Definition of other highly paid staff

Definition of other highly paid staff (OHPS) are officials of a Commonwealth entity:

- who are neither key management personnel (KMP) nor senior executives, and

- whose total remuneration exceeds the threshold remuneration amount for the reporting period.

How to determine who are other highly paid staff

The threshold remuneration for OHPS is $250,000 for entities with a reporting period that begins on:

- 1 July 2023 and ends on or before 30 June 2024 (financial year reporting - standard)

- 1 January 2024 and ends on or before 31 December 2024 (calendar year reporting).

In later financial years, the threshold remuneration amount is adjusted based on an indexation factor outlined in the PGPA Rule (section 4A). Finance will provide advice of any new threshold (generally around March each year), following the release of the relevant Wage Price Index data by the Australian Bureau of Statistics.

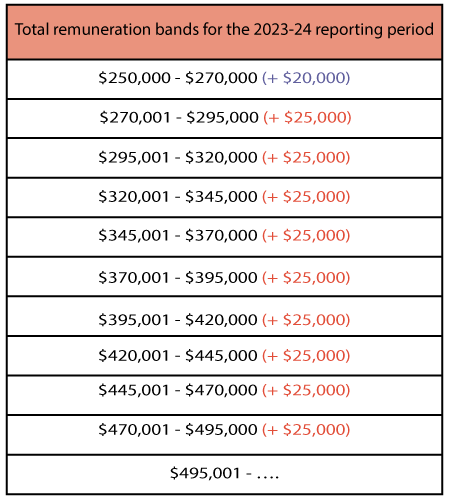

The remuneration information for OHPS for the 2023-24 reporting period is presented in total bands of $25,000 except for the first band, which is $250,000 to $270,000.

A total remuneration bands table is below.

Refer to Employment arrangements to include in disclosure tables for further detail on how to determine individuals to include in the executive remunerating reporting.

What to report under OHPS executive remuneration

OHPS remuneration information must be reported in accordance with the OHPS table in Schedule 3 of the PGPA Rule. This table reports the average total remuneration of OHPS who received remuneration above the threshold remuneration amount during the reporting period. The threshold for 2023-24 Annual Report period for OHPS is $250,000.

For the OHPS of the entity, the following must be included:

The Digital Annual Reporting Tool reporting table for OHPS is prepopulated with the appropriate threshold bands and the information above in the format required by the OHPS table in Schedule 3 of the PGPA Rule.

Entities should complete the data templates within the Digital Annual Reporting Tool to ensure that the correct information is being reported.

Please refer to How to calculate & report for further details on this and general requirements on each remuneration category.