This Toolkit item relates to

Part 1 - Investment Proposal & Business Case Development of the Commonwealth Investments Resource Management Guide.

Commercial models summary

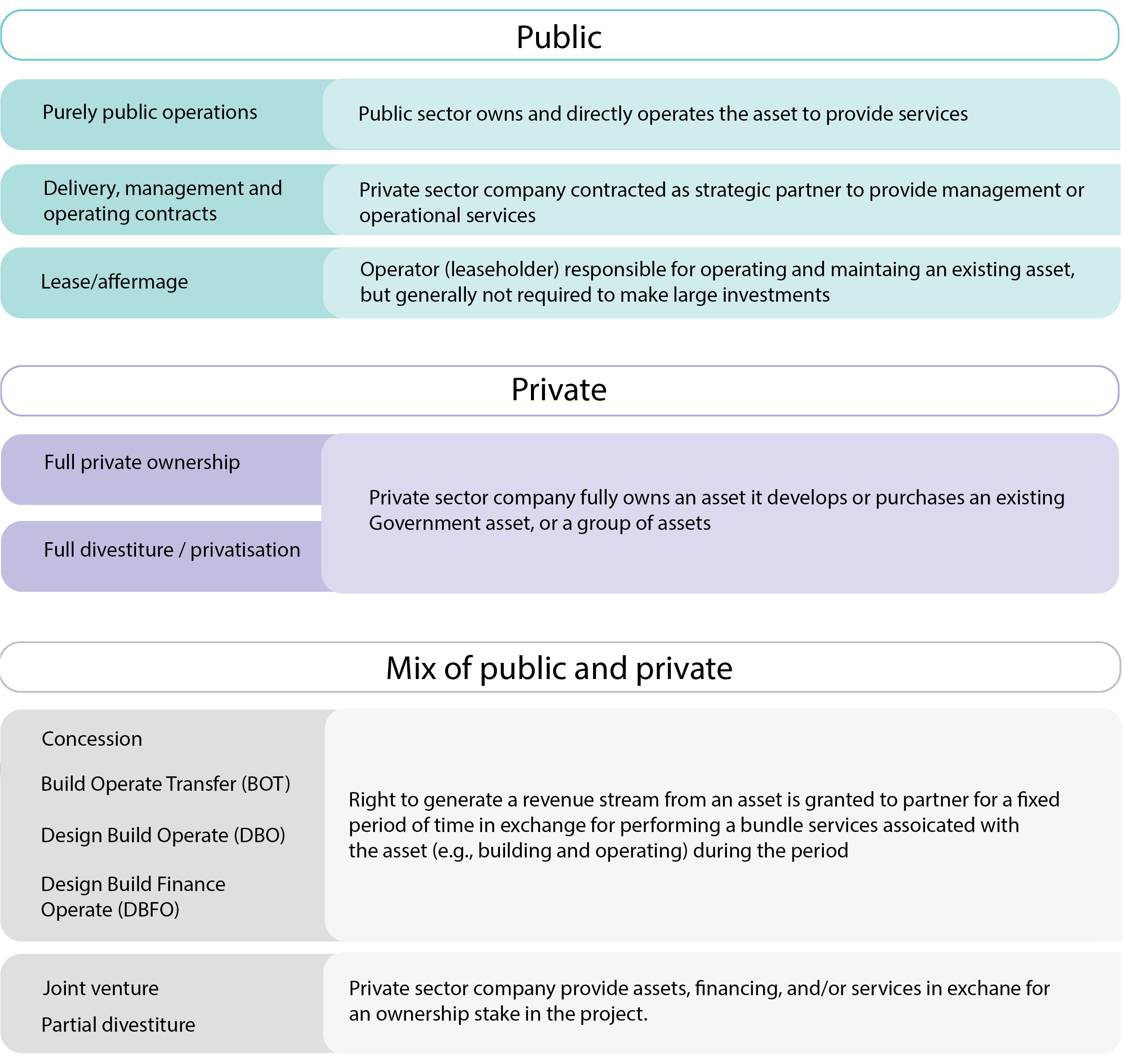

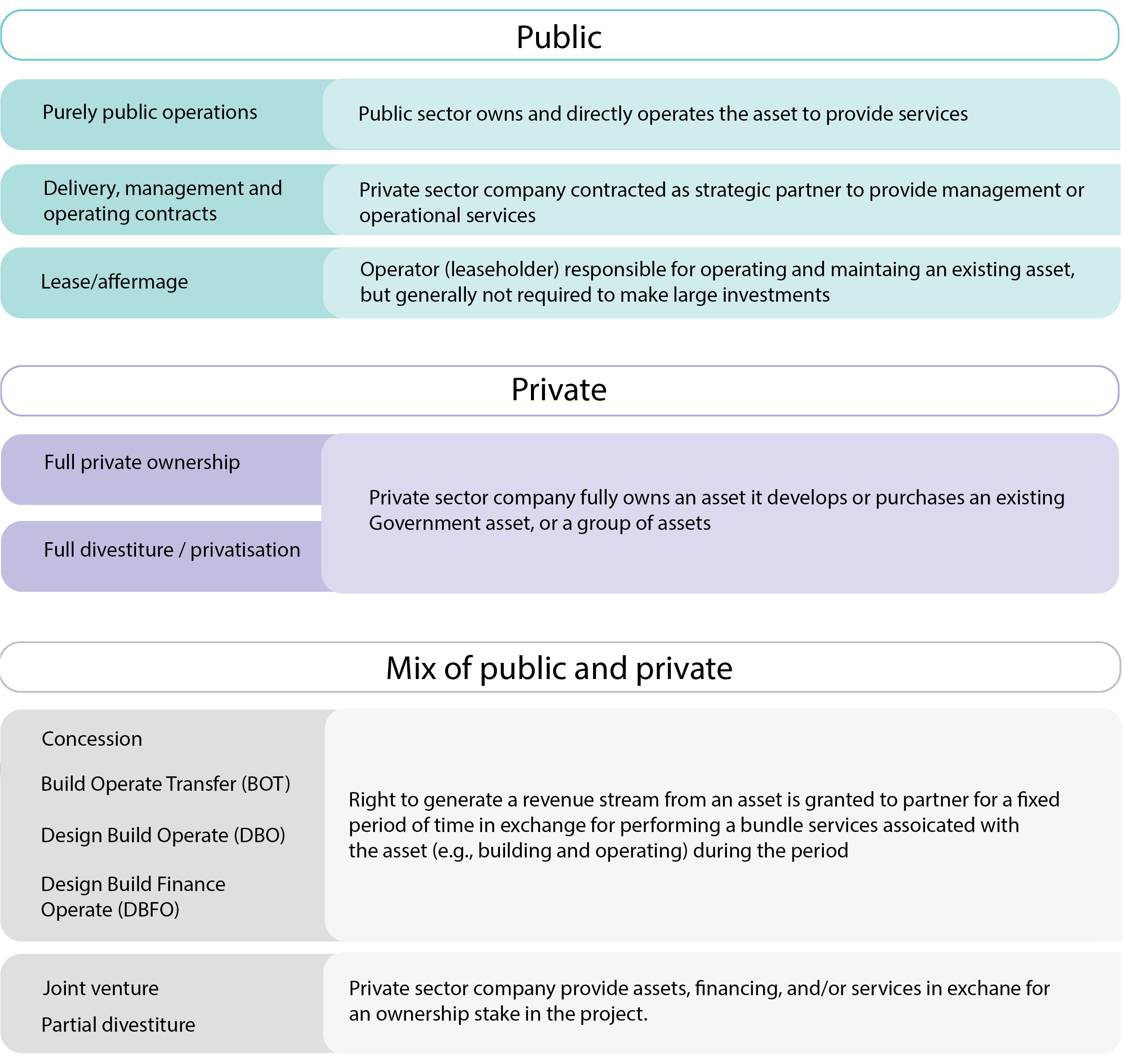

Exhibit 1 sets out commercial models that entities can consider when designing and evaluating ownership and partnership options with private sector. These commercial models are to provide illustrative examples and potential options and are not exhaustive lists.

Exhibit 1: Summary of commercial models

|

|

Conceptual ownership categories

|

Structure types

|

Roles for Government

|

Levers to add value

|

|

Key Focus

|

Type of public and private involvement

|

Partnership types

|

Balance sheet impact

|

Nature of private sector value creation

|

|

Useful for

|

Considering the overall categories of investment

|

Developing detailed structures to suit particular investments

|

Considering Government’s role in investments

|

Testing potential for private sector collaboration

|

|

Key choices

(This list is illustrative of potential options and it is not exhaustive)

|

- Publicly owned and operated

- Publicly owned, privately delivered/ operated

- Public and private co-ownership

- Fully private

|

- Public operations

- Delivery, management and operating contracts

- Lease/affermage

- Concession

- Build Operate Transfer

- Design Build Operate

- Design Build Finance Operate

- Joint Venture / Alliance

- Divestiture / fully-private

|

- Policy-maker / regulator

- Funder

- Non-controlling interest

- Owner

|

- Policy benefits for Government

- Reduction of Government Capex

- Reduction of Government Opex

- Value capture by Government

- User-generated revenue

- Commercialisation

|

Conceptual ownership categories from fully public to fully private

As a high-level conceptual map, entities can consider 5 ownership models on a spectrum from fully public to fully private, refer Exhibit 2.

The summary on the advantages and limitations for each model can be used as a guide to assess the most suitable models for the project or investment being evaluated.

The key principles and design considerations in each step of the Commonwealth Investment Framework will further guide selection of the most appropriate model, noting there are many levers available to adapt each of these high-level models.

Exhibit 2: Conceptual ownership categories from fully public to fully private

|

|

|

|

|

|

Purely private businesses

|

|

Description

|

- Investments in assets to support critical public services

|

- Government finances and owns the underlying asset but contractors design, build and/or operate it under a contract (risks should be appropriately balanced)

|

- Government and private sector each invest debt and/or equity in a project and appropriately share ownership, risk and delivery responsibilities

|

- A fully owned private business delivers public services on behalf of the Government to agreed standards

|

- Fully independent private businesses supported and controlled only indirectly by Government policies

|

|

Structure types

|

- Full public ownership and operation

|

- Management and operating contracts

- Design and build contracts

|

- Lease/affermage

- Concession

- Design Build Operate +/- Transfer (DBO/T)

- Design Build Finance Operate (DBFO/T)

- Joint venture/alliance

- Partial divestiture

|

- Full divestiture/ privatisation

|

- No public ownership or investment

|

|

Illustrative example

|

- Veterans Affairs, Centrelink, Medicare, Defence activities

|

- Western Sydney Airport Co Ltd, NBN Co Limited, Snowy Hydro Limited, Australian Rail Track Corporation Limited

|

- Construction of a toll-road under a Public Private Partnership, Operation of HQJOC Defence building

|

- Private hospitals, non-government schools, aged-care, energy distribution

|

- Private manufacturing of market goods, provision of services

|

| Key advantages |

- Complete Government control

|

- Private sector capability and innovation can improve efficiency and effectiveness

- Government retains control and value created

- Private operator financing operations through operational profits

- Opportunity for dividend returns to Government

|

- Private sector capability and innovation can improve efficiency and effectiveness

- Government investment risks and costs are appropriately balanced

|

- Private sector capability and innovation can improve efficiency and effectiveness

- No Government investment and very limited risk

|

- Private sector capability and innovation can drive efficiency and effectiveness

- Government benefits via economic activity and collects tax revenue

|

| Key limitations |

- No incentive structure to involve private sector innovation and efficiency

|

- Government fully finances initial and potentially further investment

- Government bears the residual risk and indemnifies private sector's risk

|

- Private sector's investment has a higher cost of capital than Government that must be offset

- Government bears residual risk and partner risk

|

- Private sector's investment has a higher cost of capital than Government that must be offset

- Government bears residual risk if market fails

|

- Less direct control over the quality and nature of service

- Limited control of investment decisions

|

Structure types across different ownership options

Within the conceptual ownership categories introduced in Exhibit 2, there are a number of more detailed models that define the responsibility of Government and its potential partners.

The ownership model must allocate responsibility for creating and sustaining revenues from the asset and meeting costs for financing and operations. The allocation of these responsibilities is interdependent with the ownership and financing of the asset. Ownership typically affects the bundle of rights and obligations a party will have and thus the balance of incentives that must be defined contractually.

Owner-like behaviour can be incentivised via a contract, even where the private party has no underlying property interest in the asset. Therefore, the operating model and financing approach must be considered in an integrated design exercise, which will often benefit from structured market testing and engagement to steer these choices.

There are 5 structures that projects typically adopt, refer Exhibit 3, noting that this list is not necessarily exhaustive.

This overview may assist entities in identifying potential options as they begin design of the partnership model.

Exhibit 3: Non-exhaustive list of structure types across different ownership options. Governments can invest in ‘private’ through investment instruments including convertibles or debt and/or equity (the latter of which gives Government an ownership stake).

Potential ownership options

Roles for Government in investment

At a high-level, there are 4 roles Government can play to encourage appropriate, efficient and effective investment in public policy priorities, refer Exhibit 4.

These roles vary the balance between the use of policy levers, funding, forms of capital contribution, and the level of direct government control of the asset. These roles can be combined for different elements of an investment.

Policy and regulatory levers involve the least amount of direct public financing. However, there can be operational costs for Government entities to design and implement these changes, and the changes themselves may have financial impacts on stakeholders, and indirectly on Government finances as a result.

Amongst the options that involve a financial commitment, the degree of Government investment will generally be proportionate to the ongoing control it seeks in the asset created. Acting as a funder, often a more simple and common option, provides the least control after the funding is delivered. Whereas, when Government takes on some or all of the ownership rights in the investment, or provides an appropriate form of debt financing it will typically have the types of control or oversight that a commercial investor would have over the asset.

Entities should consider how the Government’s role in a particular investment would achieve specific objectives. When presenting options that involve funding or investment, there should be a clear link to the additional benefits Government obtains by making those financial commitments.

For example, the Government should seek to use its funds to increase the appropriateness of an investment (for example, prevent the private sector controlling elements of the project that would undermine sovereignty), and/or to increase the efficiency and/or effectiveness of the investment (for example, by allowing a project to be delivered earlier).

Exhibit 4: Roles for Government in investment

Opportunities for private sector investment to add value

To be capable of investment by the private sector, the asset or project needs a viable commercial model and source of revenue that can be allocated to the investor.

For the allocation of that revenue stream to be efficient and effective, it must be based on policy and/or financial value creation that offsets the private sectors, direct costs, costs of capital, and their expectation for an acceptable risk-adjusted return on the invested capital.

Specifically, where Government is the sole or primary source of revenue for the asset, the investment will need to generate some other benefit to government that offsets the incremental cost of private capital and margin that the private investor will expect. Private partners face a higher cost of capital and their investors expect a return commensurate with the risk. In order to fund this cost of capital and return expectation, the private sector's involvement must generate sufficient value that can be shared and/or used to offset the cost to Government of meeting the private party's return expectations.

'Opportunities for private sector investment to add value' in Exhibit 5 describes the potential sources of this value that a private sector partner can provide. When considering private sector involvement, test whether any of the ways the private sector can add value apply to the subject matter and overall context of the investment.

Exhibit 5: Opportunities for private sector to add value

| |

Policy benefits for Government (levers to add value apply to different levels of Government i.e., Federal, State and Territory, and Local Governments)

|

Reduction

of Government capital expenditure (capex)

|

Reduction

of Government operating expenditure (opex)

|

Value generation under private operation

|

User-generated revenue

|

Commercialisation

|

|

Description

|

Government pays private provider because it values the policy improvements they can deliver

|

Government pays private provider(s) a share of savings made from lower cost investment in the asset

|

Government pays private provider(s) a share of savings made from lower cost operation of the asset

|

Government uses targeted taxation, levies and rates on zones surrounding asset to capture spill-over value

|

Government gives private provider(s) the right to collect revenue from users

|

Government gives private provider(s) the right to deploy the asset outside its immediate context

|

|

Key variants

|

- Balance sheet optimisation

- (Includes avoidance of policy risk)

|

- Growth vs sustainment capex

- (Includes avoidance of capital risk)

|

- Existing vs future opex

- (Includes avoidance of opex risk)

|

- Broad taxes vs targeted

- Transactional levies vs recurrent levies

|

- Existing vs new charges

- Users type: Business-to-business, business-to-consumer and business-to-gov.

- Core services vs value-added

|

- Local vs new geography

- Similar vs new applications

- Direct vs sub-licensed

|

|

Select levers private providers can use to add value

|

- Faster delivery because of experience, capability, scale

- Increased accessibility

- Improved service quality

|

- The ability to re-use the asset or know-how in other markets

- Design quality (e.g., user centricity, adaptation of existing services, etc.)

- Delivery speed

|

- Process efficiency

- Improved technology

- Scale to operate the asset in a cost-effective manner

|

- Betterment levies

- Developer charges

- Leveraging government land

- Taxes on property transactions

- Taxes on land value

|

- Attract new users in existing markets

- Offer new core services

- Increase headline price

- Increase price through product mix

|

- Expand to new markets

- Develop ancillary services

|

|

Key pre-requisites to consider as a viable option

|

- Incentives can be aligned to motivate positive policy outcomes

- Incremental policy benefits are only achievable under private delivery

|

- Whole-of-life costs and performance considerations are contractually managed

- Incremental savings are only achievable under private delivery

|

- Cost reduction can be contractually managed to ensure appropriateness (e.g., service quality/ reliability, workforce impacts, etc.)

- Incremental savings are only achievable under private operation

|

- Targeted taxes can be effectively administered

- Taxing value will handle cash flows fairly

- Value generation is only feasible under private operation

|

- Revenue growth can be contractually managed to ensure appropriateness

- Sufficient discretion and risk protection to realise assumed revenue growth

- Revenue growth is only feasible under private operation

|

- Plausible path to commercialisation within policy/appropriateness constraints

- Commercialisation is only feasible under private operation

|