The Parliament and the Australian public have a strong interest in the proper use and management of public resources, from which Commonwealth executive remuneration is paid.

All Commonwealth entities must report the policies and practices of the entity regarding the remuneration of key management personnel (KMP), senior executives and other highly paid staff (OHPS), setting out:

- the governance arrangements under which the entity’s remuneration policies and practices operate, and

- the basis on which the remuneration of KMP, senior executives and OHPS are determined.

Where should this reporting be located in an Annual Report?

The Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) does not specify where in their annual report entities must discuss their executive remuneration policies and practices. However, the better practice is for this information to be placed along with Schedule 3 remuneration information, assisting a reader to fully understand an entity’s executive remuneration policy, practices and application. The information should be readily identifiable, including through clear use of headings to assist a reader in finding and understanding the reported information.

The ‘list of requirements’ must provide details of the location of the information in the annual report that addresses each of the mandatory requirements specified by the PGPA Rule, including the reporting of executive remuneration information (PGPA Rule Schedule 2). Entities’ remuneration policy and practice should also be included in the list of requirements under ‘information about executive remuneration’ and include a link to the policy and practice location within the annual report.

Who should report their remuneration policies and practices?

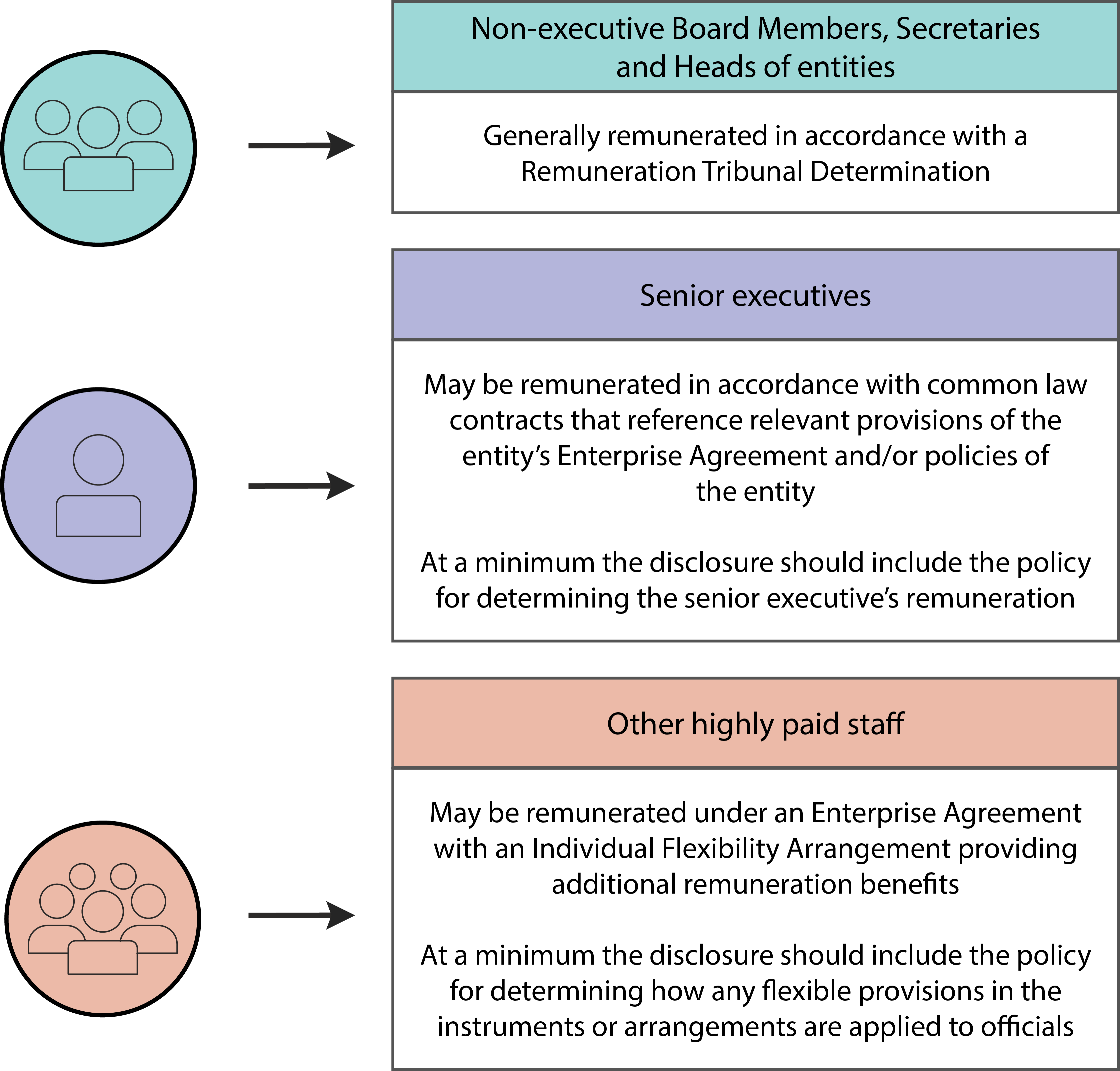

The reporting requirements apply to all Commonwealth entities, but the content of the report will vary depending on the nature of the entity and the instruments used to remunerate KMP, senior executives and OHPS. Therefore, the reporting undertaken should be fit for purpose. For example, a small, non-corporate entity is likely to have different, and less complex, remuneration policies and practices than a large corporate Commonwealth entity, and the information presented will reflect those differences.

The information below will assist in determining the minimum requirements for a Commonwealth entity.

When disclosing executive remuneration policies and practices information, Commonwealth entities should note the following:

- These reporting requirements do not weaken, in any way, any reporting obligations under an entity’s enabling legislation.

- The reporting undertaken should be fit for purpose and reflect the entity’s size and complexity.

- Commonwealth entities can reference publicly available information, such as Remuneration Tribunal Determinations or Enterprise Agreements, to further explain policies and practices.

Governance arrangements

Commonwealth entities must disclose the governance arrangement under which remuneration policies and practices operate.

The annual report should clearly identify:

![]()

The overarching body or person responsible for setting remuneration and its membership

Any committees or management positions that have input into the setting and monitoring of the remuneration arrangement and amounts

If benchmarking is used, information on how the benchmarking is used and who conducted the benchmarking.

For some entities, the Board is responsible for determining the remuneration policy and the remuneration structure for KMP, senior executives and OHPS. In practice, the Board is typically supported by a Remuneration Committee, or other mechanism, which makes remuneration recommendations to the Board. For other entities, it may be a decision of the leadership group of the entity. This may include the Chief Executive Officer and other senior managers. These arrangements should be included in the disclosures.

How is remuneration determined?

The framework for determining remuneration is generally set out in policy documents of the entity or at a high level in an entity’s enabling legislation. This information should be disclosed, along with a summary of the policies.

The details of the person or committee that is responsible for approving and monitoring the application of each policy should be disclosed.

For some entities, there may be multiple policies, depending upon the employment instruments or arrangements for different individuals or groups of officials.

For example,

Policy on various remuneration components

In order to understand how the KMP, senior executives and OHPS are remunerated, an entity needs to report information on policy and practice for different remuneration components. This would include information about the entity policy on the portion of remuneration that is fixed compared to the portion which is ‘at risk’ and subject to performance conditions.

The disclosure of remuneration information should enable readers to understand:

the different remuneration arrangements in place for the different categories of officials

the portion of remuneration that is fixed

the portion of remuneration that is 'at risk', such as bonuses or other short term incentive programs, and the conditions that apply to this component.

Commonwealth entities should also disclose details of any legislation or government policies that the entity must comply with in determining how remuneration is structured or set. For example, remuneration being set by the Remuneration Tribunal.

The remuneration disclosures could also include an explanation of how the remuneration policies and practices link to the achievement of the organisation’s strategy and objectives. In particular, where there is an explicit link between remuneration and the entity’s performance, this link should be explained.

Policy on performance bonuses

The Australian Public Service Commission has released guidance that outlines the principles governing performance bonus use in Commonwealth entities and companies.

The principles are outlined below:

- Commonwealth entities and companies exist to deliver outcomes for the public. Any performance bonuses must be carefully designed to clearly align with delivering a public benefit over and above expected outcomes.

- All Commonwealth entities and companies have a responsibility to the Australian public and therefore should act in line with community expectations regarding remuneration, regardless of their level of independence from the Government.

- Commonwealth entities and companies should exercise rigour and restraint in the use of performance bonus payments.

- Performance bonuses may only be used in limited circumstances, justifiable to the Parliament and the public.

To assist you in applying the principles, Performance Bonus Guidance is available on the Australian Public Service Commission website.