General assumptions:

- full departmental appropriation revenue, excluding DCBs, is recognised at the beginning of the financial year, consistent with Appropriation Acts

- legally valid appropriation

- legislated purpose (that is, legislation supporting a program), supported by a head of Commonwealth power or the Constitution

- no goods and services tax (GST) unless stated otherwise

- account codes used in the illustrative examples reference the Australian Equivalents to International Financial Reporting Standards (AEIFRS) account codes used in the Central Budget Management System (CBMS) chart of accounts, noting that this guide is prepared at a point in time so NCEs should refer to the latest version.

- journals for recoverable GST assume that all:

- payments of GST are drawn from the annual departmental operating appropriation

- GST refunds from the ATO are retained as Public Governance, Performance and Accountability Act 2013 (PGPA Act) section 74 retainable receipts.

D1 Recognition

Scenario

Appropriation Act (No. 1) appropriates $50M as departmental operating appropriation (excluding DCB) to the NCE. A further $5M in DCB was formally designated as contributions by owners (equity).

Journal entries

01.07.X2 | Debit | Credit |

|---|---|---|

| Dr 5233029 Appropriations receivable | $50M | |

| Cr 1280004 Price of outputs (agreed) | $50M | |

| Recognise departmental operating appropriation |

01.07.X2 | Debit | Credit |

|---|---|---|

| Dr 5233030 Appropriations receivable – Contributed Equity | $5M | |

| Cr 4100003 Contributed Equity – 7209 Injection for Departmental Capital Budget | $5M | |

| Recognise DCB |

CBMS record – Cash Management (CM) module

Budget amounts appropriated under Appropriation Act (No. 1) are made available by Finance in the CBMS CM module on the later of the:

- date the appropriation commences as an Act, and/or

- commencement of the financial period the appropriation relates to.

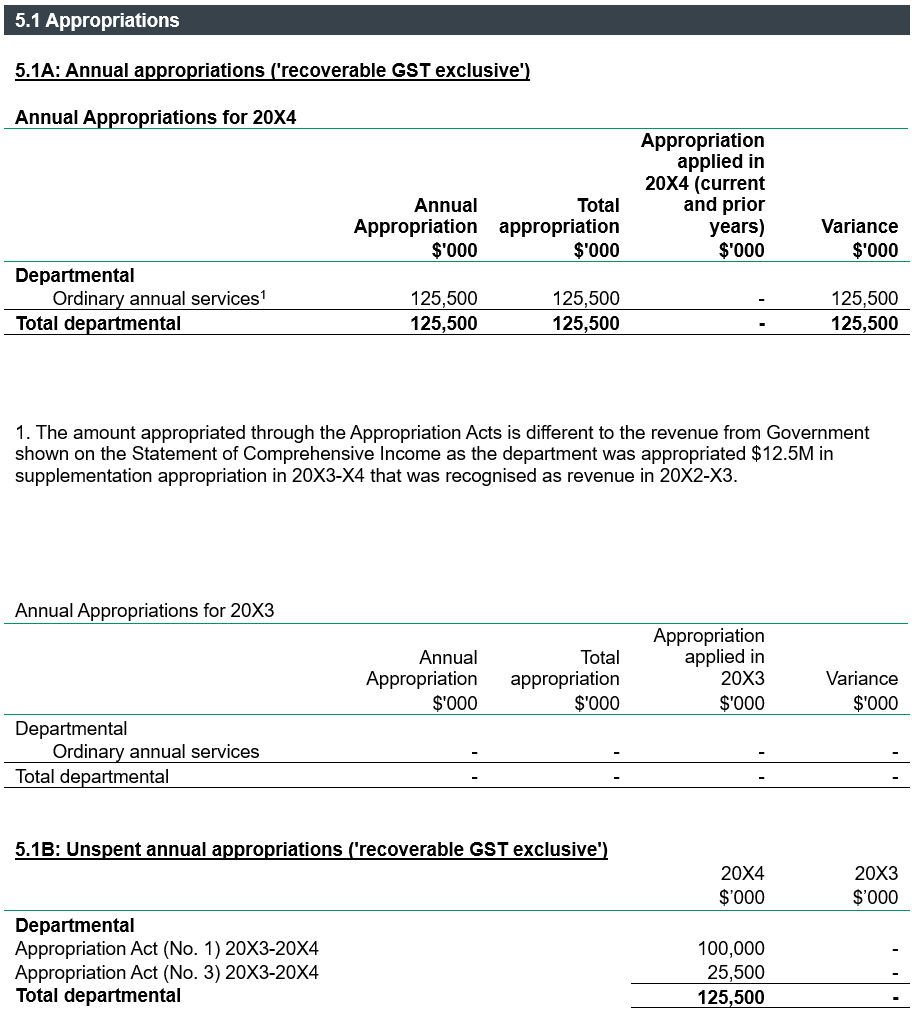

Financial Statements Disclosure

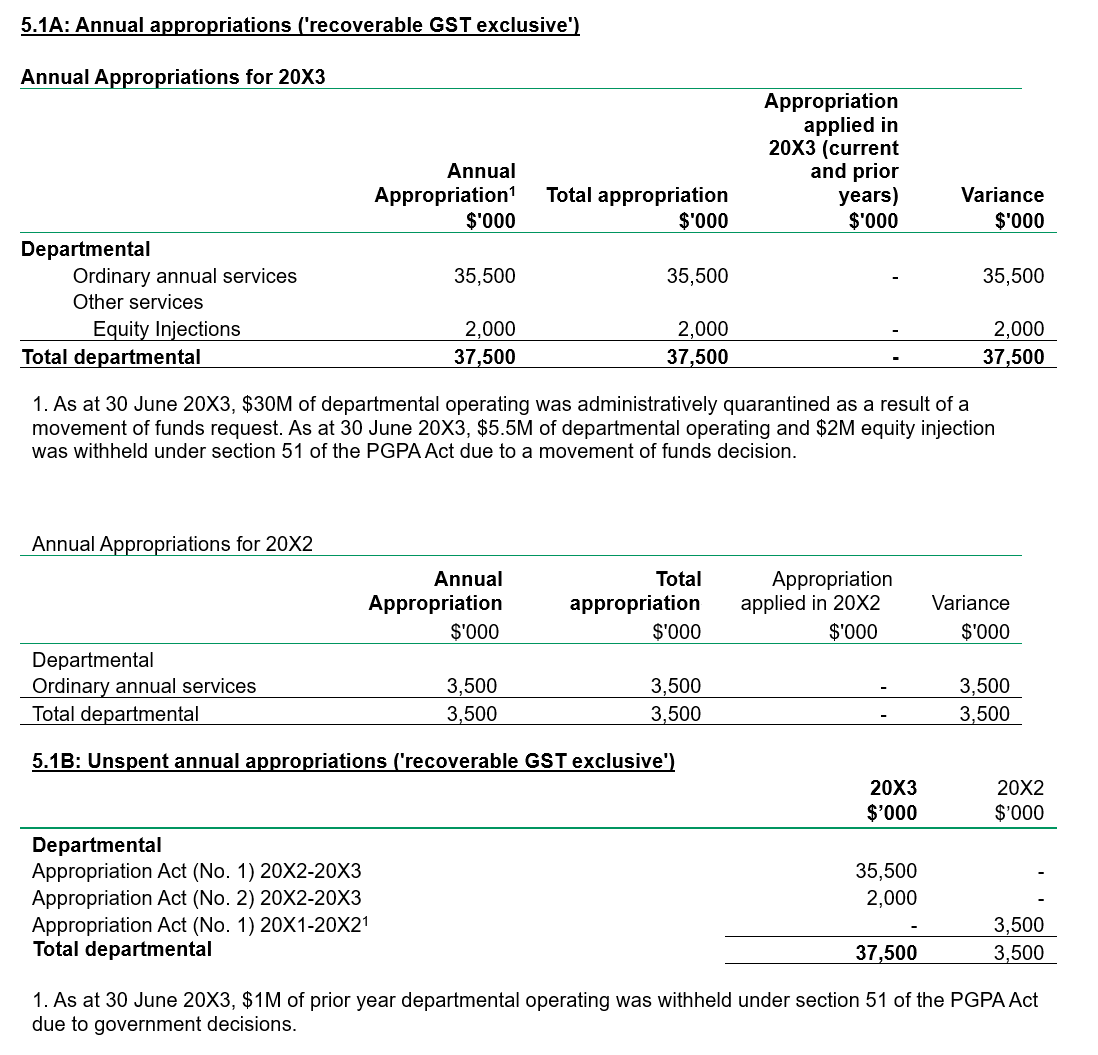

D2 Quarantines and withheld amounts (PGPA Act section 51)

Scenario

On 1 February, Finance administratively quarantined $30M of the NCE’s current year departmental operating appropriation in CBMS. On 6 March, the Finance Minister withheld the following under section 51 of the PGPA Act:

- $5.5M current year (20X2-20X3) departmental operating appropriation

- $3.5M prior year (20X1-20X2) departmental operating appropriation

- $2M current year equity injections.

On 20 June, the Finance Minister reversed the amount previously withheld under PGPA Act section 51 – being $2.5M prior year departmental operating appropriation.

Journal entries

06.03.X3 | Debit | Credit |

|---|---|---|

| Dr 1280004 Price outputs (agreed) | $5.5M | |

| Cr 5233029 Appropriations receivable | $5.5M | |

| Record PGPA Act section 51 amount withheld – current year operating |

| 06.03.X3 | Debit | Credit |

|---|---|---|

| Dr 4100001 Accumulated results – 7592 Cash transfers to the OPA | $3.5M | |

| Cr 5233029 Appropriations receivable | $3.5M | |

| Record PGPA Act section 51 amount withheld – prior year operating |

| 06.03.X3 | Debit | Credit |

|---|---|---|

| Dr 4100003 Contributed Equity – 7206 Equity injection – appropriation | $2M | |

| Cr 5233030 Appropriations receivable – Contributed Equity | $2M | |

| Record PGPA Act section 51 amount withheld – current year equity |

| 20.06.X3 | Debit | Credit |

|---|---|---|

| Dr 5233029 Appropriations receivable | $2.5M | |

| Cr 4100001 Accumulated results – 7592 Cash transfers to the OPA | $2.5M | |

| Record PGPA Act section 51 reversal – prior year operating |

Note: Amounts withheld under PGPA Act section 51 result in loss of control of the appropriation. Prior year operating funds over which an entity relinquishes control are to be accounted for as departmental equity returns, against accumulated results (whereas prior year capital funds should be accounted for as equity returns against contributed equity). By contrast, loss of control over current year operating funds is adjusted against appropriation revenue and appropriations receivable.

Note that no journal entry is required on 1 February as the $30M quarantine is administrative in nature and does not result in loss of control of the appropriation.

CBMS record – CM module

Withholding of amounts against an appropriation, including reversals of previously withheld amounts, are processed by Finance as “S51 withholding” adjustments in the CBMS CM module – these are processed with the effective date specified in the signed direction. Amounts withheld under section 51 of the PGPA Act continue to be included as legally available appropriation under section 40 of the FRR.

Under sections 43 and 45 of the FRR, in the annual appropriations notes, the entity is to state reasons for amounts of current and prior year annual appropriation being withheld under section 51 of the PGPA Act and/or quarantined for administrative purposes for each appropriation Act that is still legally in force (annual Appropriation Acts remain in force up to three years after commencement) as of 30 June. Amounts withheld or administrative quarantined do not need to be disclosed by each individual direction/item – entities should disclose total net amounts withheld and/or administrative quarantined by Act.

Financial Statements Disclosure

D3 Adjustments

D3.1 Re-crediting of repayments (PGPA Act section 74)

Scenario

On 5 July, the NCE paid $250 to XYZ for stationery supplies. On 31 July (within the same financial year):

- XYZ advised the NCE that it had overpaid for the stationery

- XYZ refunded $50 to the NCE

- the NCE transferred $50 to the OPA.

Journal entries

05.07.X2 | Debit | Credit |

|---|---|---|

| Dr 5220002 Cash at bank | $250 | |

| Cr 5233029 Appropriations receivable | $250 | |

| Drawdown from OPA to make the purchase | ||

| Dr 2230098 Other supplier expenses | $250 | |

| Cr 5220002 Cash at bank | $250 | |

| Record purchase of stationery supplies |

31.07.X2 | Debit | Credit |

|---|---|---|

| Dr 5220002 Cash at bank | $50 | |

| Cr 2230098 Other supplier expenses | $50 | |

| Reduce stationery expenses by the amount refunded (see note below) | ||

| Dr 5233029 Appropriations receivable | $50 | |

| Cr 5220002 Cash at bank | $50 | |

| Transfer cash to OPA* |

Note: As the repayment occurred in the same financial year, it is credited against the original account code from which the payment was expensed. Where an amount is paid in error and recovered in a future financial year, it should be recorded as departmental revenue in the year the cash is received.

The repayment is credited to the original appropriation item from which the payment was made. Where repayments are received and the original payments were in a prior year, the repayments should be credited back to the original appropriations, so long as those appropriation Acts are still in force. If they have been repealed, any repayments must be returned to the OPA as administered receipts. For more information on repayments, see RMG-307.

CBMS record – CM module

Process a standard NPP departmental drawdown in the CM module for payment date of 5 July. Include the following naming conventions in the description:

- Description or similar: NCE acronym, Dept, 5 July

- Program: Program X

- Budget Year: 20X3

- Appropriation: Appropriation Act (No. 1) - operating

- Amount: $250

Process a standard receipt in the CM module with effective date being the date of transfer to the OPA. Include the following naming conventions in the description:

- Description or similar: NCE acronym, effective date

- Program: Program X

- Budget Year: 20X3

- Appropriation: Appropriation Act (No. 1) - operating (the original appropriation item the overpayment was made from)

- Receipt Type: Appropriation Repayments

- Amount: $50

Financial statements disclosure

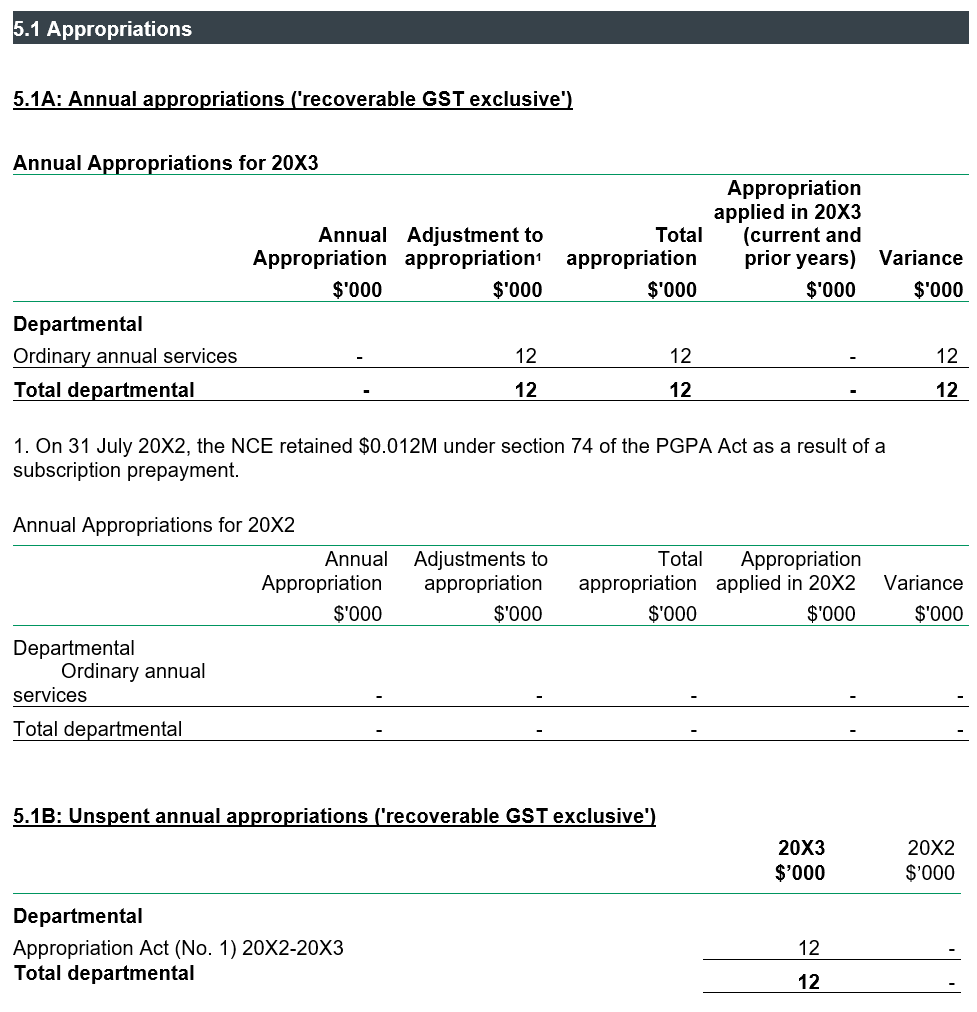

D3.2 Retainable receipts - prepayment

Scenario

On 1 July, the NCE sold a 12-month bulletin subscription to XYZ. On the same day, an invoice issued to XYZ for $12,000 with payment due on 31 July.

On the 1 July, XYZ received its first bulletin and on 31 July:

- XYZ made a payment of $12,000 to the NCE

- the NCE transferred funds $12,000 to the OPA.

Journal entries

01.07.X2 | Debit | Credit |

|---|---|---|

| Dr 5233002 Goods and services receivable | $12,000 | |

| Cr 3390205 Unearned income | $11,000 | |

| Cr 1220008 Rendering of services revenue | $1,000 | |

| Invoicing of the subscription plus earning the first month service revenue |

31.07.X2 | Debit | Credit |

|---|---|---|

| Dr 5220002 Cash at bank | $12,000 | |

| Cr 5233002 Goods and services receivable | $12,000 | |

| Receipt of cash | ||

| Dr 5233029 Appropriations receivable | $12,000 | |

| Cr 5220002 Cash at bank | $12,000 | |

| Transfer cash to OPA |

From 1 August (monthly entries) | Debit | Credit |

|---|---|---|

Dr 3390205 Unearned income | $1,000 | |

| Cr 1220008 Rendering of services revenue | $1,000 | |

| Record subsequent service revenue when earned |

CBMS record – CM module

Process a standard receipt in the CM module with effective date being the date of transfer to the OPA. Include the following naming conventions in the description:

- Description or similar: NCE acronym, effective date

- Program: Program X

- Budget Year: 20X3

- Appropriation: most recent Departmental Appropriation

- Receipt Type: Appropriation Receipts (s74)

- Amount: $12,000

*According to section 27(8) of the PGPA Rule, if section 74A of the PGPA Act was not used to increase an appropriation to pay the related GST qualifying amount, entities can retain GST refunds from the ATO under section 27(2A) of the PGPA Rule. Similar to the other section 74 Retainable Receipts, entities are to sweep amount to OPA - decrease in cash at bank and increase appropriation receivable.

In the Appropriation note, entities are to include GST refunds from the ATO retained under section 27(2A) of the PGPA Rule in the table and also include a footnote to disclose details of the GST refunds retained (similar to the accounting treatment in 10. Retainable receipts under Formal additions and reductions - guidance). For more information on section 74 Retainable Receipts, please contact the Special Appropriations Team.

Financial statement disclosure

D3.3 Retainable receipts – sale of asset (< 5% total departmental items annual limit)

Scenario

On 1 July, the NCE sold a forklift for $50,000 to XYZ and made a gain on sale of $5,000.

Assume accumulated depreciation for the asset is nil, there were no disposal costs and the NCE is able to retain sale proceeds under section 74 of the PGPA Act (that is, total asset sale proceeds less disposal costs was less than the 5% total departmental items annual limit specified in subsection 27(7) of the PGPA Rule).

The NCE’s total departmental items for the year was $1,250,000.

The sale proceeds represent 4% of the NCE’s total departmental items.

On 31 July the NCE:

- received payment of $50,000 from XYZ

- transferred $50,000 to the OPA and recognised the amount as a retainable receipt.

Journal entries

| 01.07.X2 | Debit | Credit |

|---|---|---|

| Dr 5233034 Sales of PP&E receivable | $50,000 | |

| Cr 1252004 Proceeds from sale of PP&E – Gain on sale | $50,000 | |

| Dr 5312002 – 7124 Disposal of PP&E | $45,000 | |

| Cr 1252006 Carrying value of PP&E | $45,000 | |

| Sale of the forklift |

31.07.X2 | Debit | Credit |

|---|---|---|

| Dr 5220002 Cash at bank | $50,000 | |

| Cr 5233034 Sales of PP&E receivable | $50,000 | |

| Receipt of cash | ||

| Dr 5233029 Appropriations receivable | $50,000 | |

| Cr 5220002 Cash at bank | $50,000 | |

| Transfer cash to OPA |

|

|

CBMS record – CM module

Process a standard receipt in the CBMS CM module with the effective date being the date of transfer to the OPA. Include the following naming conventions in the description:

- Description or similar: NCE acronym, effective date

- Program: Program X

- Budget Year: 20X3

- Appropriation: most recent Departmental Appropriation

- Receipt Type: Appropriation Receipts (s74)

- Amount: $50,000

Financial statements disclosure

D3.4 Retainable receipts – sale of asset (> 5% total departmental items annual limit)

Scenario

Same as D3.3, but on 30 June, the NCE had received an additional $1,000 relating to the sale of assets, which exceeded the retainable receipts 5% annual limit by $1,000. The NCE cannot retain the $1,000 under section 74 of the PGPA Act and is required to return the amount to the OPA.

Journal entry – in addition to the entries above with asset sale, cash, etc. adjusted to reflect the receipt of the additional $1,000

30.06.X2 (end of the financial year) | Debit | Credit |

|---|---|---|

| Dr 4100001 Accumulated results – 7592 Cash transfers to OPA | $1,000 | |

| Cr 5220002 Cash at bank | $1,000 | |

| Transfer excess receipts to OPA |

CBMS record – CM module

Process a standard receipt in the CM module with effective date being the date of transfer to the OPA. Include the following naming conventions in the description:

- Description or similar: NCE acronym, effective date

- Program: Program X (Administered)

- Budget Year: 20X2

- Appropriation: Nil Appropriation Impact

- Receipt Type: Administered Receipt

- Amount: $1,000

D4 Formal additions and reductions

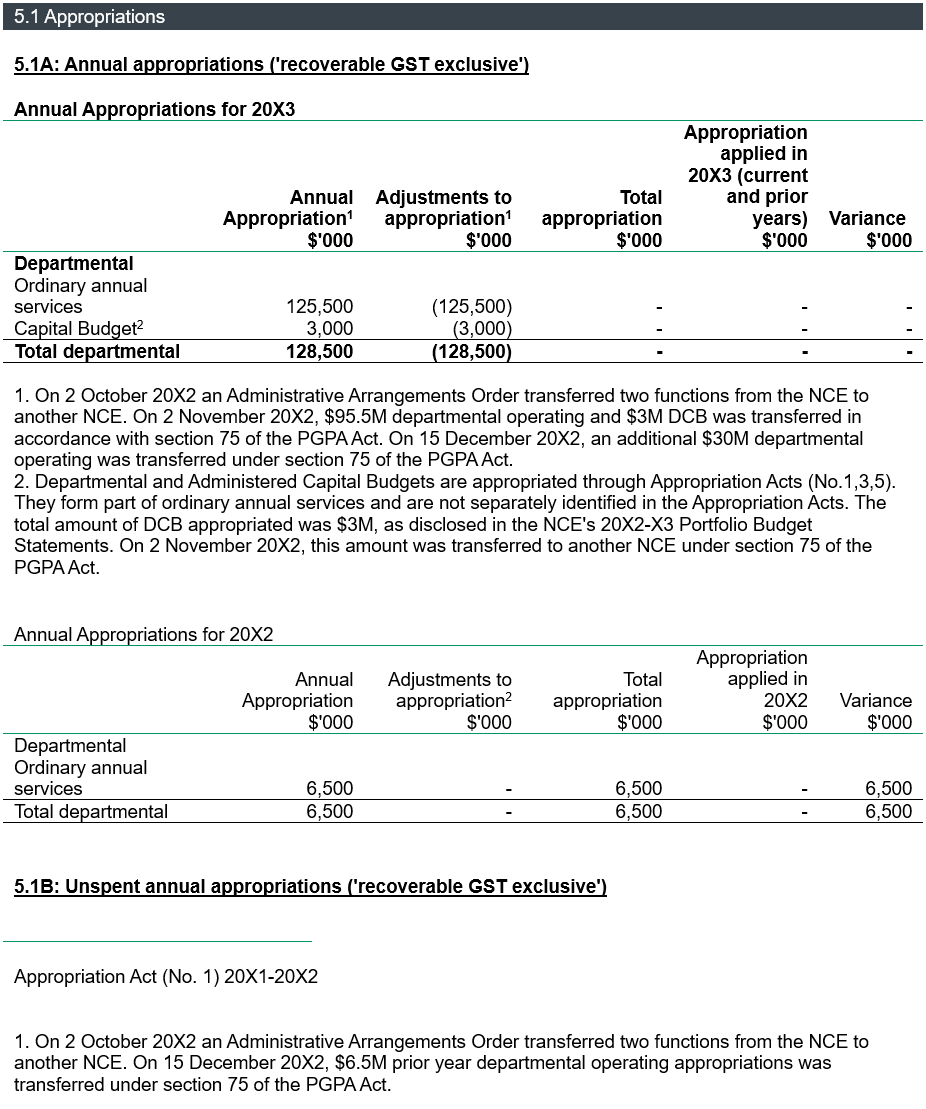

D4.1 Machinery of government changes (PGPA Act section 75)

Scenario

On:

- 2 October, an Administrative Arrangements Order transferred two functions from one NCE to another NCE

- 18 October, the two chief financial officers signed a PGPA Act section 75 CFO agreement form (which is not a legal instrument, as distinct from a PGPA Act section 75 determination)

- 1 November, the PGPA Act section 75 determination was registered on the Federal Register of Legislation with:

- a commencement date of 2 November

- a determination date of 30 October (the date the determination was signed).

The following appropriations were transferred though the PGPA Act section 75 determination:

- $95.5M departmental operating (current year)

- $3M DCB (current year).

On 30 November, the NCE identified additional appropriation that related to the transferred functions:

- $30M departmental operating (current year – 20X2-20X3)

- $6.5M departmental operating (prior year – 20X1-20X2).

Following a second PGPA Act section 75 agreement between the two NCEs:

- a second PGPA Act section 75 determination transferred the residual appropriation

- on 12 December, the second determination was registered with a:

- a commencement date of 15 December

- determination date of 10 December.

Journal entries – transferring NCE

2.11.X2 | Debit | Credit |

|---|---|---|

| Dr 1280004 Price of outputs (agreed) | $95.5M | |

| Cr 5233029 Appropriations receivable | $95.5M | |

| Record departmental operating (current year) - PGPA Act Section 75 |

2.11.X2 | Debit | Credit |

|---|---|---|

| Dr 4100003 Contributed Equity – 7209 Injection for Departmental Capital Budget | $3M | |

| Cr 5233030 Appropriations receivable – Contributed Equity | $3M | |

| Record DCB transferred – PGPA Act section 75 |

15.12.X2 | Debit | Credit |

|---|---|---|

| Dr 1280004 Price of outputs (agreed) | $30M | |

| Cr 5233029 Appropriations receivable | $30M | |

| Record departmental operating (current year) – PGPA Act section 75 |

15.12.X2 | Debit | Credit |

|---|---|---|

Dr 4100003 Contributed Equity – 7207 Restructuring | $6.5M |

|

Cr 5233029 Appropriations receivable |

| $6.5M |

Record departmental operating (prior year) – PGPA Act section 75 |

|

|

Journal entries – gaining NCE

2.11.X2 | Debit | Credit |

|---|---|---|

Dr 5233029 Appropriations receivable | $95.5M |

|

Cr 1280004 Price of outputs (agreed) |

| $95.5M |

Record departmental operating (current year) – PGPA Act section 75 |

|

|

2.11.X2 | Debit | Credit |

|---|---|---|

Dr 5233030 Appropriations receivable – Contributed Equity | $3M |

|

Cr 4100003 Contributed Equity – 7209 Injection for Departmental Capital Budget |

| $3M |

Record DCB transferred – PGPA Act section 75 |

|

|

15.12.X2 | Debit | Credit |

|---|---|---|

Dr 5233029 Appropriations receivable | $30M |

|

Cr 1280004 Price of outputs (agreed) |

| $30M |

Record departmental operating (current year) – PGPA Act section 75 |

|

|

15.12.X2 | Debit | Credit |

|---|---|---|

Dr 5233029 Appropriations receivable | $6.5M |

|

Cr 4100003 Contributed Equity – 7207 Restructuring |

| $6.5M |

Record departmental operating (prior year) – PGPA Act section 75 |

|

|

CBMS record – CM module

Transferring amounts against an appropriation from one NCE to another, is processed by Finance as a budget adjustment in the CBMS CM module. Budget adjustments processed in CBMS under section 75 of the PGPA Act are applied the day after the signed determination is registered on the Federal Register of Legislation (unless otherwise specified within the determination).

Financial statements disclosure - transferring NCE

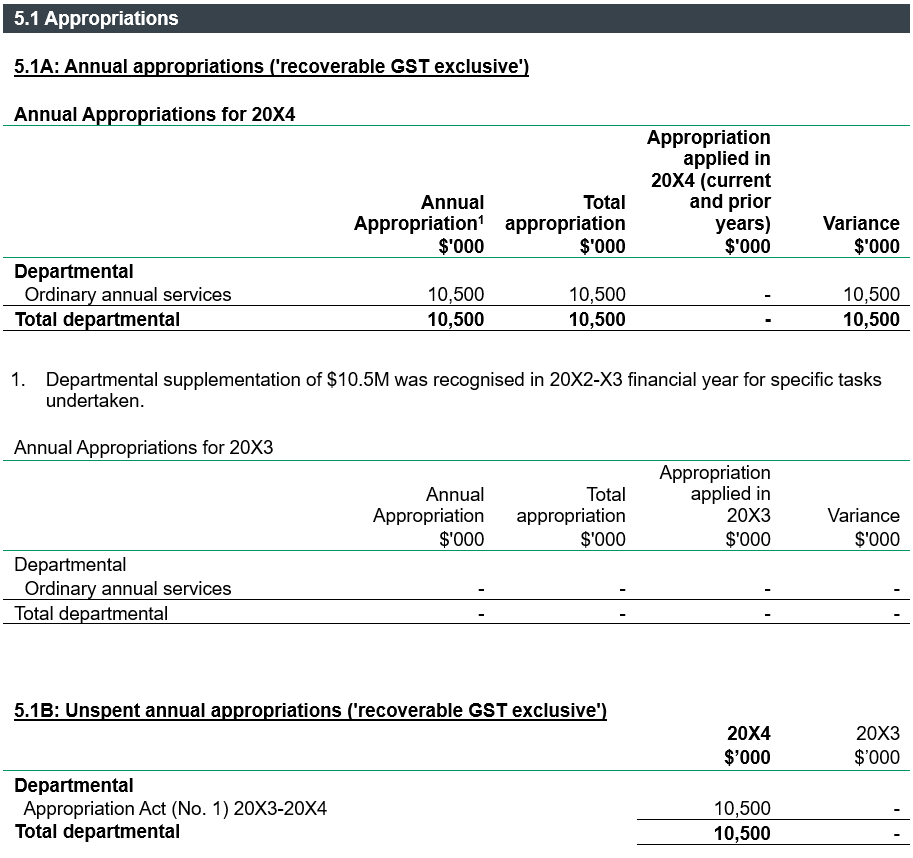

D4.2 Decision of the Cabinet or Prime Minister

Scenario

On 27 February 20X3, the NCE received a letter from the Prime Minister that approved $10.5M in departmental operating for the NCE. The letter stated that the $10.5M was for specific tasks to be undertaken in 20X2-X3. There were no more Appropriation Acts available through which the 20X2-X3 funding could be appropriated.

The NCE is required to cash manage payments required until the next set of Appropriation Acts commence, using appropriate existing appropriations. The related accounting journal entries and appropriation note discloses relating to the expenditure and draw downs from the NCE's existing appropriations have not been shown so that the example only shows the impact of the supplementation.

On 1 July 20X3, the NCE was appropriated $10.5M under Appropriation Act (No. 1) 20X3‑20X4.

Journal entry – year of approval

27.02.X3 | Debit | Credit |

|---|---|---|

Dr 5250005 Accrued appropriation revenue | $10.5M |

|

Cr 1280003 Price of outputs (provisional) |

| $10.5M |

Record supplementation approval |

|

|

Journal entries – year of appropriation

01.07.X3 | Debit | Credit |

|---|---|---|

Dr 5233029 Appropriations receivable | $10.5M |

|

Cr 1280004 Price of outputs (agreed) |

| $10.5M |

Recognise departmental operating (formerly approved as supplementation) |

|

|

01.07.X3 | Debit | Credit |

|---|---|---|

Dr 1280003 Price of outputs (provisional) | $10.5M |

|

Cr 5250005 Accrued appropriation revenue |

| $10.5M |

Reduce accrued appropriation revenue |

|

|

Note: The full amount appropriated (including supplementation) is required to be recorded against CBMS Account No. 1280004 to enable NCEs to be appropriated and subsequently drawdown from the relevant appropriation.

For the purposes of this guide, the terms below equate to the following CBMS account codes in the illustrative examples:

- Receivable from Government – Account No. 5250005 Accrued appropriation revenue

- Revenue from Government – Account No. 1280003 Price of outputs (provisional)

- Appropriation revenue – Account No. 1280004 Price of outputs (agreed).

CBMS record – CM module

Budget amounts appropriated under Appropriation Act (No. 1) are made available by Finance in the CBMS CM module on the later of the:

- date the appropriation commences as an Act, and/or

- commencement of the financial period the appropriation relates to.

Financial statements disclosure

D4.3 Workload agreement

Scenario

The NCE received a Cabinet minute (dated 1 July 20X2) requesting that it expand the scope of phase 1 of project X during 20X2-X3 under a workload agreement. It specified that $5M additional departmental operating appropriation would be provided in the next set of Appropriation Bills with respect to the additional work.

On 10 April 20X3, the NCE received $20M through Appropriation Act (No. 3) (includes the $5M for additional output).

Journal entries

01.07.X2 | Debit | Credit |

|---|---|---|

Dr 5250005 Accrued appropriation revenue | $5M |

|

Cr 1280003 Price of outputs (provisional) |

| $5M |

Record Cabinet approval of funding for additional work |

|

|

10.04.X3 | Debit | Credit |

|---|---|---|

Dr 5233029 Appropriations receivable | $20M |

|

Cr 1280004 Price of outputs (agreed) |

| $20M |

Recognise departmental operating (formerly approved) |

|

|

10.04.X3 | Debit | Credit |

|---|---|---|

Dr 1280003 Price of outputs (provisional) | $5M |

|

Cr 5250005 Accrued appropriation revenue |

| $5M |

Reduce accrued appropriation revenue |

|

|

Note: The full amount appropriated (including supplementation) is required to be recorded against CBMS Account No. 1280004 to enable NCEs to be appropriated and subsequently drawdown the from relevant appropriation.

For the purposes of this guide, the terms below equate to the following CBMS account codes in the illustrative examples:

- Receivable from Government – Account No. 5250005 Accrued appropriation revenue

- Revenue from Government – Account No. 1280003 Price of outputs (provisional)

- Appropriation revenue – Account No. 1280004 Price of outputs (agreed).

CBMS record – CM module

Budget amounts appropriated under Appropriation Acts (No. 1 and No. 3) are made available by Finance in the CM module on the later of:<

- the date the appropriation commences as an Act, and/or

- the commencement of the financial period the appropriation relates to.

Financial statements disclosure

D4.4 Supplementation (Emergency response)

Scenario

The NCE was required to undertake emergency response tasks in 20X2-X3. However, it will not receive the departmental operating appropriation until the following financial year (that is, 20X3-X4).

The NCE received:

- a letter from the Prime Minister (dated 20 January 20X3) stating that the NCE would receive $7M in 20X3-X4 for emergency response tasks to be performed in 20X2-X3

- a Cabinet Minute (dated 30 July 20X3) advising that it would receive an additional $5.5M in 20X3-X4 for emergency response tasks performed in 20X2-X3.

On 1 July 20X3, the NCE was appropriated departmental operating of $100M (including the $7M previously approved in January 20X3) under Appropriation Act (No. 1).

On 4 April 20X4, the NCE was appropriated an additional $25.5M of departmental operating (including the $5.5M previously approved in July 20X3) under Appropriation Act (No. 3).

Journal entries – year of approval ($7M)

20.01.X3 | Debit | Credit |

|---|---|---|

| Dr 5250005 Accrued appropriation revenue | $7M | |

| Cr 1280003 Price of outputs (provisional) | $7M | |

| Record formal approval – letter from Prime Minister (Emergency response) |

Journal entries – year of appropriation ($7M)

| 01.07.X3 | Debit | Credit |

|---|---|---|

| Dr 5233029 Appropriations receivable | $100M | |

| Cr 1280004 Price of outputs (agreed) | $100M | |

| Recognise departmental operating (including $7M previously approved) |

01.07.X3 | Debit | Credit |

|---|---|---|

| Dr 1280003 Price of outputs (provisional) | $7M | |

| Cr 5250005 Accrued appropriation revenue | $7M | |

| Reduce accrued appropriation revenue |

Journal entries – year of approval ($5.5M)

30.07.X3 | Debit | Credit |

|---|---|---|

| Dr 5250005 Accrued appropriation revenue | $5.5M | |

| Cr 1280003 Price of outputs (provisional) | $5.5M | |

| Record formal approval – Cabinet Minute (Emergency response) |

|

|

Journal entries – year of appropriation ($5.5M)

04.04.X4 | Debit | Credit |

|---|---|---|

| Dr 5233029 Appropriations receivable | $25.5M | |

| Cr 1280004 Price of outputs (agreed) | $25.5M | |

| Recognise departmental operating (including $5.5M previously approved) |

04.04.X4 | Debit | Credit |

|---|---|---|

Dr 1280003 Price of outputs (provisional) | $5.5M | |

| Cr 5250005 Accrued appropriation revenue | $5.5M | |

| Reduce accrued appropriation revenue |

Note: The full amount appropriated (including supplementation) is required to be recorded against CBMS Account No. 1280004 to enable NCEs to be appropriated and subsequently drawdown from the relevant appropriation.

For the purposes of this guide, the terms below equate to the following CBMS account codes in the illustrative examples:

- Receivable from Government – Account No. 5250005 Accrued appropriation revenue

- Revenue from Government – Account No. 1280003 Price of outputs (provisional)

- Appropriation revenue – Account No. 1280004 Price of outputs (agreed).

CBMS record – CM module

Budget amounts appropriated under Appropriation Acts (No. 1 and No. 3) are made available by Finance in the CM module on the later of:

- the date the appropriation commences as an Act, and/or

- the commencement of the financial period the appropriation relates to.

Financial statements disclosure

D4.5 Reappropriation – operating and DCB

Scenario

The NCE was appropriated $100M departmental operating on 1 July 20X2 under Appropriation Act (No. 1). On:

- 12 January 20X3, the NCE received policy approval from the Finance Minister to reclassify future expenditure to capital and be reappropriated $5M of the $100M as DCB

- 4 April 20X3, the NCE was reappropriated $5M DCB under Appropriation Act (No. 3)

- 21 April 20X3, a PGPA Act section 51 direction was signed to withhold $5M in departmental operating

- 5 May 20X3, the NCE identified an additional $2.5M of the original $100M in departmental operating was required for capital expenditure (however no reappropriation was possible prior to 30 June 20X3).

Journal entries

01.07.X2 | Debit | Credit |

|---|---|---|

Dr 5233029 Appropriations receivable | $100M | |

| Cr 1280004 Price of outputs (agreed) | $100M | |

| Recognise departmental operating appropriation |

04.04.X3 | Debit | Credit |

|---|---|---|

| Dr 5233030 Appropriations receivable – Contributed Equity | $5M | |

| Cr 4100003 Contributed Equity – 7209 Injection for Departmental Capital Budget | $5M | |

| Recognise departmental capital budget |

21.04.X3 | Debit | Credit |

|---|---|---|

Dr 1280004 Price of outputs (agreed) | $5M | |

| Cr 5233029 Appropriations receivable | $5M | |

| Record PGPA Act section 51 amount withheld |

CBMS record – CM module

Budget amounts appropriated under Appropriation Act (No. 1) and Appropriation Act (No. 3) are made available by Finance in the CBMS CM module of CBMS on the later of:

- the date the appropriation commences as an Act, and/or

- the commencement of the financial period the appropriation relates to.

Withholding an amount against an appropriation is processed by Finance as a “S51 withholding” adjustment in the CBMS CM module, with the effective date specified in the signed direction.

Financial statement disclosure

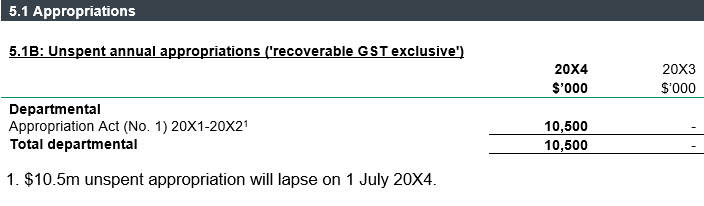

D5 Lapsing unspent appropriations

Scenario

The NCE was appropriated departmental operating funding on 1 July 20X1 under Appropriation Act (No. 1) 20X1-20X2 (the Act).

The Act contained a clause that automatically repealed any unspent appropriation three years later (that is, 1 July 20X4).

On 30 June 20X4, $10.5M of the appropriation remained unspent.

Journal entry

30.06.20X4 | Debit | Credit |

|---|---|---|

| Dr 4100001 Accumulated results – 7592 Cash transfers to the OPA | $10.5M | |

| Cr 5233029 Appropriations receivable | $10.5M | |

| Record lapsing departmental appropriation (adjusting event) |

CBMS record – CM module

Remaining unspent amounts appropriated under Appropriation Act (No. 1) are reduced by Finance in the CBMS CM module on the date the appropriation is repealed, according to the repeal clause within the Act.

Financial statements disclosure