RMGs are guidance documents. The purpose of an RMG is to support PGPA Act entities and companies in meeting the requirements of the PGPA framework. As guides, RMGs explain the legislation and policy requirements in plain English. RMGs support accountable authorities and officials to apply the intent of the framework. It is an official’s responsibility to ensure that Finance guidance is monitored regularly for updates, including changes in policy/requirements.

This guide is designed to assist you, as the accountable authority (including Secretaries, Chief Executives, and governing boards), in governing your entity and contributing to government priorities and objectives. It explains your duties and legal obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), detailing the required actions and the systems for governance and accountability that you must implement and maintain.

As an accountable authority, you must adhere to the duties of both the accountable authority and officials, which are key components of the PGPA Act. The PGPA Act serves as the cornerstone of finance law and the broader Commonwealth Resource Management Framework, and this guide also outlines the importance of reporting any breaches of finance law. You also have additional duties and legal obligations under other Commonwealth legislation, which are also outlined in this guide.

For the purpose of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), ‘finance law’ (as defined in section 8 of the PGPA Act) means:

- the PGPA Act

- the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule)

- the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015 (Financial Reporting Rule)

- an Appropriation Act

- any instrument made under the PGPA Act, such as:

- the Commonwealth Procurement Rules

- the Commonwealth Grants Rules and Principles

- accountable authority instructions issued under section 20A of the PGPA Act

- determinations establishing special accounts under section 78 of the PGPA Act

- government policy orders issued under section 22 of the PGPA Act delegations

- instruments made under sections 107-110 of the PGPA Act.

What is a breach of finance law?

A breach of finance law occurs when individuals or entities fail to comply with legal obligations related to the management of public resources. Common examples include fraudulent activity, incorrect coding or misappropriation of funds or non-compliance with procurement or grants rules.

What happens if I breach finance law?

For APS officials, a breach of finance law may give rise to a breach of the APS Code of Conduct and lead to sanctions being imposed under the Public Service Act 1999. For non-APS officials, a breach of finance law may lead to adverse consequences under their applicable employment framework. For all officials, serious breaches of finance law, such as those concerning fraud or corrupt conduct, may expose officials to a civil legal action or criminal prosecution.

A breach of finance law may damage an entity’s reputation and reduce public trust and confidence in the entity. Serious breaches of finance law may expose an entity to legal action, where the interests of other parties are adversely affected or the breach has caused loss or damage.

The PGPA Act covers 3 key areas that provide a strong foundation for a modern, streamlined and adaptable Commonwealth public sector:

|

Your duties as an accountable authority

Sections 15 to 19 of the PGPA Act prescribe the following duties imposed on you as an accountable authority:

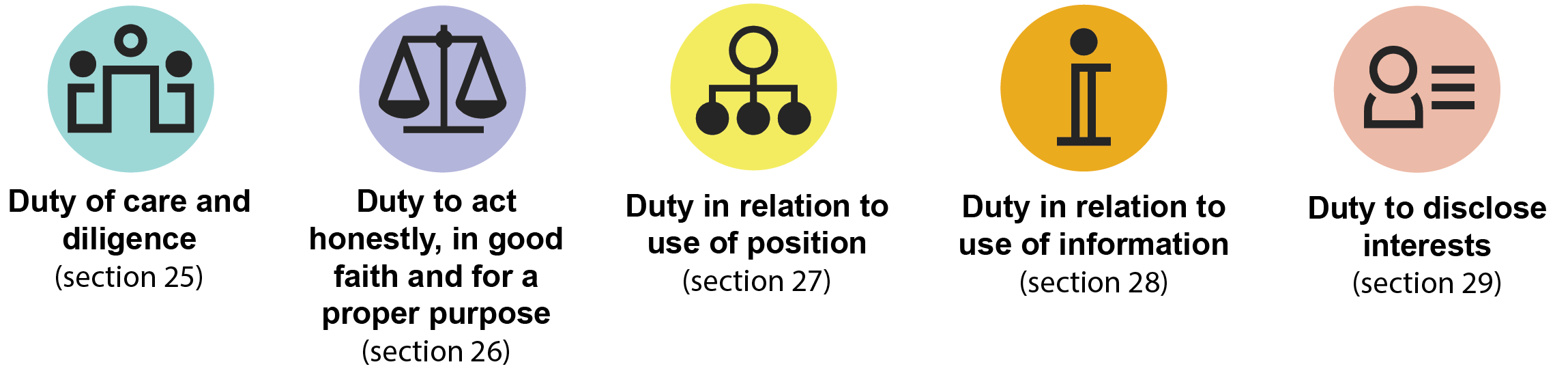

Your duties as an official

You are an official under the PGPA Act and subject to the general duties of officials as well as the duties as an accountable authority of a Commonwealth entity.

Governing your entity