AASB 124 Related Party Disclosures requires the disclosure of related party relationships, transactions and outstanding balances, including commitments, which could have a material effect on the profit and loss and financial position of the entity. Knowledge of an entity’s relationships, transactions and outstanding balances with related parties may affect assessments of its operations by users of financial statements, including assessments of the risks and opportunities facing the entity (paragraph 8 of AASB 124 refers).

AASB 124 applied to all Commonwealth reporting entities from 1 July 2016 (paragraph Aus28.2 of AASB 124 refers) and included implementation guidance for not-for-profit public sector entities.

Paragraph 9 of AASB 124 defines a related party as a person or entity that is related to the entity that is preparing its financial statements.

Examples of related parties include:

- Key management personnel (KMP) – those with authority for planning, directing and controlling the activities of the entity (or a parent entity).

- For example, the chief executive of the entity, all members of a governing body of a corporate entity (however described), and those directly reporting to the chief executive with substantive decision-making responsibilities.

- RMG-138 Commonwealth entities executive remuneration reporting guide for annual reports provides more guidance on identifying KMP.

- Close family members of KMP and bodies controlled by the KMP and/or a close family member.

- Close family members include adult children, partners and dependants.

- Entities within the same group (that is, other Commonwealth entities).

A related party transaction is a transfer of resources, services or obligations between a reporting entity and a related party, regardless of whether a price is charged (paragraph 9 of AASB 124 refers).

Finance Responsibilities

Finance collects related party declarations from Ministers as part of a centralised process. Ministerial declarations include details of any related party transactions by Ministers, their close family members or organisations they control. Finance then provides assurance letters to Australian Government-controlled entities detailing material Ministerial related party transactions that require disclosure in entity financial statements. These letters assist entities in the preparation of their financial statement related party disclosures.

Entity Responsibilities

Entities are expected to have their own accounting policies and processes in place to identify non-Ministerial KMPs and other related parties. Entities are also expected to have implemented formal accounting policies, risk assessments and procedures related to the identification of related party transactions in the preparation of their annual financial statements.

Whilst entities are not to collect further information from their Ministers, they should ensure that transactions, contracts, services and obligations with KMPs or their close family members have been appropriately recorded in and can be identified from their own systems. Management representations on the completeness and accuracy of related party transactions will also be required by the auditors - see section 9.4.1 Representations by the accountable authority in the Financial Statements Better Practice Guide.

Transactions between related parties and the reporting entity entered into in the same capacity as ordinary citizens are unlikely to be material (paragraph IG11 of AASB 124 refers). However, where discretion is exercised (such as the waiver of debt), the transaction will still need to be assessed to determine whether it is material.

- Judgement would often be required as to when transactions are material, especially when qualitative assessments are made about the nature of transactions (paragraph BC17 of AASB 124 refers).

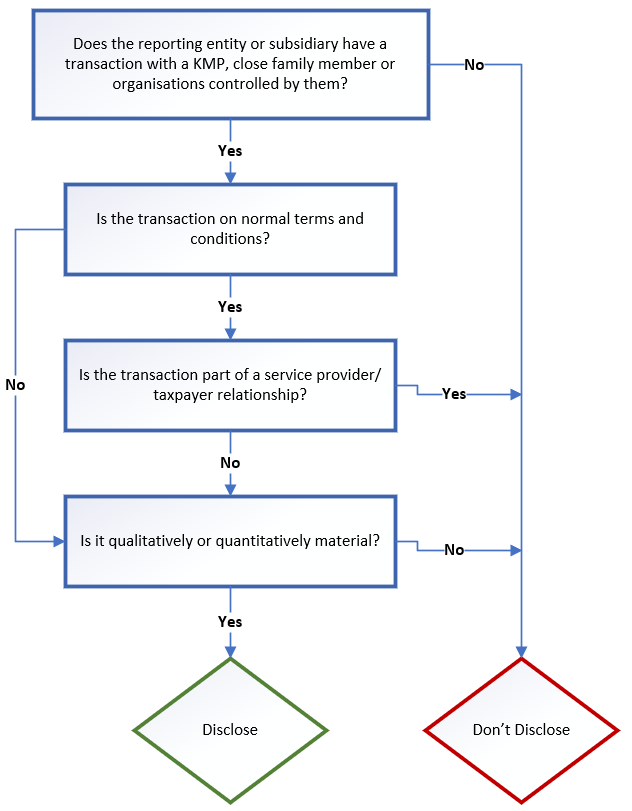

- Please refer to the Assessing disclosure of related party transactions flow chart below.

Example transactions where related party disclosures are likely to be required

The following are examples where related party disclosures are likely to be required.

Please note that this is not an exhaustive list. Where a transaction occurs as part of public service provider relationship or is conducted on normal commercial terms and conditions as part of the entity’s ordinary operations, it is assessed to determine materiality.

- Example – the spouse of the Deputy Secretary of Department X (a KMP of the Department) provided policy review support services to Department X.

- Example – the daughter of an IT executive who is a KMP of Agency Y, owns an IT company which sells scanning equipment to Agency Y.

- Example – a painting is donated by Agency G to a private gallery owned by an Agency G KMP’s close family member.

Where disclosures are required, the nature of the related party relationship and information about the transactions and outstanding balances need to be outlined so that financial statement users can understand the potential impacts of the relationship on the financial statements (paragraph 18 of AASB 124 refers). Abbreviated disclosures may be possible for related party transactions between government-controlled entities where those transactions are not individually significant (paragraphs 25-26 of AASB 124 refers). Note 6.3 Key Management Personnel Remuneration in the PRIMA Forms has example wording for related party disclosures and guidance.

Example transactions which are unlikely to require related party disclosures

- Example – taxes, student loans, other statutory charges or fees (such as application fees for a passport) are not related party transactions requiring disclosure under AASB 124.

- Example – the Secretary of Department A is also a Board member and hence KMP of corporate entity B.

- Example – a close family member of a KMP of Portfolio Department Z is a member of a government board of GBE N within the same portfolio. Department Z and GBE N are not related from having a KMP and their close family members in common.

- Example – the family of the secretary of Portfolio Department E leases an office building to Commonwealth company F within the same portfolio. The Secretary of Department E is not a KMP of company F.

Assessing disclosure of related party transactions flowchart