General assumptions:

- legally valid appropriation

- legislated purpose (that is, legislation supporting a program), supported by a head of Commonwealth power or the Constitution

- no GST unless stated otherwise

- account codes used in illustrative examples reference the AEIFRS Account Codes used in the Central Budget Management System (CBMS) Chart of Accounts (noting that the guide is prepared at a point in time so Non-Corporate Commonwealth Entities (NCE) should refer to the latest version)

- journals for recoverable GST assume that money for payments of GST are drawn from a section 74A budget in the Cash Management (CM) Module of CBMS that is associated with a ‘limited by amount’ administered appropriation (that is, section 74A of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) which is used for increasing existing administered appropriations and as a consequence means all ATO refunds are returned to the Official Public Account (OPA) as administered receipts).

A1 Re-crediting of repayments (PGPA Act section 74)

Scenario

On 1 July, the NCE received $250 in administered operating appropriations under Appropriation Act (No.1) for the 20x2-x3 financial year.

On 15 July, the NCE paid $250 to XYZ from Appropriation Act (No.1) 20x2-x3 for stationery supplies.

On 31 July, XYZ advised the NCE that it had been overpaid and refunded $50 to the NCE into the NCE’s Administered Receipts bank account and where the funds were swept to the OPA.

Journal entries

01.07.X2 | Debit | Credit |

|---|---|---|

Dr 5220002 Cash at bank | $250 |

|

Cr 4100001 Accumulated results – 7593 Administered appropriations from the OPA (agreed) |

| $250 |

Drawdown from OPA |

|

|

15.07.X2 | Debit | Credit |

|---|---|---|

Dr 2230098 Other supplier expenses | $250 |

|

Cr 5220002 Cash at bank |

| $250 |

Record purchase of stationery supplies |

|

31.07.X2 | Debit | Credit |

|---|---|---|

Dr 5220002 Cash at bank | $50 |

|

Cr 2230098 Other supplier expenses |

| $50 |

Reduce stationery expenses by the amount refunded |

|

|

Dr 4100001 Accumulated results – 7592 Cash transfers to the OPA | $50 |

|

Cr 5220002 Cash at bank |

| $50 |

Transfer cash to OPA |

|

|

Note that:

- this is a repayment during the same year, so it is credited against the item to which the payment was charged. Amounts paid out in error and recovered during future years should be recorded as revenue

- in CBMS, the transfer of cash to the OPA would be made via the movement account in the equity table. NCEs would normally have an equity account in their financial management information system called ‘Cash transferred to OPA’ or similar.

CBMS record – CM module (drawdown information)

Process a standard NPP administered drawdown in the CBMS CM module for payment date of 1 July. The following information needs to be included in the respective fields:

- Description or similar: NCE acronym, Admin, 1 July

- Program: Program X

- Budget Year: 20XX

- Appropriation: Administered Appropriation (Appropriation Act (No.1) 20x2-x3 – operating)

- Amount: $250

Process a standard receipt in the CM module with the effective date being the date of transfer to the OPA.

CBMS record – CM module (receipt information for repayments made in the same budget year)

The following information needs to be included in the respective fields:

- Description or similar: NCE acronym, effective date

- Program: Program X

- Budget Year: 20XX (current budget year)

- Appropriation: Administered Appropriation (Appropriation Act (No.1) 20x2-x3 operating)

- Receipt Type: Appropriation Repayments

- Amount: $50

Financial Statements Disclosure

A2 Recoverable GST (PGPA Act section 74A)

Scenario

On:

- 1 July, XYZ invoiced the NCE $110 (GST inclusive) for its advertising expenses for the month.

- 19 July, the NCE paid the invoice. The NCE drew down money from the CM Module ($100 administered appropriation, $10 section 74A appropriation) prior to making the payment.

- 30 September, the NCE:

- received $10 for its input tax credit from the ATO into its administered bank account

- transferred $10 to the OPA as an administered receipt.

Journal entries

1.07.XX | Debit | Credit |

|---|---|---|

| Dr 2230002 Supply of Goods and Services | $100 | |

| Dr 5233033 GST receivable | $10 | |

| Cr 3330002 Trade creditors and accruals* | $110 | |

| Record advertising expenses | ||

| Dr 6211010 Net GST received | $10 | |

| Cr 6212003 Payments to suppliers* | $10 | |

| Cash flow modification |

19.07.XX | Debit | Credit |

|---|---|---|

Dr 5220002 Cash at bank | $110 |

|

Cr 4100001 Accumulated results – 7593 Administered appropriations from the OPA (agreed) | $100 | |

| Cr 4100001 Accumulated results – 7588 Administered GST appropriations | $10 | |

| Cash drawdown from OPA (including for GST) | ||

| Dr 3330002 Trade creditors and accruals | $110 | |

| Cr 5220002 Cash at bank | $110 | |

| Pay the invoice | ||

| Dr 6212003 Payments to suppliers* | $10 | |

| Cr 6212011 GST payments to suppliers | $10 | |

| Cash flow modification |

30.09.XX | Debit | Credit |

|---|---|---|

| Dr 5220002 Cash at bank | $10 | |

| Cr 5233033 GST receivable | $10 | |

| Receive cash from ATO | ||

| Dr 4100001 Accumulated results - 7592 Cash transfers to OPA | $10 | |

| Cr 5220002 Cash at bank | $10 | |

| Transfer cash for GST received to OPA |

* or any other appropriate code

Note: In CBMS, the transfer of cash to the OPA would be made via the movement account in the equity table.

NCEs would normally have an equity account in their financial management information system called ‘Cash transferred to OPA’ or similar.

CBMS record – CM module

Process a standard NPP administered drawdown in the CBMS CM module for payment date of 31 August. The following information needs to be included in the respective fields:

- Description: NCE acronym, Admin, 19 July

- Program: Program X

- Budget Year: 20XX

- Appropriation: Administered Appropriation

- Amount: $100

- Program: Program X

- Budget Year: 20XX (current budget year)

- Appropriation: s74A GST Increase to Appropriations

- Amount: $10

CBMS record – CM module (input tax receipt information)

Process a standard receipt in the CBMS CM module, with the effective date being the date of transfer to the OPA.

The following information needs to be included in the respective fields:

- Description: NCE acronym, Admin, BAS Refund, 30 Sept

- Program: Program X

- Budget Year: 20XX (current budget year)

- Appropriation: Nil Appropriation Impact

- Receipt Type: Administered Receipt

- Amount: $10

Financial statements disclosure

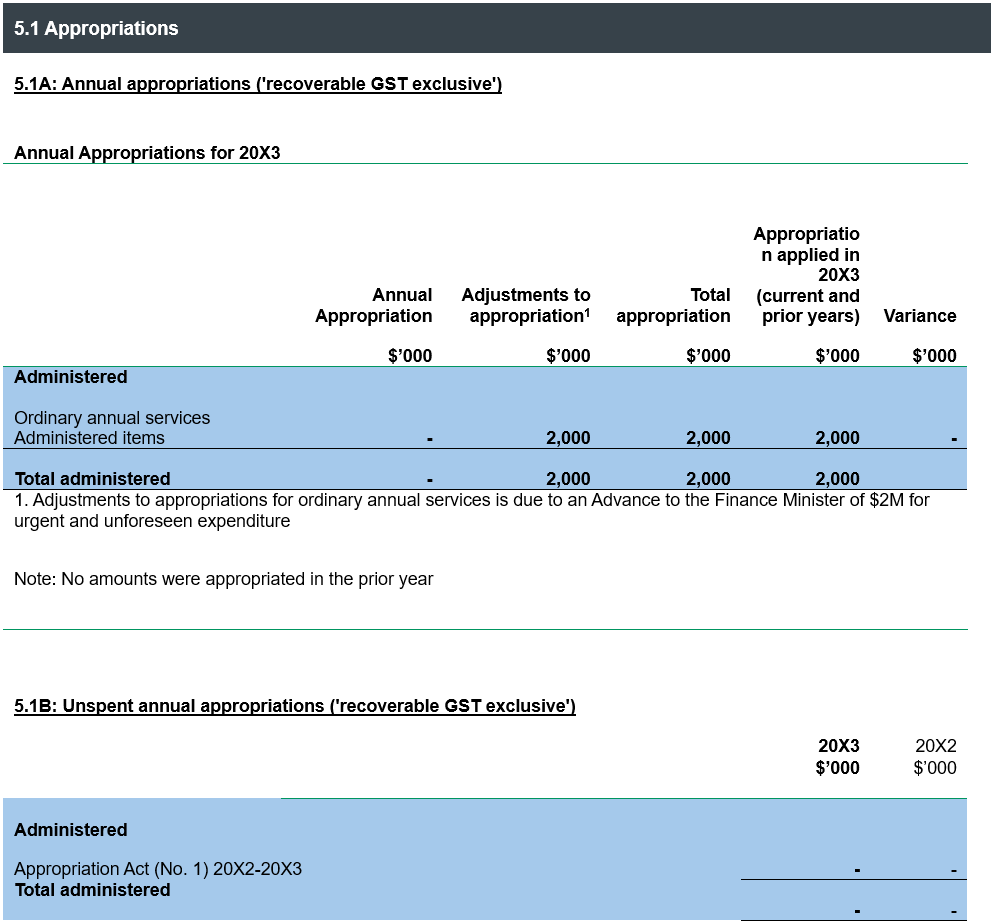

A3 Advance to the Finance Minister

Scenario

The Finance Minister made a determination (under section 10 of Appropriation Act (No.1)) to advance $2M (as administered appropriation) to the NCE for urgent and unforeseen expenditure. On:

- 31 May, the determination commenced

- 1 June, the NCE made a drawdown of $2M to make the urgent payment.

Journal entries

01.06.X3 | Debit | Credit |

|---|---|---|

| Dr 5220002 Cash at bank | $2M | |

| Cr 4100001 Accumulated results – 7593 Administered appropriations from the OPA | $2M | |

| Record drawdown from Advance to the Finance Minister |

CBMS record – CM module

An amendment to an amount appropriated under Appropriation Act (No.1) is processed by Finance as a budget adjustment in the CBMS CM module.

Budget adjustments processed in CBMS reflecting an AFM or APO are applied as soon as practicable after the commencement of the determination.

Process a standard NPP administered drawdown in the CBMS CM module for payment date of 1 June. The following naming information needs to be included in the respective fields:

- Description: NCE acronym, Admin, 1 June

- Program: Program X

- Budget Year: 20X3 (current budget year)

- Appropriation: Advance to the Finance Minister (AFM) under - Appropriation Act (No.1)

- Amount: $2M

Financial statements Disclosure

A4 Approved movement of funds between financial years

Scenario

The Government agreed through the budget process to a movement of administered funds from the current year (20X2-X3) to three years in the future (20X5-X6).

On 1 July 20X2, the NCE was appropriated $10M under Appropriation Act (No.1) 20X2-20X3.

On 20 June 20X3, the Finance Minister (or delegate) withheld the following under section 51 of the PGPA Act as a result of the agreed movement of funds:

- $5.5M current year administered appropriation (that is, before the repeal date)

On 1 July 20X5, $5.5M will be reappropriated via an Appropriation Act for the 20X5-X6 financial year.

Journal entries

No accounting entry (as administered appropriations are recognised when drawn down for payment, so there is no equivalent to departmental appropriation revenue/appropriations receivable to be adjusted).

Appropriation note - A footnote disclosure is required for (current year) and additional disclosure by appropriation Act (prior year).

CBMS record – CM module

The cash module will be adjusted for the appropriation in 20X3 when the new Appropriation Acts commence.

Withholding amounts against an appropriation are processed by Finance as ”S51 adjustments” in the CBMS CM module on the day the signed direction takes effect. Amounts withheld under section 51 of the PGPA Act continue to be disclosed in the appropriation notes as legally available appropriation under section 40 of the Financial Reporting Rule (FRR).

Financial Statements Disclosure

Under sections 43 and 45 of the FRR, as part of the annual appropriations notes, the entity has to state reasons for amounts of current and prior year annual appropriations being withheld under section 51 of the PGPA Act or quarantined for administrative purposes for each appropriation Act that is still legally in force as of 30 June (annual Appropriation Acts remain in force for three years after commencement). Amounts withheld or administrative quarantined do not need to be disclosed by each individual direction/item – entities should disclose total net amounts withheld and/or administrative quarantined by Act.

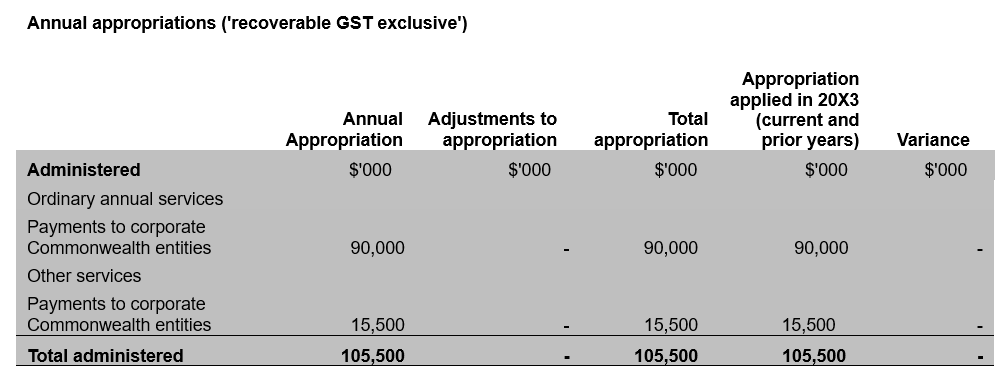

A5 Payments to corporate Commonwealth entities

Scenario

On 1 July 20X2, the NCE was appropriated the following for payment to a CCE in their portfolio under Appropriation Acts No. 1 and 2:

- $15.5M equity injections for payment to the CCE under Appropriation Act (No. 2)

- $90M operating funding for payment to the CCE (other payments under section 42(d) of the FRR) under Appropriation Act No. 1

On 15 July 20X2, the NCE paid the $15.5M equity injection to the CCE. The $90M of operating funding was paid in three instalments of:

- $30M on 31 July

- $30M on 30 November

- $30M on 31 March.

Generally, portfolio departments are required to pay appropriated amounts to CCEs in full by 30 June of the relevant financial year. This is because the legislation establishing a CCE generally contains a requirement to pay amounts appropriated for its purposes (an ‘appropriation payment provision’).

CCEs with an appropriation payment provision must be paid the full amount appropriated for the CCE by 30 June of the relevant financial year, or there may be a legislative breach.

Finance also recommends CCEs without an appropriation payment provision are paid the full amount appropriated for the CCE by 30 June of the relevant financial year.

Entities should seek legal advice if they are unsure if a CCE has an appropriation payment provision.

Journal entries

15.07.X2 | Debit | Credit |

|---|---|---|

| Dr 5220002 Cash at bank | $15.5M | |

| Cr 4100003 Contributed Equity – 7229 Administered appropriations for corporate entities | $15.5M | |

| Recognise drawdown of equity injection | ||

| Dr 5240017 Administered investments in portfolio entities | $15.5M | |

| Cr 5220002 Cash at bank | $15.5M | |

| Recognise payment of equity injection to CCE |

31.07.X2 (with identical entries for 30 November 20X2 and 31 March 20X3) | Debit | Credit |

|---|---|---|

Dr 5220002 Cash at bank | $30M |

|

Cr 4100001 Accumulated results – 7599 Administered appropriations for corporate entities | $30M | |

| Recognise drawdown of other payment | ||

| Dr 2331012 Grant payments to Corporate entities | $30M | |

| Cr 5220002 Cash at bank | $30M | |

| Recognise payment to CCE |

|

|

Financial Statements Disclosure