Central Banking

The Commonwealth’s central bank account, under subsection 53(3) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), must be maintained with the Reserve Bank of Australia (RBA).

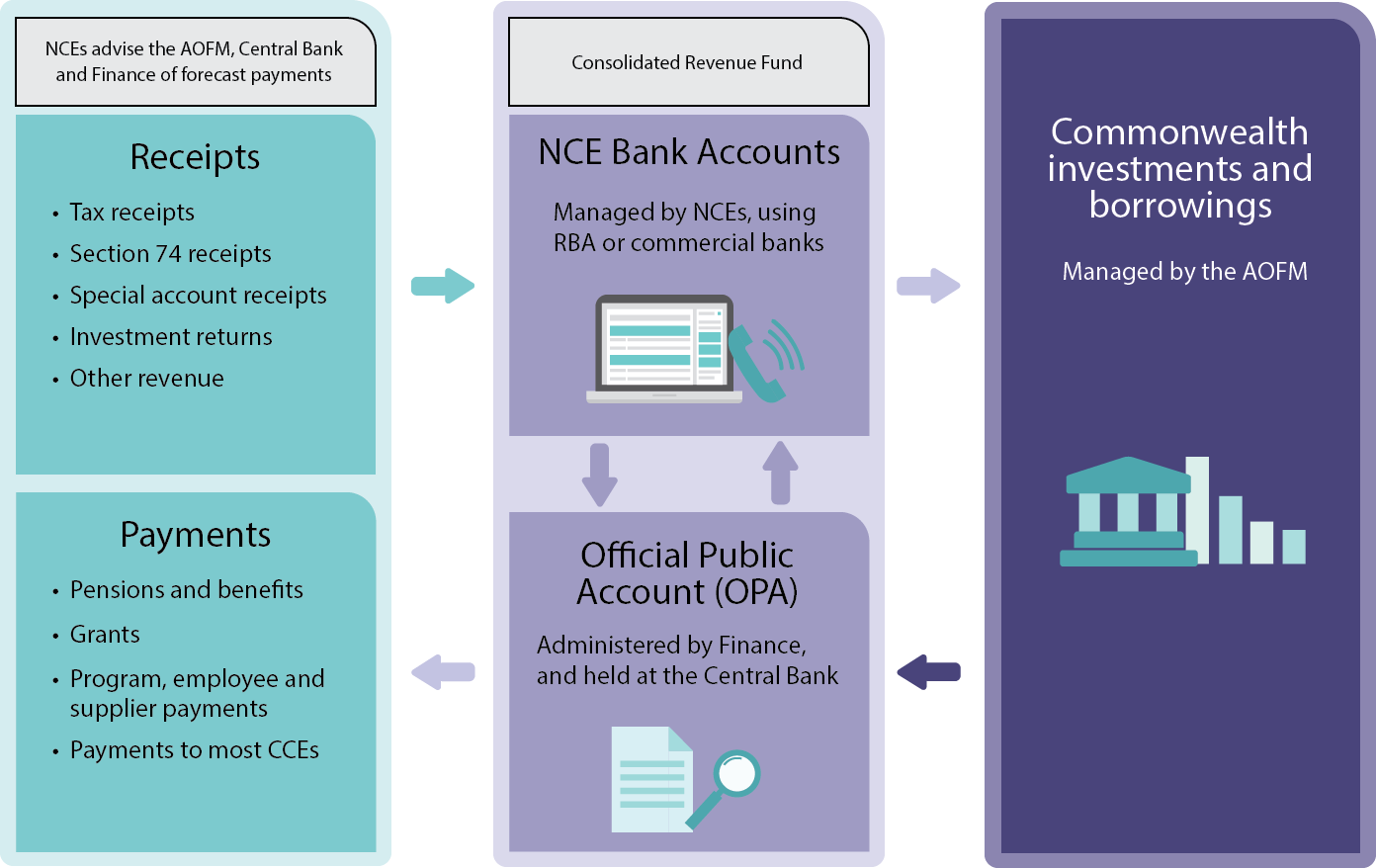

Central banking includes managing the daily consolidation of Australian Government cash in the Official Public Account (OPA) and transferring cash from the OPA to entity bank accounts.

The RBA provides a facility to manage the OPA Group, the aggregate balance of which represents the Commonwealth's daily cash position. Finance manages this facility on behalf of the Australian Government.

Central Cash Management

Central cash management involves the overnight consolidation and investment of whole of government bank account balances, including the bank account balances of all non-corporate Commonwealth entity (NCEs) and specific corporate Commonwealth entity (CCEs). Through this process, government funds are consolidated each night in the OPA Group, which includes the OPA (central bank account).

Under the Finance Minister’s Delegations (Schedule 1: Part 1: Division 2 Paragraph 1.3), any agreements between Commonwealth entities and their transactional banks must have processes in place to ensure all Commonwealth cash in Australia be consolidated each day within the OPA held with the RBA. This includes compliance with specific sweeping, transfer and reporting requirements as set out in the Commonwealth banking agreement between the Australian Government (represented by Finance) and authorised transactional banks.

The diagram below illustrates the cash flow connectivity between NCE bank accounts, the OPA, the RBA and the Australian Office of Financial Management (AOFM).

Central cash management roles

The following entities have central cash management roles:

- The AOFM, in the Treasury portfolio, is responsible for ensuring the government’s cash needs are met and is required, by ministerial direction, to maintain a cash balance in the OPA Group. The AOFM achieves this by:

- managing government debt and investment

- issuing Treasury bonds and Treasury notes to fund the government’s cash needs

- investing cash in short-term investments.

- Finance transfers amounts from the OPA at the request of entities (and in compliance with the Appropriation Acts) to their transactional bank accounts, to meet their cash requirements. Finance also monitors the implementation of related government policies.

- The RBA oversees the Australian payments system, which encompasses a wide variety of individual payment methods. These methods include electronic funds transfer between bank accounts, payment cards, cheques and high-value corporate payments.

All entities manage cash to make payments and receipt cash they receive. Bank accounts are used to manage payments and receipts.

Interbank cash transfers

The RBA maintains the OPA and also:

- holds Exchange Settlement Accounts (ESA) for authorised deposit-taking institution (ADIs)

- owns and operates the Reserve Bank Information and Transfer System (RITS) through which transactions across ESAs occur.

When an entity maintains a bank account with an ADI other than the RBA, a cash transfer between that ADI’s ESA and the RBA’s ESA is an interbank cash transfer. Interbank payment obligations in Australia are settled using RITS.

RITS payments are settled on a real-time gross settlement basis, with processing and settlement taking place in real time (continuously).

Central Budget Management System

The Central Budget Management System (CBMS) is used to manage the flow of financial information between Finance and entities to facilitate cash and appropriation management, the preparation of budget documentation and financial reporting.

Finance transfers money from the OPA to the entity’s bank account.

For cash to be made available to an entity, the entity must submit a request in CBMS for cash against a specific appropriation.