring about the intended result for the target group. Care is needed to not unduly limit the specified range of actions.

- identifies the intended result(s) of the entity – the intended result(s) must:

- Outcome statements should typically be set out as follows:

[Intended result] for [target group] through [activities/actions] or

[Intended result] through [activities/actions] for [target group]

[Intended result] through [activities/actions] for [target group]

Drafting tips

- When drafting an outcome statement, ensure the wording:

- is specific enough to form a valid appropriation – is not too abstract to be without meaning

- does not unnecessarily restrict the purpose for which the entity can spend money – entities may find they cannot spent money in relation to an administered appropriation if an outcome statement is so specific that is inappropriately limits expenditure under that outcome

- encompasses actions that may arise during the year – so that these are covered by the appropriation

- is inclusive – rather than exhaustively defining the actions the entity will undertake.

- Take care in drafting outcome statements and ensure you:

- avoid words that are not clearly defined, or are ambiguous or generic – for example, words or phrases like:

- ‘in line with community views' are not sufficiently clear as they do not specify which community or how their views will be identified. Only use such phrases where the term is clearly defined

- 'young people' is ambiguous as it does not define the age group

- avoid being subjective – words or phrases like 'higher quality' and ‘enhanced' are subjective so such terms should only be used where the entity provides a reference to factors that can be measured

- avoid being overly ambitious – words or phrases like ‘worldwide appeal' and ‘economic advantage' are overly-ambitious so such terms should only be used where the term is clearly defined

- do not include multiple purposes or use technical or difficult language.

- avoid words that are not clearly defined, or are ambiguous or generic – for example, words or phrases like:

- Outcome statements should be written in accordance with the standard for Australian Government writing and editing – see the Style Manual.

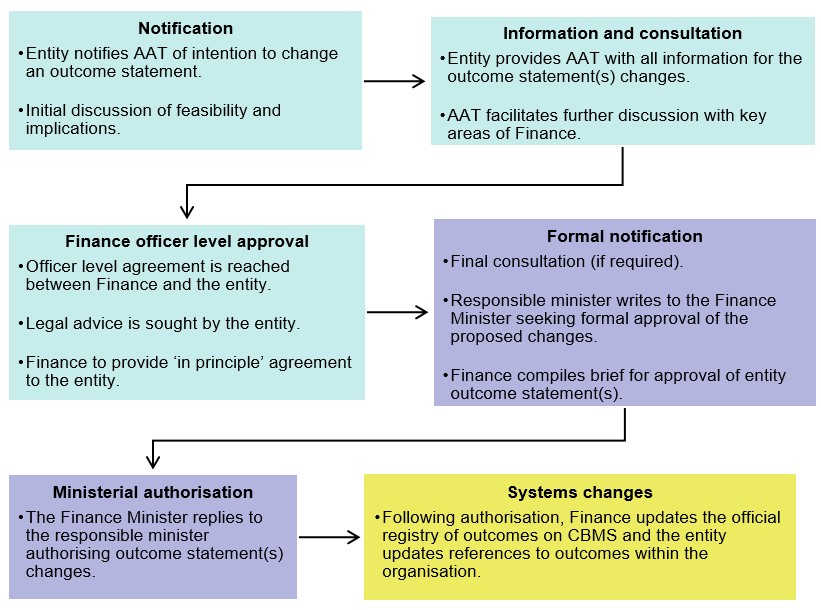

Approval process for outcome statements

- The Minister for Finance (Finance Minister) must approve all outcome statements. The Department of Finance will brief the Finance Minister on the proposed outcome statement(s) and prepare correspondence to the responsible minister approving the outcome statement(s).

- Changes to outcome statements:

- should be finalised before February each year – to allow adequate time to complete the approval processes and for the revised outcome statement(s) to be reflected in Budget documentation and the Central Budget Management System (CBMS)

- that result from a change in government policy or a MoG change may be required at any time of the year.

- When seeking new or amended outcome statement(s) the following steps should be followed:

- entities should contact the Annual Appropriations Team (AAT) in Finance and provide details of the proposed outcome statement(s). The minimum information required is:

- background information on the reason for the change (e.g. key announcements that support a change in policy or direction for the entity)

- proposed wording of new or amended outcome statement(s)

- materiality of old and proposed outcomes

- mapping of the proposed outcome to programs and appropriations for incorporation into CBMS.

- the AAT will then undertake a preliminary assessment of the proposed outcome statements, against the three key principles in paragraph 24, and if approved advise the entity to seek legal advice

- following legal advice to confirm that the proposed new or amended outcome statement(s) describe(s) a purpose fit for an appropriation, the AAT will provide ‘in principle' agreement

- the responsible minister then writes to the Finance Minister, seeking formal approval of the proposed changes.

- entities should contact the Annual Appropriations Team (AAT) in Finance and provide details of the proposed outcome statement(s). The minimum information required is:

Figure 2: Approval process for outcome statements

- For more information on outcome statement policy and approval arrangements, email the relevant Agency Advice Unit or annual.appropriations@finance.gov.au.

Appendix A: Glossary

| Activities | The actions and/or efforts performed by a Commonwealth entity or Commonwealth company to deliver government objectives and achieve desired results. |

| Administered | Those administered by a non-corporate entity on behalf of the Government (eg certain grants, benefits and transfer payments). These payments are usually made pursuant to eligibility rules and conditions established by the government or the parliament. Specifically, administered items are tied to outcomes (departmental items are not). |

| Annual appropriations | Annual funding, provided by annual appropriation Acts, to Commonwealth entities to carry out Commonwealth outcomes and programs and also for investment in assets or reduction in liabilities. |

| Appropriation | A law of the Australian Parliament that provides authority for Commonwealth entities to spend money from the CRF for a particular purpose. Entities may not spend money without an appropriation authorising that expenditure and, where necessary, other legislation authorising the specified purpose. |

| Corporate plan | The primary planning document of a Commonwealth entity that sets out the purposes of the entity, the actions it will undertake to achieve its purposes and the results it expects to achieve over a minimum four-year period – see the Commonwealth performance framework. |

| Departmental items | Involve costs over which a non-corporate entity has control. Departmental appropriations can be used to make any payment related to the functions of the non-corporate entity including on purposes covered by other items whether or not they are in the Act for an entity. |

| Entity | A non-corporate Commonwealth entity or corporate Commonwealth entity as defined by the Public Governance, Performance and Accountability Act 2013. |

| General government sector (GGS) | Institutional sector comprising all government units and non-profit institutions controlled and mainly financed by government, as set out in the Australian System of Government Finance Statistics. |

| Portfolio additional estimates statements (PAES) | Like PB statements, PAES inform senators, members of parliament and the public of the proposed allocation of resources to government outcomes by agencies within the relevant portfolio. While the PAES include an agency resource statement to inform parliament of the revised estimate of the total resources available to an agency, the focus of the PAES is on explaining the changes in resourcing since the Budget. As such, the PAES provides information on new measures and their impact on the financial and non-financial planned performance of agencies. |

| Public financial corporations | Government controlled corporations and quasi‑corporations mainly engaged in financial intermediation or provision of auxiliary financial services – see ABS Government Financial Statistics Manual and the PGPA Flipchart and List. |

| Public non-financial corporations | Resident government controlled corporations and quasi-corporations mainly engaged in the production of market goods and/or non-financial services – see ABS Government Financial Statistics Manual and the PGPA Flipchart and List. |

| Special appropriation | Authority within an Act (other than an annual appropriation Act) to spend money from the CRF for particular purposes. The Social Security (Administration) Act 1999, for example, contains several special appropriations to make social security payments. Special appropriations support around 80 per cent of all government expenditure each year. |

Download